The CLGS-32-1 form, an integral document for taxpayers within certain districts of Pennsylvania, such as the Allegheny County Southwest Tax Collection District, serves as a comprehensive platform for reporting local earned income tax. This form, updated as of August 2012, is a requisite for residents who have earned income within the tax year it covers, including but not limited to wages, salaries, and net profits from self-employment. It is meticulously designed to capture detailed taxpayer information, including periods of residence at specific addresses, which aids in accurate tax collection and ensures compliance with local tax obligations. Taxpayers are advised to use black or blue ink for clarity and must include relevant attachments like W-2 forms and PA Schedule UE for unreimbursed employee business expenses, among others. The form also provides space for reporting miscellaneous tax credits and adjustments, thereby accommodating various financial situations. Additionally, it includes instructions on calculating total tax liability, factoring in local earned income tax withheld and estimated payments. Importantly, the form not only facilitates tax collection but also informs taxpayers of their rights concerning audits, appeals, refunds, and collections, emphasizing transparency and fairness in local tax administration.

| Question | Answer |

|---|---|

| Form Name | Clgs 32 1 Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | pa clgs 32 1, clgs 32 1 instructions, tax, clgs 32 1 |

|

|

|

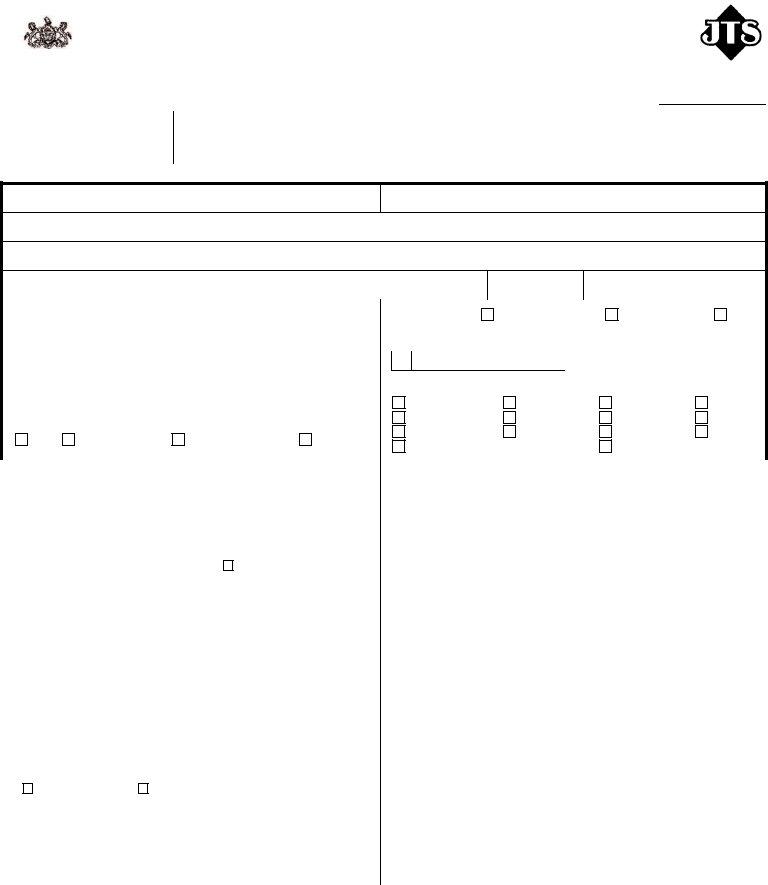

TAXPAYER |

ANNUAL |

|

|

|

|

JORDAN |

TAX SERVICE, INC. |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

LOCAL EARNED INCOME TAX RETURN |

|

|

7100 |

BAPTIST |

|

RD |

|

|

||||||||||||||||

|

|

BETHEL PARK PA |

|

|

||||||||||||||||||||||

|

|

Allegheny |

County |

Southwest |

Tax |

Collection |

District |

(73) |

|

(412) |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ct your |

||||

|

You |

re entitled to |

receive |

|

written |

expl n tion of |

your |

rights |

with reg rd |

to |

the |

udit, |

ppe l, |

enforcement, |

refund nd |

collection of loc l t xes. Cont |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Year |

|

|

|

|

|

||

If you have relocated during the tax year, |

please supply additional |

information. |

A |

separate |

final |

is |

required |

for each resident |

|

psd code. |

|

|

||||||||||||||

|

|

|

||||||||||||||||||||||||

|

DATES LIVING AT EACH |

ADDRESS |

|

STREET ADDRESS (No PO |

Box, RD |

or |

RR) |

|

|

CITY |

OR POST |

OFFICE |

|

|

|

STATE |

|

ZIP |

|

|||||||

/ |

TO/ |

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

/ |

TO/ |

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME, FIRST NAME, MIDDLE INITIAL

SPOUSE’S LAST NAME, FIRST NAME, MIDDLE INITIAL

STREET ADDRESS (No PO Box, RD or RR)

SECOND LINE OF ADDRESS

CITY

STATE

ZIP CODE

DAYTIME |

PHONE |

NUMBER |

|

|

|

|

|

|

|

|

|

RESIDENT |

|

PSD |

CODE |

|

|

|

|

|

|

|

|

|

EXTENSION |

|

|

|

AMENDED |

RETURN |

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Soci l Security |

|

|

|

|

|

|

|

|

|

Spouse’s Soci |

l Security |

|||||||||||||||

|

The |

c |

lcul |

tions reported |

in |

the |

first |

column |

MUST pert in to the n me |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

printed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

in |

the column, |

reg |

rdless |

of |

whether |

the |

hus |

|

nd or |

wife |

ppe |

rs |

|

first. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

Combining |

income |

is |

NOT |

permitted. |

|

|

|

|

|

|

|

|

|

|

|

If you h d NO |

|

EARNED INCOME, |

|

|

If |

you h d NO EARNED INCOME, |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

check the re son why: |

|

|

|

|

|

|

|

|

check the re son why: |

|||||||||||||||||

|

ONLY |

USE |

BLACK |

OR |

BLUE |

INK |

TO |

|

COMPLETE |

THIS |

|

|

|

|

dis |

|

led |

|

|

|

|

|

student |

|

|

|

|

|

dis |

|

led |

|

student |

||||||||||||||||||||||||||||||

|

|

|

FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

dece sed |

|

|

|

milit |

ry |

|

|

|

|

|

dece sed |

|

milit ry |

|||||||||||||||

|

Single |

|

M rried, |

Filing |

Jointly |

|

M rried, Filing |

Sep |

r tely |

|

Fin l |

Return* |

|

homem |

ker |

|

|

|

retired |

|

|

|

|

|

homem ker |

|

retired |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

unemployed |

|

|

|

|

|

|

|

|

|

|

|

|

unemployed |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

1. |

Gross |

Compens tion |

s |

Reported on |

|

(Enclose |

. . . . . . . . . . |

. . . . |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

2. |

Unreim ursed Employee Business Expenses. (Enclose PA |

Schedule UE) . |

. . . . . . . . . |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

3. |

Other |

T x |

le |

E rned |

Income |

(See |

Instructions) |

. . . . . . . . . . |

. . . . . . |

.00. |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

4. |

Total Taxable Earned Income(Su tr ct Line |

2 from |

Line |

1 |

nd |

dd |

|

Line |

3) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

5. |

Net |

Profit |

(Enclose |

PA |

Schedules) |

. . . . . . |

. .00. . |

. . . . |

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||||||||||||||||||||||||||||||

|

this |

|

ox: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

6. |

Net |

Loss |

(Enclose |

PA |

Schedules) |

. .00. . |

. . . . |

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

7. |

Tot |

l |

T x |

le |

Net |

Profit |

(Su |

tr |

ct |

Line |

6 |

from Line 5. |

If |

less |

th n |

|

zero, |

|

enter |

zero) . . . |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

8. |

Tot |

l |

T x |

le |

E rned |

Income |

nd Net |

Profit |

(Add |

|

Lines |

4 |

|

nd 7) |

. . . . |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

9. |

Total Tax Liability(Line 8 |

multiplied |

y |

|

|

|

|

|

|

|

|

|

) |

. |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

10. |

Tot l |

Loc l |

E |

rned |

Income T x |

Withheld |

s Reported on |

. . . |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

11. Qu rterly Estim ted P yments/Credit From |

Previous |

T x |

|

Ye r |

. . |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

12. |

Miscell neous T x Credits (See Instructions) |

. . . . . . |

..00. |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

13. |

TOTAL PAYMENTS and CREDITS(Add Lines |

10 |

through |

12) |

. |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

14. |

Refund |

IF |

MORE THAN |

1.00, |

enter |

mount |

(or |

select option |

in |

15) |

. |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

15. |

Credit |

Taxpayer/Spouse (Amount |

of Line |

13 you |

w |

|

nt |

|

s |

|

|

credit |

to |

your |

|

ccount) . . |

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||

|

Credit to next year |

Credit |

to |

spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

16. |

EARNED INCOME TAX BALANCE DUE(Line |

9 minus |

|

Line |

13) |

. |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

17. |

Penalty |

after April 15(Multiply Line |

16 |

y |

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

18. |

Interest |

after April 15(Multiply Line |

16 |

y |

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

19. |

TOTAL PAYMENT DUE(Add Lines |

16, |

17 |

|

ndPAYABLE18) |

TO ACSWTCD |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Under pen lties of perjury, I (we) decl re th t I (we) h ve ex mined |

|

this |

inform |

tion, |

including |

ll |

ccomp nying |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

schedules |

nd |

|

st tements |

|

nd |

to |

the |

|

est |

of my |

(our) |

elief, |

|

they |

re true, correct |

nd complete. |

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

YOUR SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S |

SIGNATURE |

|

(If Filing Jointly) |

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE |

(MM/DD/YYYY) |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

PREPARER’S |

PRINTED NAME |

& |

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE |

NUMBER |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAXPAYERANNUAL

LOCAL EARNED INCOME TAX RETURN

INSTRUCTIONS

A.General Instructions

1.WHEN TO FILE: This return must be completed and filed by all persons subject to the tax on or beforeApril 15 (unless the 15th is a Saturday or Sunday then file the next business day), regardless of whether or not tax is due. If you file a Federal or State Application for Extension, check the extension box on the front of the form and send this form along with your estimated payment by April 15, unless the 15th is a Saturday or Sunday, then by the next business day. If you use a professional tax preparer, confirm that they will submit your final return for you.

2.WHERE TO FILE: Remit to the local earned income tax collector for every tax collection district in which you lived during the year.

3.EFFECTIVE DATES: January 1 through December 31, unless otherwise noted on your local earned income tax return.

4.AMENDED RETURN: If a taxpayer amends his federal income tax return, an amended local earned income tax return must also be filed with the local earned income tax collector.

5.RECEIPT / COPY: Your cancelled check is sufficient proof of payment.

6.PENALTYAND INTEREST: If for any reason the tax is not paid when due, penalty and interest will be charged. Any late, incorrect filing or payment may result in additional costs of collection.

7.ROUND OFF CENTS to the nearest whole dollar. Do not include amounts under 50 cents. Increase amounts from 50 to 99 cents to the next dollar amount.

8.USE BLACK OR BLUE INK ONLY WHEN COMPLETING THIS FORM.

B.Regulations/Line by Line Instructions

LINE 1: GROSS EARNINGS FOR SERVICES RENDERED

Documentation Required:

TAXABLE INCOME INCLUDES: Salaries, Wages, Commissions, Bonuses, Tips, Stipends, Fees, Incentive Payments, Employee Contributions to RetirementAccounts, Compensation DrawingAccounts (If amounts received as a drawing account exceed the salaries or commission earned, the tax is payable on the amounts received. If the employee subsequently repays to the employer any amounts not in fact earned, the tax shall be adjusted accordingly.). BenefitsAccruing from Employment, such as:Annual Leave, Vacation, Holiday, Separation, Sabbatical Leave, Compensation Received in the Form of Property shall be taxed at its fair market value at the time of receipt, Jury Duty Pay, Payments Received from Weekend Meetings for National Guard or Reserve Units, Sick Pay (if employee received a regular salary during period of sickness or disability by virtue of his agreement of employment), and TaxesAssumed by the Employer. Taxpayer should refer to the PADepartment of Revenue regulations regarding taxable compensation. This list is not exhaustive; contact your local earned income tax collector if you have any questions.

LINE 2: ALLOWABLE EMPLOYEE BUSINESS EXPENSES

Documentation Required: Pennsylvania form

LINE 3: OTHER TAXABLE EARNED INCOME: Include income, from work or services performed, which has not been included on line 1 or line 5. Do not include interest, dividends or capital gains.

LINE 4: TOTAL TAXABLE EARNED INCOME: Subtract line 2 from line 1 and add line 3.

LINES 5 & 6: NET PROFITS/NET LOSSES FROM BUSINESS: Use line 5 for profit and line 6 for loss.

Documentation Required: 1099(s), PAschedules C, E, F, or

Rule: Ataxpayer may NOT offset a business loss against wages and other compensation

Instructions |

|

|

|

|

|

LINE 7: TOTAL TAXABLE NET PROFIT: Subtract line 6 from line 5; if less than zero, enter zero.

LINE 8: TOTAL TAXABLE EARNED INCOMEAND NET PROFIT: Add lines 4 & 7.

LINE 9: TAX LIABILITY: Multiply line 8 by your local earned income tax rate. If you don’t know your rate, contact your local earned income tax collector where you live or visit www.newPA.com to find your rate.

LINE 10: EARNED INCOME TAX WITHHELD: You may claim credit for local tax withheld as shown on your

LINE 11: QUARTERLY ESTIMATED PAYMENTS/CREDITS FROM PREVIOUS TAX YEAR: : List any quarterly estimated payments made to date for appropriate filing year. Do not include any penalty and interest amounts that may have been made with the quarterly payments.Also, include tax credit from the previous tax year.

LINE 12: MISCELLANEOUS CREDITS

General RulesApplicable toAll Line 12 Credits:

(1)Credits for income taxes paid to other states must first be used against your Pennsylvania state income tax liability; any credit remaining thereafter may be used against your local earned income tax liability.

(2)Credits for income taxes paid to political subdivisions located outside of Pennsylvania or for wage taxes paid to Philadelphia may be taken directly against your local earned income tax liability.

(3)In calculating your credit for income taxes paid to another state or to a political subdivision, note that the same items of income must be subject to both your local earned income tax and the

(4)No credit for income taxes paid to another state or political subdivision may exceed your total local earned income tax liability.

Credit for Taxes Paid to Other States: You may take a credit based upon the gross earnings taxed both in another state and in Pennsylvania that is in excess of Pennsylvania state personal income tax rate. THIS CREDIT WILL BE DISALLOWED IF THE

No credits are given for state income taxes paid to states that reciprocate with the Commonwealth of Pennsylvania. These states are: Maryland, New Jersey, Ohio, Virginia, West Virginia and Indiana.

Example: Taxpayer earned wages of $10,000.00 in Delaware and paid an income tax liability to that state of $317.00. Assuming the current Pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (PATax) amount of $307.00 by $10.00, the $10.00 may be credited against your local income tax.

Gross Income |

.(1) |

$10,000.00 |

Local Tax 1% x .01 |

. . . |

. . . . . .x.01 |

|

(2) |

100.00 |

Tax paid to Delaware |

.(3) |

317.00 |

PAIncome Tax (3.07% x $10,000.00) |

.(4) |

307.00 |

Credit to be used against Local Tax |

|

|

(Line 3 minus Line 4) |

|

|

On Line 12 of the tax return, enter this amount . . . |

.(5) |

10.00 |

or the amount on Line 2 of worksheet, |

|

|

whichever is less |

|

|

If all your wages or gross earnings are subject to Delaware State Income Tax (not PA), use the above example to calculate your tax obligation. If you had earned income NOT taxed by Delaware, this income would be subject to the earned income tax effective where you live and must be shown separately on the Local Earned Income Tax Return.

Credit for Taxes Paid to Political Subdivisions Outside of Pennsylvania: You may take a credit based upon the gross earnings taxed in both another political subdivision and where you live in Pennsylvania. THIS CREDIT WILL BE DISALLOWED IF THE FOREIGN CITY RETURNAND OR YOUR

Credit for Taxes to Philadelphia: You may use any wage tax paid to Philadelphia as a credit toward your local earned income tax liability. You must complete the Local Earned Income Tax Return.ACOPY OF YOUR

LINE 13: TOTAL PAYMENTSAND CREDITS: Enter the sum of lines 10, 11 & 12.

LINE 14: REFUND: If tax (line 9) is less than your credits (line 13), enter amount of refund. If you have an overpayment of taxes in excess of $1.00, you may elect to receive a refund or take same as credit against the next year's tax liability.A1099 will be issued to the Federal Government for any credit or refund in excess of $10.00.

LINE 15: CREDIT: If tax (line 9) is less than your credits (line 13) enter amount of credit and check the applicable box for credit to spouse or credit to next year.A1099 will be issued to the Federal Government for any credit or refund in excess of $10.00.

LINE 16: AMOUNT OF TAX DUE: If tax (line 9) is larger than your credits (line 13), enter amount of tax due, if less than $1.00,

ENTER ZERO.

LINE 17 & 18: INTERESTAND PENALTIES: If for any reason the tax is not paid when due, interest and penalty of the unpaid tax for each month shall be added and collected. Returns received after the due date may be charged additional costs of collection.

LINE 19: TOTALAMOUNT DUE: The sum of lines 16, 17 & 18. OMIT IF LESS THAN $1.00.

Note: All accounts are subject to audit and review. Local or city copy of

(Legible photocopies of

Allegheny CountyCENTRAL Tax Collection District Resident PSD Codes and Tax Rates

Allegheny CountySOUTHWEST Tax Collection District Allegheny CountySOUTHWEST Tax Collection District |

|

Resident PSD Codes and Tax Rates |

Resident PSD Codes and Tax Rates |

PSD CCODE |

TAX |

ENTITY |

NAME |

TAX RATE |

|

|

PSD CCODE |

|

TAX |

ENTITY NAME |

TAX RATE |

|

PSD CCODE |

|

TAX |

ENTITY NAME |

TAX RATE |

|

||||||||

700101 |

MOUNT OLIVER |

BORO |

3.00 |

|

|

|

730601 |

|

CLAIRTON CITY |

|

1.50 |

|

731602 |

|

STOWE |

|

TWP |

|

1.00 |

|

||||||

700102 |

PITTSBURGH |

CITY |

3.00 |

|

|

|

730701 |

|

CORAOPOLIS |

BORO |

|

1.00 |

|

731701 |

|

UPPER |

|

ST |

CLAIR |

TWP |

1.30 |

|

||||

|

|

|

|

|

|

|

|

|

|

730702 |

|

NEVILLE |

TWP |

|

|

1.00 |

|

731801 |

|

FINDLAY |

TWP |

|

1.00 |

|

||

Allegheny CountySOUTHWEST Tax Collection District |

730801 |

|

DUQUESNE CITY |

|

1.65 |

|

731802 |

|

NORTH |

|

FAYETTE |

TWP |

1.00 |

|

||||||||||||

Resident PSD Codes and Tax Rates |

730901 |

|

CASTLE |

SHANNON |

(KOSD) |

1.00 |

|

731803 |

|

OAKDALE BORO |

|

1.00 |

|

|||||||||||||

PSD CCODE |

TAX |

ENTITY |

NAME |

TAX RATE |

|

730902 |

|

DORMONT BORO |

|

1.00 |

|

731901 |

|

JEFFERSON |

HILLS |

BORO |

1.00 |

|

||||||||

730101 |

BALDWIN |

|

BORO |

|

1.00 |

|

|

|

730903 |

|

GREEN |

TREE |

BORO |

1.00 |

|

731902 |

|

PLEASANT |

HILLS |

(WJHSD) |

1.00 |

|

||||

730102 |

BALDWIN |

|

TWP |

|

1.00 |

|

|

|

731001 |

|

INGRAM |

BORO |

|

1.00 |

|

731903 |

|

WEST |

ELIZABETH |

BORO |

1.00 |

|

||||

730103 |

PLEASANT |

HILLS |

(BWSD) |

1.00 |

|

|

|

731002 |

|

KENNEDY TWP |

|

1.00 |

|

732001 |

|

WEST |

MIFFLIN BORO |

1.00 |

|

|||||||

730104 |

WHITEHALL |

BORO |

1.50 |

|

|

|

731003 |

|

PENNSBURY VILLAGE BORO |

1.00 |

|

732002 |

|

WHITAKER |

BORO |

|

1.00 |

|

||||||||

730105 |

PITTSBURGH |

CITY (BWSD) |

1.50 |

|

|

|

731004 |

|

ROBINSON TWP |

|

1.00 |

|

|

|

|

|

|

|

|

|

|

|||||

730201 |

BETHEL PARK BORO |

1.40 |

|

|

|

731005 |

|

THORNBURG |

BORO |

|

1.00 |

|

|

|

|

|

|

|

|

|

|

|||||

730202 |

CASTLE |

SHANNON (BPSD) |

1.00 |

|

|

|

731101 |

|

CRESCENT TWP |

|

1.00 |

|

|

|

|

|

|

|

|

|

|

|||||

730301 |

BRENTWOOD BORO |

1.00 |

|

|

|

731102 |

|

MOON TWP |

|

|

1.00 |

|

|

|

|

|

|

|

|

|

|

|||||

730401 |

CARNEGIE |

BORO |

1.00 |

|

|

|

731201 |

|

MT LEBANON |

TWP |

|

1.30 |

|

|

|

|

|

|

|

|

|

|

||||

730402 |

CRAFTON |

BORO |

|

1.00 |

|

|

|

731301 |

|

SOUTH |

FAYETTE TWP |

1.00 |

|

|

|

|

|

|

|

|

|

|

||||

730403 |

ROSSLYN |

|

FARMS |

BORO |

1.00 |

|

|

|

731401 |

|

SOUTH |

PARK |

TWP |

|

1.00 |

|

|

|

|

|

|

|

|

|

|

|

730501 |

BRIDGEVILLE BORO |

1.00 |

|

|

|

731501 |

|

HOMESTEAD |

BORO |

|

1.00 |

|

|

|

|

|

|

|

|

|

|

|||||

730502 |

COLLIER |

TWP |

|

1.00 |

|

|

|

731502 |

|

MUNHALL BORO |

|

1.00 |

|

|

|

|

|

|

|

|

|

|

||||

730503 |

HEIDELBERG |

BORO |

1.00 |

|

|

|

731503 |

|

WEST HOMESTEAD |

BORO |

1.00 |

|

|

|

|

|

|

|

|

|

|

|||||

730504 |

SCOTT TWP |

|

|

1.00 |

|

|

|

731601 |

|

MCKEES |

ROCKS BORO |

1.00 |

|

|

|

|

|

|

|

|

|

|

||||