You may fill in colorado severance effectively in our online PDF editor. Our tool is continually developing to deliver the very best user experience achievable, and that's thanks to our dedication to continuous enhancement and listening closely to customer opinions. If you're looking to begin, this is what you will need to do:

Step 1: Click the "Get Form" button above on this webpage to get into our PDF tool.

Step 2: Once you launch the tool, you will notice the form prepared to be completed. In addition to filling out various fields, you may as well do various other things with the form, that is writing your own text, changing the original textual content, adding illustrations or photos, putting your signature on the document, and much more.

As for the blanks of this particular document, this is what you should consider:

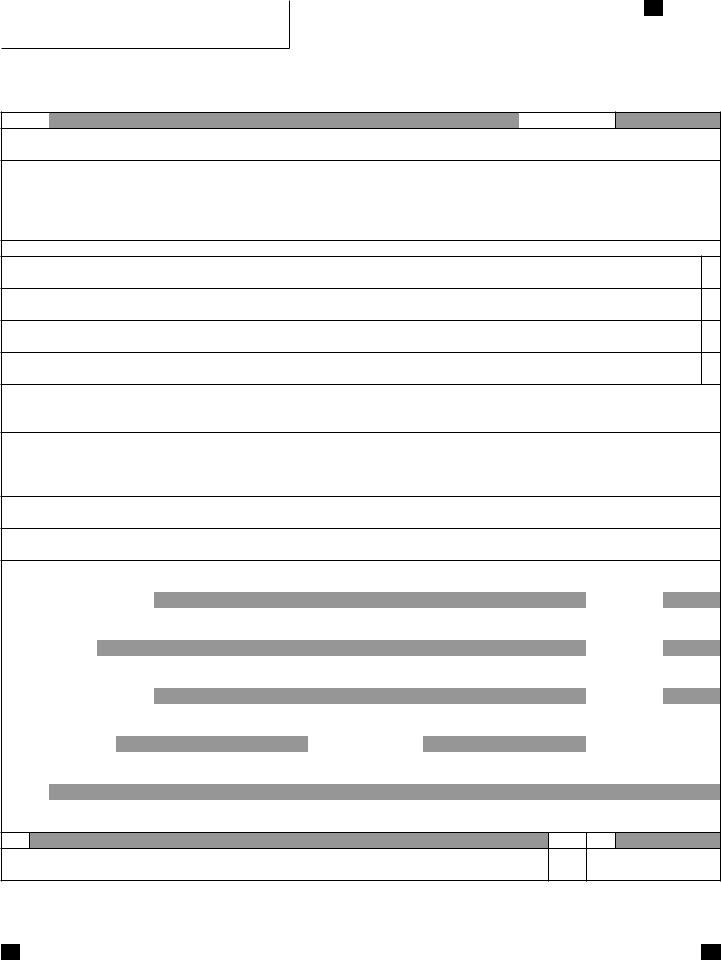

1. Fill out your colorado severance with a number of necessary blanks. Note all of the necessary information and be sure absolutely nothing is omitted!

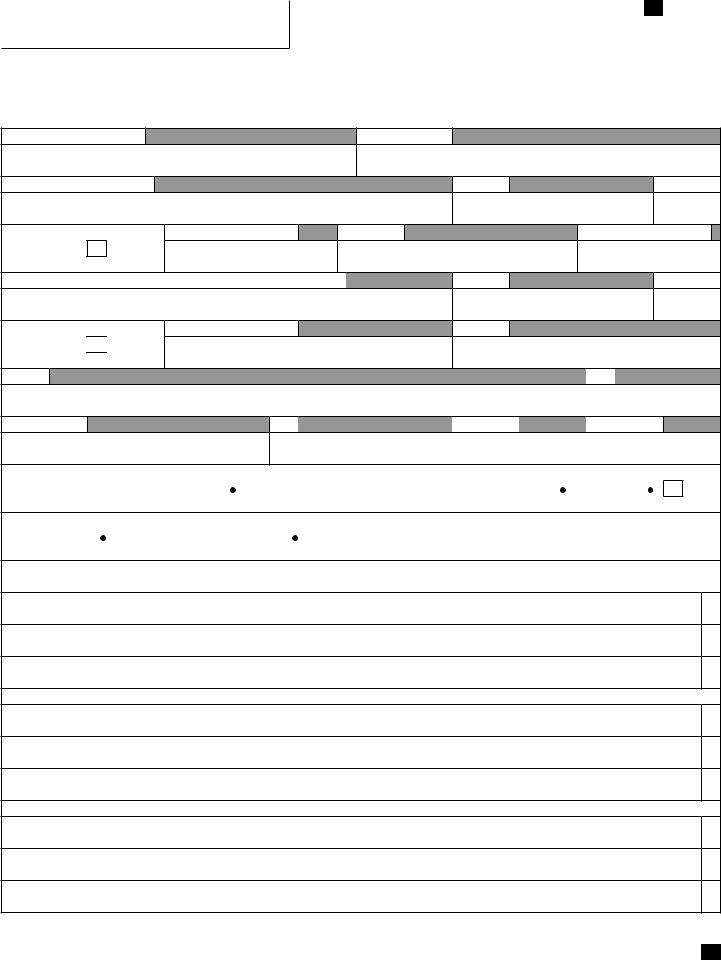

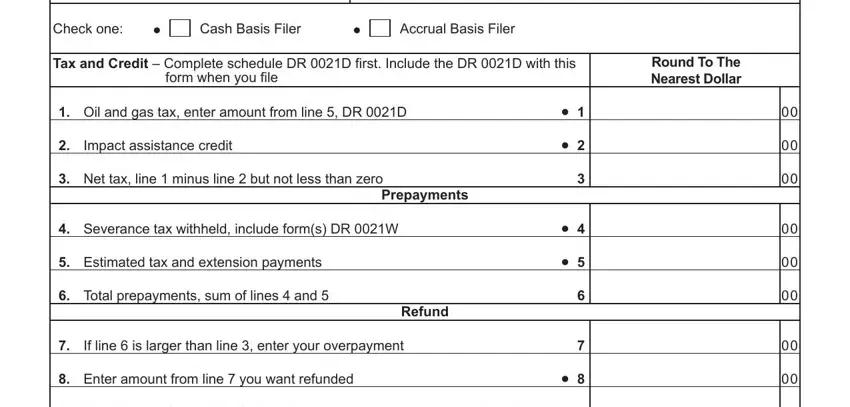

2. Once your current task is complete, take the next step – fill out all of these fields - Check one, Cash Basis Filer, Accrual Basis Filer, Tax and Credit Complete schedule, form when you file, Round To The Nearest Dollar, Oil and gas tax enter amount from, Impact assistance credit, Net tax line minus line but not, Prepayments, Severance tax withheld include, Estimated tax and extension, Total prepayments sum of lines, Refund, and If line is larger than line with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

A lot of people often make mistakes while filling out Cash Basis Filer in this area. You need to re-examine what you type in here.

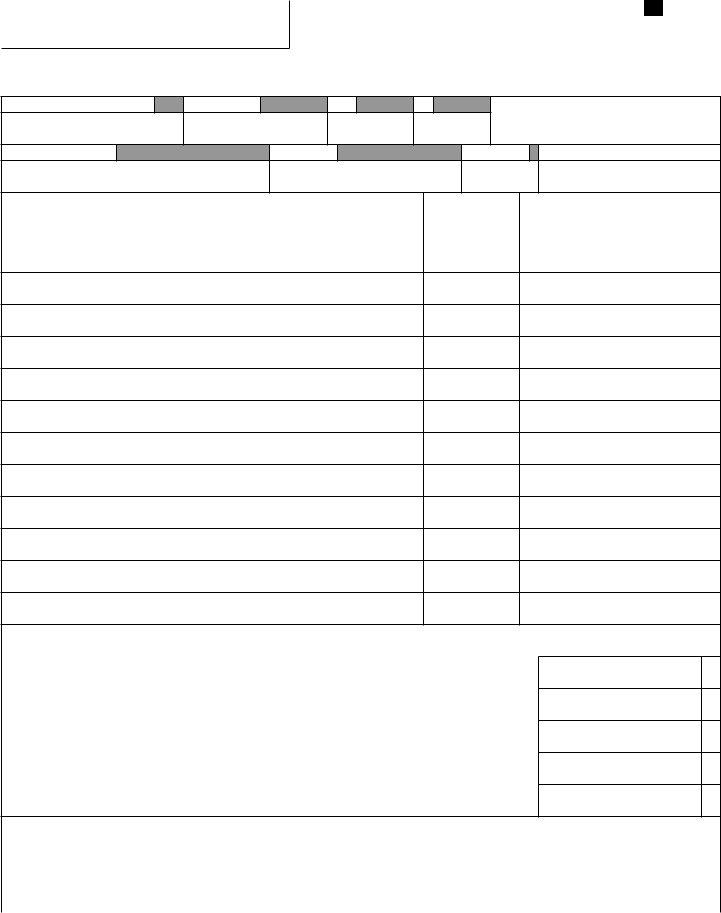

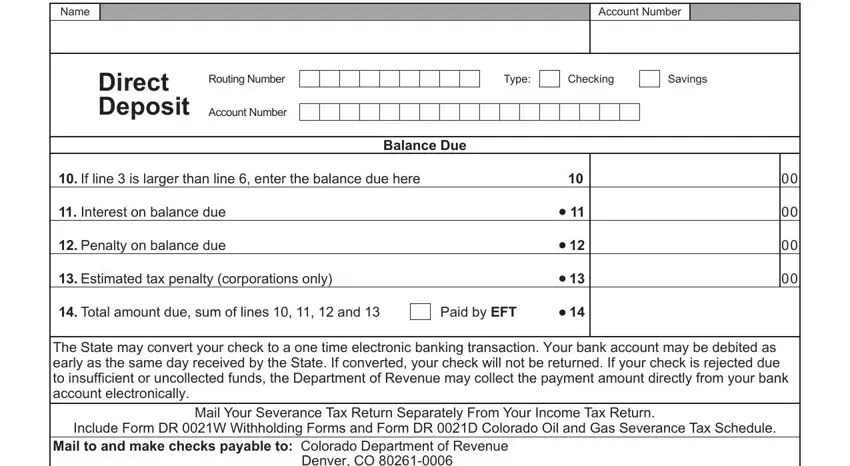

3. In this stage, review Name, Account Number, Direct Deposit, Routing Number, Account Number, Type, Checking, Savings, If line is larger than line, Balance Due, Interest on balance due, Penalty on balance due, Estimated tax penalty, Total amount due sum of lines, and Paid by EFT. All of these should be filled in with utmost precision.

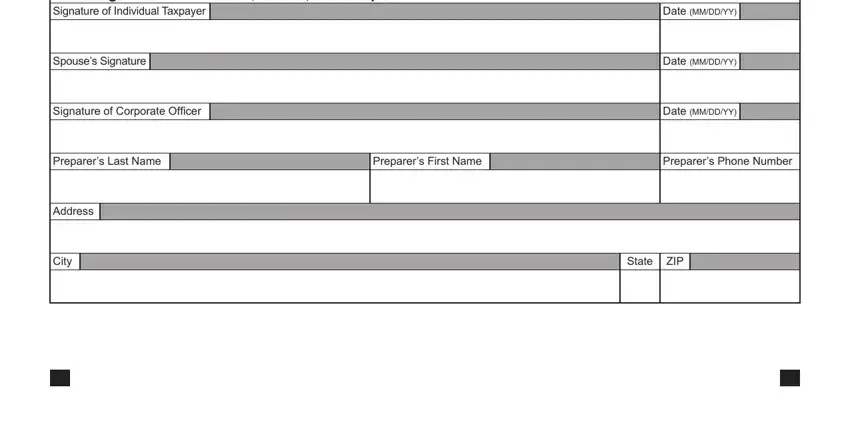

4. This next section requires some additional information. Ensure you complete all the necessary fields - Mail to and make checks payable to, Date MMDDYY, Spouses Signature, Signature of Corporate Officer, Date MMDDYY, Date MMDDYY, Preparers Last Name, Preparers First Name, Preparers Phone Number, Address, City, and State ZIP - to proceed further in your process!

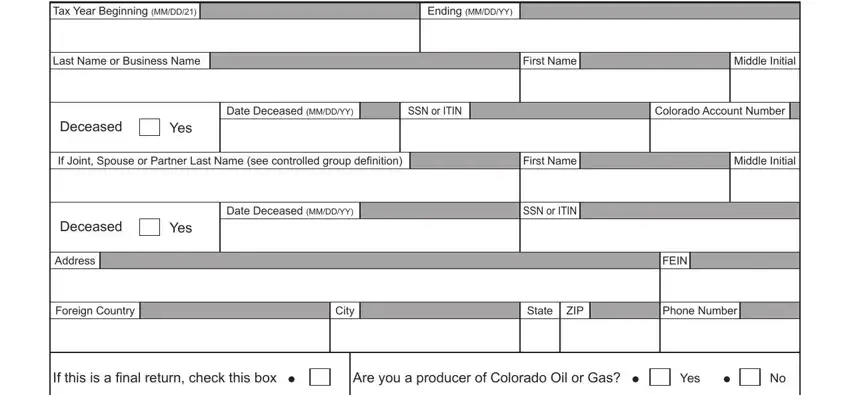

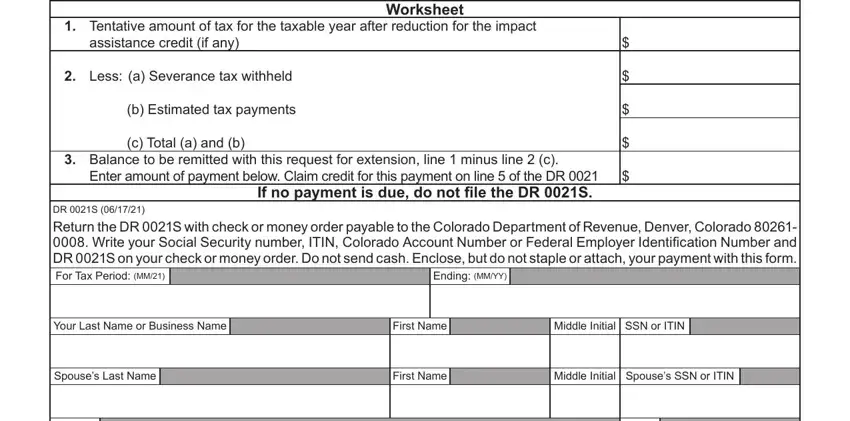

5. Lastly, this final segment is precisely what you have to wrap up prior to closing the document. The fields in this instance include the next: Tentative amount of tax for the, assistance credit if any, Worksheet, Less a Severance tax withheld, b Estimated tax payments, c Total a and b, Balance to be remitted with this, Enter amount of payment below, DR S Return the DR S with check, Ending MMYY, Your Last Name or Business Name, First Name, Middle Initial SSN or ITIN, Spouses Last Name, and First Name.

Step 3: Spell-check the details you have entered into the blank fields and then hit the "Done" button. Go for a 7-day free trial plan at FormsPal and get instant access to colorado severance - with all changes saved and accessible from your personal account page. FormsPal is committed to the privacy of our users; we make certain that all information put into our editor continues to be protected.