We were creating the PDF editor having the idea of making it as fast to use as it can be. For this reason the process of typing in the colorado sales tax exemption certificate is going to be effortless perform these steps:

Step 1: The very first step will be to hit the orange "Get Form Now" button.

Step 2: Now, you may modify the colorado sales tax exemption certificate. Our multifunctional toolbar will let you insert, eliminate, adapt, highlight, and perform other sorts of commands to the text and fields inside the file.

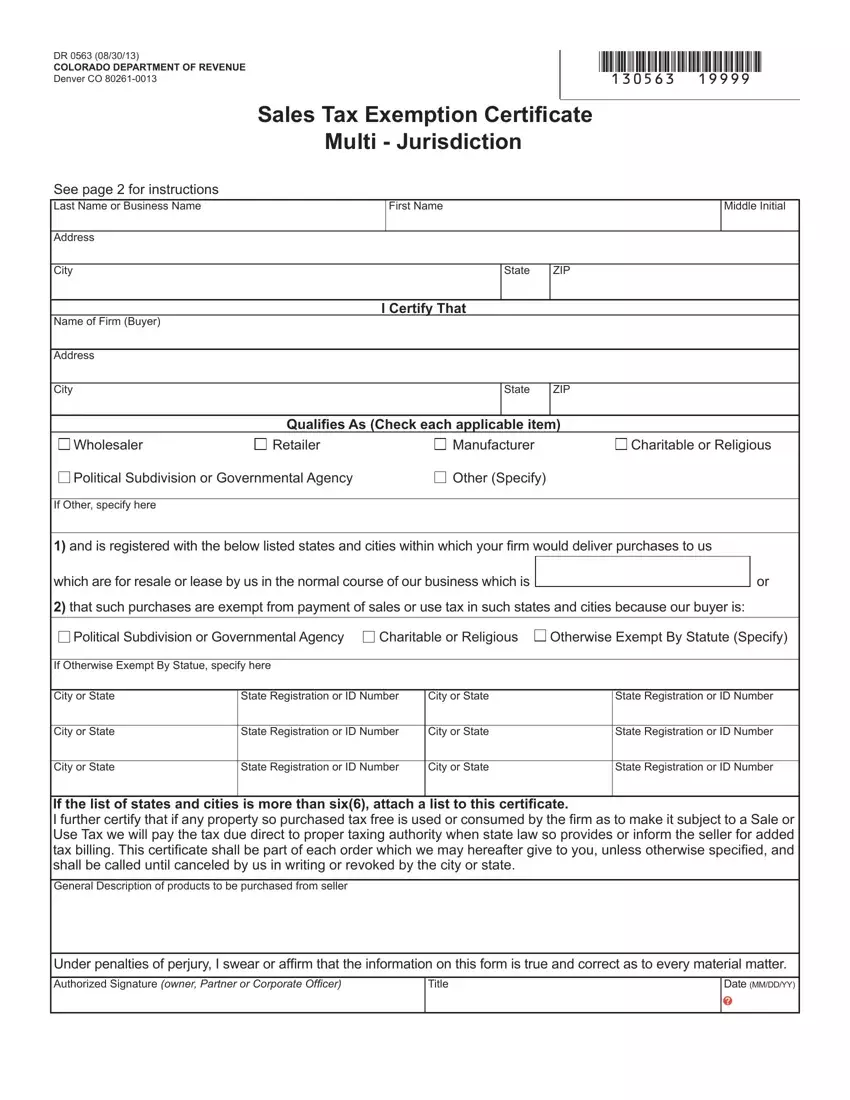

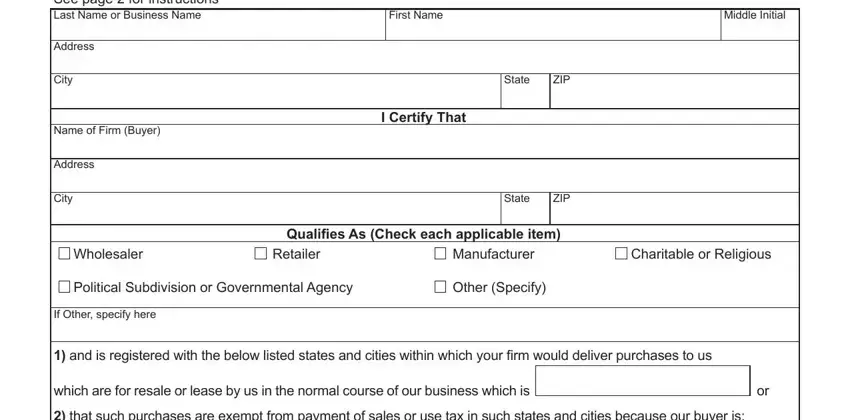

Create the colorado sales tax exemption certificate PDF by typing in the content required for every single area.

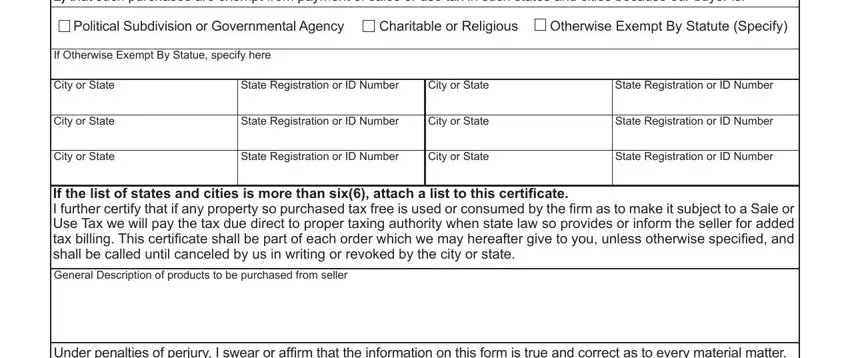

Write down the essential details in that such purchases are exempt, Political Subdivision or, Charitable or Religious, Otherwise Exempt By Statute Specify, If Otherwise Exempt By Statue, City or State, State Registration or ID Number, City or State, State Registration or ID Number, City or State, State Registration or ID Number, City or State, State Registration or ID Number, City or State, and State Registration or ID Number field.

You should be asked for some key data if you need to complete the Under penalties of perjury I swear, Date MMDDYY, and Title segment.

Step 3: At the time you click the Done button, your final document is conveniently exportable to any kind of of your gadgets. Or, you can send it via mail.

Step 4: Produce a copy of each single document. It should save you some time and help you stay away from problems down the road. By the way, your information will not be used or viewed by us.