Using PDF documents online can be surprisingly easy with this PDF editor. Anyone can fill in Colorado Form 104X here effortlessly. To retain our tool on the forefront of efficiency, we work to put into operation user-oriented capabilities and improvements on a regular basis. We're routinely pleased to get suggestions - play a pivotal role in reshaping the way you work with PDF documents. In case you are seeking to start, here's what it takes:

Step 1: Click the "Get Form" button above. It'll open our pdf editor so that you could begin filling in your form.

Step 2: The editor helps you modify your PDF form in a variety of ways. Modify it by writing your own text, correct original content, and put in a signature - all at your disposal!

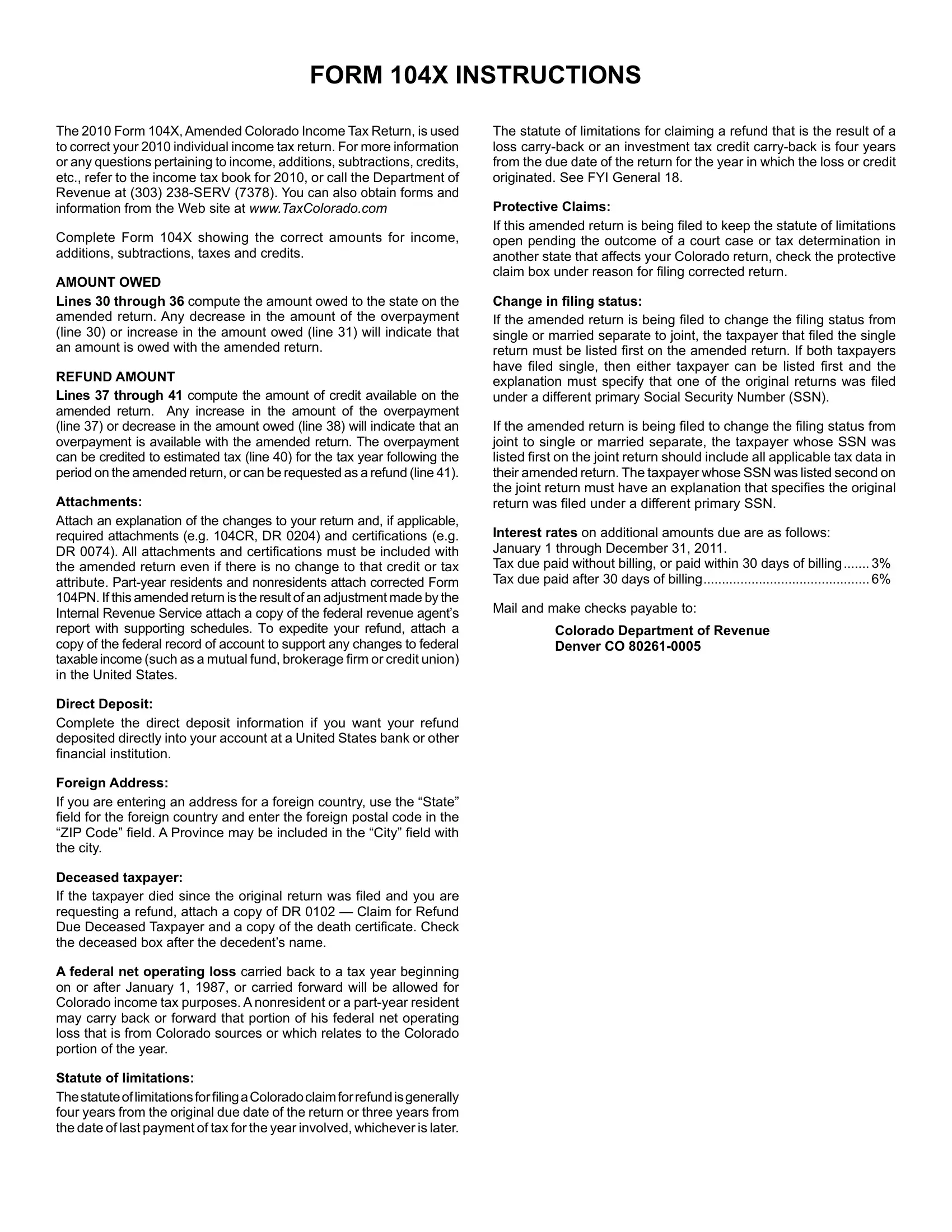

This PDF will require particular data to be entered, so be sure to take some time to fill in precisely what is expected:

1. It is advisable to complete the Colorado Form 104X properly, thus pay close attention when working with the segments that contain these particular fields:

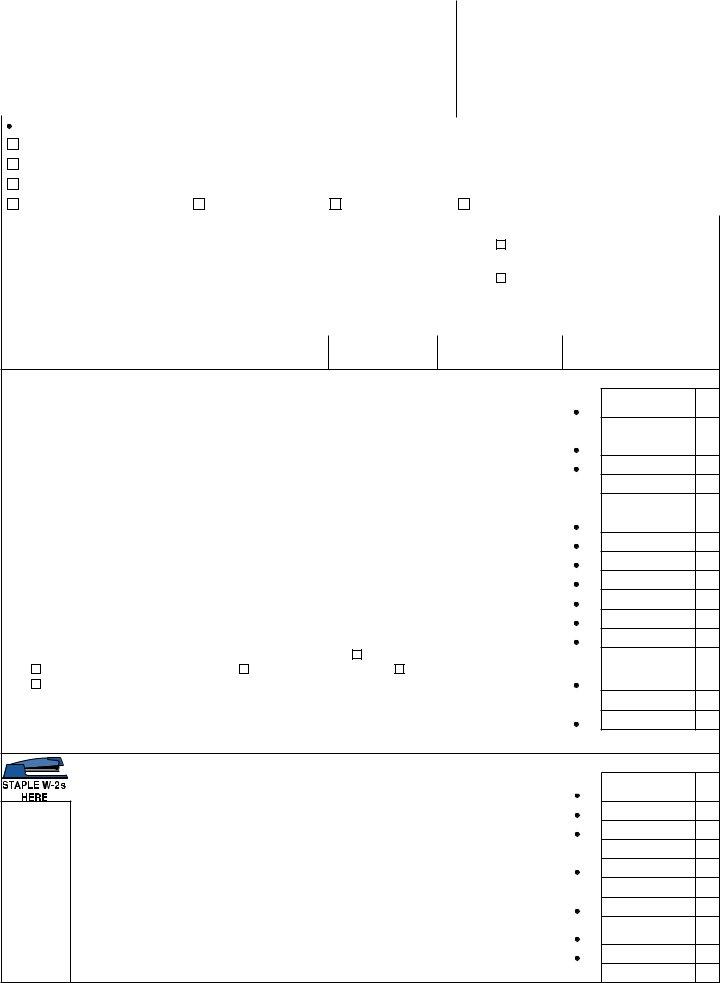

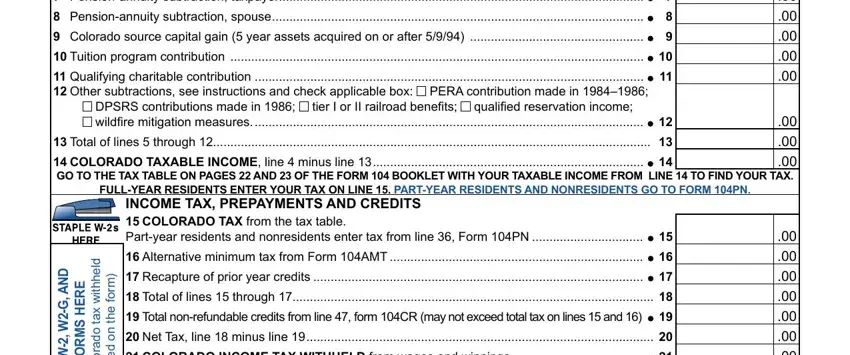

2. Your next stage is to complete these particular blanks: Pensionannuity subtraction, Pensionannuity subtraction spouse, Colorado source capital gain, Tuition program contribution, Qualifying charitable, PERA contribution made in, DPSRS contributions made in, qualiied reservation income, tier I or II railroad beneits, cOLORADO tAXAbLE incOME line, D n A, G W W E L P A t s, FuLLYEAR REsiDEnts EntER YOuR tAX, incOME tAX PREPAYMEnts AnD cREDits, and Total nonrefundable credits from.

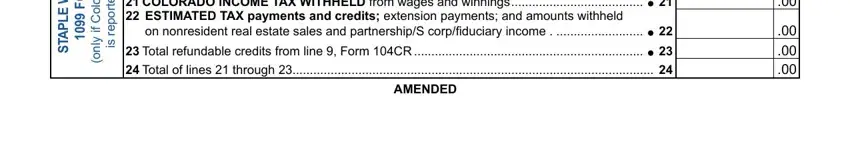

3. Completing G W W E L P A t s, cOLORADO incOME tAX WitHHELD from, on nonresident real estate sales, Total of lines through, w x a t o d a r o o C, f i y n o, m r o f e h t n o d e, t r o p e r s, AMEnDED, and E R E H s M R O F is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

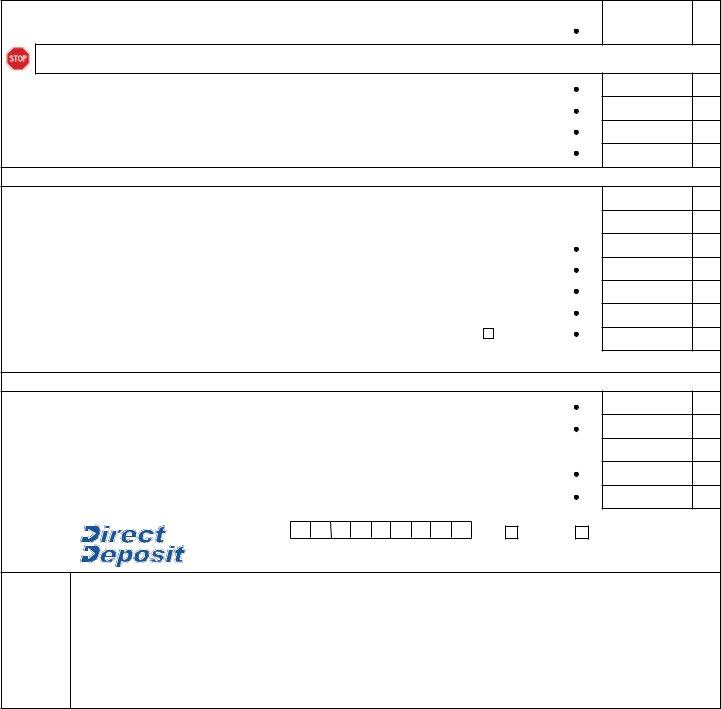

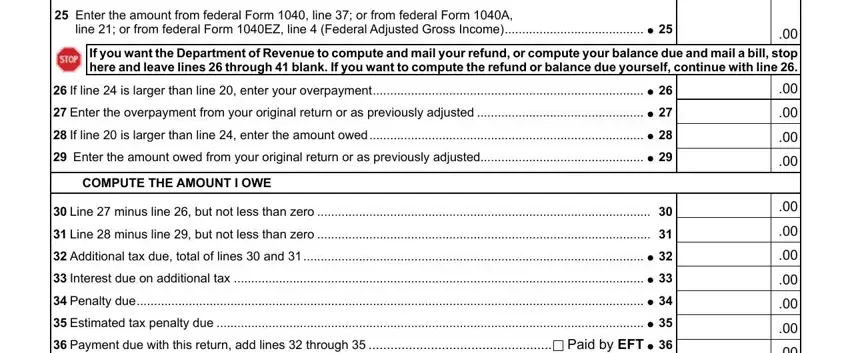

4. Completing Enter the amount from federal, line or from federal Form EZ line, if you want the Department of, If line is larger than line, Enter the overpayment from your, If line is larger than line, Enter the amount owed from your, cOMPutE tHE AMOunt i OWE, Line minus line but not less, Line minus line but not less, Additional tax due total of lines, Interest due on additional tax, Penalty due, Estimated tax penalty due, and Payment due with this return add is key in the fourth section - be certain to don't rush and take a close look at every single blank area!

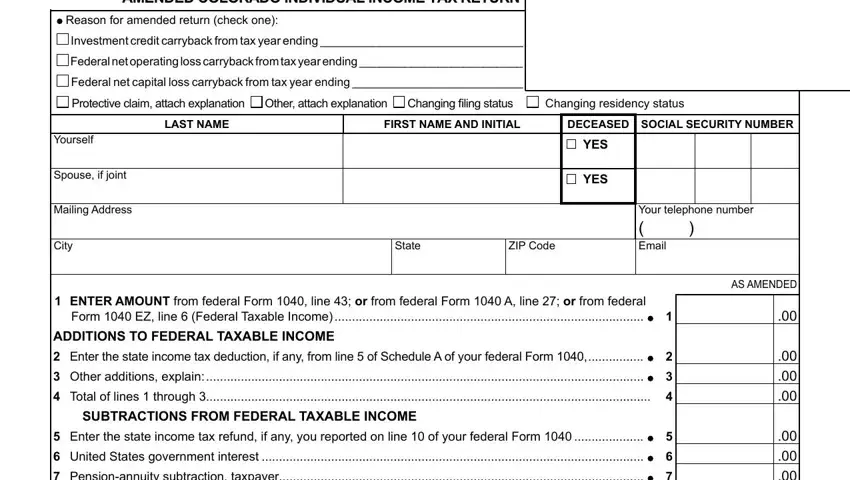

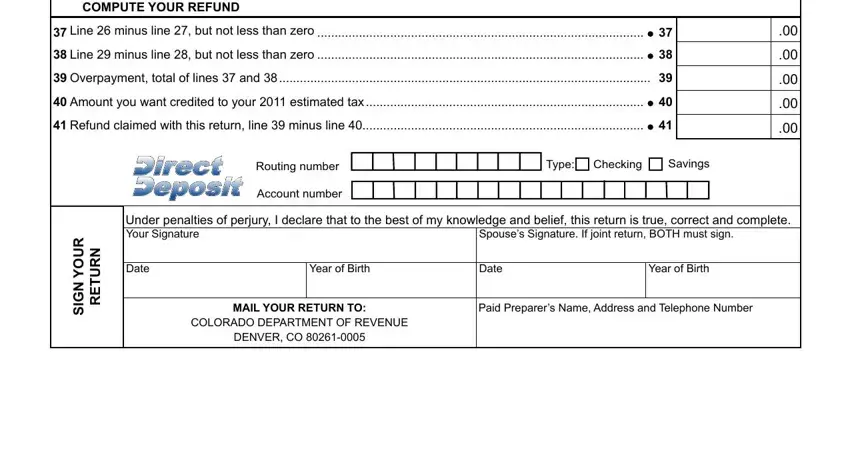

5. This very last stage to complete this document is essential. You'll want to fill in the necessary fields, and this includes be returned If your check is, Line minus line but not less, Line minus line but not less, Overpayment total of lines and, Amount you want credited to your, Refund claimed with this return, Routing number, Account number, Type, Checking, Savings, Under penalties of perjury I, Spouses Signature If joint return, Date, and Year of Birth, before finalizing. Otherwise, it could end up in an unfinished and potentially unacceptable paper!

Be really mindful when filling in Line minus line but not less and Under penalties of perjury I, because this is where a lot of people make mistakes.

Step 3: Before finalizing this form, check that all form fields are filled out correctly. Once you are satisfied with it, press “Done." Get hold of your Colorado Form 104X once you sign up for a 7-day free trial. Instantly get access to the form in your FormsPal account, along with any modifications and adjustments conveniently saved! FormsPal provides protected form completion without personal information record-keeping or distributing. Rest assured that your details are secure with us!