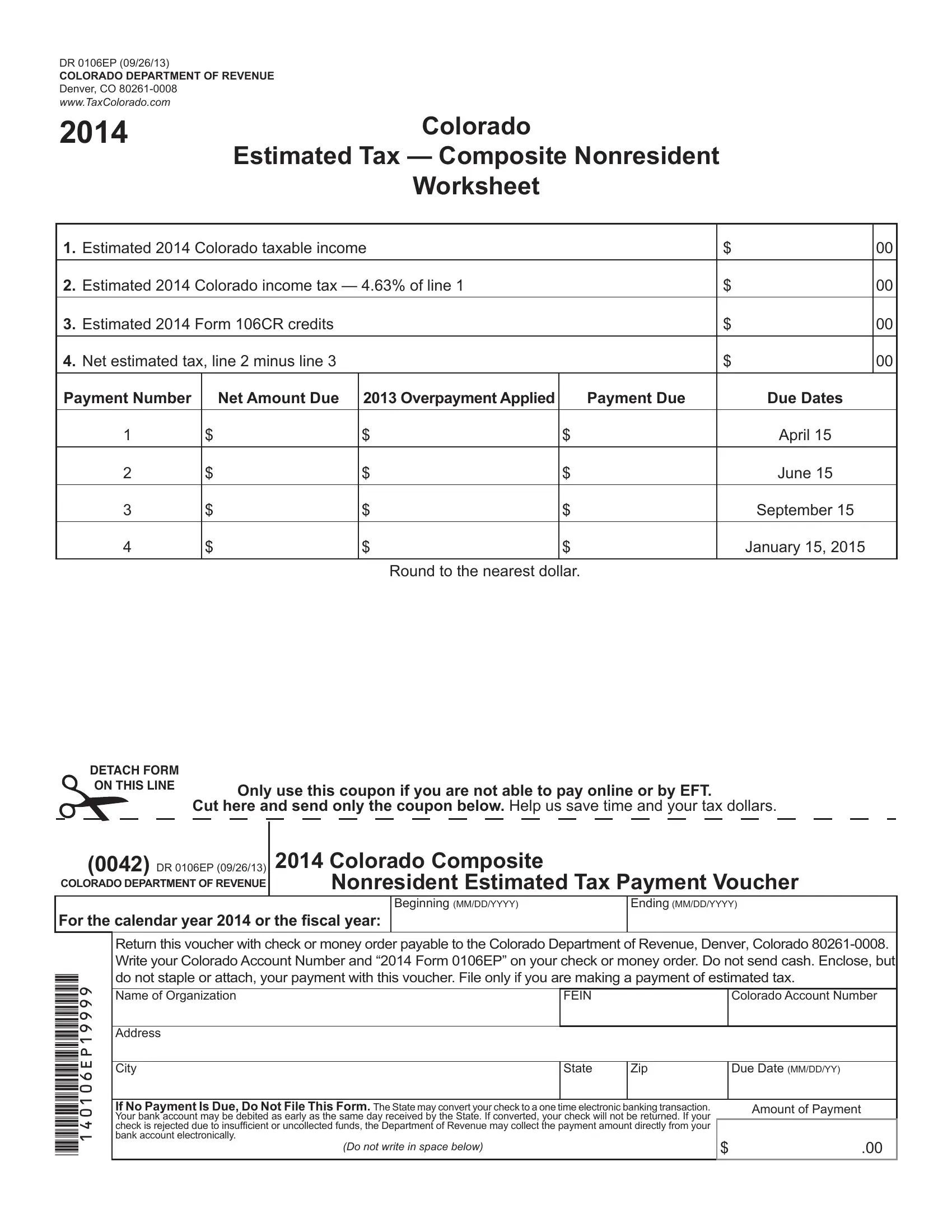

You could work with Colorado Form Dr 0106Ep effectively in our PDFinity® online tool. FormsPal team is dedicated to giving you the best possible experience with our tool by regularly introducing new capabilities and upgrades. Our tool is now a lot more user-friendly as the result of the newest updates! So now, working with PDF documents is easier and faster than before. All it requires is several simple steps:

Step 1: Access the PDF in our editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: This editor offers the ability to change PDF files in various ways. Change it with customized text, adjust original content, and place in a signature - all when you need it!

Filling out this document demands thoroughness. Ensure each and every blank field is filled out accurately.

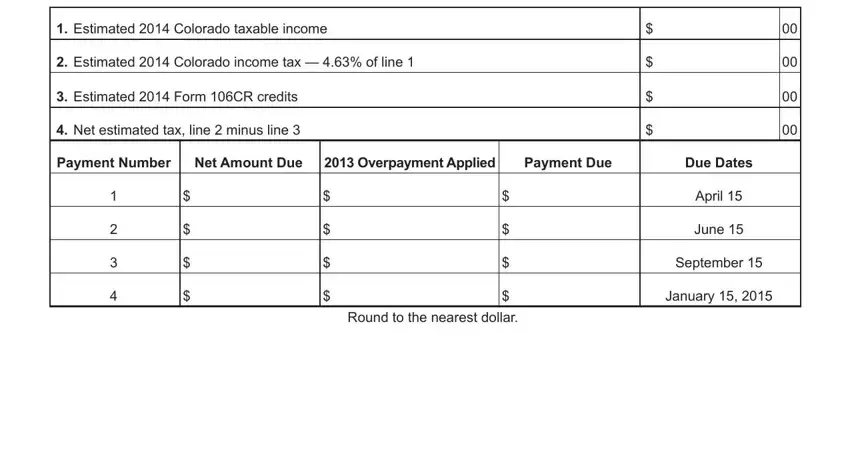

1. Whenever completing the Colorado Form Dr 0106Ep, make certain to complete all important blank fields in its relevant part. It will help facilitate the work, allowing your details to be processed promptly and appropriately.

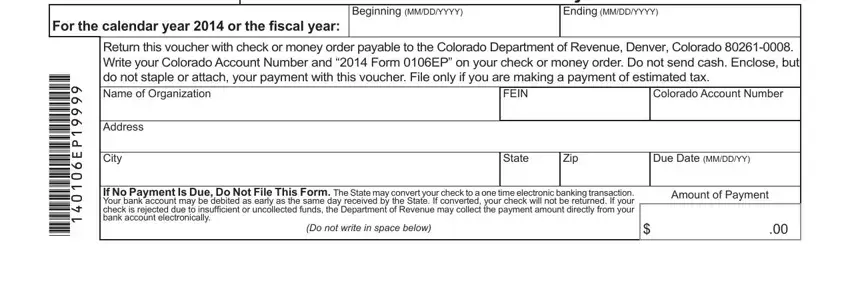

2. When this selection of blanks is done, go to enter the applicable details in all these - Colorado Composite, Nonresident Estimated Tax Payment, Beginning MMDDYYYY, Ending MMDDYYYY, For the calendar year or the, Return this voucher with check or, Colorado Account Number, FEIN, Address, City, State, Zip, Due Date MMDDYY, If No Payment Is Due Do Not File, and Amount of Payment.

It is possible to make a mistake when completing the FEIN, for that reason make sure you look again before you'll send it in.

Step 3: Confirm that the details are accurate and then click on "Done" to continue further. Download the Colorado Form Dr 0106Ep the instant you join for a 7-day free trial. Immediately use the pdf file within your personal cabinet, along with any modifications and adjustments being automatically kept! FormsPal is invested in the confidentiality of our users; we make certain that all personal information coming through our editor stays secure.