Due to the purpose of making it as quick to operate as it can be, we made this PDF editor. The entire process of creating the 15th will be uncomplicated should you comply with the following actions.

Step 1: Select the button "Get Form Here".

Step 2: You're now on the file editing page. You may edit, add content, highlight certain words or phrases, place crosses or checks, and insert images.

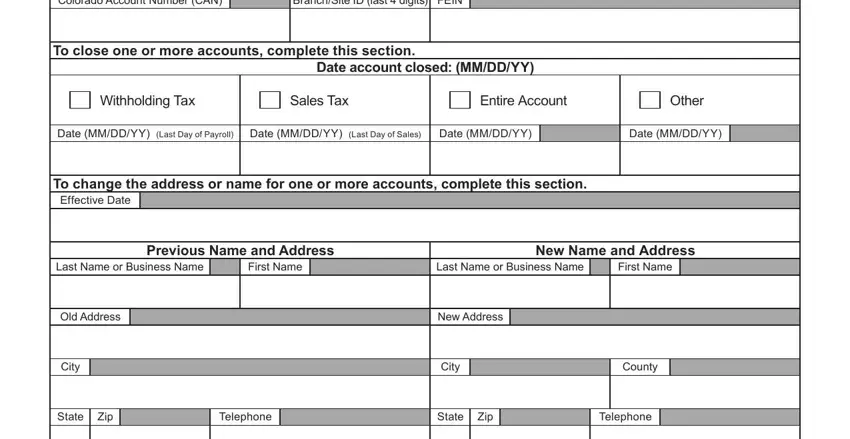

Enter the required material in each section to complete the PDF 15th

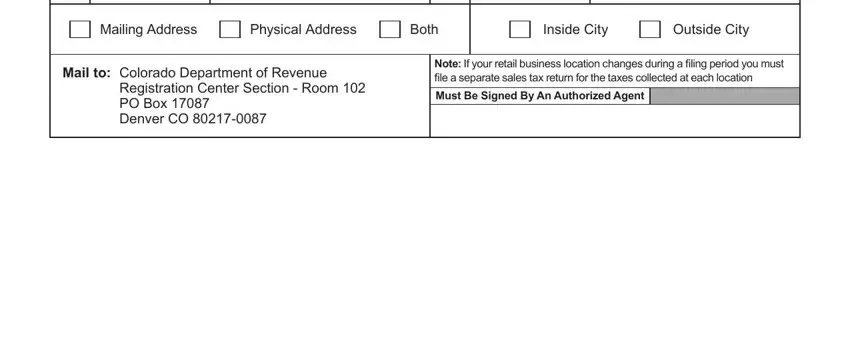

Fill in the Mailing Address, Physical Address, Both, Inside City, Outside City, Mail to Colorado Department of, Registration Center Section Room, Note If your retail business, and Must Be Signed By An Authorized fields with any data that can be requested by the program.

Step 3: Press the Done button to assure that your finished document can be transferred to any electronic device you use or forwarded to an email you indicate.

Step 4: Make copies of your form - it will help you stay clear of upcoming complications. And fear not - we do not share or check your details.