Embarking on the task of navigating the Colorado tax form can initially seem daunting, but a thorough look reveals a comprehensive framework designed to address the diverse financial contexts of its residents. Whether one is a full-year resident, a part-time resident, or a non-resident with financial ties to Colorado, the booklet provides clear guidance tailored to each situation. It includes a variety of forms such as the DR 0104 for individual income tax, DR 0104CH for voluntary contributions, and specialized schedules for calculating subtractions from income and tax credits, among others. Importantly, the booklet doesn't just stop at form-filling instructions. It also includes detailed disclosures on average taxes paid, offering a transparent snapshot of the fiscal landscape across different income brackets. With a structured mailing address system based on payment status and an emphasis on electronic filing to minimize errors, Colorado's Department of Revenue encourages efficient and accurate tax filing. Timing is also a critical aspect, providing specific deadlines for the regular tax season, extensions, and special considerations for deceased persons' filings and those living or traveling abroad. Moreover, the guide addresses unique situations such as military service, stressing the state's adherence to federal regulations while accommodating the peculiarities of military income. By delving into the nuances of the Colorado Individual Income Tax Filing Guide, one gains access to a wealth of resources aimed at demystifying the tax filing process, underscoring the state's commitment to fostering a user-friendly tax environment.

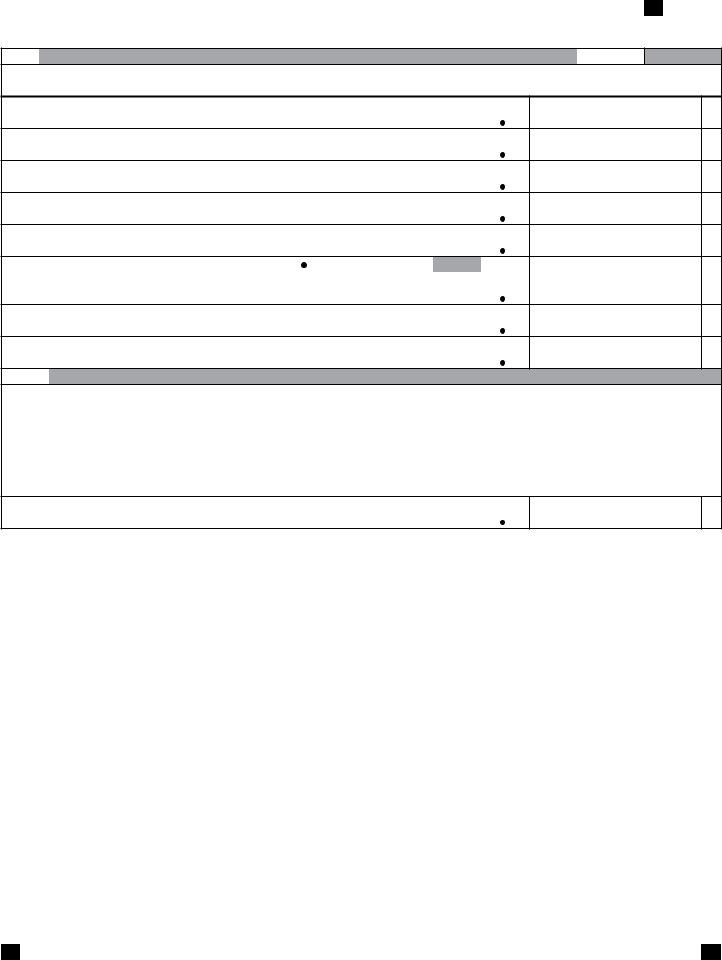

| Question | Answer |

|---|---|

| Form Name | Colorado Tax Form |

| Form Length | 40 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 10 min |

| Other names | colorado income form, colorado income tax, colorado income tax form 104, colorado income tax form printable |

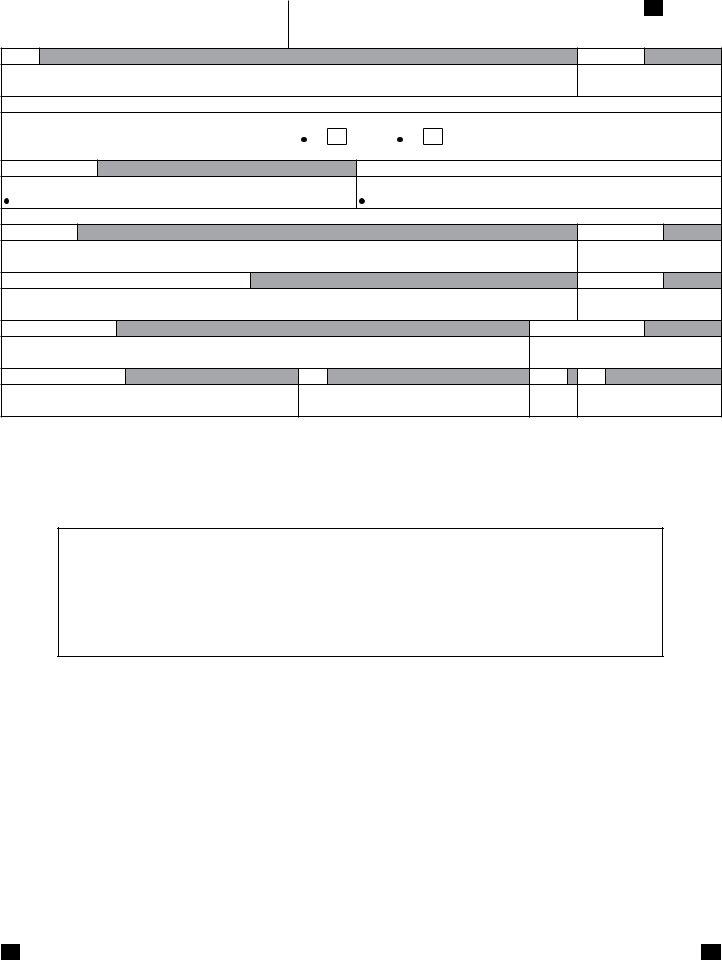

(11/04/19)

BOOKLET INCLUDES: |

104 |

Book |

Instructions |

||

DR 0104 |

|

|

Related Forms

2019

Colorado Individual Income Tax Filing Guide

This book includes:

DR 0104 2019 Colorado Individual Income Tax Form

DR 0104CH 2019 Voluntary Contributions Schedule

DR 0900 2019 Individual Income Tax Payment Form

DR 0104AD 2019 Subtractions from Income Schedule

DR

DR 0104CR Individual Credit Schedule 2019

Disclosure of Average Taxes Paid

Colorado Income Tax Table

Description of Voluntary Contribution organizations

MAILING ADDRESS FOR FORM DR 0104

WITH |

WITHOUT |

PAYMENT |

PAYMENT |

Mail To |

Mail To |

COLORADO DEPARTMENT OF REVENUE |

COLORADO DEPARTMENT OF REVENUE |

Denver, CO |

Denver, CO |

These addresses and zip codes are exclusive to the Colorado Department of Revenue, so a street address is not required.

Page 2

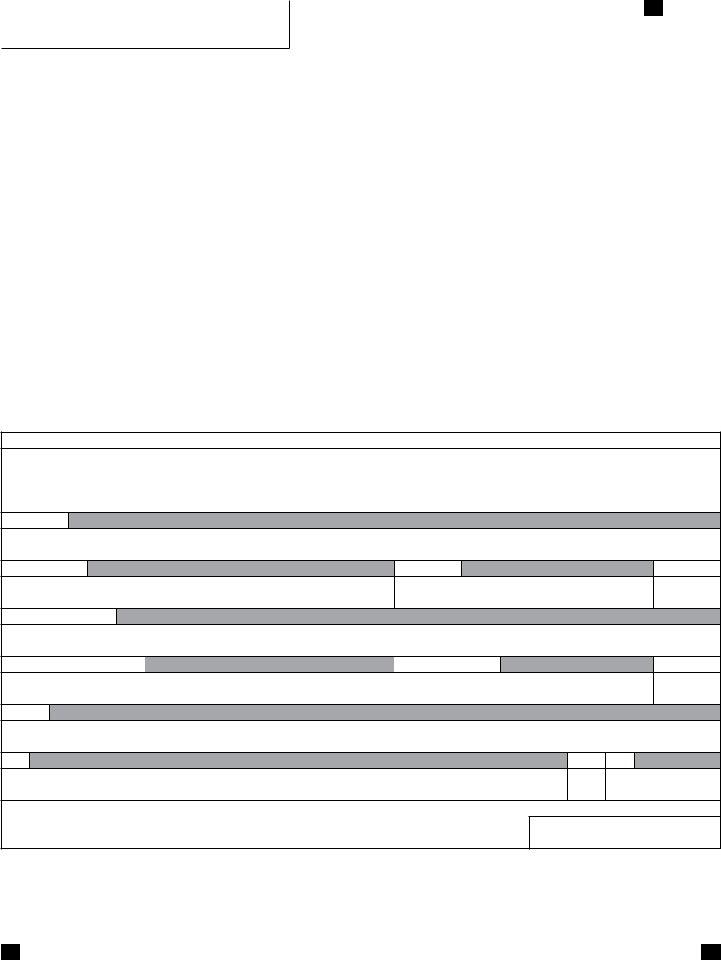

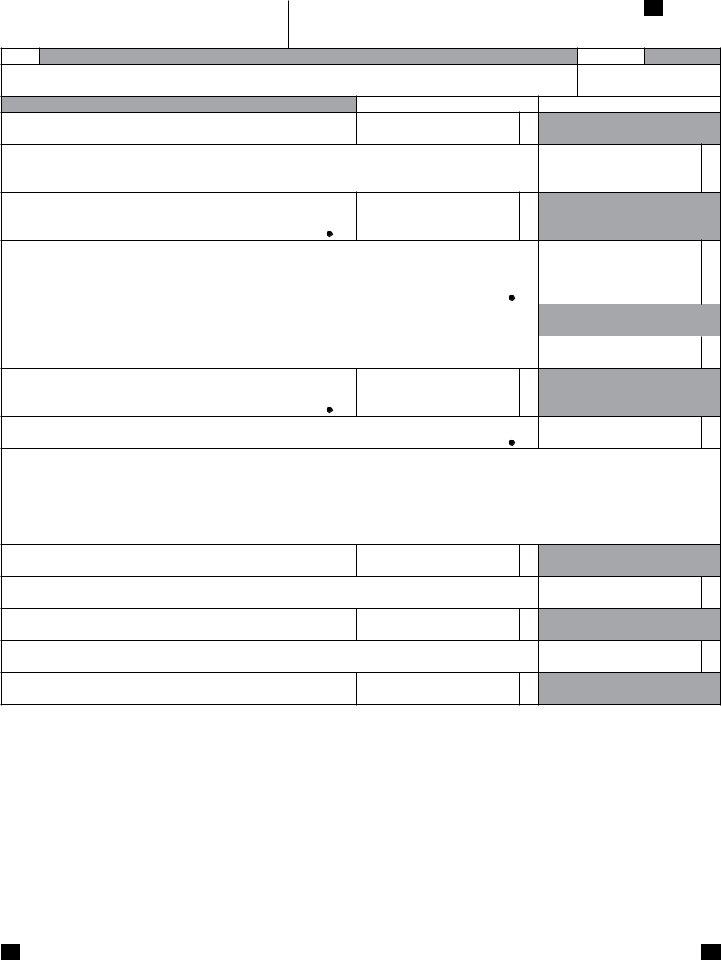

Disclosure of Colorado Expenditures and Revenues

** Due to rounding, the values in each chart may not sum to 100% |

|

|

|

|

|

|

||||

Revenues by Source |

|

|

|

Expenditures by Function |

|

|||||

Other |

|

|

|

|

Transportation |

Other |

|

|

||

|

|

|

|

8.9% |

|

|

||||

3.2% |

|

|

|

|

|

|

||||

|

|

|

|

|

4.5% |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Federal Grants |

|

|

|

|

|

Justice |

|

|

|

|

& Contracts |

|

|

|

|

|

|

|

|

||

|

Taxes |

|

|

6.4% |

|

Education |

||||

29.7% |

|

|

|

|

||||||

|

41.1% |

Business, Community |

|

|

39.9% |

|

||||

|

|

|

|

|

||||||

|

|

|

|

& Consumer Affairs |

|

|

|

|

||

|

|

|

|

|

5.2% |

|

|

|

|

|

Interest & Rents |

|

|

|

|

|

|

|

|

|

|

2.6% |

|

|

|

|

|

|

|

|

|

|

License, Permits |

Charges for |

|

|

|

|

|

|

|

||

& Fines |

|

|

|

Social Assistance |

|

|

||||

|

Goods & Services |

|

|

|

|

|||||

2.9% |

|

|

|

|

|

|||||

|

|

|

|

35.2% |

|

|

|

|||

|

20.5% |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

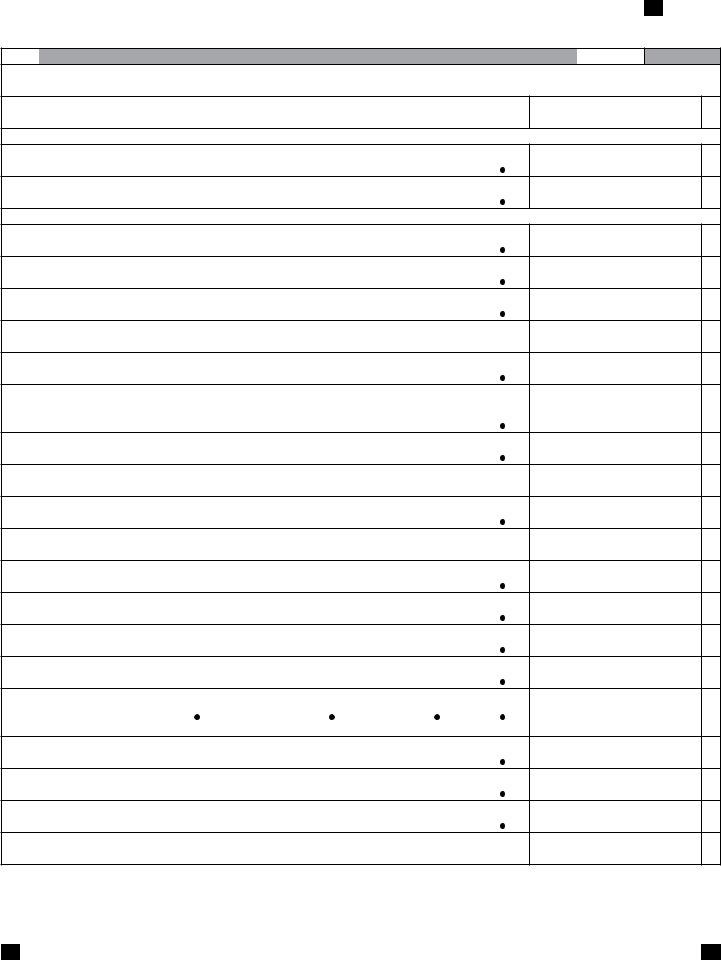

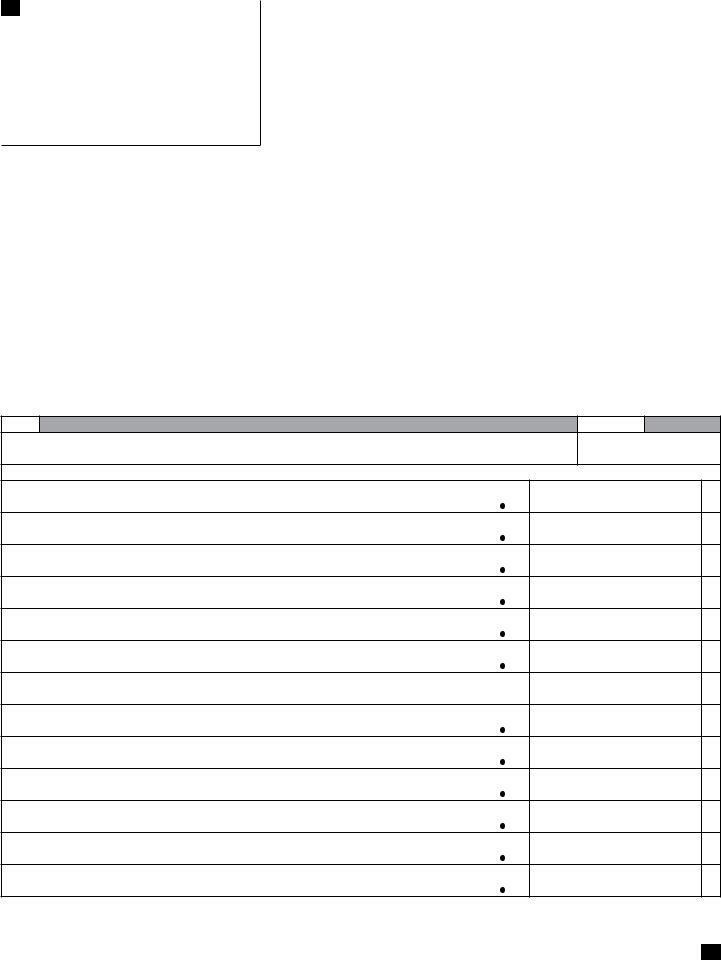

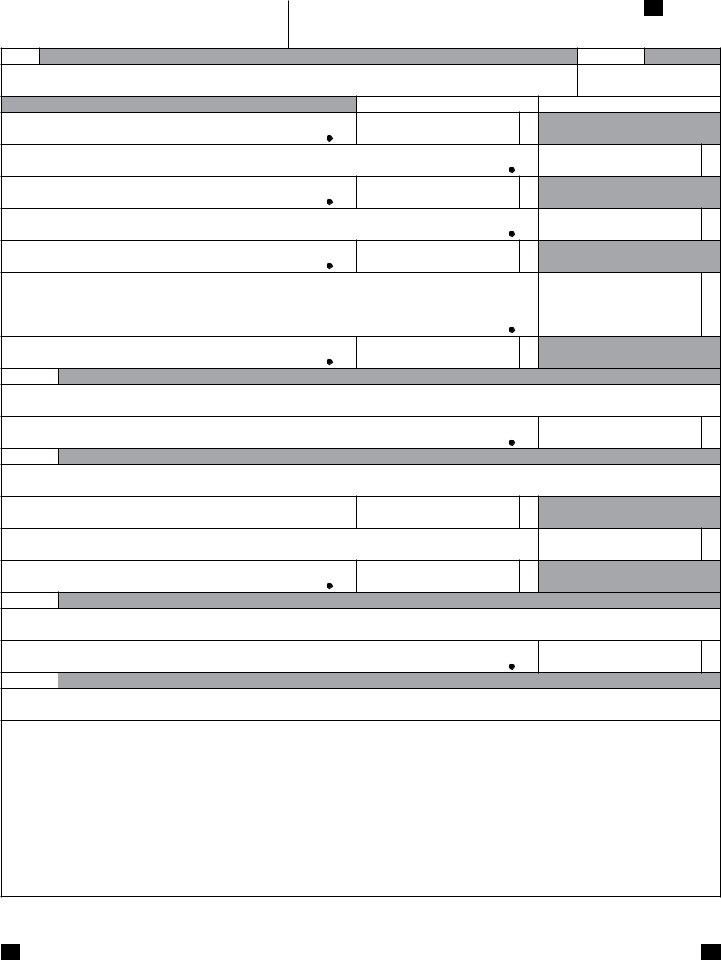

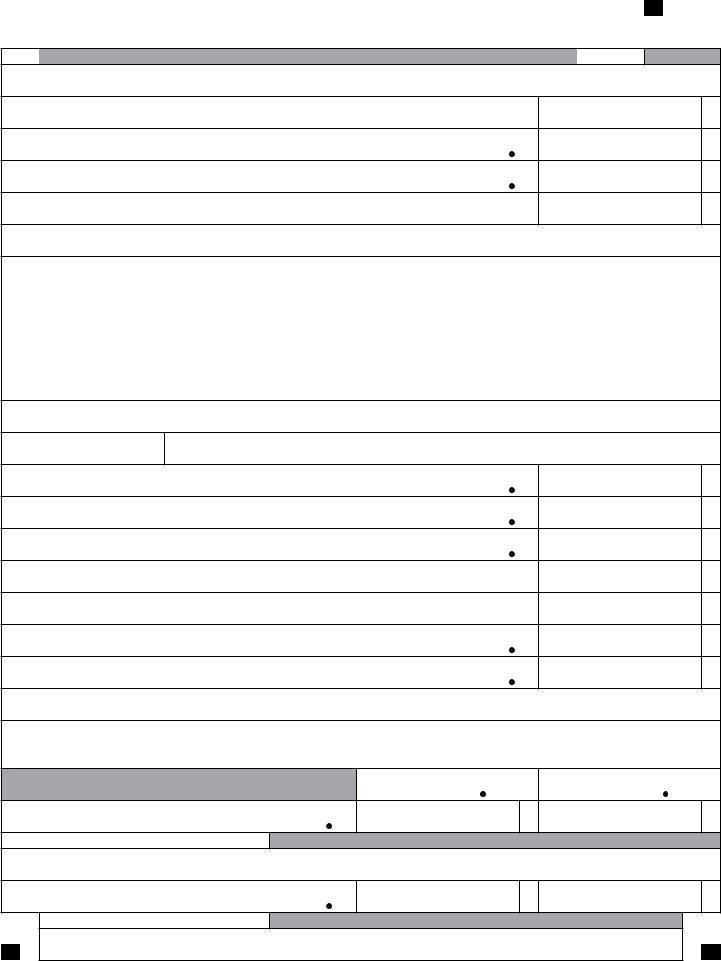

Disclosure of Average Taxes Paid |

|

|

|

|

|

|

||||

Calendar Year 2016 |

|

|

|

Average Family Money Income 1 |

|

|

|

|||

|

$0 |

$15,000 |

$30,000 |

$40,000 |

$50,000 |

$70,000 |

$100,000 |

$150,000 |

$200,000 |

|

|

to |

to |

to |

to |

to |

to |

to |

to |

and |

Weighted |

State Taxes and Fees |

$15,000 2 |

$29,999 |

$39,999 |

$49,999 |

$69,999 |

$99,999 |

$149,999 |

$199,999 |

more |

Average 3 |

|

|

|

|

|

|

|

|

|

|

|

Individual Income 4 |

$83 |

$319 |

$719 |

$1,063 |

$1,567 |

$2,428 |

$3,850 |

$5,696 |

$16,241 |

$2,544 |

Sales 5 |

$285 |

$347 |

$468 |

$487 |

$582 |

$712 |

$923 |

$1,204 |

$2,480 |

$690 |

Gasoline and Gasohol 6 |

$92 |

$117 |

$156 |

$178 |

$202 |

$240 |

$274 |

$288 |

$437 |

$198 |

Licenses 7 and Registrations 8 |

$91 |

$126 |

$162 |

$171 |

$188 |

$224 |

$250 |

$250 |

$259 |

$179 |

Alcoholic Beverages 6 |

$4 |

$3 |

$4 |

$6 |

$6 |

$9 |

$14 |

$18 |

$42 |

$9 |

Cigarettes and Tobacco 6 |

$44 |

$42 |

$48 |

$49 |

$49 |

$52 |

$50 |

$34 |

$42 |

$46 |

Total State Taxes and Fees |

$598 |

$955 |

$1,557 |

$1,955 |

$2,595 |

$3,665 |

$5,361 |

$7,491 |

$19,501 |

$3,667 |

Local Taxes and Fees |

|

|

|

|

|

|

|

|

|

|

Residential Property 5 |

$666 |

$1,024 |

$1,363 |

$1,316 |

$1,652 |

$2,128 |

$2,998 |

$4,259 |

$9,964 |

$2,240 |

Sales and Use 5 |

$446 |

$544 |

$733 |

$763 |

$912 |

$1,115 |

$1,444 |

$1,886 |

$3,882 |

$1,081 |

Specific Ownership 8 |

$94 |

$136 |

$177 |

$188 |

$209 |

$250 |

$282 |

$282 |

$292 |

$198 |

Occupation 9 |

$2 |

$6 |

$9 |

$11 |

$15 |

$22 |

$31 |

$44 |

$136 |

$23 |

Total Local Taxes and Fees |

$1,208 |

$1,709 |

$2,282 |

$2,278 |

$2,788 |

$3,515 |

$4,755 |

$6,470 |

$14,273 |

$3,542 |

Federal Taxes |

|

|

|

|

|

|

|

|

|

|

Individual Income 4 |

$609 |

$1,166 |

$2,273 |

$3,377 |

$5,318 |

$8,716 |

$14,652 |

$24,598 |

$100,649 |

$12,224 |

Medicare 10 |

$106 |

$303 |

$483 |

$630 |

$843 |

$1,198 |

$1,746 |

$2,478 |

$12,382 |

$1,595 |

Social Security 10 |

$455 |

$1,294 |

$2,067 |

$2,693 |

$3,607 |

$5,121 |

$7,347 |

$7,347 |

$7,347 |

$3,536 |

Total Federal Taxes |

$1,170 |

$2,762 |

$4,824 |

$6,699 |

$9,768 |

$15,035 |

$23,745 |

$34,422 |

$120,377 |

$17,356 |

Total Taxes and Fees Paid |

|

|

|

|

|

|

|

|

|

|

Households |

$2,977 |

$5,426 |

$8,663 |

$10,932 |

$15,150 |

$22,214 |

$33,861 |

$48,384 |

$154,152 |

$24,565 |

Taxes Paid by Employers 11 |

$561 |

$1,597 |

$2,551 |

$3,323 |

$4,450 |

$6,319 |

$9,093 |

$9,825 |

$19,729 |

$5,131 |

Federal data and other data sources are used to estimate average taxes paid when actual data are unavailable for most tax types.

The methodology for some estimates and income class categories changed from 2014 due to changes in the Bureau of Labor Statistics Consumer Expenditure Survey (CES), therefore estimates from prior years may not be comparable.

1Estimate of income uses the CES definition of “money income” which includes all sources of income, taxable and nontaxable, as well as transfer payments (such as public

assistance, supplemental security income, food stamps, and other benefits or contributions).

2Some taxpayers family money income estimate was negative. Negative income is associated with

because we cannot reliably assign them to the income categories used in this table.

3The weighted averages were calculated for each row using the average tax paid for each income class multiplied by the total number of filers in that income class. This

report’s weighted average values are not comparable to prior reports’ average values.

4Estimate is based on values from state and Federal income tax returns.

5Estimate is calculated using the CES proportion of income for the tax on that item for each class, multiplied by the Colorado average income value for each class.

6Industry data (e.g., average prices) was used to estimate the tax paid based on the CES value for that item. Then, the estimate was calculated using the CES proportion of

income for the tax on that item for each class, multiplied by the Colorado average income value for each class.

7The total state collections for drivers licenses was divided by the total number of filers, yielding a flat fee across all income classes.

8The registrations and specific ownership fees/taxes paid were estimated using the total state collections and the CES average number of vehicles for each income class.

9Total local occupation fees collected were distributed by income class.

10Medicare and Social Security taxes were estimated based on income subject to these taxes.

11Employers pay taxes to Medicare and Social Security on the employees’ behalf.

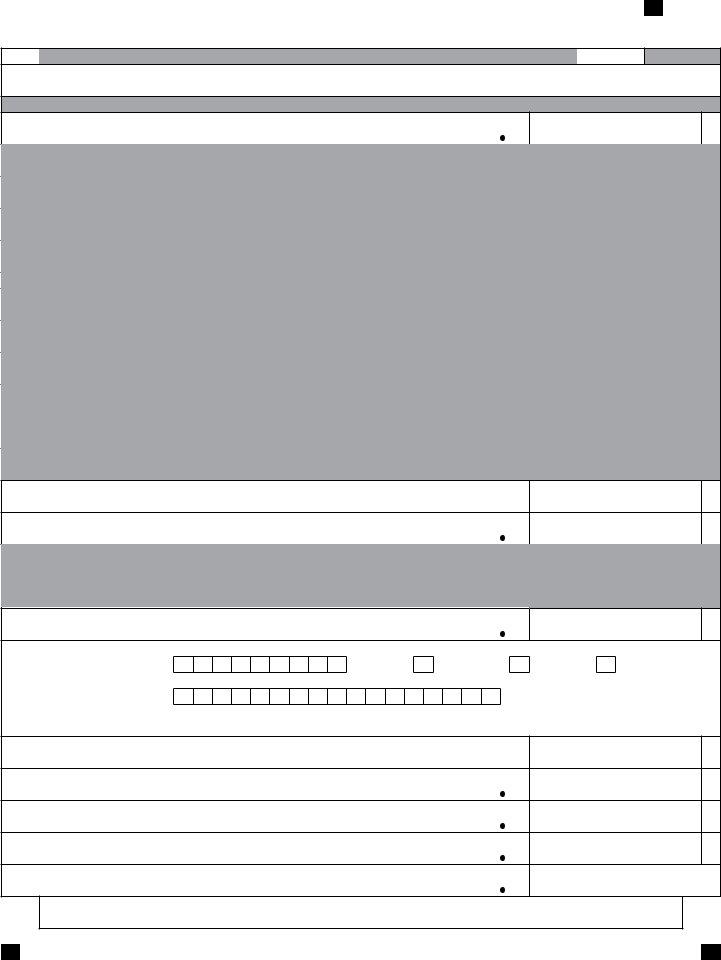

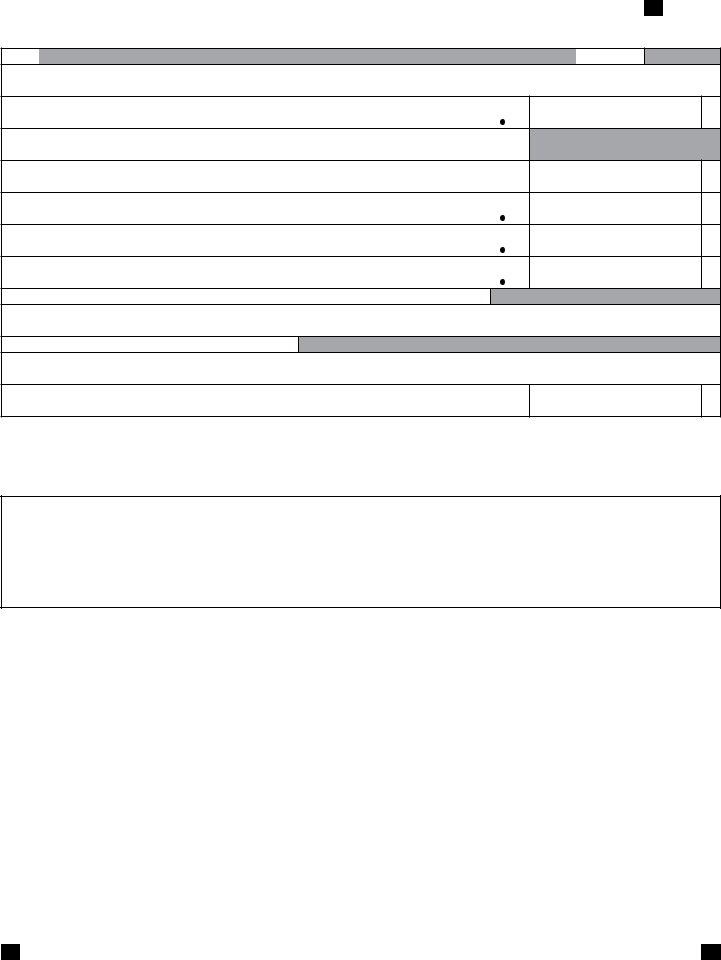

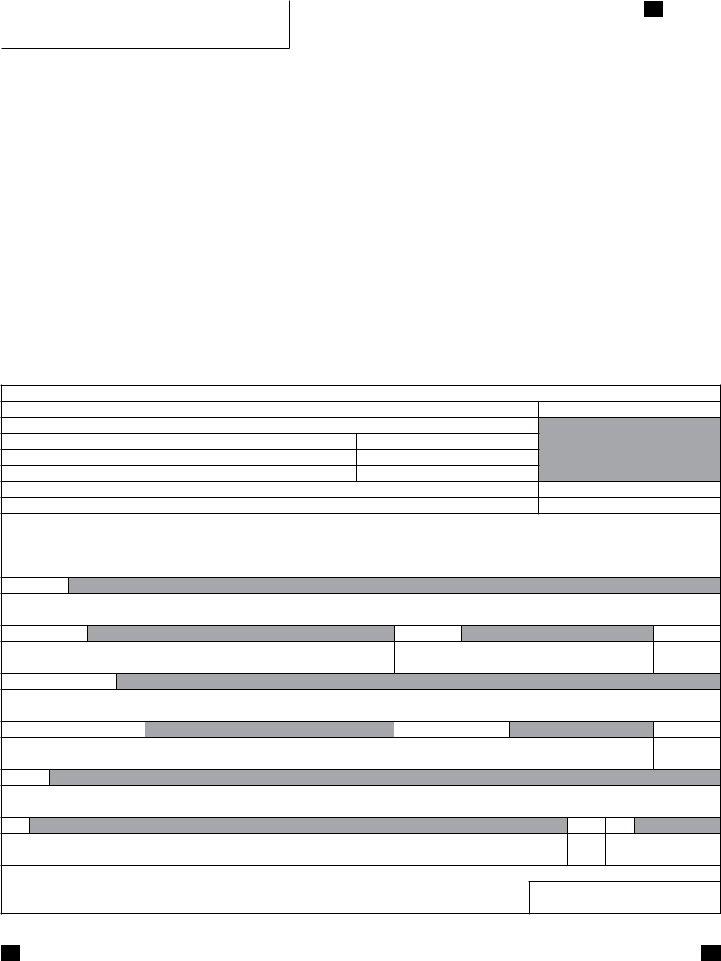

Table of Contents

Disclosure of Average Taxes Paid |

2 |

DR 0900: Individual Payment Form |

25 |

Using this Guide: Filing Instructions |

3 |

DR |

27 |

Taxpayer Service and Assistance |

8 |

DR 0104PN: |

|

Tax Table |

15 |

Tax Calculation Schedule |

29 |

DR 0104: Colorado Return for All Resident Types |

17 |

DR 0104US: Consumer Use Tax Reporting Schedule.. |

33 |

DR 0104CH: Voluntary Contributions Schedule |

21 |

DR 0104CR: Individual Credit Schedule |

35 |

DR 0104AD: Subtractions from Income Schedule .. |

23 |

Voluntary Contribution Information |

39 |

How To Use This Filing Guide

This filing guide will assist you with completing your Colorado

Income Tax Return. Please read through this guide before

starting your return. Once you finish the form, file it with a computer, smartphone or tablet using our free and secure

Revenue Online service at Colorado.gov/RevenueOnline. You may also file using private

reason, mail the enclosed forms as instructed. All Colorado

forms and publications referenced in this guide are available for download at Colorado.gov/Tax, the official Taxation website.

The following symbols appear throughout this guide and point out important information, reminders and changes to tax rules.

This points out a topic that is the source of common

filing errors. Filing your return on Revenue Online will reduce the risk of errors; however, it is important

to understand the information on your return. Errors

cause processing delays and erroneous bills.

Several subtractions and tax credits require you to provide supporting documentation. This symbol points out those requirements. If the additional documentation is not provided, it will cause processing delays or denial of the credits/ subtractions. These documents can be scanned and attached to your electronic filing through

Revenue Online or most tax software, mailed with

the DR 1778 or attached to your paper return.

publications are available in the Education and Legal Research section at Colorado.gov/Tax.

Filing Information

Who Must File This Tax Return

Each year you must evaluate if you should file a Colorado income tax return. Generally, you must file this return if you are required to file a federal income tax return with the IRS for this year or will have a Colorado income tax liability for

this year and you are:

•A

•A

•Not a resident of Colorado, but received income from sources within Colorado.

Colorado residents must file this return if they are required to file an income tax return with the IRS,

even if they do not have a Colorado tax liability.

Otherwise, the Department may file a return on your

behalf and our return might not consider your unique tax situation. Also, the only way to determine if you

are entitled to a refund is to file a return.

Due Date

Page 3

postmarked by April 15. An automatic extension to file is

granted until October 15, but there is no extension to pay. See page 27 for more information.

Deceased Persons

Legal representatives and surviving spouses may file a return on behalf of a deceased person whose date of death was

during the tax year. Surviving spouses may complete the

return as usual and indicate the deceased status on the return. They can file the return and submit a copy of the death certificate through Revenue Online. Legal represen- tatives may file the return and submit a copy of the death certificate through Revenue Online, but they must complete

the Third Party Designee portion of the return. Either a

surviving spouse or legal representative can avoid problems when filing on paper by marking the box next to the name of the deceased person, writing “DECEASED” in large letters in the white space above the tax year of the return, writing “FILING AS SURVIVING SPOUSE” or “FILING AS LEGAL REPRESENTATIVE” after their signature, and attaching the DR 0102 and a copy of the death certificate to the return.

To claim a refund on behalf of a deceased person: you must submit a copy of the death certificate with the DR 0102 when filing the return.

Filing Status

You must file using the same filing status on both your federal and Colorado income tax returns. Any two individuals who legally file a joint federal income tax

return must also file their Colorado income tax return jointly. Individuals filing a joint return must list the

taxpayer names and Social Security numbers (SSN) in the same order on both the federal and Colorado returns. For married filing separate, do not list your spouse’s name or SSN on the return.

Claiming Credits from a

Individuals claiming tax credits as a partner or shareholder must obtain from the partnership or S corporation a federal Schedule

of Revenue verifies the credit claims of partners and shareholders by reviewing the partnership or S

corporation’s return. The Schedule

may be submitted through Revenue Online, through tax software or may be attached to a paper return.

First, complete the federal income tax return you will file with the IRS because you will use information from that return

on your Colorado income tax return. Colorado income tax

is based on your federal taxable income, which has already

considered your deductions.

Residency Status

Mark the appropriate box to designate your residency status.

The DR 0104 and any tax payment owed are due April 15, 2020. Revenue Online will accept returns as timely filed until midnight. Returns that are mailed must be

If you are filing a joint return, and one person is a

Colorado resident and the other is either a

Page 4

Tax is prorated so that it is calculated only on income received

in Colorado or from sources within Colorado. We recommend you review publication FYI Income 6 if this applies to you. You will calculate your prorated tax by completing the DR 0104PN. You must submit the DR 0104PN with your return.

Persons Traveling or Residing Abroad

If you are traveling or residing outside the United States

on April 15, the deadline for filing your return is June 15, 2020. If you need additional time to file your return, you will automatically have until October 15, 2020, to file. Interest is

due on any tax paid after April 15, 2020. To avoid any late

payment penalties, you must pay 90% of your tax liability by June 15, 2020, file your return by October 15, 2020 and pay any remaining tax due at the time of filing. When filing your return, mark the “Abroad on Due Date” box on Revenue

Online or the paper return.

Active Duty Military

Under federal law, a military servicemember’s state of legal

residence does not change solely as the result of the service-

member’s assignment for service in another state. Consequently, a Colorado resident who enters into military service will remain a Colorado resident unless they officially change their state of

legal residence as described in DD Form 2058.

In general, military servicemembers who are Colorado residents are subject to the same income tax filing requirements as other

Colorado residents, even if they are serving in another state.

These requirements are described on the preceding page, under the heading “Who Must File This Tax Return.”

However, any military servicemember who spends at least 305 days of the tax year stationed outside of the United States on

active military duty may elect to be treated as a nonresident.

The servicemember may make this election by filing a return and checking the applicable box on Form 104PN.

Military servicemembers who are stationed in Colorado, but

are not Colorado residents, are not required to pay Colorado tax on their military income. However, any other Colorado source income of a nonresident servicemember is subject to

Colorado taxation.

Please see “Military Service Members — Special Filing Information” webpage on our website for additional information.

The residency rules described above for military servicemembers also apply generally to a

servicemember’s spouse if the spouse is residing with the servicemember either inside or outside of Colorado in compliance with the servicemember’s military orders. If a servicemember and their spouse

are nonresidents stationed in Colorado, any wages earned by the spouse for work performed in Colorado are not subject to Colorado taxation. The military spouse must complete a DR 1059, provide a copy to their employer when hired for employment, and submit a copy to the Department, along with a copy of their military ID card, when they file their Colorado return each year. The DR 1059 may be filed with the Department through Revenue Online, with DR 1778,

or as an attachment to a DR 0104 filed by paper.

Name and Address

Provide your name, mailing address, date of birth, Social

Security number, as well as the state of issue, last four digits, and the date of issuance of your state issued ID card in the provided spaces. If filing Married Filing Joint, provide the spouse’s information where prompted. Provide the spouse’s information ONLY if filing a joint return. Otherwise leave blank. All Departmental correspondence will be mailed to

the mailing address provided. We recommend you read publication FYI General 2 for the Privacy Act Notice.

Line 1 Federal Taxable Income

Refer to your federal income tax return to complete this line:

• Form 1040 line 11b

If your federal taxable income is a negative amount, be sure to enter the amount as such on your Colorado return. If submitting a paper return, put the negative amount in parentheses, for example ($1,234).

Do not enter your total income or wages on this line because it will make your tax too high. The Department will compare the amount you list here to the return you file with the IRS, so be very careful

to complete this correctly.

Additions

Line 2 State Addback

Refer to your federal income tax return to complete this line.

Enter $0 if you filed Form 1040 or 1040SR but did not itemize

your deductions on Schedule A.

Taxpayers who deduct general sales taxes on Schedule A

line 5a, Form 1040 or 1040SR, are not required to calculate this addback. If you deducted state income tax on Schedule

A line 5a, complete the worksheet below to calculate the Income Tax Deduction.

We recommend that you read publication FYI

Income 4 for special instructions before completing the worksheet below.

Complete the following worksheet to determine your state

income tax deduction addback.

a) |

Is the amount on federal Form 1040 or |

|

|

1040SR Schedule A line 5d greater than |

|

|

the amount on federal Form 1040 or |

|

|

1040SR Schedule A line 5e? |

|

|

No. Enter the state income tax |

|

|

deduction from federal Form 1040 |

|

|

or 1040SR Schedule A line 5a. |

|

|

Yes. Subtract the amounts on federal |

|

|

Form 1040 or 1040SR Schedule |

|

|

A lines 5b and 5c from the |

|

|

amount on line 5e. Enter the |

|

|

result, but not less than $0. |

$ |

b) Total itemized deductions from federal |

|

|

|

Form 1040 or 1040SR Schedule A line 17 |

$ |

|

|

|

c) |

The amount of federal standard deduction |

|

|

you could have claimed (See instructions |

|

|

federal Form 1040 or 1040SR line 9 for |

|

|

2019 federal standard deductions.) |

$ |

$

Transfer to line 2 of the DR 0104 the smaller amount from line (a) or (d) of the worksheet above.

Line 3 Other Additions

Enter the sum of the following and specify which addition(s)

in text box:

• Bond

from bonds issued by any state or political subdivision, excluding any bonds issued by the State of Colorado or its political subdivisions on or after May 1, 1980. Calculate the appropriate amount by subtracting the amortization of bond premiums and expenses (required to be allocated to interest income by Internal Revenue Code) from the gross amount of state and local bond interest. We recommend that you read publication FYI Income 52 if this applies to you.

•Improper distributions from a qualified state tuition program for which tuition program contribution subtraction was previously claimed. See FYI

Income 44 for additional information.

•Dependent child

•Charitable gross conservation

• Alien

unauthorized alien labor services. We recommend that you read publication FYI Income 64 if this applies to you.

•

•Any expenses incurred by a taxpayer with respect to expenditures made at, or payments made to, a club that restricts membership on the basis of sex, sexual orientation, marital status, race, creed, religion, color, ancestry or national origin.

•Distributions from a medical savings account not made for an eligible expense.

•Charitable hunger relief credit

amount of your federal charitable deduction for a donation for which a Credit for Food Contributed to

Line 4 Subtotal

Enter the sum of lines 1 through 3.

Line 5 Subtractions from the DR 0104AD Schedule, line 20

Transfer the amount from the DR 0104AD line 20 to report

any subtractions from your Federal Taxable Income. These subtractions will change your Colorado Taxable Income from

the amount of Federal Taxable Income. See instructions in the income tax booklet for additional guidance on completing this schedule. Do not enter negative amounts. To ensure faster processing of your paper return, the amount entered

Page 5

on line 5 must exactly match the amount on the DR 0104AD.

You must submit the DR 0104AD with your return.

Line 6 Colorado Taxable Income

Subtract line 5 from line 4. This is your Colorado taxable income and is the figure used to determine how much Colorado tax is owed, if any.

Line 7 Colorado Tax

The income tax rate is currently 4.5%.

should transfer the apportioned tax amount from the DR 0104PN line 36. You must submit the DR 0104PN with your return.

Line 8 Alternative Minimum Tax

Enter the amount of any Alternative Minimum Tax. Generally, if you

pay alternative minimum tax on your federal income tax return, you will pay the same for your Colorado return. We recommend

that you read publication FYI Income 14 if this applies to you.

Line 9 Recapture of Prior Year Credits

Enter any credit claimed in prior years that is subject to recapture under Colorado law.

Line 10 Subtotal

Sum of lines 7 through 9.

Tax Credits

Visit

about which tax credits can be claimed on this form.

Line 11 Nonrefundable Credits

Complete the DR 0104CR to claim various nonrefundable credits. Transfer the amount from the DR 0104CR line 41 to

this line. The nonrefundable credits used from the DR 0104CR combined with the total Nonrefundable Enterprise Zone Credit

used cannot exceed line 10. To ensure faster processing of your paper return, the amount entered on line 11 must exactly

match the amount on the DR 0104CR. You must submit the

DR 0104CR with your return.

Scan and submit any required documentation through Revenue Online

to your electronic return or mail paper documentation with the DR 1778

Line 12 Nonrefundable Enterprise Zone Credits

Use your tax software, Revenue Online or the DR 1366 to calculate the total amount of Nonrefundable Enterprise Zone

Credits being used to offset the current year tax liability.

Complete the DR 1366 and transfer line 87 to this line. The total Nonrefundable Enterprise Zone Credit used combined with nonrefundable credits from the DR 0104CR cannot

exceed the amount on line 10. You must submit the DR 1366 and a copy of each certificate with your return.

The Department strongly recommends electronic filing for taxpayers with enterprise zone credits. Failure to file electronically may result in delays processing your return.

Page 6

Line 13 Strategic Capital Tax Credits

Use your tax software, Revenue Online or the DR 1330 to calculate the total amount of nonrefundable Strategic Capital Tax Credits being used to offset the current year tax liability. Complete the DR 1330 and transfer amount on line 5b to this

line. The total nonrefundable Strategic Capital Tax Credits used combined with nonrefundable credits from lines 11 and

12 cannot exceed the amount on line 10. You must submit the

DR 1330 and a copy of each certificate with your return. The Department strongly recommends electronic filing for taxpayers with Strategic Capital Tax credits. Failure to file

electronically may result in delays processing your return.

Please include a copy of each Strategic Capital Tax Credit Certificate

Line 14 Net Income Tax

Sum of lines 11, 12, and 13. Subtract that sum from line 10. This cannot be a negative number.

Line 15 Use Tax

Enter the amount from the DR 0104US schedule line 7. If you

did not have any purchases from retailers who do not collect

Colorado state sales tax, then leave this line blank and DO

NOT fill out the DR 0104US schedule. For more information on your consumer use tax obligation, including how to use the new

annual customer reports from

visit Colorado.gov/Tax/UseTax. If you are reporting use tax on this return, you must submit the DR 0104US with your return.

Line 16 Net Colorado Tax

Sum of lines 14 and 15.

Line 17 Colorado Income Tax Withheld

Enter the sum of all Colorado income tax withheld as reported on

Enclose your Colorado withholding forms where indicated or, if filing electronically, scan and submit them through Revenue Online

Failure to submit your withholding forms will

result in the credit being denied. Do NOT include

withholding for federal income tax, income tax from

another state, or income tax from local governments.

Be certain to exclude amounts withheld from

Colorado real estate sales by nonresidents, nonresident beneficiary withholding, or Colorado partnership or S Corporation income withholding

for nonresidents because these specified amounts should be listed on line 21.

Line 18

Enter the amount, if any, from your 2018 Colorado DR 0104 line 27.

Line 19 Quarterly Estimated Payments

Carefully review your payment(s) before completing this

line. Use Revenue Online (Colorado.gov/RevenueOnline) to verify estimated taxes paid on your account. Doing so will reduce processing delays. Most taxpayers who have made

quarterly estimated payments used the DR 0104EP to remit these payments. Refer to FYI Income 51 for more information about Estimated Payments.

Line 20 Extension Payment

Enter the amount, if any, you remitted with the DR

Line 21 Other Prepayments

Enter the sum of payments remitted on your behalf because

you received Colorado income from:

•an estate as a beneficiary – remitted using the

DR 0104BEP, and/or

•partnership or shareholder

•a real estate transaction that closed during the tax year for which you are filing this return

– remitted using the current DR 1079.

Be sure to mark corresponding box(es) as appropriate.

Line 22 Gross Conservation Easement Credit

Complete all applicable parts of the DR 1305. Enter the

amount from the DR 1305G line 33. You must submit the

DR 1305G with your return.

Line 23 Innovative Motor Vehicle and

Innovative Truck Credit

Complete one Form DR 0617 for each vehicle, truck, trailer, or modification claimed, then enter the amount (or sum) from

each DR 0617 line 9 and/or line 18. You must submit each DR 0617 with your return. NOTE: If you assigned the credit to a financing entity you will not submit a Form DR 0617. For

additional information, please refer to FYI Income 69.

For each Form DR 0617, you must also submit copies

of the title, purchase invoice, lease agreement, or conversion receipts, along with proof of permanent Colorado registration for each vehicle for which you

are claiming a credit. For financing entities that accept assignment of the credit, a completed Form DR 0618 must be submitted for each vehicle claimed.

Line 24 Refundable Credits

Complete the DR 0104CR to claim various refundable credits. Transfer the amount from the DR 0104CR line 8 to this line.

You must submit the DR 0104CR with your return.

See the DR 0104CR for the required documentation for the credit claimed. Submit using Revenue Online, attach to an electronically filed return as a PDF or attach to your paper return.

Line 25 Subtotal

Sum of lines 17 through 24.

Line 26 Federal Adjusted Gross Income

Refer to your 2019 federal income tax return to complete this line:

• Form 1040 line 8b

If your federal adjusted gross income is a negative amount, be sure to enter the amount as such on your Colorado return. If submitting a paper return, put the negative amount in parentheses, for example ($1,234).

Compare lines 16 and 25. If line 16 is greater, skip to line 38. If line 25 is greater, continue to line 33.

Line 33 Overpayment

Subtract line 16 from line 25.

Line 34 Estimated Tax Carryforward

Enter the amount, if any, you would like to be available for

2020 estimated tax.

Line 37 Refund

Subtract line 34 from line 33. This is the amount of your refund. You have the option of authorizing the Department

to directly deposit these funds to your bank or CollegeInvest account. Otherwise, a refund check will be mailed to the

address you have designated on this return.

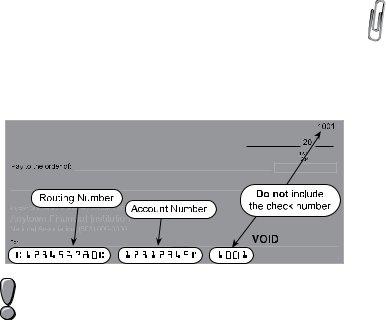

•Direct

symbols. We recommend that you contact your financial institution to ensure you are using the correct information and that they will honor a direct deposit. See the sample check below to assist you in finding the account and routing numbers.

Did you know you can now direct deposit your tax refund into a new or existing CollegeInvest

account? Please contact

•Intercepted

only one party is responsible for the unpaid debt, you may file a written claim to: Injured Spouse

Desk, 1375 Sherman Street, Room 240, Denver, CO 80261. Claims must include a copy of your federal income tax return, federal form 8379 and copies of all

received by both parties. DO NOT attach your claim to this return. It will not be processed.

Line 38 Net Tax Due

Subtract line 25 from line 16. This is the amount you owe with this return. If you are filing after the due date (or valid extension) or you owe estimated tax penalty, continue to the next line. If you are filing timely and do not owe penalty or interest, go to line 42.

Line 39 Delinquent Payment Penalty

Calculate any penalty owed for delinquent filing or payment.

The penalty is the greater of $5 or 5% of the net tax due for the first month after the due date and increased by 0.5%

for each additional month past the due date. The maximum penalty is 12%. If you prefer not to calculate this penalty, the

Department will bill you.

Page 7

Line 40 Delinquent Payment Interest

Calculate any interest owed for delinquent filing or payment.

The interest rate is 6% of the net tax due. If you prefer not to

calculate this interest, the Department will bill you. Interest on

any bill issued that remains unpaid after 30 days of issuance will increase to 9%.

Line 41 Estimated Tax Penalty

To calculate this penalty, complete the form DR 0204. Enter any estimated tax penalty owed on this line. You must submit the DR 0204 with your return. If you over compute your estimated tax penalty from what the Department calculates, any amount of overpayment of penalty will be refunded to you.

Scan and submit the form DR 0204 through Revenue Online

Line 42 Amount You Owe

Enter the sum of lines 38 through 41. You have three payment options. Please note: Any assessment made by the

Department will likely include delinquent payment penalty and interest. The only way to avoid paying penalty and interest is to pay in full by the filing due date.

•Pay

Transfer (EFT). A nominal processing fee may apply. If you file a paper return, you may still choose to pay electronically. Visit Colorado.gov/ RevenueOnline for details.

•Pay by

send a check or money order, complete the form

DR 0900 and mail with your payment. Make payable to “Colorado Department of Revenue” and clearly write your Social Security number and “2019 DR 0104” on the memo line. Be sure

to keep a copy of the money order or note the check number with your tax records.

•Payment

Third Party Designee

Mark the “Yes” box to allow the Colorado Department of Revenue to discuss this tax return with the paid preparer or designee who signed it. This authorization is valid for any period of time and can be revoked with a written statement to the Department. Revocations must declare the return filing

period and tax type, must designate that the Third Party Designee is being revoked and must be signed and dated by the taxpayer and/or designee. By completing this area of the return, the taxpayer is granting the designee the ability to:

•Provide any missing information needed for the processing of the return, and

•Call the Department for information about the return, including the status of any refund or processing time, and

Page 8

•Receive upon request copies of notices, bills or transcripts related to the return, and

•Respond to notices about math errors, intercepts and questions about the preparation of the return.

This designation does not allow the third party to receive any

refund check, bind the taxpayer to anything (including any additional tax liability), or otherwise represent the taxpayer

before the Colorado Department of Revenue. In order to expand the designee’s authorization, complete the DR 0145

Power of Attorney for

When filing a paper return, all

filing an electronic return, attach scanned copies of all

attach

Taxpayer Service and Assistance

Revenue Online and Secure Messaging

The Department offers many services through Revenue Online.

You can file or amend a return, submit required return attachments,

monitor your account activity, pay taxes, check the status of a

refund, file a protest and send a secure message to Department staff. Visit Colorado.gov/RevenueOnline to get started.

Taxation Website

Visit the official Colorado Department of Revenue’s Taxation Division website, Colorado.gov/Tax, for tax

forms, FYI publications, education resources, legal research and more.

Call Center

Representatives are available Monday through Friday, 8 a.m. to 4:30 p.m.

TTY/TDD

Forms and information are available Monday through Friday, 8 a.m. to 4:30 p.m.

Colorado

Common Issues

Did Not Receive

•Contact your employer to request a copy, or

•Use the

stub to complete a Substitute

DR 0084 and submit both with your return.

Records Retention

Keep all documentation you used to prepare your return

at least 4 years after the due date, which is the statute of

limitations for the Department to make changes to your return.

However, if the Department does not receive your return, they may file on your behalf using the best information available.

There is no statute of limitations for assessment if a return is

not filed.

Correcting Errors or Changing a Return

Individual income tax returns from 2009 and forward may be amended electronically through Revenue Online. Filing and

amending returns in Revenue Online is a free service. You may amend online even if the original return was filed on paper.

Revenue Online has all the information from your original return. You will not need to

•If you cannot amend online, you may file the

DR 0104X. Make sure you use the appropriate form version for the year you are amending.

•If you are changing your Colorado return

because the IRS made changes to your federal return, you must file the DR 0104X within 30 days of being notified by the IRS. You must amend your Colorado return in this case, even if there is no net change to your tax liability.

IT IS VERY IMPORTANT THAT YOU SUBMIT ALL SCHEDULES AND SUPPORTING DOCUMENTATION FOR ANY CHANGES WITH YOUR AMENDED RETURN. YOU MUST SUBMIT ALL SCHEDULES, EVEN IF YOU ARE NOT CHANGING THOSE VALUES.

Estimated Tax Requirements

If you expect next year’s Colorado tax liability to be greater than $1,000 after subtracting credits, you should make estimated tax payments using the DR 0104EP. We recommend that you read publication FYI Income 51 for additional information.

Filing Errors and Incomplete Information

It is important to read all the information available for your specific tax situation and to submit all required documentation with your return. Failure to do so may result in delayed

processing of your return and refund, if any. We recommend that you file using Revenue Online to avoid common

mathematical errors. You may also opt to use a commercial tax preparation software program or a paid tax professional

to help you complete your return.

Federal Earned Income Tax Credit and Colorado Insurance Programs

Individuals whose income does not exceed certain

thresholds and/or have qualifying children may be eligible for a refund resulting from the federal Earned Income Tax

Credit (EITC) and/or

Child Health Plan Plus (CHP+). You may obtain additional information regarding the EITC online at IRS.gov or by calling Colorado United Way at 211. Additional information regarding CHP+ may be found at CCHP.org or by calling

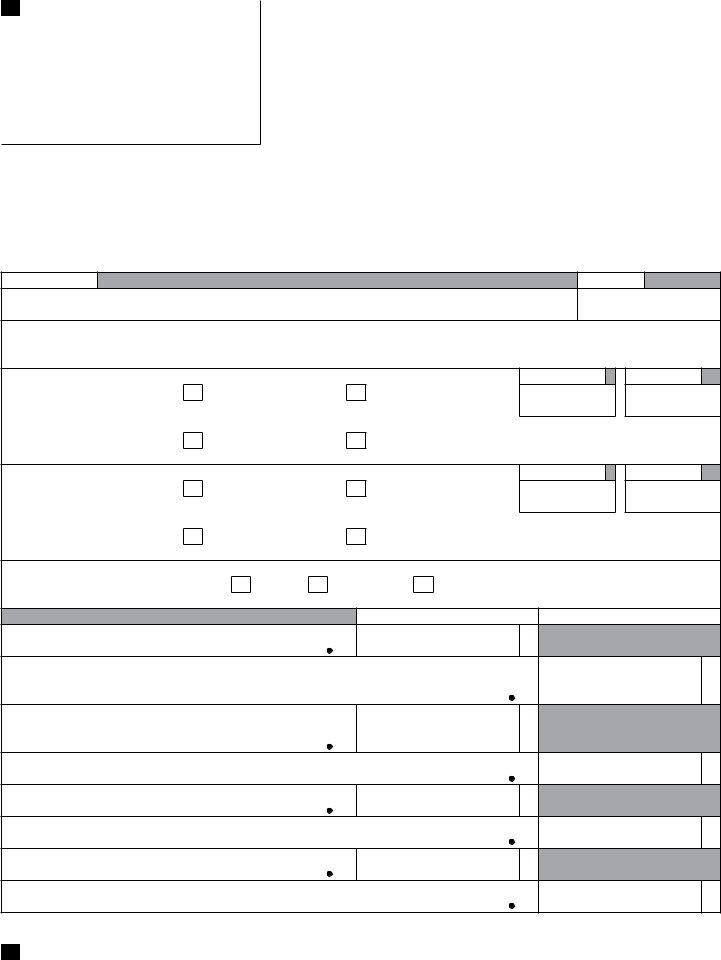

If you use this schedule to claim any subtractions from your income, you must submit it with the DR 0104.

Line 1 State Income Tax Refund

Refer to your federal income tax return to complete this line. If you did not complete federal Schedule 1,

Form 1040 or 1040SR, enter $0. Otherwise, enter the amount from line 10, Schedule 1, Form 1040 or 1040SR.

Line 2 U.S. Government Interest

Enter the sum of all interest earned from U.S. government bonds, treasury bills and other obligations of the U.S. or its territories, possessions and agencies that you reported on your federal income tax return and is calculated as part of your federal taxable income. We recommend that you read publication FYI Income 20 if this applies to you.

Do not include interest earned from Federal National Mortgage Association and Government National Mortgage Association (Fannie Mae and Ginnie Mae). Dividends from mutual funds may not be 100% exempt.

Line 3 Pension and Annuity

Subtraction

You might be eligible to subtract the income you earned from a

pension or annuity. We recommend that you read publication

FYI Income 25 if this applies to you. This subtraction is allowed only for pension or annuity income that is included in your federal taxable income. The amount of subtraction you can claim is also limited based upon your age.

As of December 31, 2019, if you were:

•Age 65 or older, then you are entitled to subtract

$24,000 or the total amount of your taxable pension/annuity income, whichever is smaller; or

•At least 55 years old, but not yet 65, then you are entitled to subtract $20,000 or the

total amount of your taxable pension/annuity income, whichever is smaller; or

•Younger than 55 years old and you received

pension/annuity income as a secondary beneficiary (widow, dependent child, etc.) due to the death of the person who earned the pension/annuity, then you are entitled to

subtract $20,000 or the total amount of your secondary beneficiary taxable pension/annuity income, whichever is smaller. If this applies to you, please list the Social Security number of the deceased in the space provided.

Pension/annuity income should not be intermingled between spouses. Each spouse must meet the

requirements for the subtraction separately and claim the subtraction only on their pension/annuity income. Any qualifying spouse pension/annuity income should be reported on line 4.

Submit copies of all 1099R and

Revenue Online or attach to your paper return.

Page 9

Line 4 Spouse Pension and

Annuity Subtraction

If the secondary taxpayer listed on a jointly filed return is

eligible for the pension and annuity subtraction, enter the qualifying amount on this line. Review the instructions for line 3 to see what amount qualifies. We recommend that

you read publication FYI Income 25 if this applies to you.

Take precautions to report the subtraction on the correct line. The first person listed on the return shall report on line 3 and the second person listed shall report on line 4.

Line 5 Military Retirement Subtraction

You might be eligible to subtract the income you earned from your military retirement benefits. We recommend

that you read publication FYI Income 25 if this applies to you. This subtraction is allowed only for military

retirement income that is included in your federal taxable income. To qualify, you must have been 54 years of age or younger as of December 31,2019. If you meet the age requirement, then you are entitled to subtract $4,500

or the total amount of your taxable military retirement benefits, whichever is smaller.

Military retirement benefits should not be intermingled between spouses. Each spouse must meet the

requirements for the subtraction separately and claim the subtraction only on their military retirement benefits. Any qualifying spouse military retirement benefits should be reported on line 6.

Submit copies of all 1099R statements with your return. Submit as attachments when

paper return.

Line 6 Spouse Military Retirement

Subtraction

If the secondary taxpayer listed on a jointly filed return is

eligible for the military retirement subtraction, enter the qualifying amount on this line. Review the instructions for line 5 to see what amount qualifies. We recommend that you

read publication FYI Income 25 if this applies to you.

Take precautions to report the subtraction on the correct line. The first person listed on the return must report on line 5 and the second person listed must report on line 6.

Line 7 Colorado Capital Gain

Subtraction

You might be eligible to subtract some or all of the capital gain included in your federal taxable income, if the gain is derived from the sale of tangible personal property or from the sale of real property located in Colorado. The amount of this subtraction is limited to $100,000. We recommend that you read publication FYI Income 15 if this applies to you.

You must complete and submit the DR 1316 with your return. Take precaution to completely fill out

each item of this form. Be as detailed as possible, especially when providing property descriptions, ownership, and dates of acquisition and sale.

Page 10

Line 8 CollegeInvest Contribution

Contributions to CollegeInvest can be deducted from your return. The contribution must have been included on your federal income tax return and calculated as part of your federal taxable income. We recommend that you read publication FYI Income 44 if this applies to you.

The three fields on line 8 should be left blank if the

taxpayer and/or spouse are the CollegeInvest account owners who set up the account for the student beneficiary. If you are not the account owner (e.g.

grandparent, friend,) complete the three additional fields. To report contributions to more than one account, you must file electronically. Do not deduct

contributions made to a tuition savings plan for another state or any tuition you paid while attending school.

Do NOT deduct contributions made by your employer/ business to your College Invest account on this line. To claim

Line 9 Qualifying Charitable Contributions

Taxpayers who make charitable contributions that would be eligible for a federal income tax deduction, but do not claim federal itemized deductions on Schedule A of form 1040 or 1040SR, might be eligible to deduct a portion of their contribution on this form. We recommend that you read publication FYI

Income 48 if this applies to you. Use the worksheet on the next

page to determine your qualifying contribution.

(a) Did you itemize your deductions on Schedule |

|

|

A of federal form 1040 or 1040SR? |

Yes |

No |

|

|

|

(b) Did you deduct charitable contributions on |

|

|

the federal form? |

Yes |

No |

|

|

|

If you answered Yes on either (a) or (b) above, enter $0 on line 9; you do not qualify for this subtraction. If you answered No on both

(a) and (b) above, continue below.

(c)Enter the amount you could have deducted as charitable contributions on lines 11 and

12 of federal Schedule A. |

$ |

|

|

(d) Colorado adjustment |

$500 |

(e)Subtract line (d) from line (c). This is the qualifying amount. If the amount is greater than $0, transfer to line 9.

Enter the total contributions in the space provided and the subtraction after the $500 adjustment on line 9.

Do not enter an amount on this line if you already

deducted your charitable donation on Schedule A of the federal 1040 or 1040SR form. Otherwise, you will be issued an assessment that will likely include

penalty and interest.

For claims greater than $5,000, submit the receipts you received at the time of donation. For

Online or attach to your paper return. Do not send receipts of items that were purchased for donation.

Line 10 Qualified Reservation Income

List any amount of income that was derived wholly from reservation sources by an enrolled tribal member who lives on the reservation, which was included as taxable income on

the Federal income tax form.

Submit proof of tribal membership, residence, and source of income. This must be submitted every three years by taxpayers claiming this subtraction.

Line 11 PERA/DPSRS Subtraction

If you made contributions to PERA between July 1, 1984, and December 31, 1986, or to Denver Public Schools District No. 1 Retirement during 1986 and your 2019 federal taxable income includes pension income, see FYI Income 16 to determine if you can take a subtraction for any of your pension income.

Submit a copy of your previously taxed contribution. PERA statements can be obtained from Copera.org or by calling

Do not list the amount of contributions you made as an employee this past year.

Line 12 Railroad Benefit

List any railroad retirement benefits that you reported on your federal income tax return and is calculated as part of your federal taxable income. We recommend that you read publication FYI Income 25 if this applies to you.

Submit copies of all

Statements. Submit using Revenue Online or submit with your paper return.

Line 13 Wildfire Mitigation Measures

Enter the amount incurred in performing wildfire

mitigation on your land, up to $2,500. We recommend that you read publication FYI Income 65 to properly calculate this subtraction.

Submit copies of receipts for qualified costs for wildfire

mitigation for your property. Submit using Revenue

Online or submit with your paper return.

Line 14 Colorado Marijuana Business Deduction

For

expenditure that is eligible to be claimed as a federal income tax deduction but is disallowed by section 280E of the Internal Revenue Code because marijuana is a controlled substance under federal law.

To calculate this deduction, you must create pro forma federal schedule(s) for Business Profit or Loss as if the federal government would have allowed the expenditures from the marijuana business. The Colorado deduction shall be the difference between the profit/loss as calculated on the ACTUAL schedule(s) filed with the federal return and the pro

forma schedule(s) described above.

You must submit both the pro forma federal schedule(s) and the actual federal schedule(s) with your Colorado return when claiming this deduction. Submit using Revenue Online or submit with your paper return.

Line 15 Nonresident Disaster Relief

Worker Subtraction

For nonresident individuals, enter the amount of compensation

earned for performing

during a declared state disaster emergency and for the 60

days thereafter.

renovating, installing, building, or rendering services that relate to infrastructure that has been damaged, impaired,

or destroyed by a declared state disaster emergency or providing emergency medical, firefighting, law enforcement,

hazardous material, search and rescue, or other emergency service related to a state declared disaster emergency.

This subtraction is only available to nonresident individuals. If you are a

Line 16 Reacquisition of Colorado

Residency During Active Duty Military Service

Subtraction

This subtraction is only allowed to military servicepersons who meet several requirements. In order to qualify for the

subtraction the serviceperson must (1) have Colorado as his or her home of record, (2) after enlisting in the

military, have acquired legal residency in a state other than Colorado and, (3) on or after January 1, 2016, have

reacquired Colorado residency. A military serviceperson who meets these three requirements can claim a

subtraction for any compensation included in his or her federal taxable income that he or she received for active duty service after reacquiring Colorado residency.

In order to have acquired residency in another state, you must have:

1.been physically present in that state,

2.intended to make that state your permanent home, and

3.intended to abandon your previous state of legal residence.

In order to reacquire residency in Colorado, you need not be physically present in Colorado, but you must intend to both make Colorado your permanent home and to abandon your previous state of legal residence.

In order to claim this subtraction, a taxpayer must include with his or her return: (1) a military form showing Colorado as his

or her home of record, (2) evidence of acquiring residency in another state, and (3) evidence of reacquiring residency in

Page 11

Colorado during the tax year. Evidence of acquiring residency

in another state and reacquiring residency in Colorado must come in one of the following forms:

1.voter registration;

2.records reflecting the purchase of residential property or an unimproved residential lot;

3.motor vehicle titling and registration;

4.notification to your prior state of legal residence

of your intention to change your state of legal residence;

5.preparation of a new last will and testament reflecting your state of legal residence.

If you qualify for this subtraction, enter the amount of

compensation received for active duty military service on line 16 and submit all required evidence of residency with your return.

Line 17 Agricultural Asset Lease Deduction

Enter the certificate number

Development Authority (CADA). If you received more than one certificate you must file electronically. Enter the amount

of the deduction on this line. The amount of deduction allowed to a qualified taxpayer may not exceed $25,000. You must submit a copy of each certificate with your return.

Line 18

Account Interest Deduction

You must complete the DR 0350 and submit with your return if

you are claiming this deduction. You may only deduct the amount of taxable interest and/or earnings on the qualified account in the tax year claimed. This deduction is subject to recapture.

Line 19 Other Subtractions from Federal Taxable Income

Enter the sum of all other allowable subtractions. For more information about what to enter on this line, see the Income

Tax – Subtractions page on Colorado.gov/Tax.

Military Family Relief Fund on this line. Include a clear explanation of the subtraction being claimed on your return.

Line 20 Subtotal

Enter the sum of lines 1 through 19.

Page 12

Instructions for form DR 0104US– Consumer Use Tax Reporting Schedule

Was Colorado sales or use tax paid on your purchases from

YES: Some purchases will have sales or use tax included. Check your invoices and receipts to see if sales tax

was paid. If sales tax was paid on your purchases, no consumer use tax is due. DO NOT FILL OUT THIS FORM.

NO: Many online or

sales or use tax from customers on purchases. Total the amount of your 2019 purchases where no tax was paid. State and special district (if applicable)

consumer use tax must be paid on your purchases.

Lines

Enter the total amount of 2019 purchases where no state sales tax or use tax was paid on line 1. Multiply line 1

by 0.029 (for the Colorado state sales tax rate of 2.9%).

Round this number to the nearest whole dollar to calculate your Colorado consumer use tax liability. Enter this number on line 2.

Lines

Use the table below to determine if you lived within a special

district(s) in 2019. Report the total amount of 2019 purchases

where no special district tax was paid on line 3. Then, enter the Special District Consumer Use (SDCU) code based on

you lived in 2019 on line 4. If no special districts apply, enter

00 in the SDCU code field on line 4 and skip to line 6. Enter

the special district use tax rate on line 5. Multiply line 3 by line

5.Round this number to the nearest whole dollar and enter your special district use tax liability on line 6. If no special districts apply, enter $0.

Line 7

Enter the sum of lines 2 and 6. Transfer this amount to

DR 0104 line 15. Submit this schedule with the DR 0104.

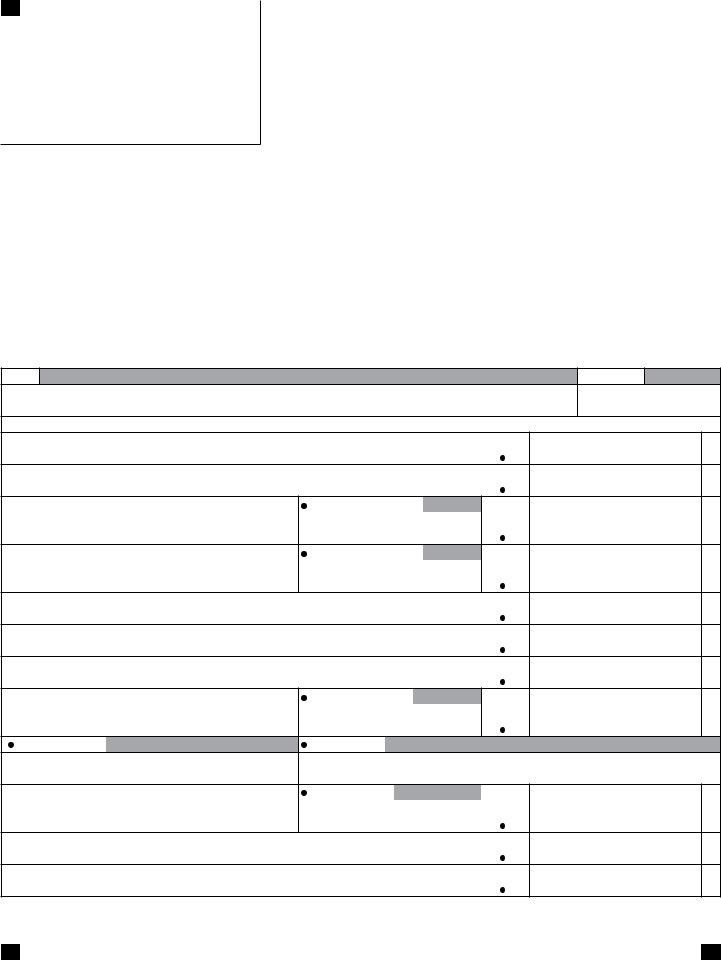

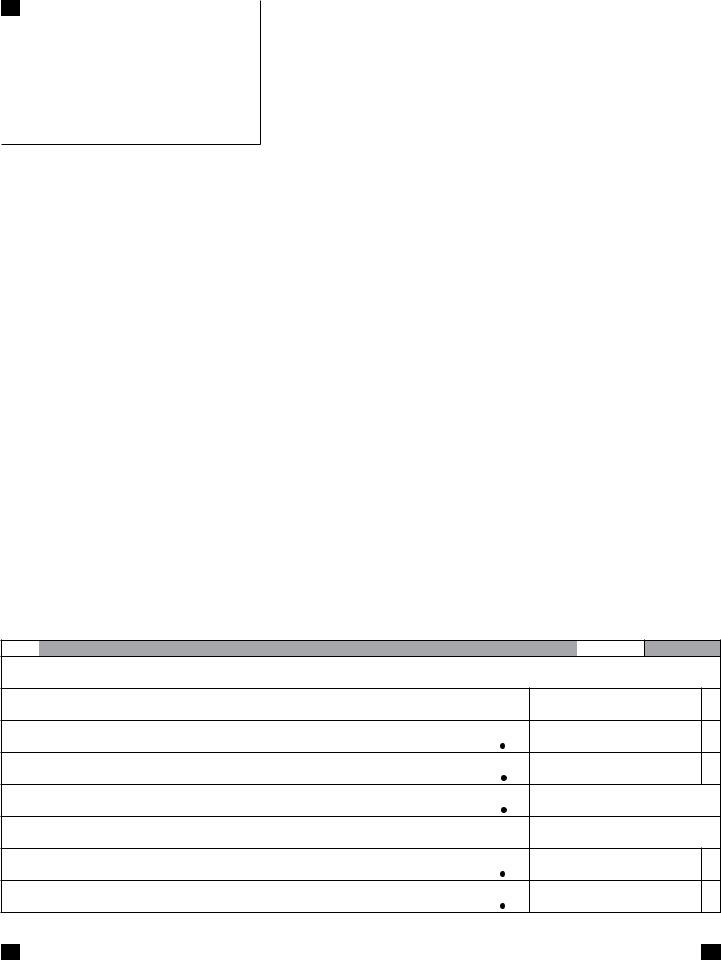

Special District Rates and Boundaries Table

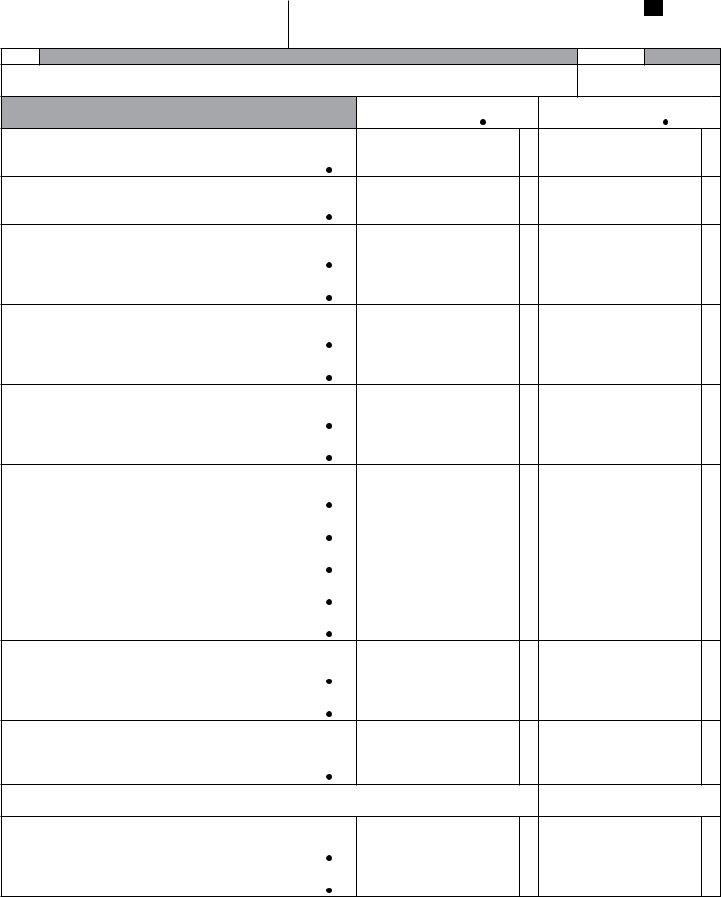

Special District Name and Boundaries |

Use Tax |

SDCU |

|

Rate |

Code |

||

|

|

|

|

No Special District |

N/A |

00 |

|

|

|

|

|

Regional Transportation District (RTD) Only |

|

|

|

The Denver metropolitan area including all |

|

|

|

of Boulder, Denver, and Jefferson Counties, |

|

|

|

northern Douglas County, the western areas |

0.010 |

10 |

|

of Adams and Arapahoe Counties, most |

|

|

|

of Broomfield County, and small part of |

|

|

|

southwest Weld County. |

|

|

|

Scientific & Cultural Facilities District (CD) |

|

|

|

Only |

|

|

|

The Denver metropolitan area including |

|

|

|

all areas of Adams, Arapahoe, Boulder, |

0.001 |

20 |

|

Broomfield, Denver, and Jefferson Counties. |

|

|

|

All of Douglas county EXCEPT the city limits |

|

|

|

of Castle Rock and Larkspur. |

|

|

|

Regional Transportation District (RTD) and |

|

|

|

Scientific & Cultural Facilities District (CD) |

|

|

|

Overlap between the RTD and CD districts |

0.011 |

12 |

|

(see individual descriptions above.) |

|

|

|

|

|

|

|

Pikes Peak Rural Transportation Authority |

|

|

|

El Paso County EXCEPT within the |

|

|

|

municipal limits of Calhan, Fountain, |

|

|

|

Monument, Palmer Lake, or the Colorado |

|

|

|

Springs Commercial Aeronautical Zone. |

0.010 |

30 |

|

Note - Any areas annexed into these |

|

|

|

municipalities after 2004 are included in |

|

|

|

the PPRTA. |

|

|

|

South Platte Valley Regional Transportation |

|

|

|

Authority |

0.001 |

50 |

|

Within the city limits of Sterling. |

|

|

|

|

|

|

|

Roaring Fork Transportation Authority |

|

|

|

Within the city limits of Glenwood Springs or |

0.010 |

61 |

|

Carbondale. |

|

|

|

|

|

|

|

Roaring Fork Transportation Authority |

|

|

|

Within the city limits of Basalt or New Castle. |

0.008 |

62 |

|

|

|

|

|

Roaring Fork Transportation Authority |

|

|

|

Areas of unincorporated Eagle County in the |

0.006 |

63 |

|

El Jebel area and outside the city limits of |

|||

|

|

||

Carbondale. |

|

|

|

Roaring Fork Transportation Authority |

|

|

|

Aspen and Snowmass Village city limits, |

0.004 |

64 |

|

unincorporated Pitkin County. |

|

|

|

|

|

|

Reference publication DR 1002 at Colorado.gov/Tax, your county assessor’s office, or district maps for additional information to determine whether you live within the

boundaries of the above special districts.

Most residents of the Denver metropolitan area are within the

district boundaries of both the Regional Transportation District

(RTD) and the Scientific & Cultural Facilities District (CD).

Instructions for Select Credits from the DR 0104CR

Line 1 Child Care Expenses Credit (DR 0347 and DR 0104CR Part I)

Even when the federal tax is zero, Colorado offers

child care expenses up to $500 for one child, or up to $1,000 for two or more children. Use form DR 0347 to calculate this credit and submit it along with the form DR 0104CR.

Lines 2 through 5 To Calculate the Colorado Earned Income Tax Credit (EITC) on DR 0104CR:

Line 2 Enter the amount of earned income calculated for your federal return.

In order to calculate the value of your Federal earned income tax credit, you must determine the amount of earned income. You may use the Earned Income Credit Worksheet (EIC Worksheet) and the Earned Income Credit (EIC) Table in the instruction booklet for Federal Form 1040 or

1040SR or use the EITC Assistant Tool online:

in both English and Spanish.

Line 3 The federal EITC you claimed

Refer to the credit you entered on the Federal Form 1040.

•Enter the amount of line 18a from Federal Form 1040 or 1040SR on the Colorado Form DR 0104CR line 3.

Table Instructions: If you have a qualifying child and you

claimed the EITC on the Federal 1040 or 1040SR, you will need to identify that child or those children in this table. Enter each qualifying child’s last name, first name,

year of birth and Social Security number. Only check the

“Deceased” box for a qualifying child if the child was born and died in 2019 and was not assigned an SSN, you must submit a copy of the child’s birth certificate, death certificate, or hospital records showing a live birth with your return.

Line 4 COEITC

Multiply the amount you entered on line 3 by 0.1 to calculate your Colorado EITC.

Line 5 If you are filing as a

Multiply the amount you entered on line 4 by the percentage on the DR 0104PN line 34. (If the percentage exceeds 100%, use 100%.) Enter the result on line 5.

This is the portion of the Colorado EITC you are allowed.

Line 6 Business Personal Property Credit for Individual Business Owners

The income tax credit for business personal property taxes is limited to $18,000 of the actual value of your personal property that you paid tax on during 2019. This is different

than real property, which is not eligible for this credit. If your

Page 13

actual value is less than $18,000, you can claim the total

amount of the assessment you paid, and you must include the assessor’s statement(s) for which you are claiming the credit. To find your actual value, either look for it on your statement, or find your assessed value and divide it by 0.29.

Actual Value = Assessed Value/0.29.

If you own personal property whose actual value is above $18,000 for which you were assessed, you can only claim the assessment on the first $18,000 of the property in question. You will need to prorate your assessment with the following formula:

actualvalue18,000 * assessment = allowable credit

For example, if your assessment was $2,000 for personal property tax paid in 2019, but your actual value was $25,000, you would be permitted to claim $1,440 (72% of the tax

assessed or ($18,000/$25,000)*$2,000)).

Please include a copy of your property tax statement for property tax paid in 2019.

Note There are two credits that are available for

the preservation of historic properties and

structures. Each credit has a different certification process and is subject to different

limitations and qualification requirements.

Line 19 Historic Property Preservation Credit

The Historic Property Preservation credit

For more information on this credit, review FYI Income 1.

Lines

Structures Credit

The Preservation of Historic Structures credit

of the DR 0104CR. For more information on this credit, review resources available online from the Colorado Office

of Economic Development or from History Colorado.

Line 37 Rural & Frontier Health Care

Preceptor Credit

In order to claim this credit, the taxpayer must:

•Receive certification that the preceptor satisfied

all requirements to receive the credit from the institution for which the preceptor teaches or from the regional AHEC office with jurisdiction over the area in which the preceptorship took place. This certification must be completed on the DR 0366.

•Send an electronic copy of the completed certification (DR 0366) to the Department by email to dor_preceptor@state.co.us.

•If the preceptor receives notification from the

Department that the taxpayer is entitled to claim the credit, file a Colorado income tax return and

claim the credit on the return. You must submit the

DR 0366 with your return.

Page 14

Instructions for Select Credits from the DR 0104CR – Continued

Line 38 Retrofitting a Residence to Increase a Residence’s Visitability Credit

An income tax credit is available to help people with an illness, impairment or disability retrofit their residence for

greater accessibility and independence. Dependents and spouses are also eligible and allows for up to a $5,000 credit per person in the family with a disability.

To claim the credit, you must have been issued a tax credit certificate from the Colorado Department of Local

Affairs/Division of Housing. For more information about the application process, visit colorado.gov/dola

Please provide a copy of your tax credit certificate(s) from the Department of Local Affairs/Division of

Housing when claiming this credit.

Line 39 Credit for Employer Contributions to Employee 529 Plan

Complete the DR 0289 and transfer over the amounts of

credit available and used to the DR 0104CR. You must submit the DR 0289 with your return.

Page 15

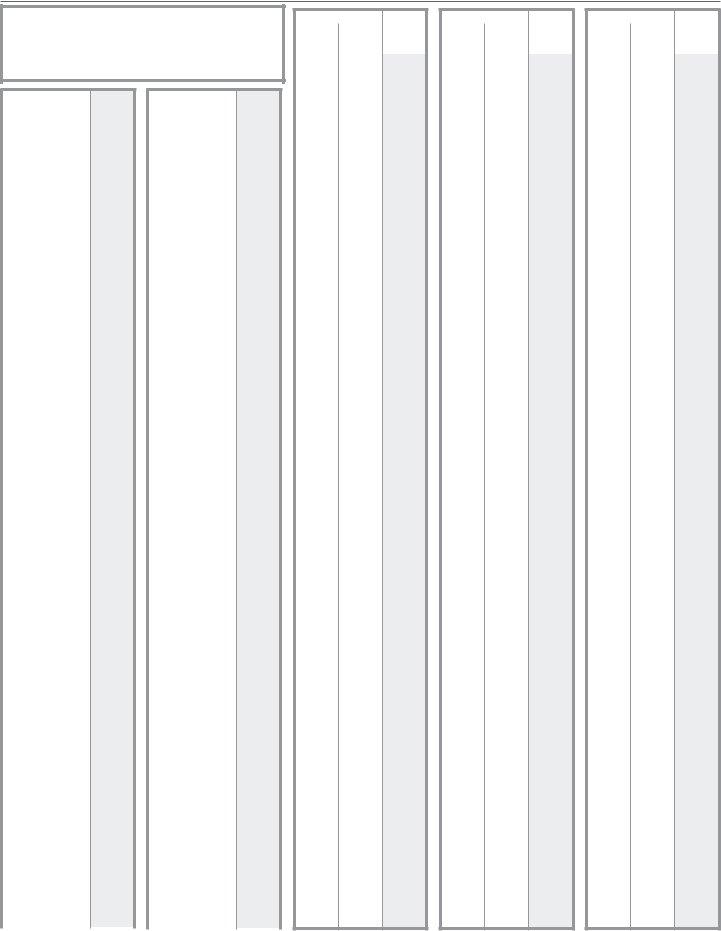

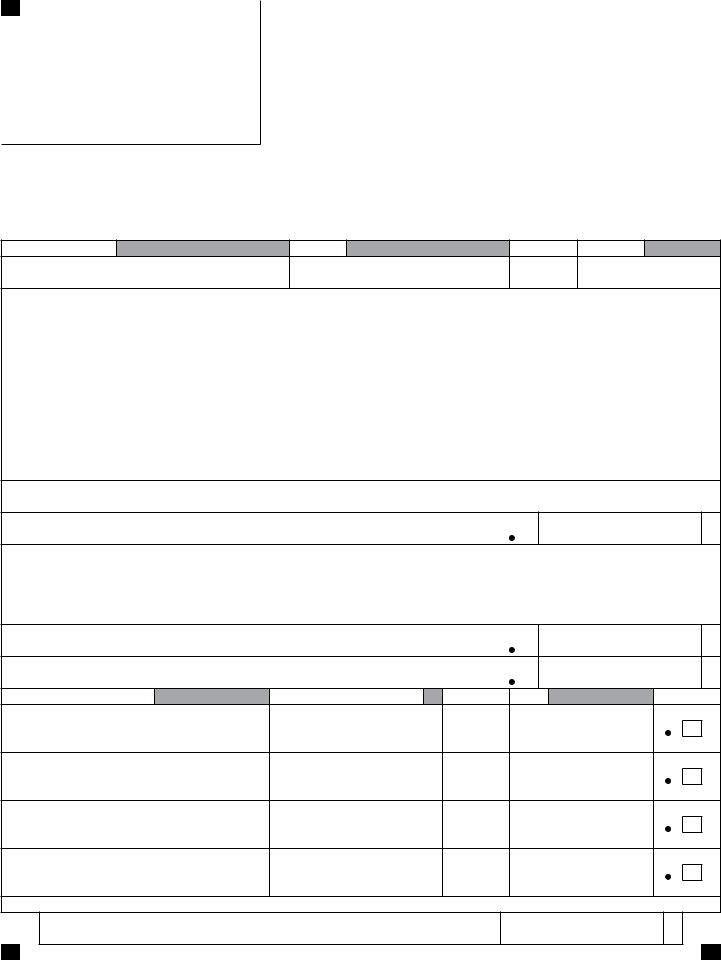

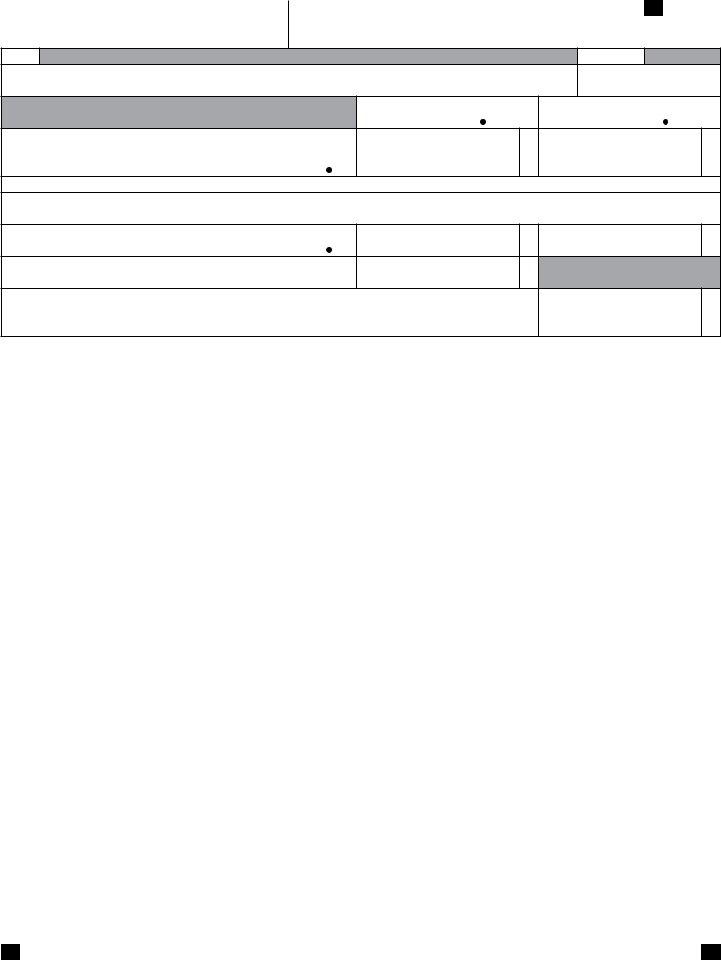

2019 Colorado Income Tax Table with tax rate of 4.5%

To find your tax from the table below, read down the taxable

income column to the line containing your Colorado taxable income from DR 0104 line 6. Then read across to the tax column and enter this amount on DR 0104 line 7.

TAXABLE INCOME |

|

|

|

Over |

But |

TAX |

|

not over |

|

|

|

9,600 |

9,700 |

434 |

|

9,700 |

9,800 |

439 |

|

9,800 |

9,900 |

443 |

|

TAXABLE INCOME |

|

|

|

Over |

But |

TAX |

|

not over |

|

|

|

15,100 |

15,200 |

682 |

|

15,200 |

15,300 |

686 |

|

15,300 |

15,400 |

691 |

|

TAXABLE INCOME |

|

|

|

Over |

But |

TAX |

|

not over |

|

|

|

20,600 |

20,700 |

929 |

|

20,700 |

20,800 |

934 |

|

20,800 |

20,900 |

938 |

|

TAXABLE INCOME |

|

|

Over |

But |

TAX |

not over |

|

|

|

|

|

0 |

10 |

0 |

10 |

30 |

1 |

30 |

50 |

2 |

50 |

75 |

3 |

75 |

100 |

4 |

100 |

200 |

7 |

200 |

300 |

11 |

300 |

400 |

16 |

400 |

500 |

20 |

500 |

600 |

25 |

600 |

700 |

29 |

700 |

800 |

34 |

800 |

900 |

38 |

900 |

1,000 |

43 |

1,000 |

1,100 |

47 |

1,100 |

1,200 |

52 |

1,200 |

1,300 |

56 |

1,300 |

1,400 |

61 |

1,400 |

1,500 |

65 |

1,500 |

1,600 |

70 |

1,600 |

1,700 |

74 |

1,700 |

1,800 |

79 |

1,800 |

1,900 |

83 |

1,900 |

2,000 |

88 |

2,000 |

2,100 |

92 |

2,100 |

2,200 |

97 |

2,200 |

2,300 |

101 |

2,300 |

2,400 |

106 |

2,400 |

2,500 |

110 |

2,500 |

2,600 |

115 |

2,600 |

2,700 |

119 |

2,700 |

2,800 |

124 |

2,800 |

2,900 |

128 |

2,900 |

3,000 |

133 |

3,000 |

3,100 |

137 |

3,100 |

3,200 |

142 |

3,200 |

3,300 |

146 |

3,300 |

3,400 |

151 |

3,400 |

3,500 |

155 |

3,500 |

3,600 |

160 |

3,600 |

3,700 |

164 |

3,700 |

3,800 |

169 |

3,800 |

3,900 |

173 |

3,900 |

4,000 |

178 |

4,000 |

4,100 |

182 |

4,100 |

4,200 |

187 |

4,200 |

4,300 |

191 |

4,300 |

4,400 |

196 |

4,400 |

4,500 |

200 |

4,500 |

4,600 |

205 |

TAXABLE INCOME |

|

|

Over |

But |

TAX |

not over |

|

|

|

|

|

4,600 |

4,700 |

209 |

4,700 |

4,800 |

214 |

4,800 |

4,900 |

218 |

4,900 |

5,000 |

223 |

5,000 |

5,100 |

227 |

5,100 |

5,200 |

232 |

5,200 |

5,300 |

236 |

5,300 |

5,400 |

241 |

5,400 |

5,500 |

245 |

5,500 |

5,600 |

250 |

5,600 |

5,700 |

254 |

5,700 |

5,800 |

259 |

5,800 |

5,900 |

263 |

5,900 |

6,000 |

268 |

6,000 |

6,100 |

272 |

6,100 |

6,200 |

277 |

6,200 |

6,300 |

281 |

6,300 |

6,400 |

286 |

6,400 |

6,500 |

290 |

6,500 |

6,600 |

295 |

6,600 |

6,700 |

299 |

6,700 |

6,800 |

304 |

6,800 |

6,900 |

308 |

6,900 |

7,000 |

313 |

7,000 |

7,100 |

317 |

7,100 |

7,200 |

322 |

7,200 |

7,300 |

326 |

7,300 |

7,400 |

331 |

7,400 |

7,500 |

335 |

7,500 |

7,600 |

340 |

7,600 |

7,700 |

344 |

7,700 |

7,800 |

349 |

7,800 |

7,900 |

353 |

7,900 |

8,000 |

358 |

8,000 |

8,100 |

362 |

8,100 |

8,200 |

367 |

8,200 |

8,300 |

371 |

8,300 |

8,400 |

376 |

8,400 |

8,500 |

380 |

8,500 |

8,600 |

385 |

8,600 |

8,700 |

389 |

8,700 |

8,800 |

394 |

8,800 |

8,900 |

398 |

8,900 |

9,000 |

403 |

9,000 |

9,100 |

407 |

9,100 |

9,200 |

412 |

9,200 |

9,300 |

416 |

9,300 |

9,400 |

421 |

9,400 |

9,500 |

425 |

9,500 |

9,600 |

430 |

9,900 |

10,000 |

448 |

10,000 |

10,100 |

452 |

10,100 |

10,200 |

457 |

10,200 |

10,300 |

461 |

10,300 |

10,400 |

466 |

10,400 |

10,500 |

470 |

10,500 |

10,600 |

475 |

10,600 |

10,700 |

479 |

10,700 |

10,800 |

484 |

10,800 |

10,900 |

488 |

10,900 |

11,000 |

493 |

11,000 |

11,100 |

497 |

11,100 |

11,200 |

502 |

11,200 |

11,300 |

506 |

11,300 |

11,400 |

511 |

11,400 |

11,500 |

515 |

11,500 |

11,600 |

520 |

11,600 |

11,700 |

524 |

11,700 |

11,800 |

529 |

11,800 |

11,900 |

533 |

11,900 |

12,000 |

538 |

12,000 |

12,100 |

542 |

12,100 |

12,200 |

547 |

12,200 |

12,300 |

551 |

12,300 |

12,400 |

556 |

12,400 |

12,500 |

560 |

12,500 |

12,600 |

565 |

12,600 |

12,700 |

569 |

12,700 |

12,800 |

574 |

12,800 |

12,900 |

578 |

12,900 |

13,000 |

583 |

13,000 |

13,100 |

587 |

13,100 |

13,200 |

592 |

13,200 |

13,300 |

596 |

13,300 |

13,400 |

601 |

13,400 |

13,500 |

605 |

13,500 |

13,600 |

610 |

13,600 |

13,700 |

614 |

13,700 |

13,800 |

619 |

13,800 |

13,900 |

623 |

13,900 |

14,000 |

628 |

14,000 |

14,100 |

632 |

14,100 |

14,200 |

637 |

14,200 |

14,300 |

641 |

14,300 |

14,400 |

646 |

14,400 |

14,500 |

650 |

14,500 |

14,600 |

655 |

14,600 |

14,700 |

659 |

14,700 |

14,800 |

664 |

14,800 |

14,900 |

668 |

14,900 |

15,000 |

673 |

15,000 |

15,100 |

677 |

15,400 |

15,500 |

695 |

15,500 |

15,600 |

700 |

15,600 |

15,700 |

704 |

15,700 |

15,800 |

709 |

15,800 |

15,900 |

713 |

15,900 |

16,000 |

718 |

16,000 |

16,100 |

722 |

16,100 |

16,200 |

727 |

16,200 |

16,300 |

731 |

16,300 |

16,400 |

736 |

16,400 |

16,500 |

740 |

16,500 |

16,600 |

745 |

16,600 |

16,700 |

749 |

16,700 |

16,800 |

754 |

16,800 |

16,900 |

758 |

16,900 |

17,000 |

763 |

17,000 |

17,100 |

767 |

17,100 |

17,200 |

772 |

17,200 |

17,300 |

776 |

17,300 |

17,400 |

781 |

17,400 |

17,500 |

785 |

17,500 |

17,600 |

790 |

17,600 |

17,700 |

794 |

17,700 |

17,800 |

799 |

17,800 |

17,900 |

803 |

17,900 |

18,000 |

808 |

18,000 |

18,100 |

812 |

18,100 |

18,200 |

817 |

18,200 |

18,300 |

821 |

18,300 |

18,400 |

826 |

18,400 |

18,500 |

830 |

18,500 |

18,600 |

835 |

18,600 |

18,700 |

839 |

18,700 |

18,800 |

844 |

18,800 |

18,900 |

848 |

18,900 |

19,000 |

853 |

19,000 |

19,100 |

857 |

19,100 |

19,200 |

862 |

19,200 |

19,300 |

866 |

19,300 |

19,400 |

871 |

19,400 |

19,500 |

875 |

19,500 |

19,600 |

880 |

19,600 |

19,700 |

884 |

19,700 |

19,800 |

889 |

19,800 |

19,900 |

893 |

19,900 |

20,000 |

898 |

20,000 |

20,100 |

902 |

20,100 |

20,200 |

907 |

20,200 |

20,300 |

911 |

20,300 |

20,400 |

916 |

20,400 |

20,500 |

920 |

20,500 |

20,600 |

925 |

20,900 |

21,000 |

943 |

21,000 |

21,100 |

947 |

21,100 |

21,200 |

952 |

21,200 |

21,300 |

956 |

21,300 |

21,400 |

961 |

21,400 |

21,500 |