4th can be filled out online without any problem. Just make use of FormsPal PDF tool to get it done fast. The tool is constantly improved by us, receiving powerful features and growing to be greater. By taking a few basic steps, it is possible to begin your PDF editing:

Step 1: First of all, open the pdf editor by pressing the "Get Form Button" in the top section of this webpage.

Step 2: With our online PDF file editor, you're able to accomplish more than simply fill out blanks. Edit away and make your docs seem faultless with customized text added in, or modify the file's original input to perfection - all that supported by an ability to insert stunning graphics and sign the PDF off.

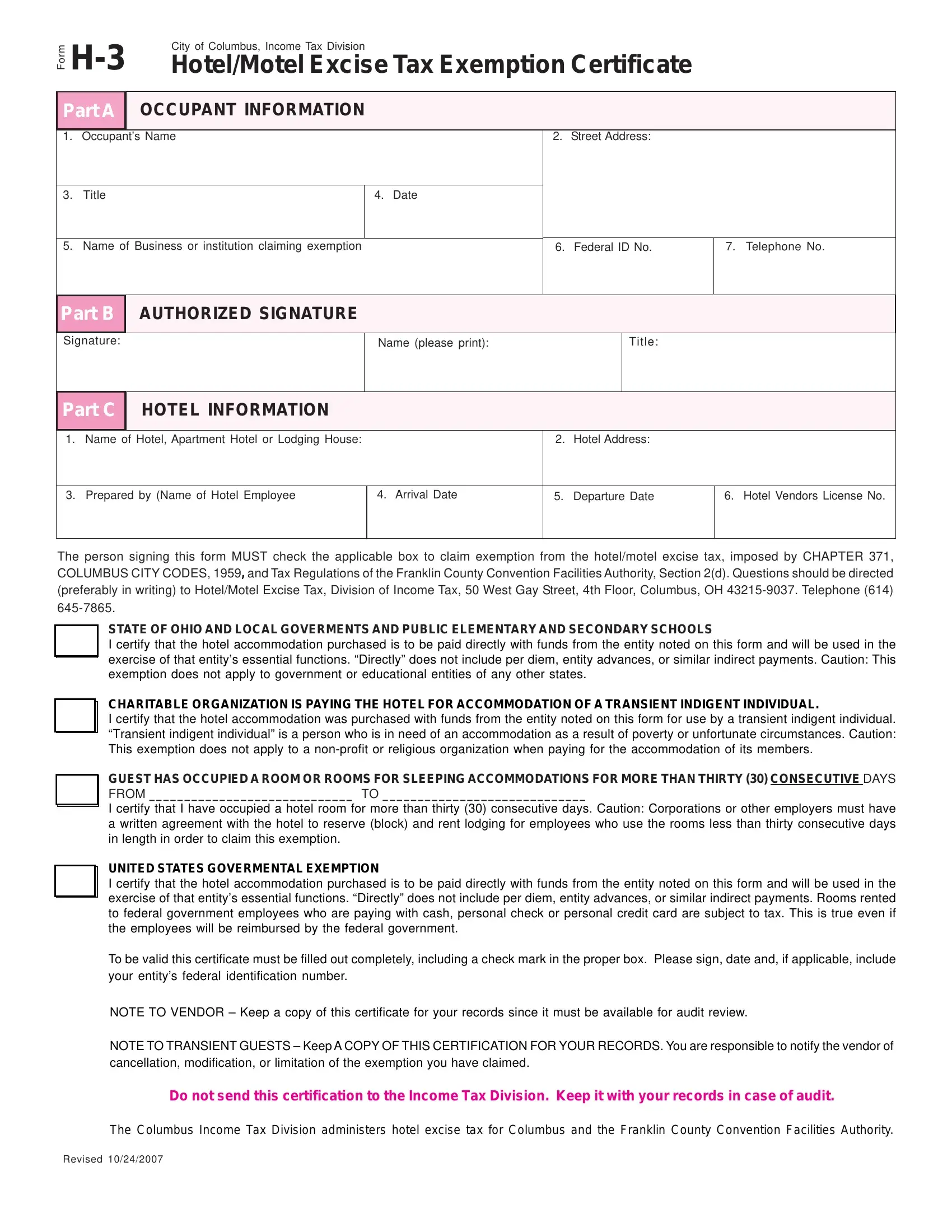

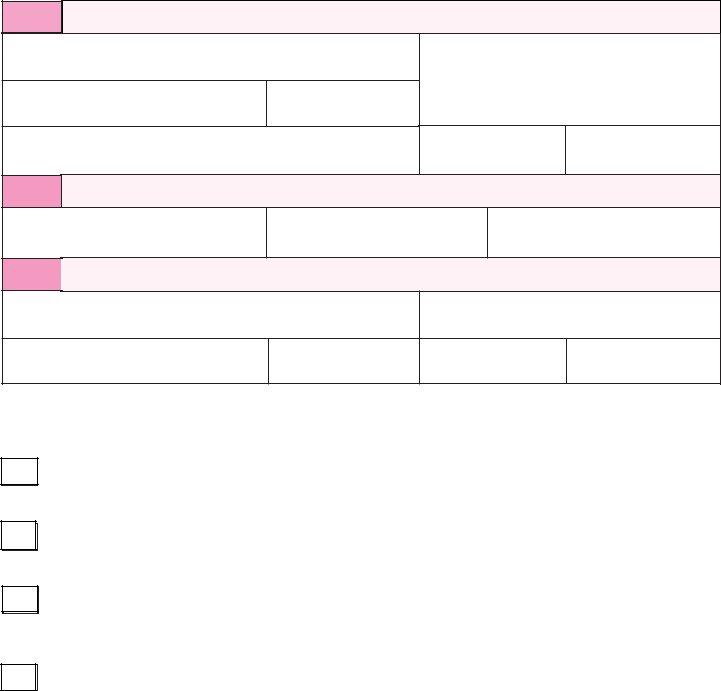

So as to fill out this PDF document, be certain to provide the required information in every single blank field:

1. Start filling out the 4th with a selection of essential fields. Collect all the important information and ensure not a single thing missed!

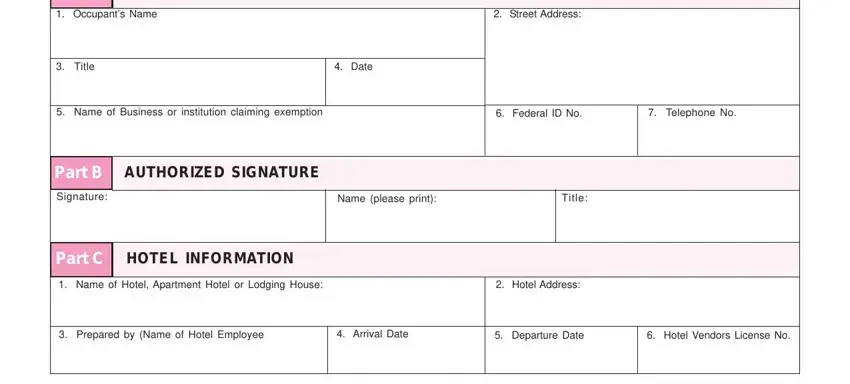

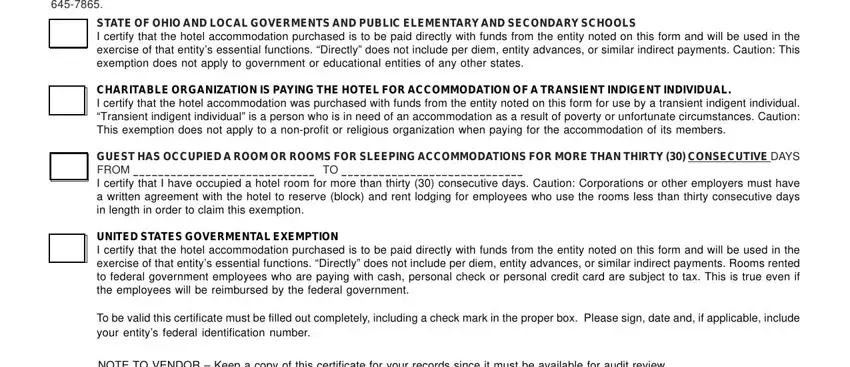

2. The third step is to complete these particular blanks: STATE OF OHIO AND LOCAL GOVERMENTS, CHARITABLE ORGANIZATION IS PAYING, GUEST HAS OCCUPIED A ROOM OR ROOMS, UNITED STATES GOVERMENTAL, To be valid this certificate must, and NOTE TO VENDOR Keep a copy of.

In terms of STATE OF OHIO AND LOCAL GOVERMENTS and CHARITABLE ORGANIZATION IS PAYING, be certain you get them right here. These are the most important ones in the form.

Step 3: Spell-check all the details you've inserted in the blank fields and then click on the "Done" button. After getting a7-day free trial account here, you will be able to download 4th or send it via email without delay. The document will also be easily accessible via your personal account with your every single modification. FormsPal provides safe document tools without personal data recording or distributing. Rest assured that your information is safe with us!