Our PDF editor was built to be as straightforward as it can be. While you comply with these actions, the process of preparing the transfer my stock form document is going to be straightforward.

Step 1: At first, choose the orange "Get form now" button.

Step 2: When you enter the transfer my stock form editing page, you'll see lots of the options you can take with regards to your file within the top menu.

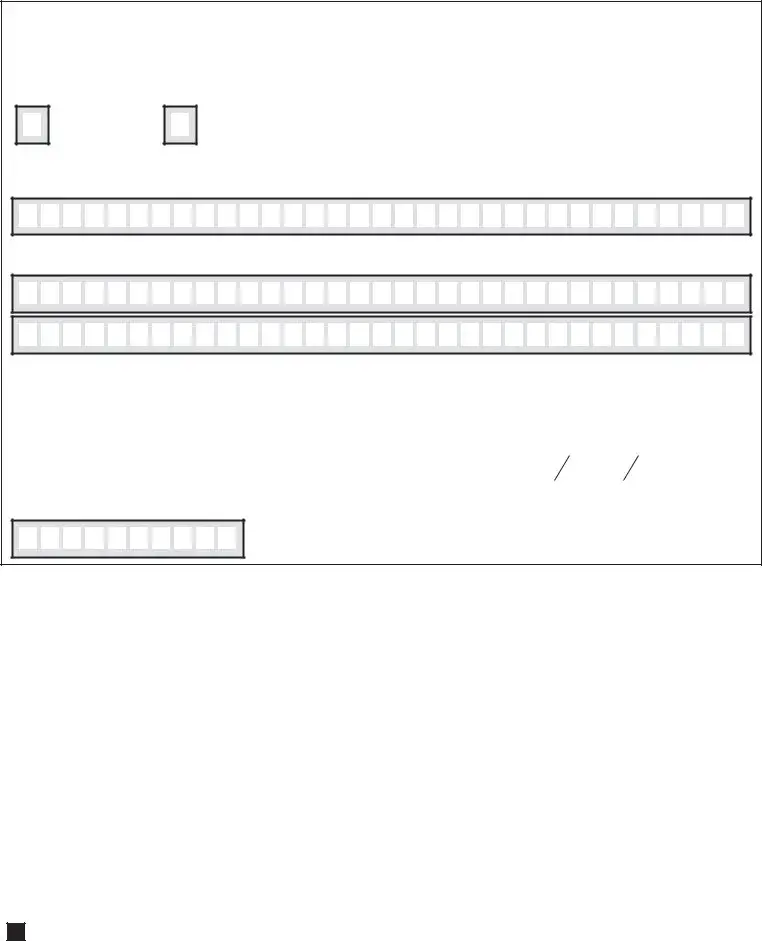

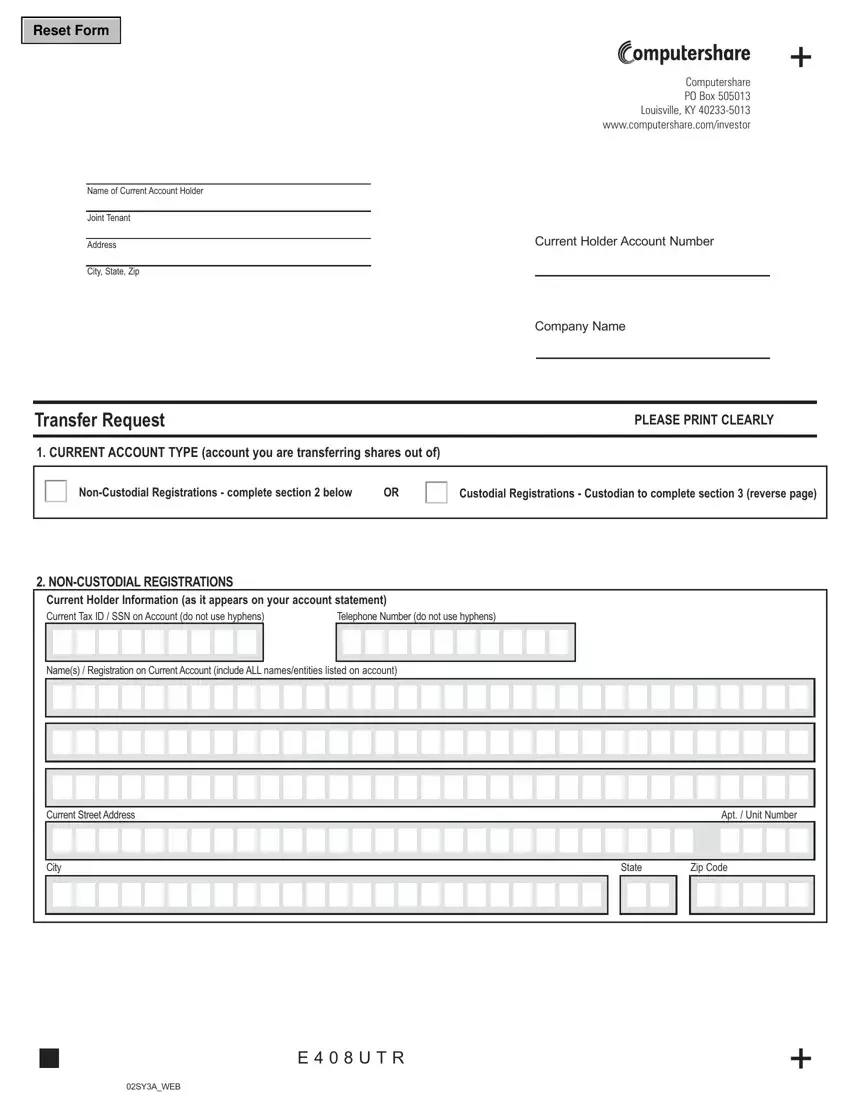

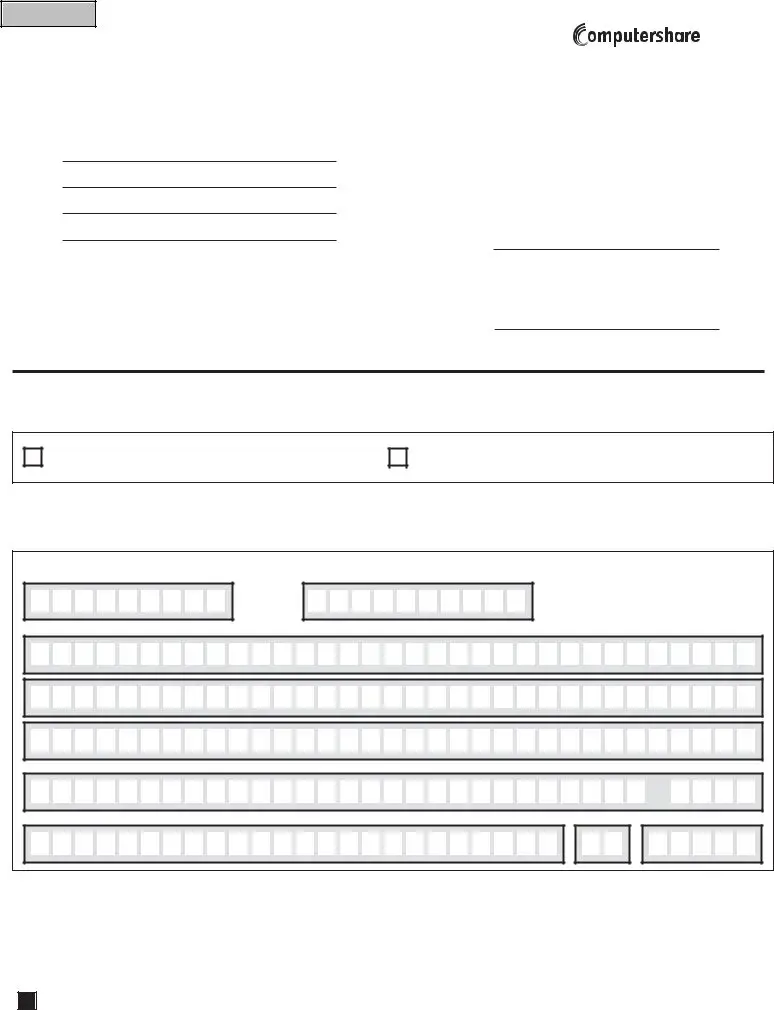

In order to complete the document, provide the data the program will require you to for each of the following segments:

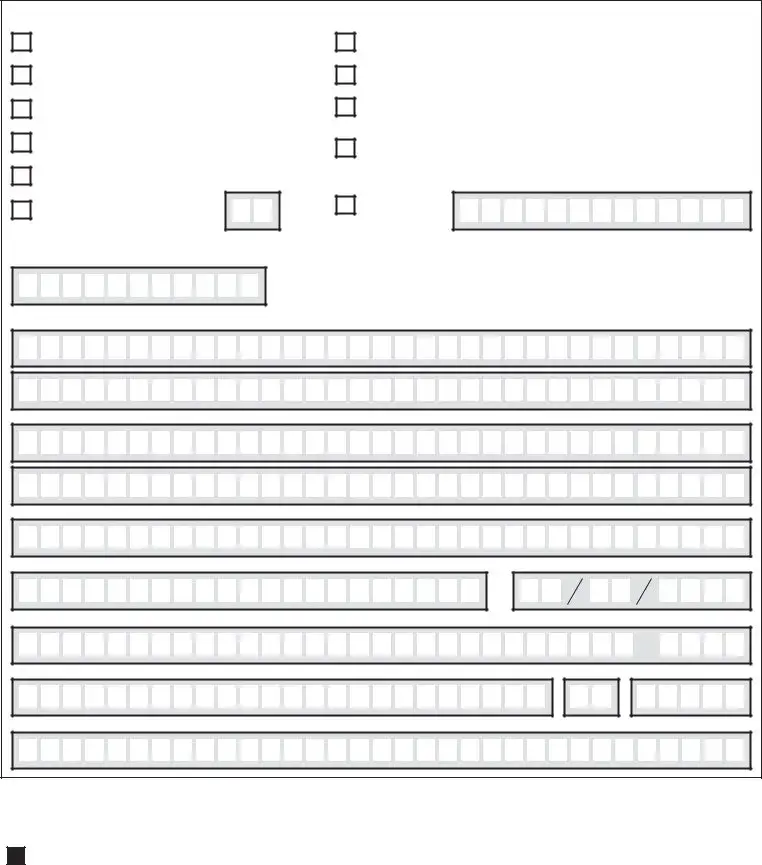

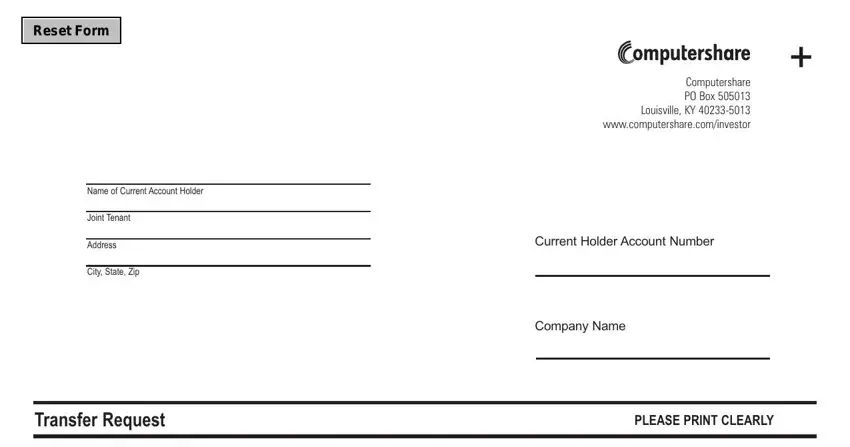

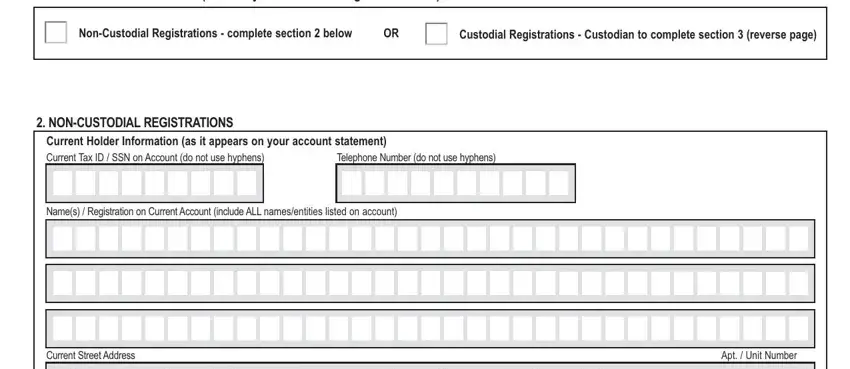

Indicate the information in CURRENT ACCOUNT TYPE account you, NonCustodial Registrations, Custodial Registrations Custodian, NONCUSTODIAL REGISTRATIONS, Current Holder Information as it, Telephone Number do not use hyphens, Names Registration on Current, Current Street Address, and Apt Unit Number.

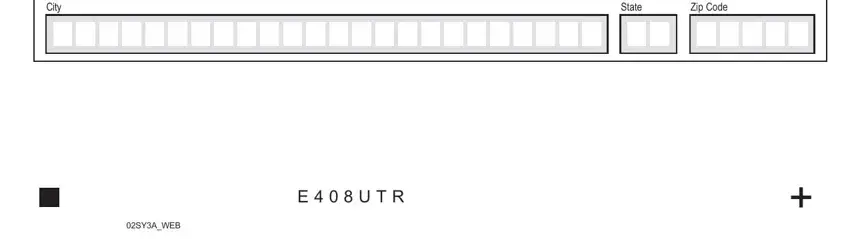

You should be asked for some valuable details so you can complete the City, State, Zip Code, E U T R, and SYAWEB part.

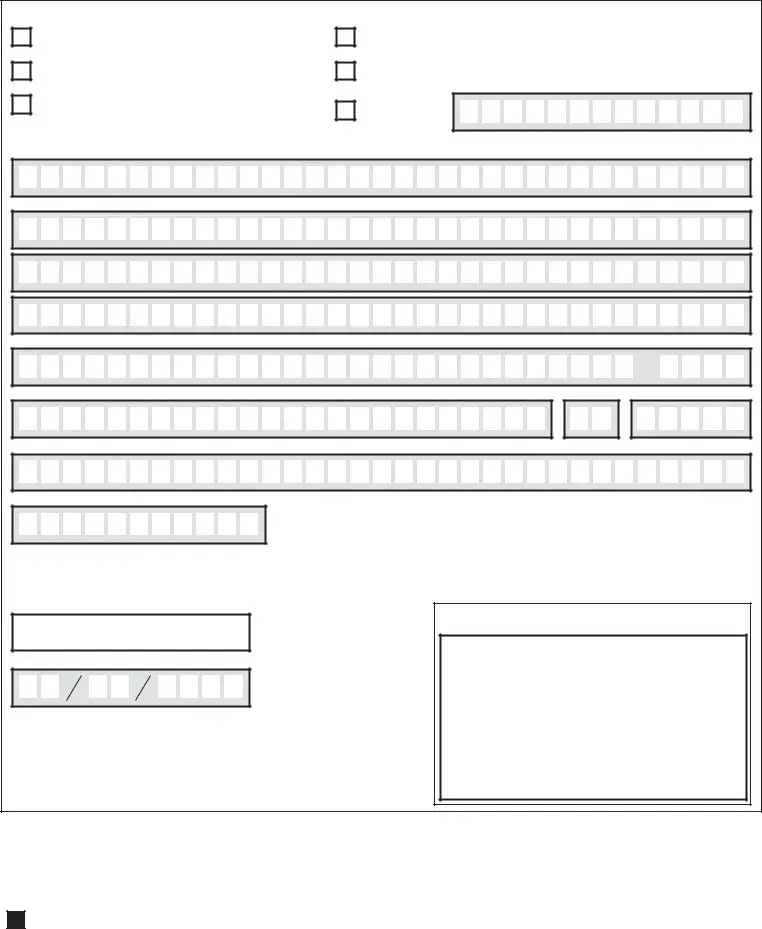

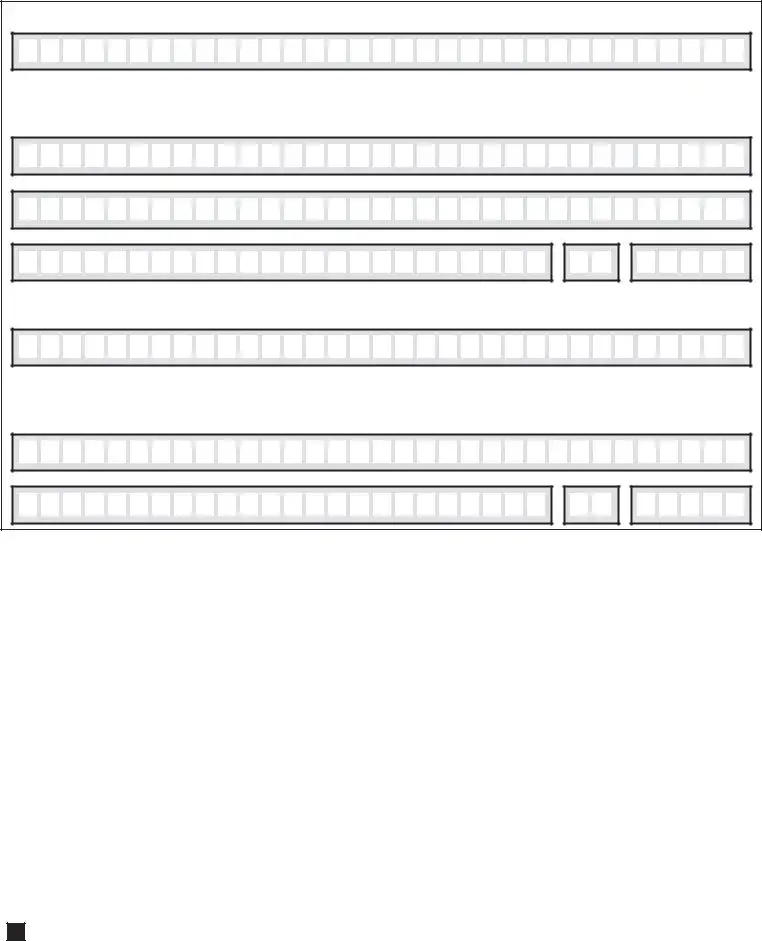

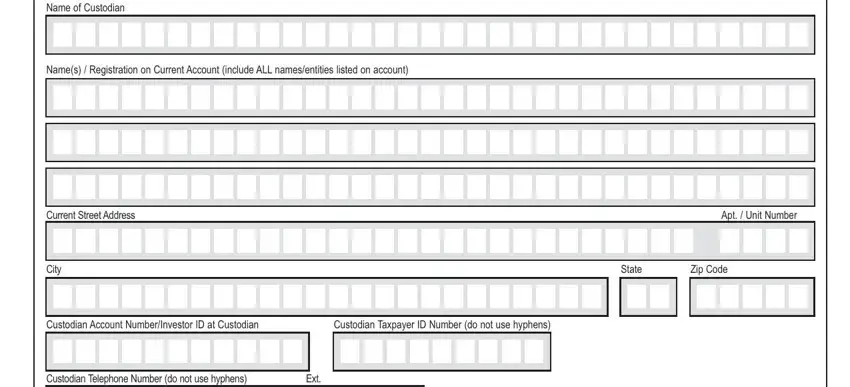

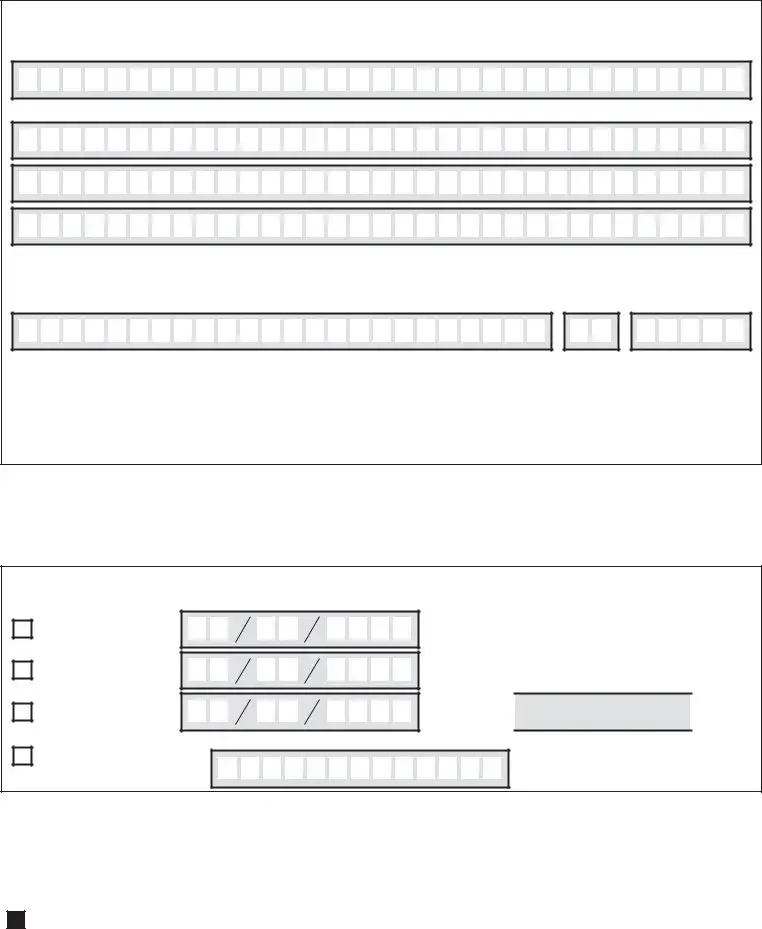

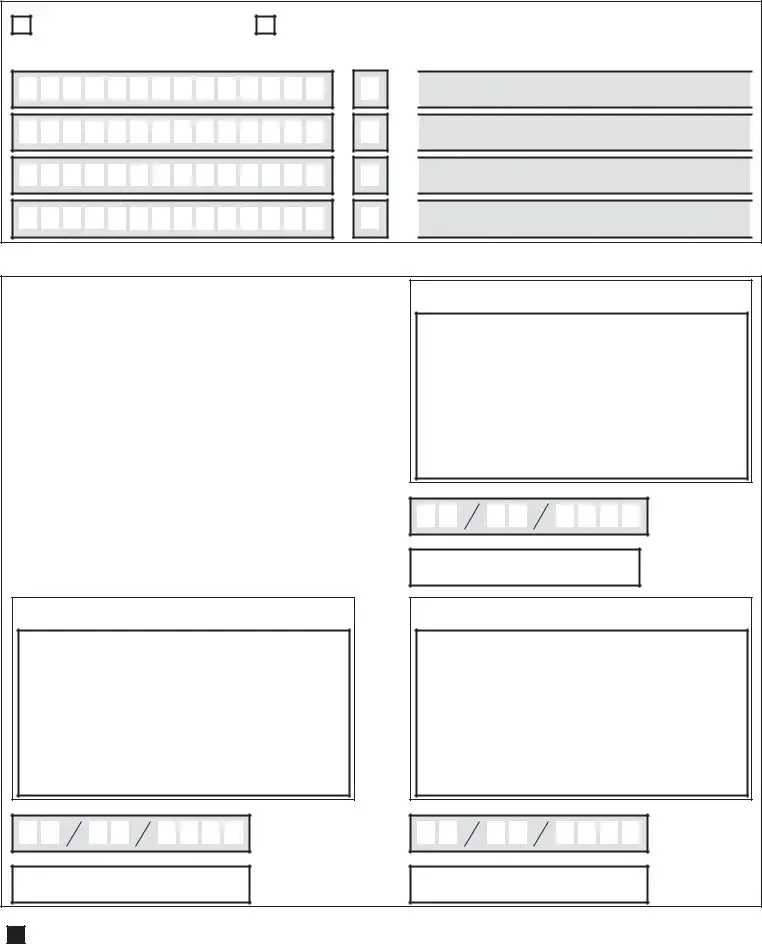

The The Custodian registered to the, Names Registration on Current, Current Street Address, City, Apt Unit Number, State, Zip Code, Custodian Account NumberInvestor, Custodian Taxpayer ID Number do, Custodian Telephone Number do not, and Ext field has to be applied to write down the rights or responsibilities of both parties.

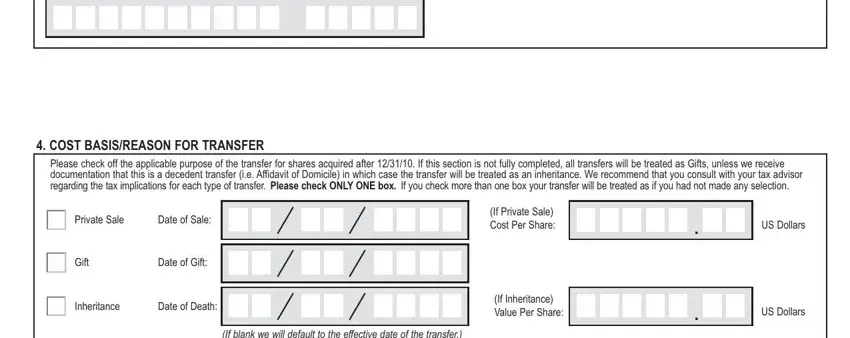

Finalize by checking all of these sections and filling out the pertinent information: COST BASISREASON FOR TRANSFER, Please check off the applicable, Private Sale, Date of Sale, Gift, Date of Gift, Inheritance, Date of Death, If blank we will default to the, If Private Sale Cost Per Share US, and If Inheritance Value Per Share US.

Step 3: As you press the Done button, your ready document can be easily transferred to each of your devices or to email indicated by you.

Step 4: Generate duplicates of the document - it may help you keep clear of possible issues. And don't be concerned - we are not meant to display or watch your data.

.

.

.

.

.

.

.

.

.

.