It is possible to fill in the nevada use tax form document with this PDF editor. The next actions can help you immediately create your document.

Step 1: This web page has an orange button stating "Get Form Now". Press it.

Step 2: Now you are on the file editing page. You may change and add content to the file, highlight specified content, cross or check selected words, insert images, put a signature on it, get rid of unwanted fields, or take them out entirely.

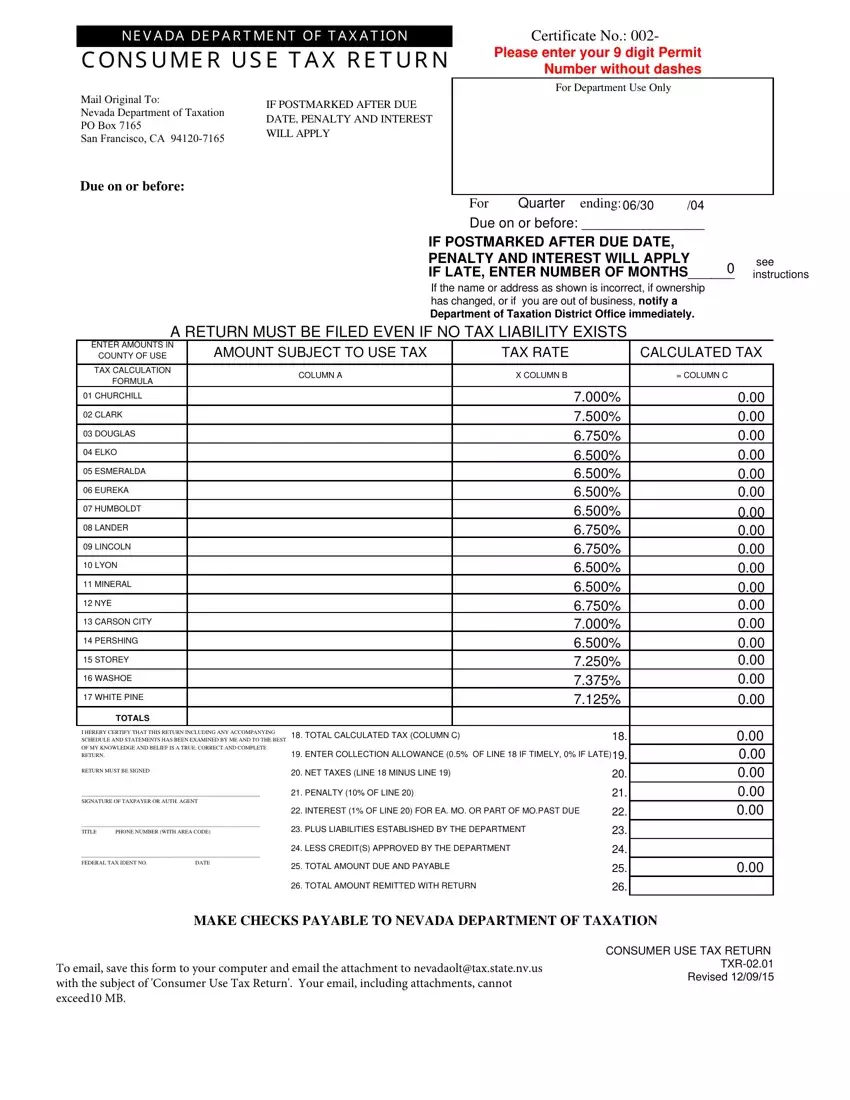

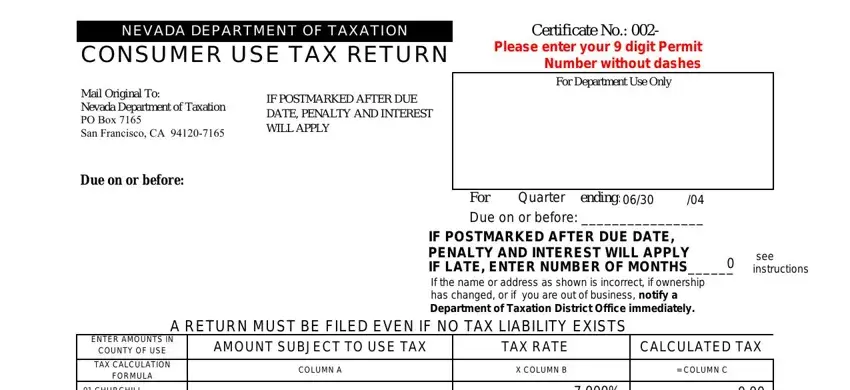

For every single part, complete the data required by the software.

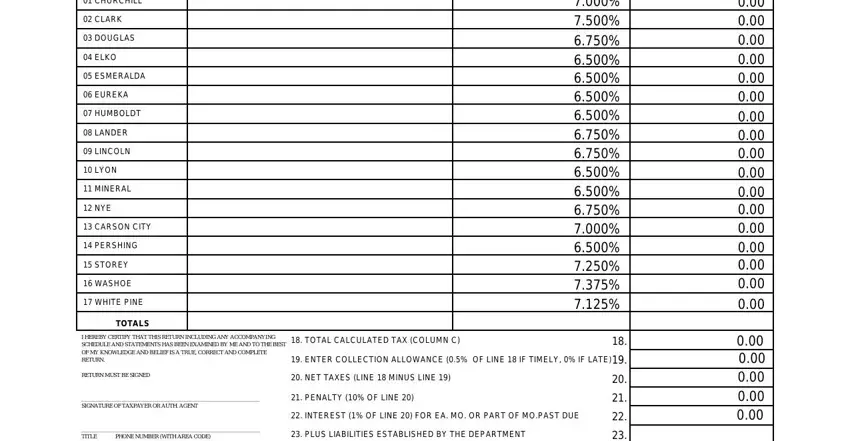

Type in the appropriate data in the section CHURCHILL, CLARK, DOUGLAS, ELKO, ESMERALDA, EUREKA, HUMBOLDT, LANDER, LINCOLN, LYON, MINERAL, NYE, CARSON CITY, PERSHING, and STOREY.

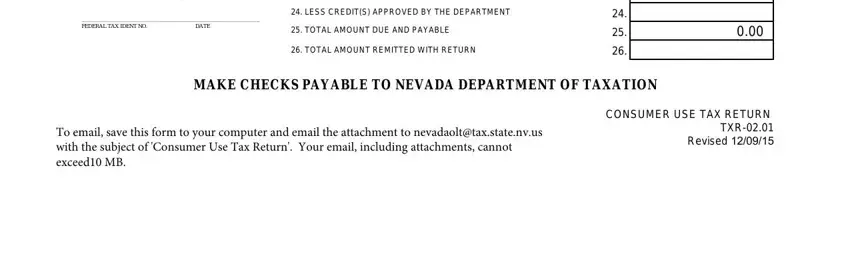

Determine the key details in the FEDERAL TAX IDENT NO DATE, LESS CREDITS APPROVED BY THE, TOTAL AMOUNT DUE AND PAYABLE, TOTAL AMOUNT REMITTED WITH RETURN, MAKE CHECKS PAYABLE TO NEVADA, To email save this form to your, and CONSUMER USE TAX RETURN TXR box.

Step 3: Click the button "Done". The PDF form is available to be exported. It is possible to upload it to your pc or email it.

Step 4: Try to generate as many duplicates of the form as possible to remain away from future misunderstandings.