In the State of Missouri, corn producers have the opportunity to request a refund for corn assessment fees through a specific process managed by the Missouri Department of Agriculture's Commodity Fund Program. When a corn producer sells their crop, a small fee is deducted from the sale for the corn assessment, which is used to support various agricultural programs. However, producers can opt to claim a refund for these fees by submitting a Corn Assessment Refund Request form within a sixty-day window after the fees have been deducted. This form requires detailed information, including the producer’s and the first purchaser's names and contact details, the date of sale, the number of bushels sold, and the amount of corn assessment fees deducted. Additionally, settlement sheets that verify these details must be attached to the request. It’s important that the information provided is accurate, as the producer certifies the truthfulness of their submission under penalty of perjury. This process, while straightforward, underscores the importance of maintaining good record-keeping practices to ensure eligible producers can reclaim their assessment fees efficiently and without hassle.

| Question | Answer |

|---|---|

| Form Name | Corn Assessment Refund Request Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | corn assessment, iowa corn checkoff refund form, mo assessment refund, missouri corn checkoff form |

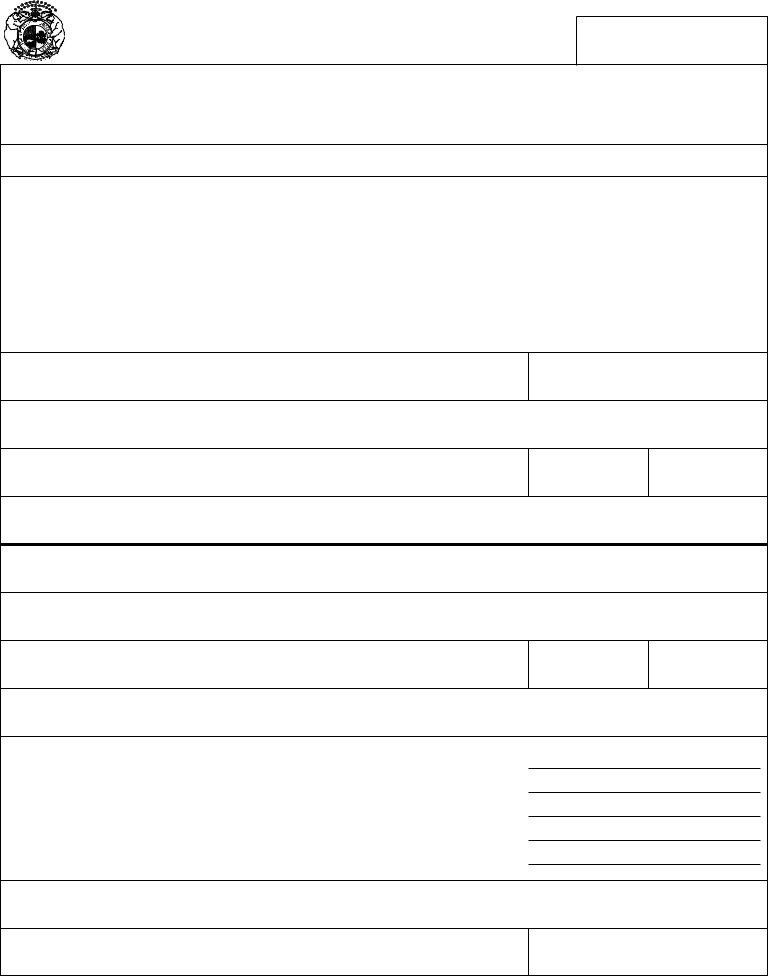

STATE OF MISSOURI DEPARTMENT OF AGRICULTURE COMMODITY FUND PROGRAM

IDENTIFICATION NUMBER

________________________________________

DO NOT WRITE IN THIS SPACE

MISSOURI DEPARTMENT OF AGRICULTURE

CORN COMMODITY FUND

P.O. BOX 630

JEFFERSON CITY, MISSOURI 65102

CORN ASSESSMENT REFUND REQUEST

IN ORDER TO QUALIFY FOR A CORN ASSESSMENT REFUND:

1.COMPLETE THE FOLLOWING INFORMATION AND ATTACH SETTLEMENT SHEETS WHICH VERIFY THE DATE OF SALE, NUMBER OF BUSHELS SOLD, AND THE AMOUNT OF CORN ASSESSMENT FEES DEDUCTED.

2.SUBMIT THIS CORN ASSESSMENT REFUND REQUEST FORM AND SETTLEMENT SHEETS TO THE MISSOURI DEPARTMENT OF AGRICULTURE WITHIN SIXTY (60) DAYS AFTER THE DEDUCTION IS MADE.

PRODUCER NAME

FED. TAX ID # OR SOCIAL SECURITY #

ADDRESS

CITY

STATE

ZIP

TELEPHONE NO.

FIRST PURCHASER NAME

ADDRESS

CITY

STATE

ZIP

TELEPHONE NO.

NUMBER OF SETTLEMENT SHEETS ATTACHED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

MONTH DEDUCTION MADE BY FIRST PURCHASER . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

TOTAL BUSHELS SOLD TO FIRST PURCHASER . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

TOTAL BUSHELS CLAIMED FOR REFUND . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

AMOUNT CLAIMED FOR REFUND AT $.01 PER BUSHEL . . . . . . . . . . . . . . . . . . . . . . . . . . . .

UNDER PENALTIES OF PERJURY, I CERTIFY THAT TO THE BEST OF MY KNOWLEDGE AND BELIEF, THE INFORMATION CONTAINED ON THIS FORM AND THE ATTACHED SETTLEMENT SHEETS IS TRUE AND ACCURATE.

SIGNATURE

DATE

MO