Handling PDF documents online can be simple with our PDF editor. Anyone can fill in Cpa Form 11A 5 here without trouble. Our professional team is always working to enhance the tool and insure that it is even faster for clients with its many features. Make use of the latest progressive prospects, and find a myriad of new experiences! In case you are seeking to get going, here is what it's going to take:

Step 1: Open the PDF form in our tool by hitting the "Get Form Button" above on this webpage.

Step 2: With this online PDF tool, it is possible to do more than merely fill in blank fields. Try each of the functions and make your documents appear faultless with customized textual content added in, or modify the original input to perfection - all backed up by an ability to insert any graphics and sign the PDF off.

It really is easy to complete the pdf following our detailed guide! Here's what you need to do:

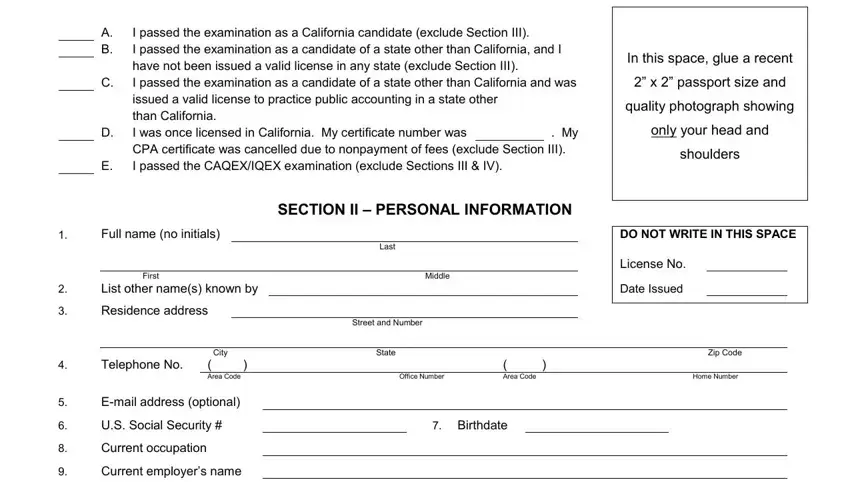

1. The Cpa Form 11A 5 usually requires specific details to be inserted. Be sure that the subsequent fields are finalized:

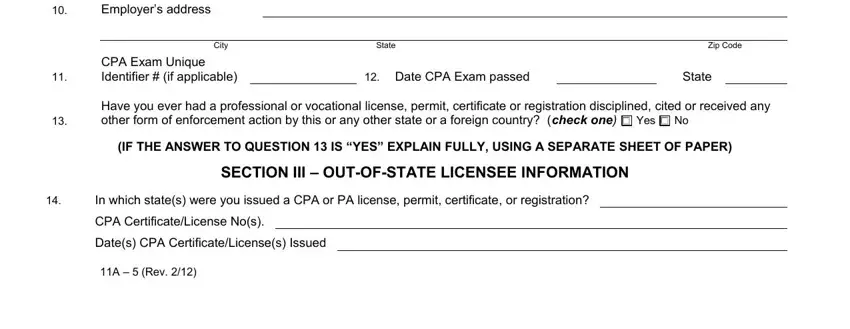

2. Right after finishing the last section, go to the next part and fill out the essential details in all these fields - State, Zip Code, Date CPA Exam passed, State, US Social Security Current, City, CPA Exam Unique Identifier if, Have you ever had a professional, Yes, IF THE ANSWER TO QUESTION IS YES, SECTION III OUTOFSTATE LICENSEE, In which states were you issued a, and A Rev.

People generally make mistakes while completing SECTION III OUTOFSTATE LICENSEE in this part. Ensure you read twice whatever you type in right here.

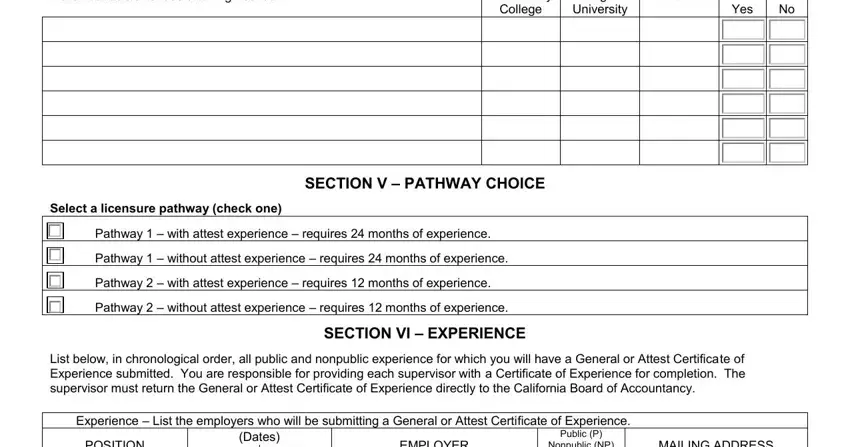

3. Your next stage is normally straightforward - fill out every one of the fields in List all schools attended after, Business School, College, Junior or Community, College or University, Yes, SECTION V PATHWAY CHOICE, Select a licensure pathway check, Pathway with attest experience, SECTION VI EXPERIENCE, List below in chronological order, Experience List the employers who, EMPLOYER, Nonpublic NP, and Dates to complete the current step.

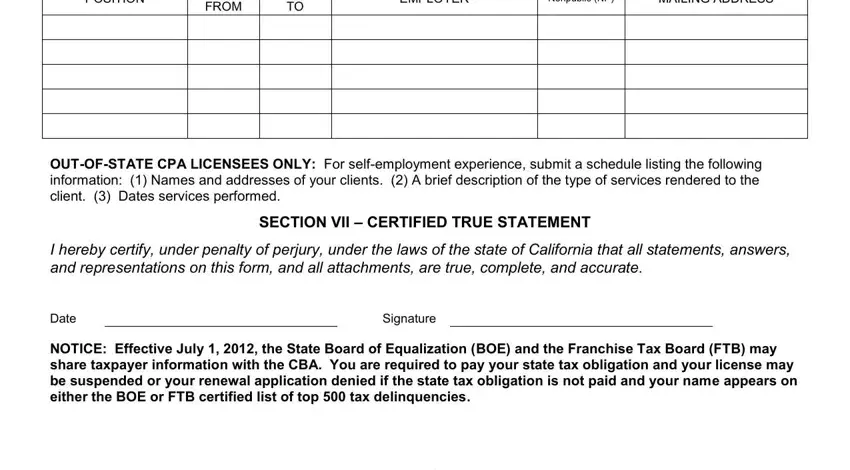

4. You're ready to start working on this fourth section! Here you have all these Experience List the employers who, EMPLOYER, Nonpublic NP, FROM, MAILING ADDRESS, OUTOFSTATE CPA LICENSEES ONLY For, SECTION VII CERTIFIED TRUE, I hereby certify under penalty of, and Signature blanks to do.

Step 3: Right after looking through the completed blanks, hit "Done" and you're all set! Get hold of the Cpa Form 11A 5 after you sign up at FormsPal for a 7-day free trial. Conveniently use the form inside your personal account page, with any edits and changes being all saved! FormsPal guarantees protected document editing devoid of personal data recording or sharing. Feel safe knowing that your details are in good hands with us!