You can fill in Cpe Reporting Form effectively in our online PDF editor. To keep our tool on the cutting edge of efficiency, we work to implement user-driven capabilities and improvements on a regular basis. We're routinely glad to receive suggestions - play a vital role in reshaping PDF editing. All it requires is several easy steps:

Step 1: Just click the "Get Form Button" in the top section of this site to start up our pdf form editing tool. There you'll find everything that is necessary to work with your document.

Step 2: This editor will allow you to work with your PDF document in a range of ways. Change it by adding personalized text, correct what's already in the document, and place in a signature - all at your disposal!

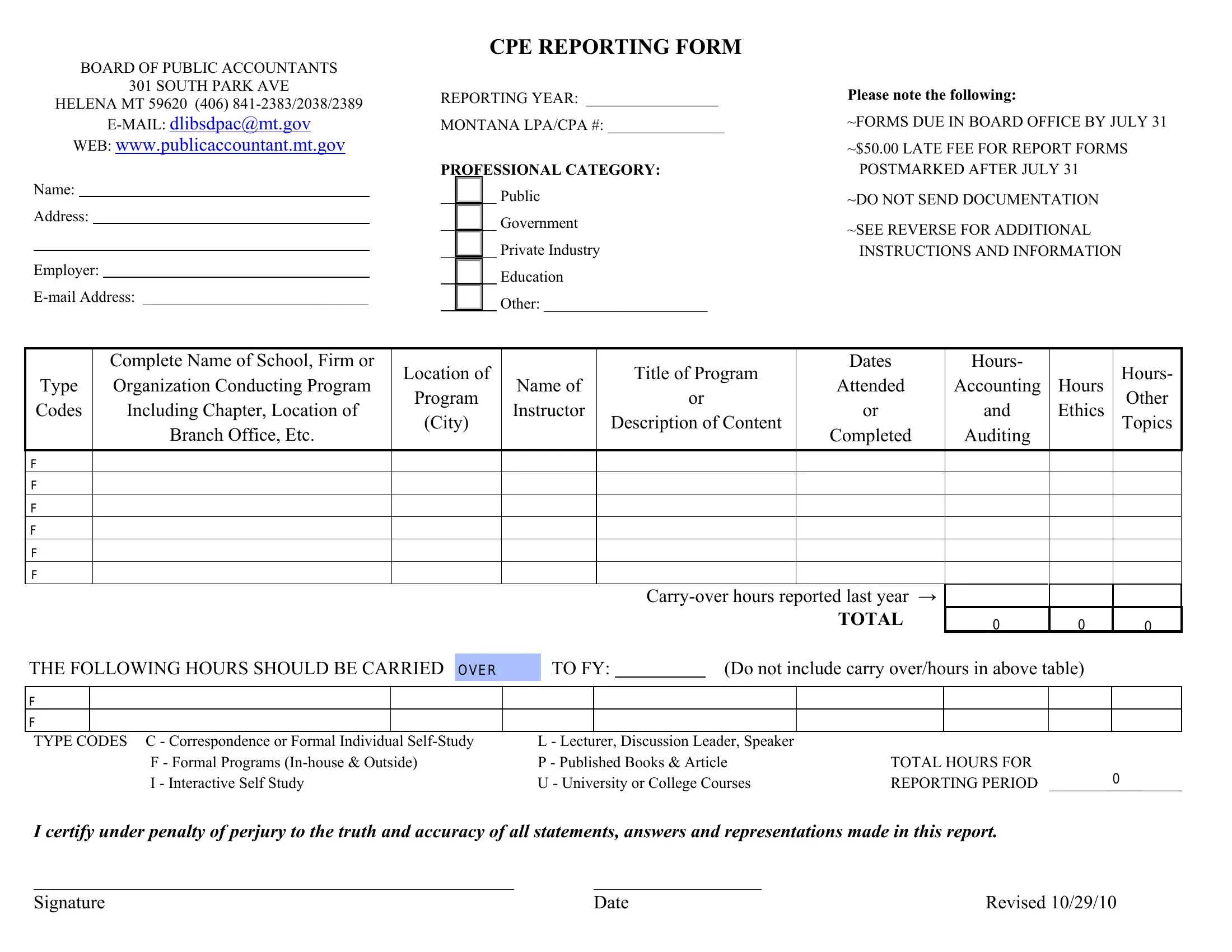

As for the blank fields of this specific form, here is what you need to do:

1. To get started, while completing the Cpe Reporting Form, start with the section that features the following blank fields:

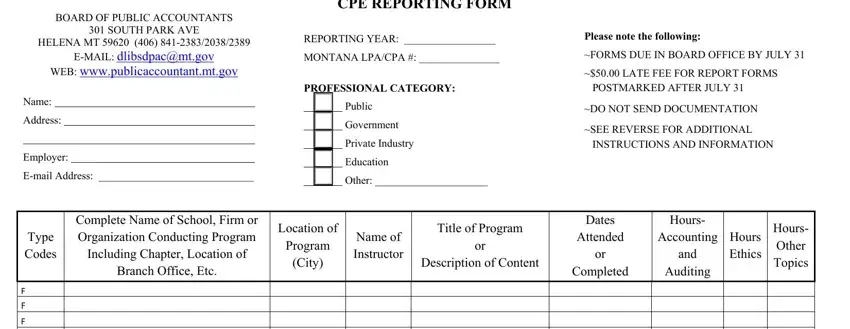

2. The third part would be to fill in the following fields: Carryover hours reported last year, TOTAL, THE FOLLOWING HOURS SHOULD BE, Do not include carry overhours in, TYPE CODES C Correspondence or, Discussion Leader Speaker, L Lectur P Published Books, I certify under penalty of perjury, Signature, Date, and Revised.

When it comes to THE FOLLOWING HOURS SHOULD BE and Signature, be certain that you do everything properly here. Both of these are the key ones in this PDF.

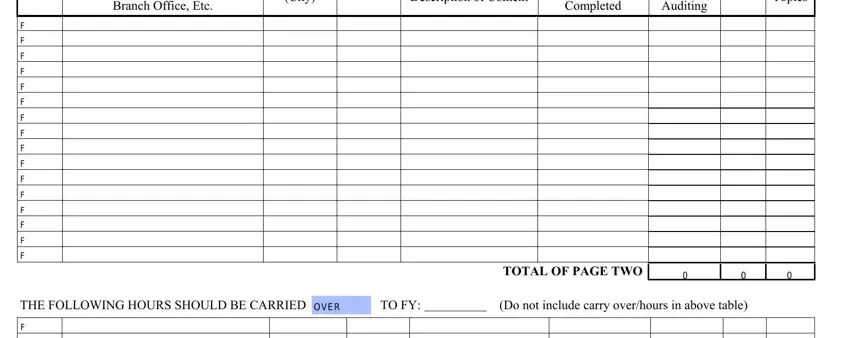

3. Throughout this part, review Branch Office Etc, City, Description of Content, Completed, Auditing, Hours Other Topics, TOTAL OF PAGE TWO, THE FOLLOWING HOURS SHOULD BE, and Do not include carry overhours in. All these are required to be filled in with greatest accuracy.

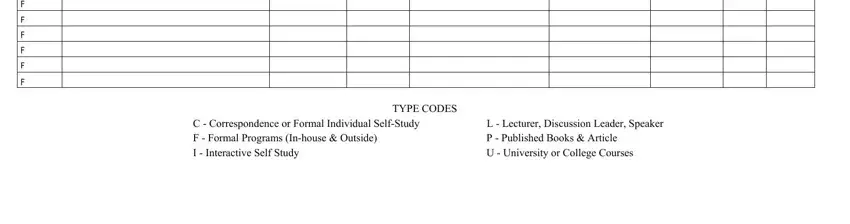

4. Completing TYPE CODES, C Correspondence or Formal, F Formal Programs Inhouse, L Lecturer Discussion Leader, and P Published Books Article U is essential in this fourth stage - you'll want to take the time and take a close look at each and every field!

Step 3: Soon after taking one more look at the entries, click "Done" and you're good to go! Join us now and instantly use Cpe Reporting Form, set for downloading. Every last edit made is handily saved , which means you can change the file later on as required. FormsPal ensures your data privacy by using a secure system that never saves or shares any type of personal information provided. Be assured knowing your docs are kept safe whenever you work with our services!