election to stop contributing to the canada pension plan can be filled out effortlessly. Just make use of FormsPal PDF tool to perform the job without delay. To make our tool better and more convenient to use, we consistently implement new features, bearing in mind suggestions coming from our users. Starting is easy! All you have to do is follow these basic steps directly below:

Step 1: First, access the tool by clicking the "Get Form Button" in the top section of this page.

Step 2: With the help of our online PDF tool, you can actually do more than merely fill in blank fields. Try all of the features and make your docs seem professional with customized textual content incorporated, or tweak the file's original input to excellence - all supported by the capability to add any photos and sign the PDF off.

Filling out this form calls for attention to detail. Make sure each blank is completed properly.

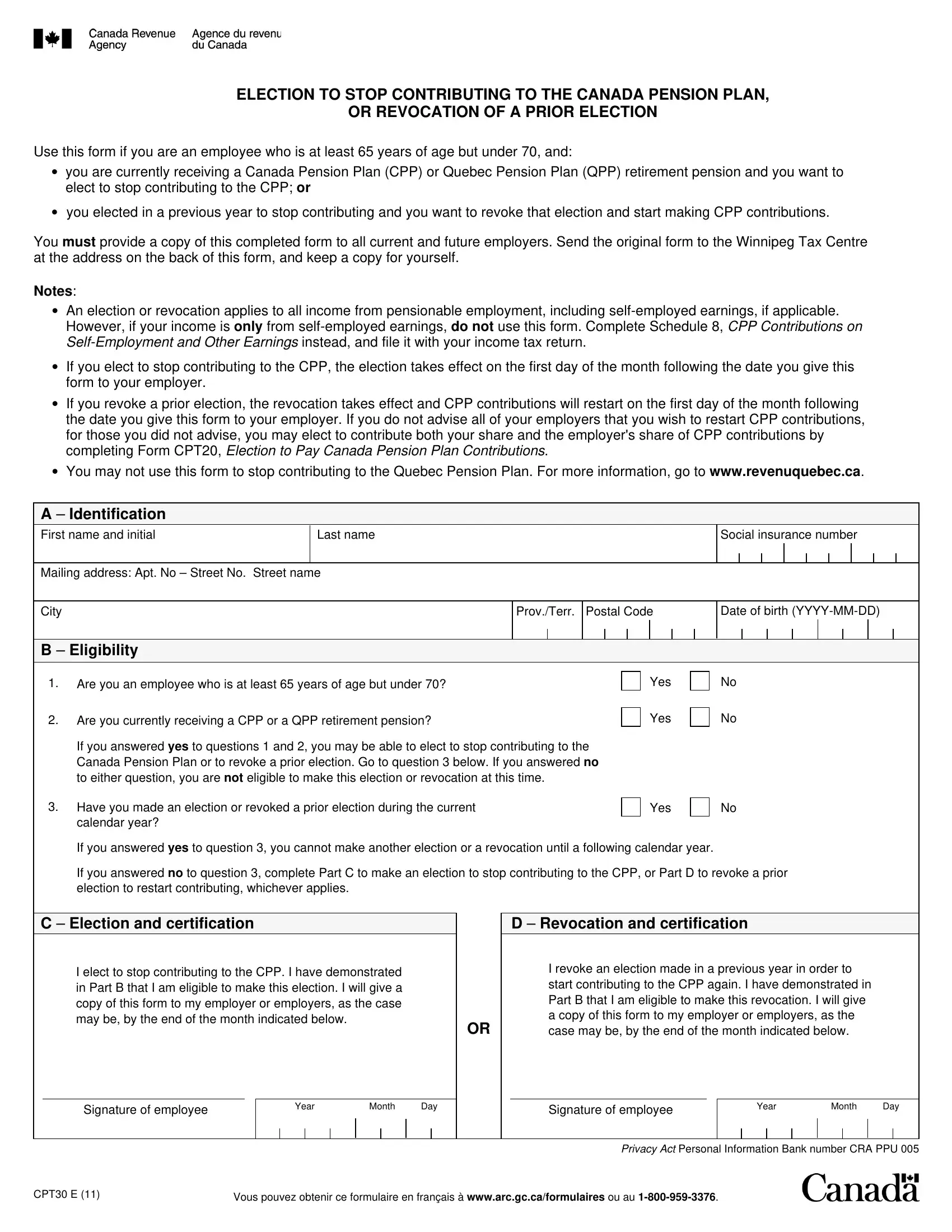

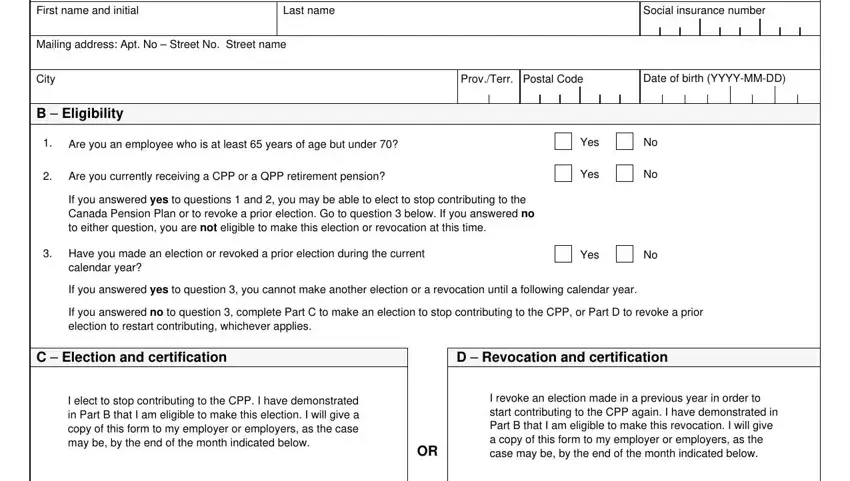

1. It's important to fill out the election to stop contributing to the canada pension plan properly, so be attentive while filling out the parts containing all of these blanks:

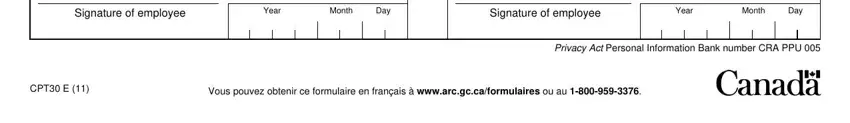

2. Once your current task is complete, take the next step – fill out all of these fields - Signature of employee, Year, Month, Day, Signature of employee, Year, Month, Day, Privacy Act Personal Information, CPT E, and Vous pouvez obtenir ce formulaire with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be extremely attentive when completing CPT E and Month, as this is where most users make errors.

Step 3: Before submitting your file, make certain that blank fields are filled out the right way. When you think it's all fine, click “Done." Grab your election to stop contributing to the canada pension plan when you register here for a free trial. Instantly gain access to the form in your FormsPal cabinet, with any edits and changes being conveniently synced! We don't share or sell any details that you use when working with forms at our site.