You'll be able to work with colorado sales tax withholding account application without difficulty with our online tool for PDF editing. We are aimed at providing you with the perfect experience with our editor by consistently adding new functions and upgrades. Our editor has become a lot more helpful with the newest updates! Currently, filling out PDF forms is a lot easier and faster than ever. All it takes is just a few basic steps:

Step 1: Access the PDF doc inside our tool by pressing the "Get Form Button" at the top of this page.

Step 2: Using our advanced PDF editing tool, it's possible to do more than merely complete blank fields. Express yourself and make your documents look professional with customized text added in, or adjust the file's original content to perfection - all backed up by an ability to incorporate stunning graphics and sign the file off.

It is actually straightforward to fill out the pdf with this practical tutorial! Here's what you must do:

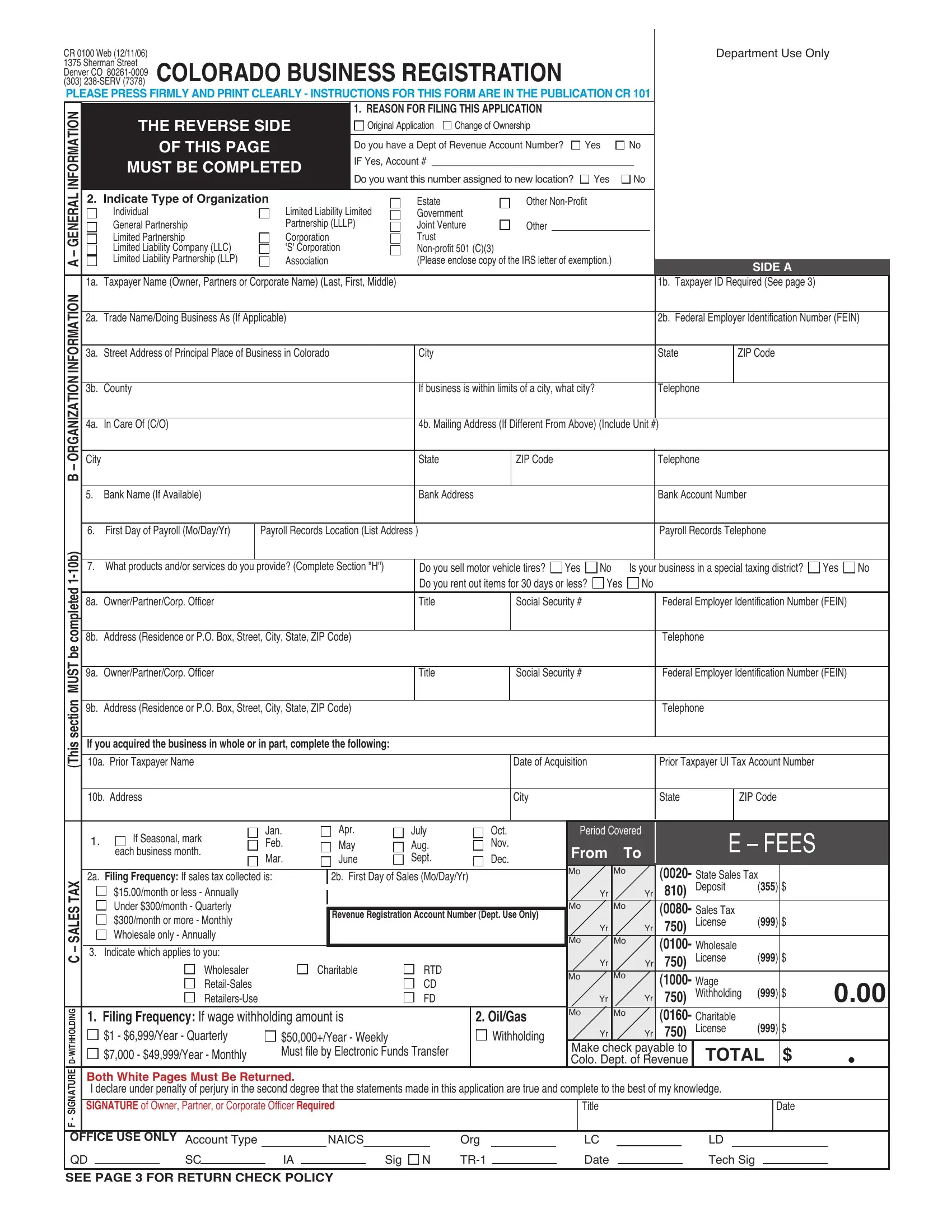

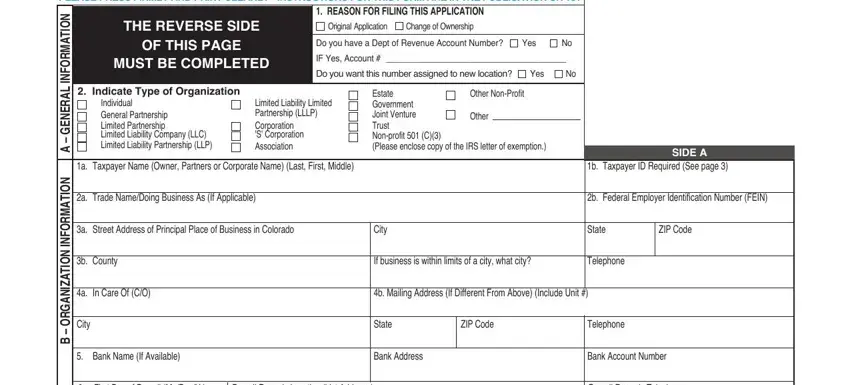

1. To begin with, once filling out the colorado sales tax withholding account application, begin with the area that contains the following blanks:

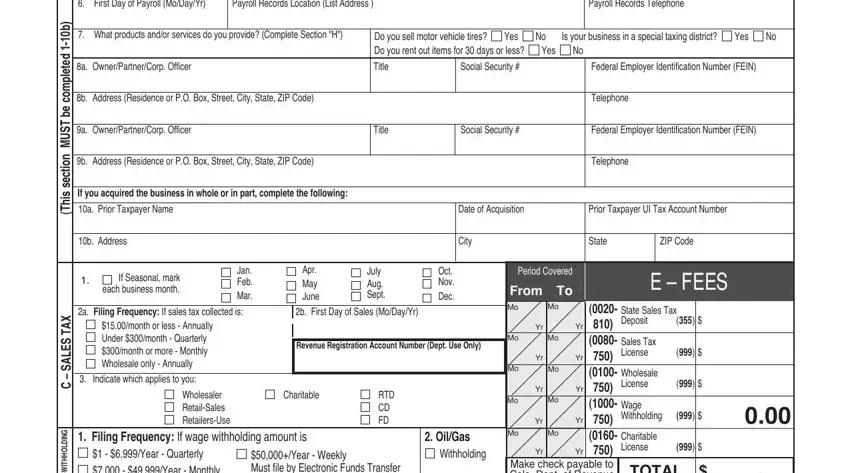

2. After the previous section is done, you're ready to insert the essential particulars in First Day of Payroll MoDayYr, Payroll Records Location List, Payroll Records Telephone, What products andor services do, Do you sell motor vehicle tires Do, Yes, No Is your business in a special, Yes, Yes, a OwnerPartnerCorp Officer, Title, Social Security, Federal Employer Identification, b Address Residence or PO Box, and a OwnerPartnerCorp Officer so that you can go further.

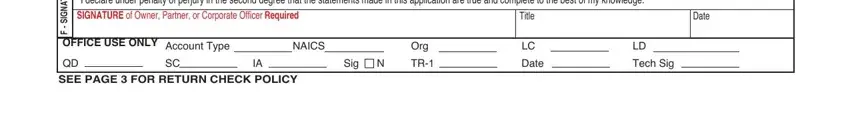

3. The following part focuses on Both White Pages Must Be Returned, Title Date, OFFICE USE ONLY, Account Type, NAICS, Sig, SEE PAGE FOR RETURN CHECK POLICY, Org, Date, Tech Sig, and E R U T A N G S - fill out each one of these empty form fields.

Concerning Org and Both White Pages Must Be Returned, be sure that you don't make any errors here. Both of these could be the most significant ones in this page.

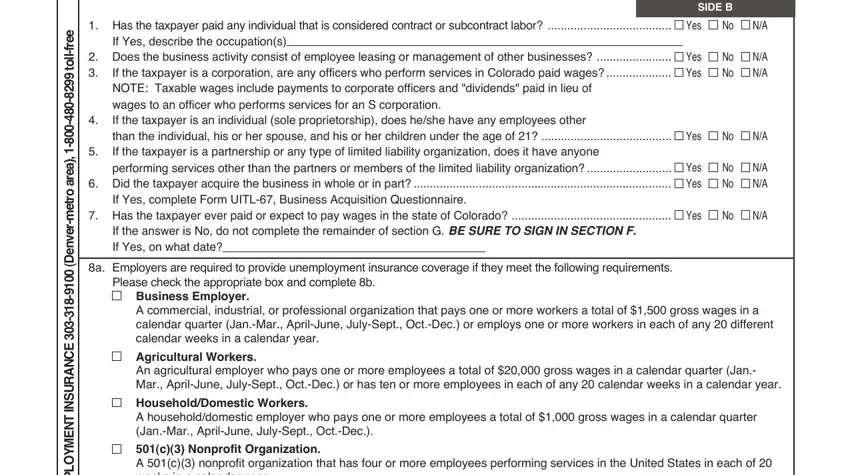

4. To move forward, the next part requires filling out a couple of form blanks. Examples include e e r f l l, o t a e r a o r t, r e v n e D, E C N A R U S N, T N E M Y O L P M E N U G, Has the taxpayer paid any, Yes, If Yes describe the occupations, SIDE B, Does the business activity, If Yes complete Form UITL Business, Has the taxpayer ever paid or, Yes Yes, No No, and NA NA, which are vital to carrying on with this particular PDF.

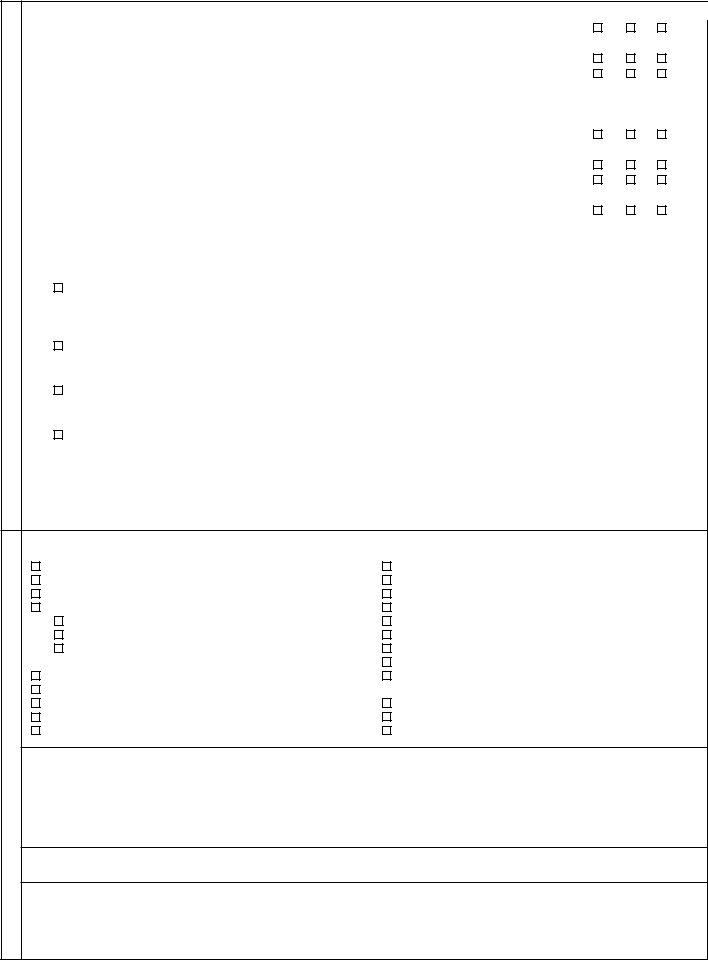

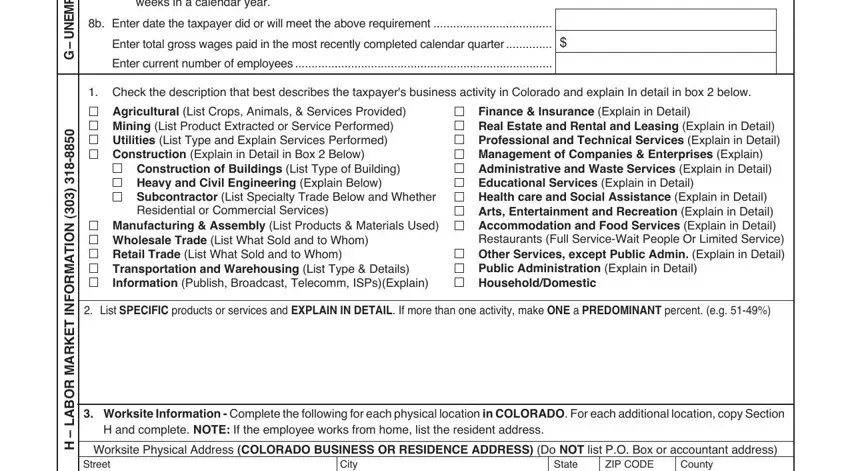

5. This final stage to submit this PDF form is crucial. Make sure to fill in the displayed fields, like T N E M Y O L P M E N U G, N O T A M R O F N, T E K R A M R O B A L H, c Nonprofit Organization A c, b Enter date the taxpayer did or, Enter total gross wages paid in, Enter current number of employees, Check the description that best, Agricultural List Crops Animals, Construction of Buildings List, Manufacturing Assembly List, Finance Insurance Explain in, List SPECIFIC products or, Worksite Information Complete, and H and complete NOTE If the, prior to using the pdf. In any other case, it can give you an incomplete and possibly invalid form!

Step 3: After you have looked again at the details entered, just click "Done" to conclude your document creation. Find the colorado sales tax withholding account application once you sign up for a free trial. Immediately use the form in your personal account, with any edits and changes being automatically saved! FormsPal guarantees your information confidentiality via a protected method that in no way saves or distributes any type of private data used in the file. You can relax knowing your paperwork are kept confidential whenever you work with our service!