Filling in Cr A Form is straightforward. We developed our tool to make it intuitive and assist you to complete any PDF online. Here are a few steps that you need to go through:

Step 1: You can choose the orange "Get Form Now" button at the top of this page.

Step 2: It's now possible to modify the Cr A Form. The multifunctional toolbar lets you insert, eliminate, modify, and highlight content or undertake other commands.

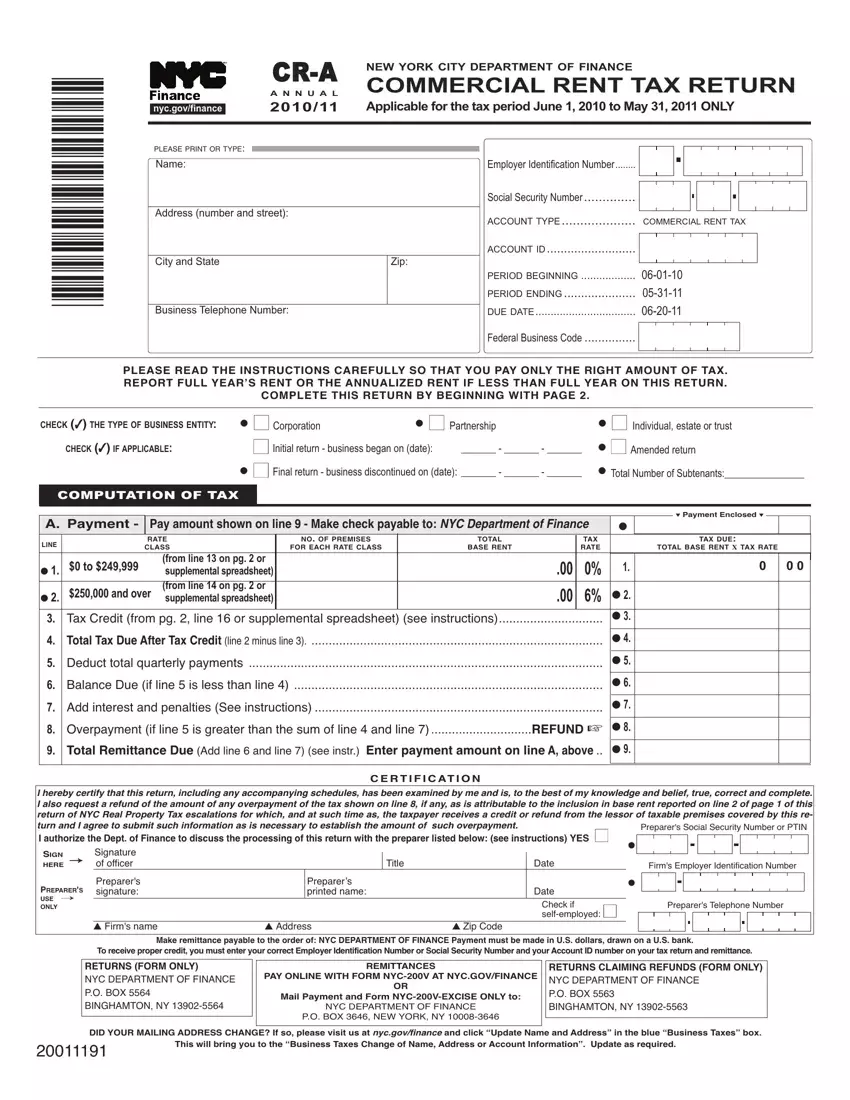

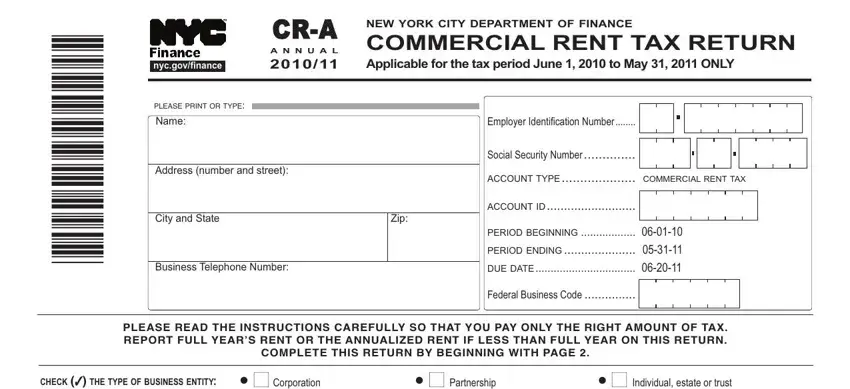

The next areas will compose the PDF template that you will be creating:

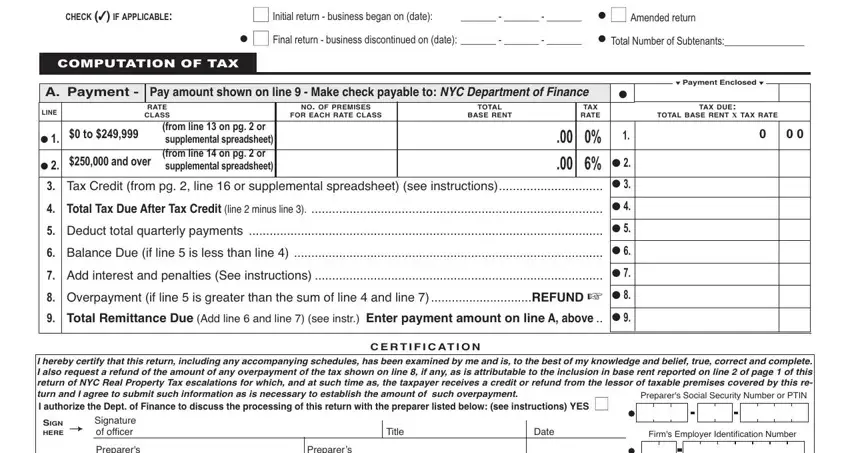

In the Corporation, Partnership, CHECK IF APPLICABLE, Initial return business began on, Final return business, Individual estate or trust, COMPUTATION OF TAX, A Payment, LINE, from line on pg or supplemental, Pay amount shown on line Make, NO OF PREMISES FOR EACH RATE CLASS, TOTAL BASE RENT, TAX RATE, and and over field, type in your data.

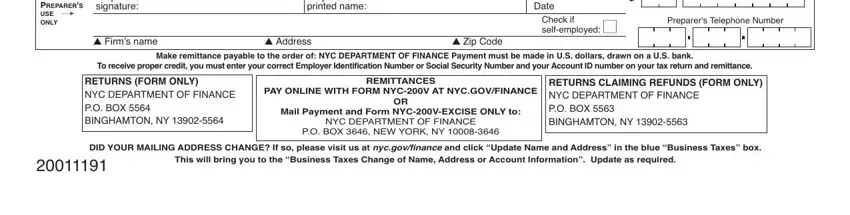

The application will demand you to give particular vital particulars to effortlessly submit the field Preparers signature, PREPARERS USE ONLY, Preparers printed name, Date Check if selfemployed, Preparers Telephone Number, Firms name, Address, Zip Code, Make remittance payable to the, RETURNS FORM ONLY NYC DEPARTMENT, REMITTANCES PAY ONLINE WITH FORM, RETURNS CLAIMING REFUNDS FORM ONLY, and DID YOUR MAILING ADDRESS CHANGE If.

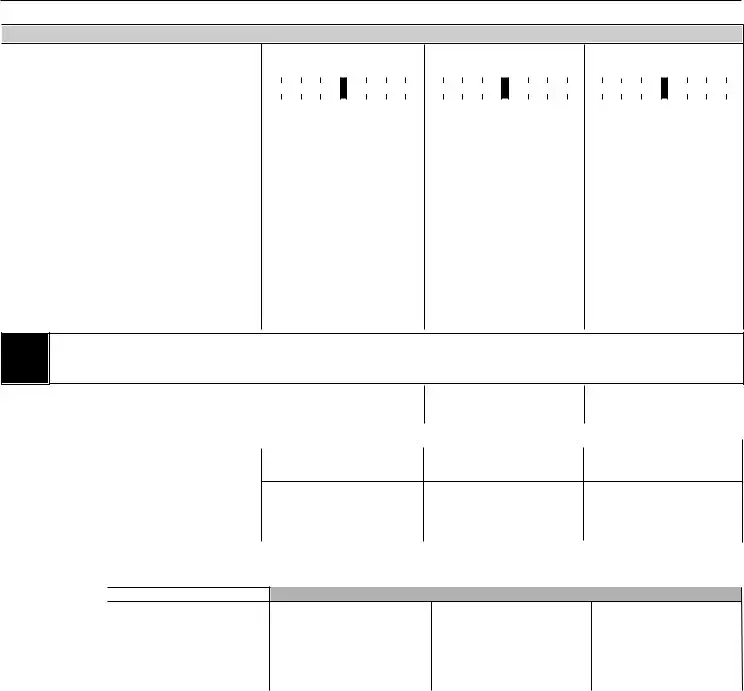

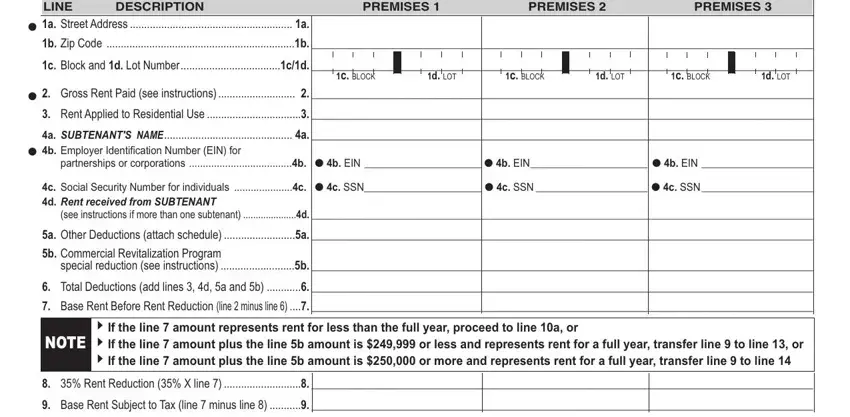

The LINE a Street Address a, DESCRIPTION, PREMISES, PREMISES, PREMISES, b Zip Code b, c Block and d Lot Numbercd, c BLOCK, d LOT, c BLOCK, d LOT, c BLOCK, d LOT, Gross Rent Paid see instructions, and Rent Applied to Residential Use section can be used to specify the rights and obligations of either side.

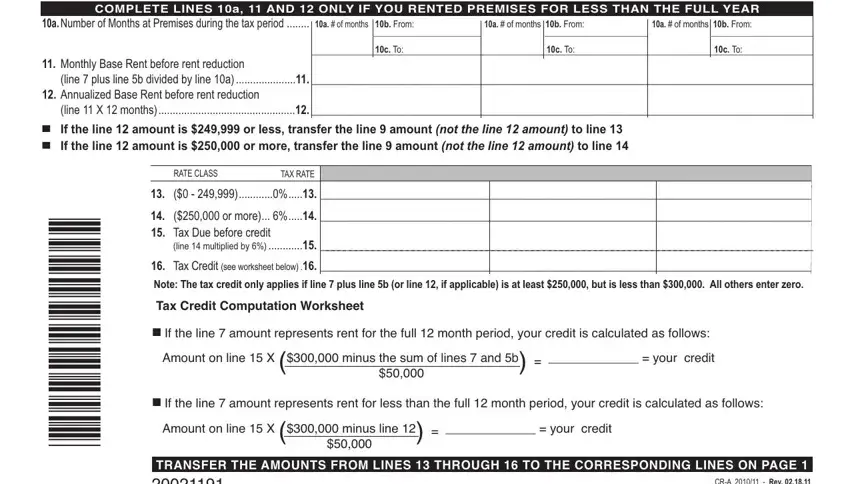

Complete the form by looking at all of these areas: COMPLETE LINES a AND ONLY IF YOU, a Number of Months at Premises, a of months b From, a of months b From, c To, c To, c To, Monthly Base Rent before rent, line plus line b divided by line, Annualized Base Rent before rent, line X months, If the line amount is or less, RATE CLASS, TAX RATE, and or more.

Step 3: As soon as you are done, click the "Done" button to transfer the PDF file.

Step 4: Get duplicates of the template. This may save you from upcoming complications. We cannot check or share the information you have, thus be certain it will be safe.