Our PDF editor makes it easy to fill out documents. It's not necessary to perform much to modify cr q1 commercial rent tax forms. Merely follow these particular steps.

Step 1: You can select the orange "Get Form Now" button at the top of the following webpage.

Step 2: After you access our crq1 editing page, you'll see lots of the options you may take about your document in the top menu.

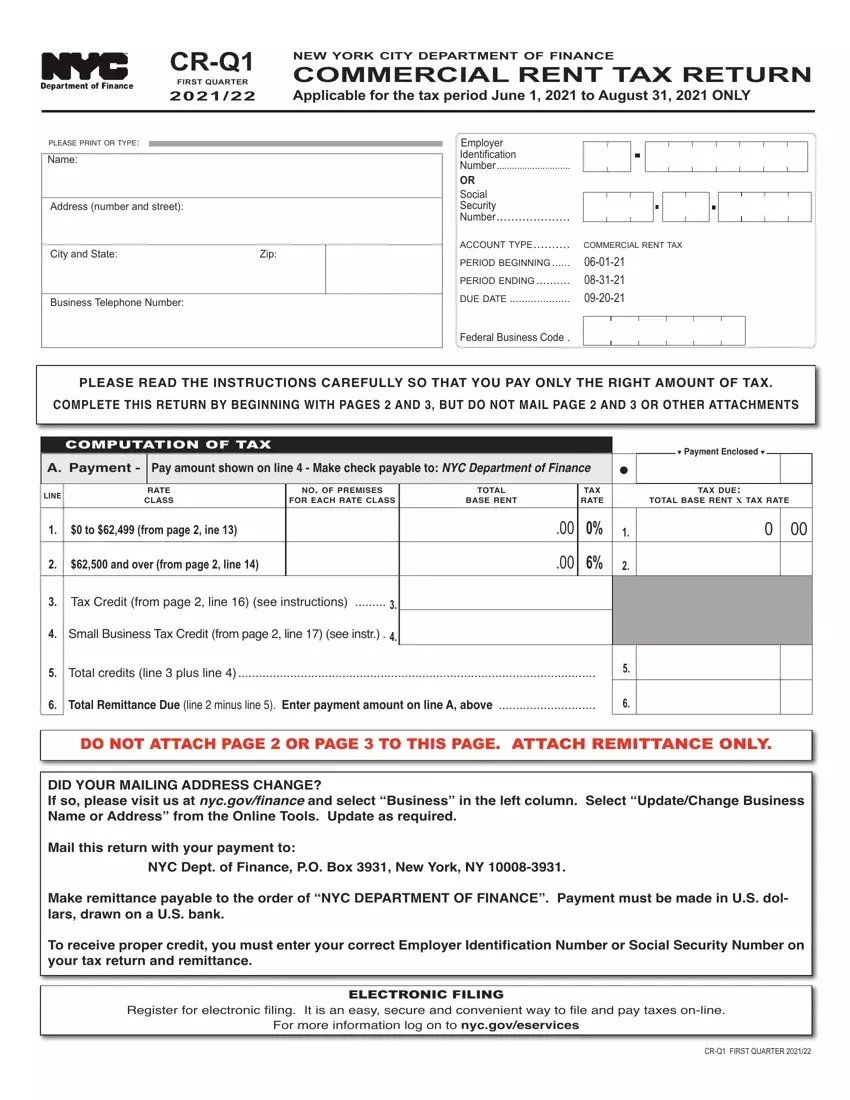

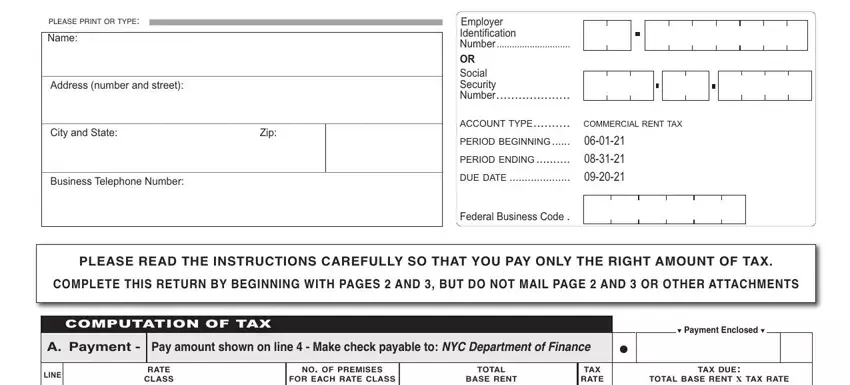

Fill out the next segments to fill in the form:

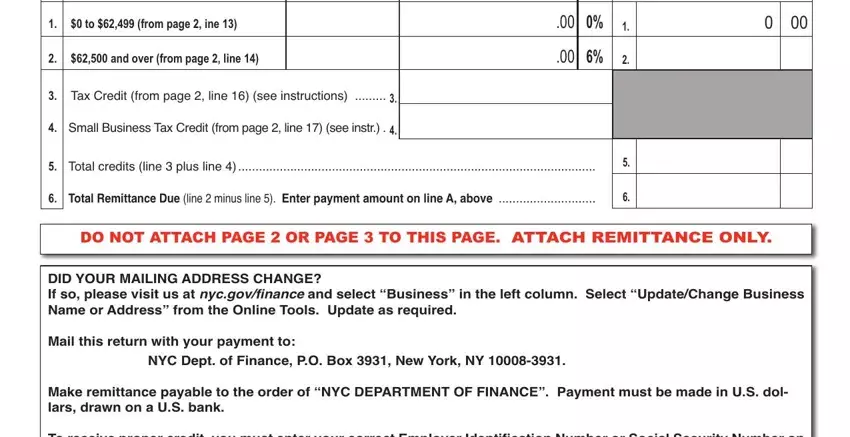

Fill out the LINE, to, frompage, in, e and, over, frompage, line and NYC, Dept, of, Finance, PO, Box, New, York, NY fields with any particulars that is demanded by the application.

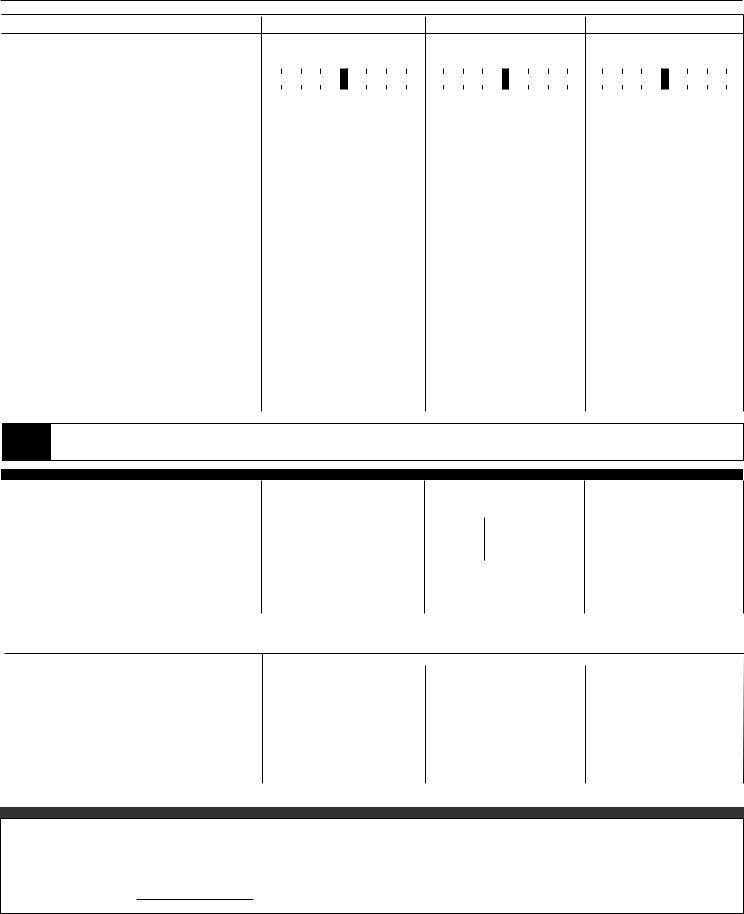

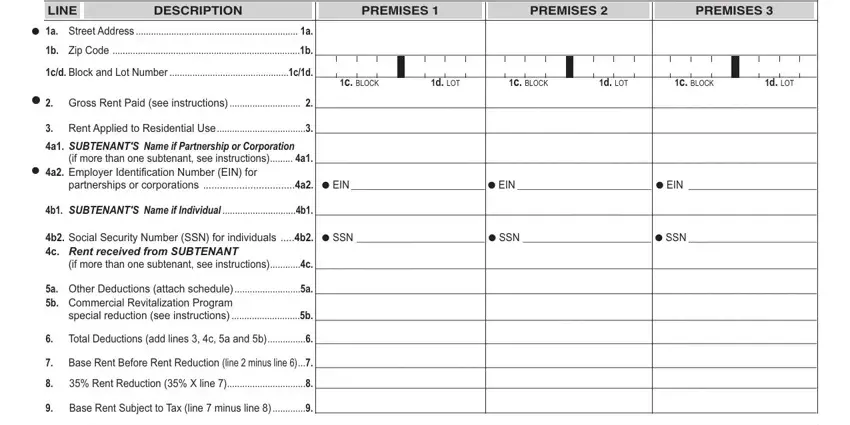

You should be asked for some relevant information so you can complete the DESCRIPTION, PREMISES, PREMISES, PREMISES, c, BLOCK d, LOT c, BLOCK d, LOT c, BLOCK d, LOT and a, Employer, Identification, Number, E, IN, for segment.

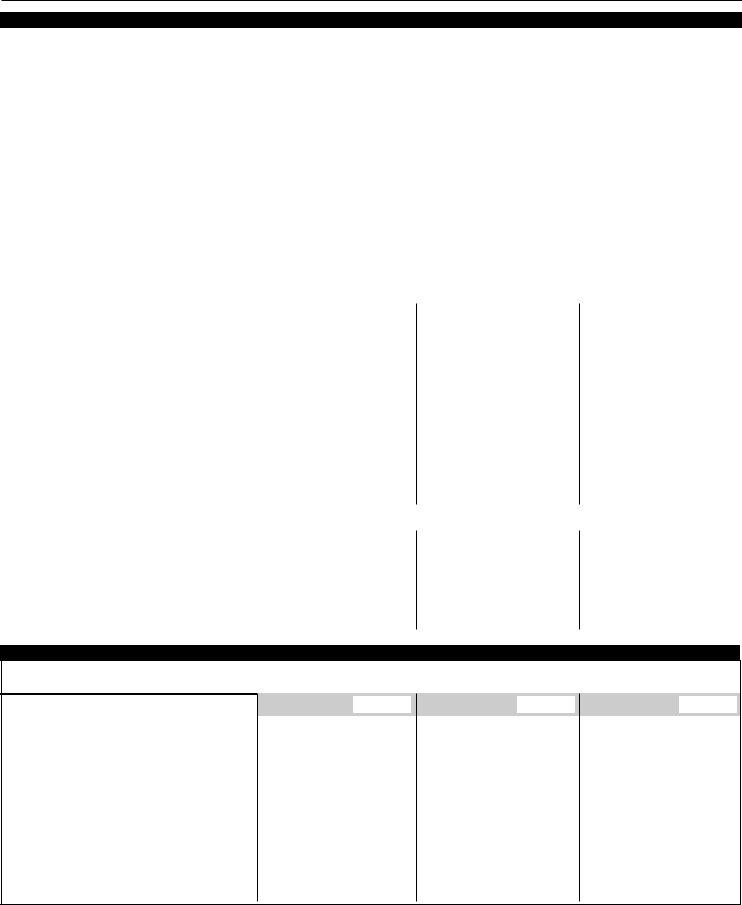

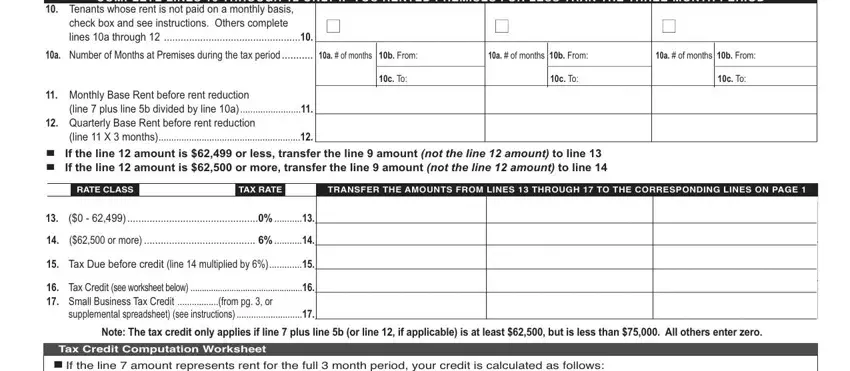

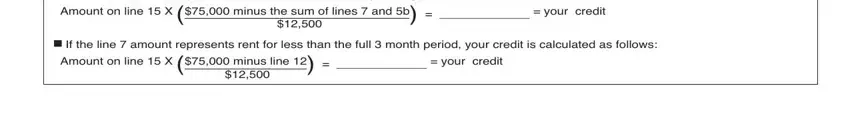

The a, of, months, b, From a, of, months, b, From c, To c, To c, To Monthly, Base, Rent, before, rent, reduction line, plus, line, b, divided, by, line, a lineX, months RATE, CLASS and TAX, RATE section is the place to add the rights and obligations of both parties.

Finish by taking a look at these sections and preparing them accordingly: .

Step 3: Hit the "Done" button. It's now possible to upload your PDF file to your electronic device. Besides, you may deliver it through email.

Step 4: It could be simpler to create duplicates of your file. You can rest easy that we will not share or read your information.