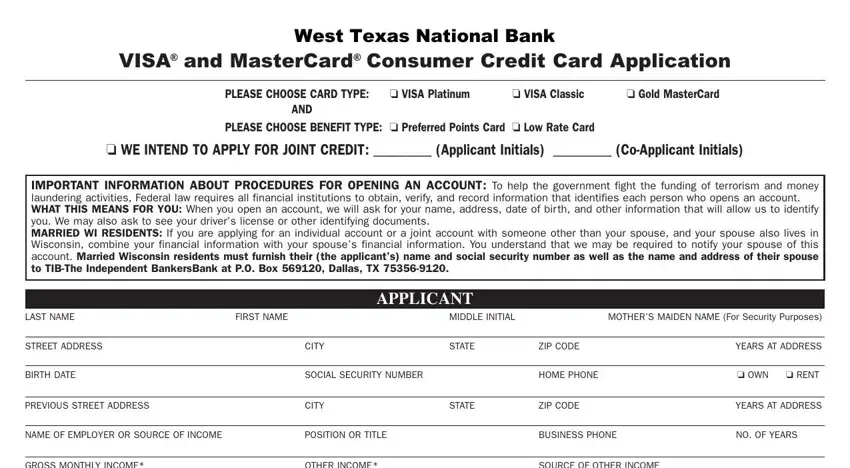

VISA and MasterCardWest TexasConsumerNationalCreditBankCard Application

®®

|

|

|

|

PLEASE CHOOSE CARD TYPE: |

❏ VISA Platinum |

❏ VISA Classic |

❏ Gold MasterCard |

AND

PLEASE CHOOSE BENEFIT TYPE: ❏ Preferred Points Card ❏ Low Rate Card

❏WE INTEND TO APPLY FOR JOINT CREDIT: _________ (Applicant Initials) _________ (Co-Applicant Initials)

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING AN ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. WHAT THIS MEANS FOR YOU: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

MARRIED WI RESIDENTS: If you are applying for an individual account or a joint account with someone other than your spouse, and your spouse also lives in Wisconsin, combine your financial information with your spouse’s financial information. You understand that we may be required to notify your spouse of this

account. Married Wisconsin residents must furnish their (the applicant’s) name and social security number as well as the name and address of their spouse to TIB-The Independent BankersBank at P.O. Box 569120, Dallas, TXAPPLICANT75356-9120.

LAST NAME |

FIRST NAME |

|

MIDDLE INITIAL |

MOTHER’S MAIDEN NAME (For Security Purposes) |

|

|

|

|

|

|

STREET ADDRESS |

|

CITY |

STATE |

ZIP CODE |

YEARS AT ADDRESS |

|

|

|

|

|

|

BIRTH DATE |

|

SOCIAL SECURITY NUMBER |

|

HOME PHONE |

❏ OWN ❏ RENT |

|

|

|

|

|

|

PREVIOUS STREET ADDRESS |

|

CITY |

STATE |

ZIP CODE |

YEARS AT ADDRESS |

|

|

|

|

|

|

NAME OF EMPLOYER OR SOURCE OF INCOME |

|

POSITION OR TITLE |

|

BUSINESS PHONE |

NO. OF YEARS |

|

|

|

|

|

|

GROSS MONTHLY INCOME* |

|

OTHER INCOME* |

|

SOURCE OF OTHER INCOME |

|

$______________________ |

|

$______________________ |

|

__________________________________________________________ |

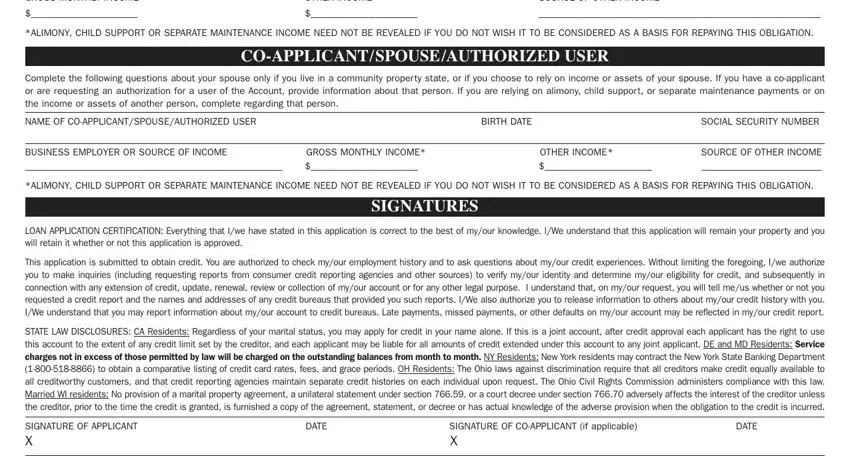

*ALIMONY, CHILD SUPPORT OR SEPARATE MAINTENANCECO-APPLICANT/SPOUSE/AUTHORIZEDINCOME NEED NOT BE REVEALED IF YOU DO NOT WISH T TO BE CONUSERID ED AS A BASIS FOR REPAYING THIS OBLIGATION.

Complete the following questions about your spouse only if you live in a community property state, or if you choose to rely on income or assets of your spouse. If you have a co-applicant or are requesting an authorization for a user of the Account, provide information about that person. If you are relying on alimony, child support, or separate maintenance payments or on the income or assets of another person, complete regarding that person.

NAME OF CO-APPLICANT/SPOUSE/AUTHORIZED USER |

|

BIRTH DATE |

SOCIAL SECURITY NUMBER |

|

|

|

|

BUSINESS EMPLOYER OR SOURCE OF INCOME |

GROSS MONTHLY INCOME* |

OTHER INCOME* |

SOURCE OF OTHER INCOME |

_____________________________________________________ |

$______________________ |

$______________________ |

____________________________ |

|

SIGNATURES |

|

|

*ALIMONY, CHILD SUPPORT OR SEPARATE MAINTENANCE INCOME NEED NOT BE REVEALED IF YOU DO NOT WISH IT TO BE CONSIDERED AS A BASIS FOR REPAYING THIS OBLIGATION.

LOAN APPLICATION CERTIFICATION: Everything that I/we have stated in this application is correct to the best of my/our knowledge. I/We understand that this application will remain your property and you will retain it whether or not this application is approved.

This application is submitted to obtain credit. You are authorized to check my/our employment history and to ask questions about my/our credit experiences. Without limiting the foregoing, I/we authorize you to make inquiries (including requesting reports from consumer credit reporting agencies and other sources) to verify my/our identity and determine my/our eligibility for credit, and subsequently in connection with any extension of credit, update, renewal, review or collection of my/our account or for any other legal purpose. I understand that, on my/our request, you will tell me/us whether or not you requested a credit report and the names and addresses of any credit bureaus that provided you such reports. I/We also authorize you to release information to others about my/our credit history with you. I/We understand that you may report information about my/our account to credit bureaus. Late payments, missed payments, or other defaults on my/our account may be reflected in my/our credit report.

STATE LAW DISCLOSURES: CA Residents: Regardless of your marital status, you may apply for credit in your name alone. If this is a joint account, after credit approval each applicant has the right to use

this account to the extent of any credit limit set by the creditor, and each applicant may be liable for all amounts of credit extended under this account to any joint applicant. DE and MD Residents: Service

charges not in excess of those permitted by law will be charged on the outstanding balances from month to month. NY Residents: New York residents may contract the New York State Banking Department

(1-800-518-8866) to obtain a comparative listing of credit card rates, fees, and grace periods. OH Residents: The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law. Married WI residents: No provision of a marital property agreement, a unilateral statement under section 766.59, or a court decree under section 766.70 adversely affects the interest of the creditor unless the creditor, prior to the time the credit is granted, is furnished a copy of the agreement, statement, or decree or has actual knowledge of the adverse provision when the obligation to the credit is incurred.

SIGNATURE OF APPLICANT |

|

DATE |

|

SIGNATURE OF CO-APPLICANT (if applicable) |

|

|

|

|

DATE |

X |

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

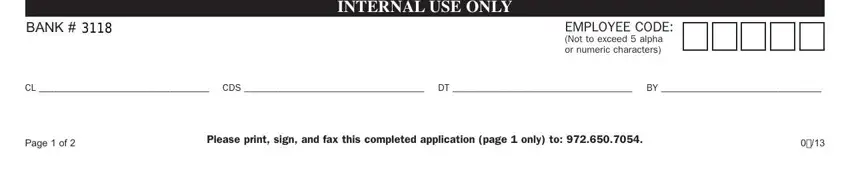

BANK # 3118 |

|

|

INTERNAL USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE CODE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to exceed 5 alpha |

|

|

|

|

|

|

|

|

|

|

|

|

|

or numeric characters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CL ___________________________________ |

CDS _____________________________________ |

DT _____________________________________ |

BY _________________________________ |

Page 1 of 2 |

Please print, sign, and fax this completed application (page 1 only) to: 972.650.7054. |

0/13 |

|

|

|

|

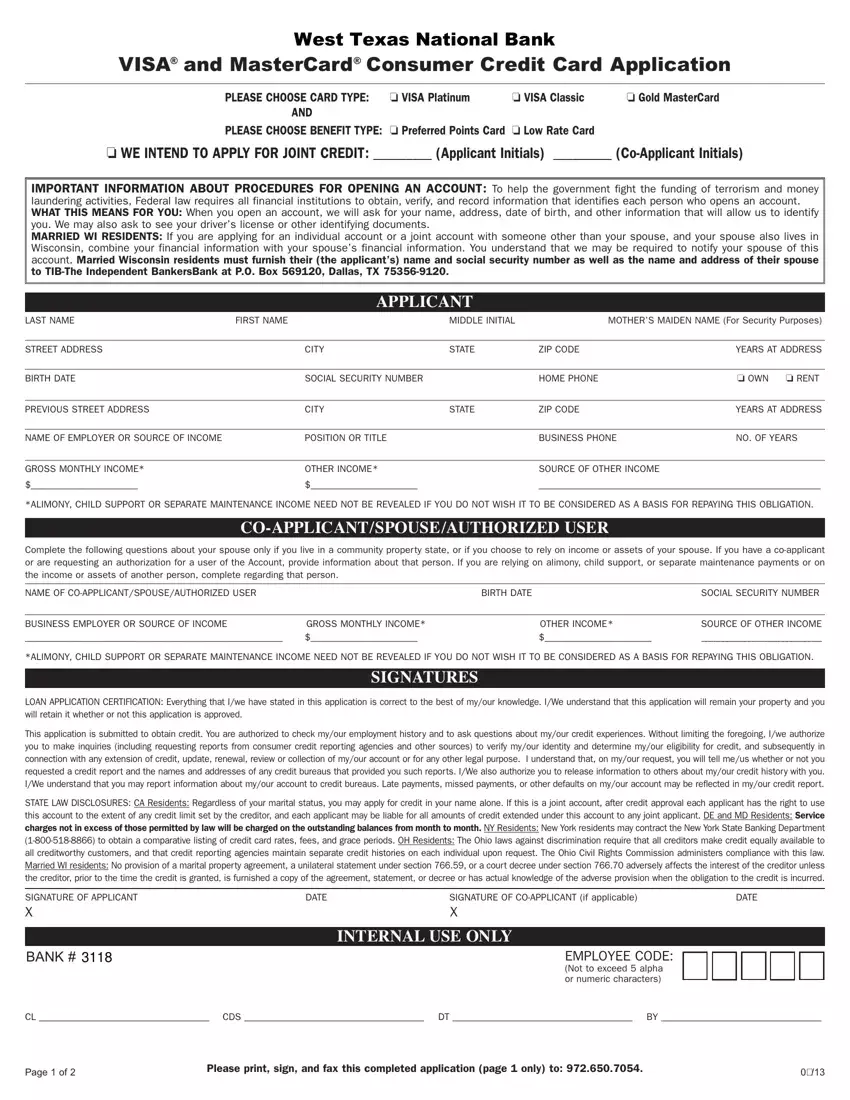

VISA® and MasterCard® Consumer Credit Card Application

|

|

PREFERRED POINTS CARD |

|

LOW RATE CARD |

|

|

|

|

|

|

Interest Rates and Interest Charges |

|

|

|

|

|

|

|

|

|

2.90% introductory APR for six months. |

|

2.90% introductory APR for six months. |

|

Annual Percentage Rate |

After that, your APR will be 15.24%. |

|

After that, your APR will be 10.24%. |

|

(APR) for Purchases |

|

|

|

This APR will vary with the market based on |

|

This APR will vary with the market based on |

|

|

the Prime Rate.a |

|

the Prime Rate.b |

|

|

2.90% introductory APR for six months. |

|

2.90% introductory APR for six months. |

|

APR for Balance Transfers |

After that, your APR will be 15.24%. |

|

After that, your APR will be 10.24%. |

|

and Cash Advances |

|

|

This APR will vary with the market based on |

|

This APR will vary with the market based on |

|

|

the Prime Rate.a |

|

the Prime Rate.b |

|

Penalty APR and |

19.24% – This APR will vary with the market based on the Prime Rate.c |

|

This APR may be applied if you allow your Account to become 60 days past due. |

|

When It Applies |

How Long Will the Penalty Apply? If your APR is increased for the reason stated above, the |

|

|

Penalty APR will apply until you make three consecutive minimum payments when due. |

|

|

|

|

|

How to Avoid Paying Interest |

Your due date is at least 25 days after the close of each billing cycle. We will not charge you |

|

on Purchases |

any interest on purchases if you pay your entire balance by the due date each month. |

|

|

|

|

|

|

For Credit Card Tips from |

To learn more about factors to consider when |

applying for or using a credit card, visit the website |

|

the Consumer Financial |

|

of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/credit-cards/. |

|

Protection Bureau |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees |

|

|

|

|

|

|

|

|

|

Annual Fee |

None |

|

None |

|

|

|

|

|

|

Transaction Fees: |

|

|

|

|

Balance Transfer |

Either $10 or 3% of the amount of each balance transfer or each cash advance, whichever |

|

and Cash Advance |

is greater. |

|

|

|

International Transaction |

2% of each transaction in U.S. dollars. |

|

|

|

|

|

|

|

|

Penalty Fees: |

|

|

|

|

Late Payment |

$25 |

|

|

|

Returned Payment |

$25 |

|

|

|

|

|

|

|

|

Other Fees: |

|

|

|

|

Pay-by-Phone |

Up to $10 for agent assisted payments. |

|

|

|

|

|

|

|

How We Will Calculate Your Balance: We use a method called “average daily balance (including new purchases).” See your account agreement for more details.

Prime Rate: After the introductory rate, the APR will vary based on changes in the Index, the Prime Rate (the base rate on corporate loans posted by at least 70% of the ten largest U.S. banks) published in the Wall Street Journal. The Index will be adjusted on the 25th day of each month or the business day preceding the 25th day if that day falls on a weekend or a holiday recognized by the Board of Governors of the Federal Reserve System. Changes in the Index will take effect beginning with the first billing cycle in the month following a change in the Index. Increases or decreases in the Index will cause the APR and periodic rate to fluctuate, resulting in increased or decreased Interest Charges on the Account. As of December 24, 2012, the Index was 3.25%.

aWe add 11.99% to the Prime Rate to determine the APR for Purchases, Balance Transfers, and Cash Advances. The Account will never have an APR over 21%.

bWe add 6.99% to the Prime Rate to determine the APR for Purchases, Balance Transfers, and Cash Advances. The Account will never have an APR over 21%.

cWe add 15.99% to the Prime Rate to determine the Penalty APR. The Account will never have an APR over 21.00%.

If at least one box at the top of the application is not checked, or, if too many boxes are inadvertently checked, you will be deemed to have selected the VISA Platinum card with the Low Rate option.

If you do not qualify for a VISA Platinum Card and you qualify for a VISA Classic Card, you will automatically be offered a VISA Classic Card.

The issuer and administrator of the credit card program is TIB-The Independent BankersBank.

The information about the Cost described in this table is accurate as of January 1, 2013.

This information may change after that date. To find out what may have changed, call us at 800-367-7576

or write TIB-The Independent BankersBank, P.O. Box 569120, Dallas, Texas 75356-9120.

Page 2 of 2 |

Please print and save this page for your records. |

01/13 |

|

|