Navigating the complexities of the Creditors and Their Bonds form unveils an intricate interplay between debt, credit, and the law, offering a glimpse into the concealed mechanics of the commercial court process. At the heart of this process lies the understanding that a bond, in various forms, serves as evidence of debt, delineating the relationship between creditor and debtor, with the former holding the bond as an asset. The historical backdrop to these bonds is rich and varied, stretching back to actions as significant as the depositing of gold in Federal Reserve Banks in 1933, a move that implicitly bound citizens to a vast, unseen network of financial obligations and entitlements. This expansive view encompasses not just secured debt instruments but also ventures into the realms of unsecured debt, bringing to light how everyday actions, such as applying for a birth certificate or securing a loan, further entangle individuals in this complex web. The concept of straw men, or third-party fronts, is pivotal, acting as agents through which individuals interact with the state and the broader financial system, further complicating the creditor-debtor dynamic. This formative relationship underpins the issuance of social security numbers, tying personal identity to financial identity, and underscores the transformation of personal credit into a tool for discharging public debt. The document delves into the nuanced legalities of using bonds for discharge, appearance, and ensuring court appearances, emphasizing voluntary participation in these processes. It articulates a system built on the foundations of implied contracts, where participation in the financial system requires navigating bonds, pledges, and the personal credit that underlies the national economy. Understanding the Creditors and Their Bonds form is essential for unraveling these layers, providing not just a means of engaging with public debt but a lens through which the shadowy outlines of the commercial court process become starkly visible.

| Question | Answer |

|---|---|

| Form Name | Creditors And Their Bonds Form |

| Form Length | 47 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 11 min 45 sec |

| Other names | creditors their pdf, creditors and their bonds book, creditors and their bonds pdf, creditors and their bonds document |

+

CREDITORS AND THEIR BONDS

PLUS

THE HIDDEN COMMERCIAL COURT PROCESS

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 1 |

CREDITORS AND THEIR BONDS

Bond. In every case a bond represents debt – its holder is a creditor of the corporation and not a part owner as is the shareholder.

The word “bond” is sometimes used more broadly to refer also to unsecured debt instruments.

[Definitions used here are generally from Black’s 6th]

1)Bond supporting credit authorizations

This bond is the debt side of the implied contract that resulted when your grandparents took all their gold to the Federal Reserve Banks by May 1, 1933.

A bond is always evidence of a debt.

It can be a liability to the deb tor or an asset to the creditor.

This bond is also the implied debt that resulted when you applied for a birth certificate for new entities (straw men) you requested that the States create when you had your babies. You put a description of your baby on the application. This tied the baby and the straw man together as long as the described baby man lived. When the man dies, the straw man is terminated by the State with a Death Certificate. It has no commercial energy without the man.

Straw man: A “front”; a third party who is put up in name only to take part in a transaction. Nominal party to a transaction; one (JOHN) who acts as an agent for another (John) for the purposes of taking title to real property and executing whatever documents and instruments the principal (John) may direct respecting the property. Person (JOHN) who purchases property for another (John) to conceal identity or real purchaser or to accomplish something that is otherwise not allowed. [Can’t mix public and private!]

Implied Partnership: One which is not a real partnership but which is recognized by the court as such because of the conduct of the parties [the defendant trust you as trustee, as the defendant’s surety];

In effect, the parties are estopped from denying the existence of a partnership. [That is a dishonor.]

This bond is also the implied debt that resulted when you applied for a title to a car, a mortgage, or any other Loan that resulted in collateral being registered with the State.

You cannot be required to pledge your substance, but you can voluntarily pledge it to help the UD through its bankruptcy status.

Pledge: A bailment

Bailment: A delivery of goods or personal property, by one person (bailor) [strawman] to another (bailee) [State or UD], in trust for the execution of a special object [exemption] upon or in relation to such goods.

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 2 |

If you do not volunteer, you may be given “choices” to make it easier for you to volunteer, but you must always do this voluntarily. You are not asked to GIVE your substance, only to pledge it, while you keep possession of the substance. In return, you get the implied bond. The straw man received a social security number. The correlating private side number is the exemption identifier number – same digits, just no dashes.

Public debt number = |

Strawman / Debtor / agent of US or State |

Private exemption number = 123456789 |

Creditor |

The straw man is a creation of the debtor corporation, so it is presumed to be an officer, agent, or employee of the debtor corporation. It must file tax returns and must follow all the corporate rules and regulation (public laws).

The man, on the other hand, is not a creation of the debtor corporation, but is the presumed representative of the straw man. The man is also the one who had the creditor side of the debt the US owes. This is the national debt

–at least part of it. Part of the national debt is owed to the people who pledge their substance in return for an exemption from “paying” public debts. The US runs on credit. It does not have its own credit. Everything is backed by the full faith and credit of the people. We have to have faith the US will honor its debts, and we have to know how to use our credit. The straw man cannot use your credit on its own, but it can use it if you authorize it. Our authorization is backed by the implied contract and the resulting bond (debt) the US has to the people. As long as the people are not acting like debtors and victims, they can use their credit. When the people start acting like debtors (straw man), they dishonor their own heritage and rights.

Your private instruments are backed by the bond. The number on the bond is 123456789 for John Doe.

2)Bond for discharge

This is the creditor / holder’s side of the bond (evidence of a debt). When you use a bond for discharge, you are using your credit backed by the implied bond (debt) resulting from your pledges to help the US through its bankruptcy. There is no value limit to this bond, as you voluntarily agree to pledge every bit of substance you ever get until the money is put back into circulation. All the substance you have (cars, dirt, shoes, food, toothbrushes) was acquired by giving the merchants Federal Reserve notes.

You can never get title to things unless you pay for them. Since there is no money in the US, only debt paper, every time you get a pair of shoes, you are exchanging a debt for the shoes. In the US, since 1933, That is an acceptable practice. Outside the US and its States, in the states, that is not acceptable. If you tried to get shoes without paying for them in the states, you would be put in jail for stealing, but in the jurisdiction of the US, you can get possession of the shoes by giving the merchant debt paper. You just can’t get title. If you want the title, you will have to give the merchant a real asset from the private side (substance). The only substance that is yours is your exemption. That equates to credit in admiralty and equity.

March 9, 1933 73rd Congress

MR PATMAN: “Under the new law the money is issued to the banks in return for Government obligations, bills of exchange drafts, notes, trade acceptances, and banker’s acceptances. The money will be worth 100cents on the dollar, because it is backed by the credit of the Nation. It will represent a mortgage on all the homes and other property of all the people in the Nation.”

MR PATMAN: “The money so issued will not have one penny of gold coverage behind it, because it is really not needed.”

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 3 |

The bills of exchange are government obligations and to the private investors.

The banker’s acceptances are government obligations. When you accept a presentment for value and

sign it, you have just done a banker’s acceptance. Public banks can also do a banker’s acceptance. It is not designated to just one side or the other.

Have you asked who is ISSUING the new money to the banks? Can the Government issue money to the banks? Can other banks issue money to the banks? Where is this new money that is going to be issued to banks? Where does the bank go when it wants to be issued more money? The people have been always been private bankers in the states in America. Now we also have public bankers. The people used to dig the gold and silver out of the ground, have it minted, and then put it into circulation. Now the people sign notes, and give them to the banks to turn into “debt money”, and the banks put the debt into circulation “as money”. It would be against the law for the people to do that. They have to issue their credit (money) to the bank to do through the straw men. When you use the US bond (even though it is an implied bond), to discharge a public debt, the debt is discharged. House Joint Resolution 192 is the written public (insurance) policy guaranteeing this can be done. The people are still issuing new money to the banks by signing notes and giving them to the banks.

Implied: This word is used in law in contrast to “express”;i.e., where the intention in regard to the subject matter is not manifested by explicit and direct words, but is gathered by implication or necessary action from the circumstances, the general language, or the conduct of the parties.

Using the bond (debt) to discharge another debt is common in the US. Mr. Patman said the new money represented a mortgage on all the homes and other property of all the people in the Nation. He used the word nation” with an expansive intent. There were and are no people in the nation. The nation is a political creation. But, there are people behind all the straw men, which are in the nation. On a mortgage there is always a debtor and a creditor. The new money was issued based on the people and US corporations turning in their gold. The corporations were controlled by the US, but the people were not. The corporations had no substance, but the people did. The people volunteered to enter an implied contract with the US. The New Deal was announced in Congress in March 1933. The executive order was given in April. The gold had to be deposited in the Federal Reserve Banks by May 1. The congress proclaimed its public policy in House Joint resolution 192 in June. The new public policy was that no creditor on this new mortgage could require payment in any particular form of US coin or currency. As creditors, the people could not require payment for any new mortgage in gold. Neither could any other creditor. That New Deal made the people who participated in the salvation of the US corporation, creditors. It also made debtors of the US corporations their officers, agents, and employee – including all the straw men.

This is an example of

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 4 |

3)Appearance bond

This is a bond that assures you will appear in a court proceeding. It is not a catchall bond that covers everything that will come up in the case. To get the appearance bond you have to give your word (bond) that you will appear to finish settling the accounting. It is issued by the hearing officer, if it is requested and if there is no controversy. If you are honorable enough not to start arguing with the hearing officer or the Complainant, or the prosecuting attorney, you can get this bond.

There must be no controversy. That fact is established by your voluntary act of accepting the charging Instrument for value and returning it. In doing so, you are exchanging your exemption (credit) for the discharge of the charge(s). You are bonding your pledge to appear and settle. If it were not voluntary, that would be bondage. You must tell the hearing officer that you are not disputing any of the facts.

Dispute: A conflict or controversy; an assertion of a right, claim, or demand on one side, met by contrary claims or allegations on the other. The subject of litigation; the matter for which a suit is brought and upon which issue us joined, and in relation to which jurors are called and witnesses examined.

When you enter a dispute, you join the issue and confirm the existence of what was just an idea, making it materialize and give subject matter that can be tested by a jury or witnesses.

Once you ask for the bond, it is yours. If you ask for it again, it will appear that you do not know you already have it, and the hearing officer will proceed as though he is talking to a debtor/straw man. A debtor/straw man does not automatically get an appearance bond. It may be required to pay for a bail bond. An appearance bond with conditions incorporates a cost to you.

If you have requested the appearance bond at no cost to you, there will be no conditions to the release. If you do not ask for it that way, there may be conditions – like drug testing, required meetings with court officers, or required daily or weekly phone calls. Those are a cost to you, as they take your time and your property.

If you don’t appear AND settle the accounting, you will be in dishonor of your word (your bond), and the appearance bond will be revoked. They will not tell you it has been revoked. Your dishonor will then be used to carry out the presumption that you are representing the straw man in a fiduciary capacity, and that

you are in breach of your fiduciary duty. That is not allowed in equity. Then the debt of the straw man will be put on you. If there is not enough property held in the name of the straw man to cover the dishonor, or if

you as trustee refuse to turn over the trust property to settle the debt. They will take your body as surety for the debt. It is the trustee’s body being taken. You volunteered to be the trustee.

Charging order: A statutorily created means for a creditor [Plaintiff] of a judgment debtor [Defendant] who is a partner of others [you] to reach the debtor’s beneficial interest in the partnership [your Credit], without risking dissolution of the partnership. Uniform Partnership Act, ss 28.

The purpose of the court case is for the judge to test the facts of an accounting. He is the auditor in a possible dispute between a creditor and a debtor. The creditor always wins. It is a matter of how much the debtor will pay that is being determined in a court case.

Audit: Systematic inspection of accounting records involving analysis, tests, and confirmations. The hearing and investigation had before an auditor. A formal or official examination and authentication of accounts, with witness, vouchers, etc. [L audit he hears, a hearing, from audio – to hear]

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 5 |

Auditor: An officer of the court, assigned to state the items of debit and credit between the parties in a suite where accounts are in question, and exhibit the balance. Under Rules of Civil Procedure in many states, the term “master” is used to describe those persons formerly known as auditors;

Magistrate: [L. magister – a master, from magia - sorcery, from Greek mageia – the theology of Magicians]

Vouch: To give personal assurance or serve as a guarantee.

Voucher: A receipt, acquittance, or release, which may serve as evidence of payment or discharge of a debt, or to certify the correctness of accounts.

4)Surety bond

The surety bond is used to subrogate liability from one party to another. It is similar to an indemnity bond. you can issue a surety bond to relieve someone, who is in dishonor, of potential financial damage. You can indemnify an honorable party who may have made a mistake, by volunteering to b e his surety. This is often the case with a judge. If you do this, you are moving into a creditor position because you are taking responsibility for the actions of another. Three parties are requested; 1) the one who is volunteering to be the surety, 2) the debtor, and 3) the creditor. There can be more than one creditor and more than one debtor. Creditor status can change during the case. When you become the creditor, someone has to be the debtor, the prosecuting attorney signed the complaint, and there is not bond in the case file, and there is no signed security agreement, he is going to be the debtor. If he acts honorably and tells the judge he wants to settle or have the case dismissed, he stays in honor. You may have to authorize him to sign the check to settle the accounting. If he acts in dishonor, he is the one who will be left holding the bag. You can bond the parties and/or bond the case. [See 6 Case Bond]

Suretyship: The relationship among three parties whereby one person (the surety) [you] guarantees payment of debtor’s [Defendant] debt owed to a creditor [Plaintiff] or acts as a

Suretyship bond: A contractual arrangement [created by your mother’s signature on the application for the birth certificate] between the surety [you], the principal [Defendant] and the oblige [Plaintiff] whereby the surety [you] agrees to protect the oblige [Plaintiff] if the principal {Defendant] defaults in performing the principal’s contractual obligations [discharging debt, or in anyway dishonors the Plaintiff]. The bond [your written word] is the instrument which binds the surety [you].

The surety bond is delivered to the one who dishonored you. It is wise to have evidence of the dishonor before you issue a surety bond. Satisfactory evidence could be a certificate from a notary after an administrative process has been completed to assure there really is a dishonor. You might just think you were dishonored.

If you are in dishonor yourself, and have not corrected the mistake, you are not in a position to be claiming you have been dishonored. This is a very narrow window. You must always approach equity with clean hands.

The surety bond is also delivered to the bonding company if the one in dishonor is a public officer with a bond. It is also delivered to the clerk of court, if there is a court case in process. Always get a certified copy of the surety bond from the clerk after it is filed.

6)Case bond

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 6 |

This bond is in the nature of a replevin bond. A replevin bond was formerly used in common law (equity) when there was a dispute and one party chose to file a claim in court against another party in possession of property in dispute. The moving party was required to bond his charge (claim) before he could get temporary possession of the subject property. The replevin bond was double the value of the subject property. Part of it was to indemnify the sheriff who seized the subject property from the defendant in possession. The order part was to guarantee the defendant would be reimbursed at least for the value of the seized property if it were not returned to him in the event he won the case.

In equity all charges need to be bonded. You have heard: “Put your money where your mouth is.” That is what is happening when charges are brought in court and the moving party bonds the case. This policy assures the defendant will not be damaged by a unsupported complaint. Charges are rarely bonded in modern court procedures, until after the case is decided. By that time, the defendant is almost always in dishonor, so the prosecuting attorney can use the defendant’s dishonor to bond the case. It is really the defendant’s representative that is bonding the case. Again it is the man’s credit that gives life to the bond. If the defendant is in dishonor because of what its representative (trustee) said or did or did not say or did not do, it is the trustee’s credit that is used to satisfy the debt – discharge the bond.

You can voluntarily bond the case if there is no bond already in the clerk’s file. Be sure to get a certified copy of the docket sheet as evidence there is no bond in the case, before you issue your bond. When you Bond the case, you are the creditor and creditors win. If you bond the case, become the creditor, and then dishonor the judge, the attorneys, or the process in any way, you will lose your position as a creditor and go back to representing the defendant. All the dishonors are pinned on the defendant even if you are the one who went into dishonor through your words or your actions. The defendant cannot talk or act. It all comes from you.

If you bond the case and underwrite all the obligations/loss/cost/ of the honorable citizens of the State of

_______________, that would include the attorney, as long he is honorable. If he is not, he refuses the

Indemnification and volunteers to have his dishonor give the commercial energy to the settlement. It is up to him. The judge will go along with what he requests. Usually, the attorney will tell the judge that the Plaintiff moves for dismissal.

7)Performance bond

Performance bonds guarantee that parties to a contract will not be damaged by the conduct or lack of conduct of an officer. This could include an executor, trustee, officer of a court, officer of a corporation, guardian,

etc. Wherever there is a fiduciary duty, there may be a need for a performance bond. An oath is a performance bond in common law. In the modern States and integrated court system, bonds are backed by

insurance companies. They are actually insurance policies.

Performance bond: Type of contract bond, which protects against loss due to the inability or refusal of a contractor to perform his contract. Such are normally required on public construction projects.

Official bond: A bond given by a public officer, conditioned that he shall well and faithfully perform all the duties of the office.

Contractor: One who in pursuit of independent business undertakes to perform a job or piece of Work, retaining in himself control of means, method and manner of accomplishing the desired result.

Construction: Interpretation of statute, regulation, court decision or other legal authority. The process, or the art, of determining the sense, real meaning, or proper explanation of obscure, complex or ambiguous terms or provision in a statute, written instrument, or oral agreement, or the application of such subject to the case in question, by reasoning in the light derived from extraneous connected circumstances or

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 7 |

actions or writings bearing upon the same or a connected matter. Or by seeking and applying the probably aim or purpose of the provision. Drawing conclusions respecting subjects that lie beyond the direct expression of the term.

Refusal: The act of one who has, by law, a right and power of having or doing something of advantage, and declines it. …a refusal implies the positive denial of an application or command, or at least evidential determination not to comply.

Power: Authority to do any act which the grantor (you) might himself lawfully perform. The following is taken from In Search of Liberty in America (one of Byron’s books)

Why do officers of government hold positions called “trust or profit”? Look at some constitutions to find the phrase. References to the Constitution for the Unites States of America are provided below.

Any Office of honor, Trust or Profit under the United States” Article I, Section 3

Any Office of honor, Trust or Profit under the United States” Article I, Section 9

Any Senator or Representative, or Person holding an Office of Trust or Profit under the United States” Article II, section 1

Any Office or public Trust under the United States” Article VI, clause 3

Suffice it to say, trillions of dollars in assets are being held in these Trusts in America today. You can verify this if you study the Comprehensive Annual Financial Reports that each corporate entity within the Unites States empire is required to have.

The Trust transfers possession of trust assets to another, the trustee can make rules and regulations for the use of the Trust property and also rules for the conduct of those “persons” accepting protection or receiving property. Trust property may remain in the

public and private, until it is taken out of the protection of Trust.

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 8 |

RULES OF THE GAME

RULE #1: The fiction and real cannot mix. The public and the private cannot mix.

You cannot create a public debt. That is against the law.

A creditor can issue a bond (evidence of a public debt) and use the bond to discharge other public debts. You cannot use the public federal reserve routing numbers on the private credit instruments you issue. Those routing numbers are public.

Your credit instruments use your private routing number (EIN) with the closed account number. You are a private banker.

The closed account number was accepted and put on a

Your acceptance of the account number takes it to the private side for adjustment and setoff.

You gave notice to John Snow, or his predecessor, that you had accepted the account as collateral. Your secured party collateral rights are private.

You are a secured party on the private side even without filing a

That is why you can use the account for adjustment and setoff of public debts. There is no money on the private side.

Debt is used on the public side to discharge other public debts.

There is no money on the public side either, but debt is accepted “as money”.

The debts that are owed to you by the public, can be used to discharge public debts. A debt is a liability to the debtor and an asset, a bond, each time you use your credit. You can bond your bill of exchange, or use a bond.

Either way, it is a bond (evidence of a public debt owed to you) that discharges the public debt.

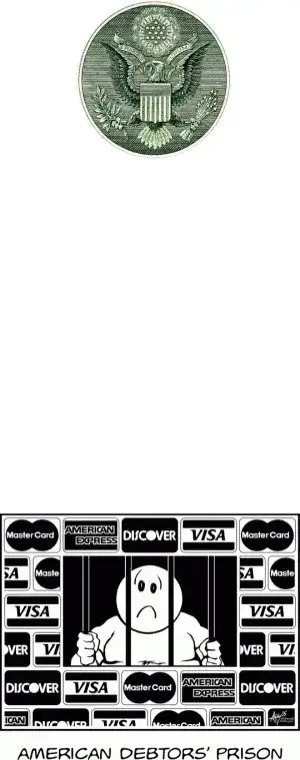

If the State cannot file a claim against you, because it is a fictitious entity and you are a real man, then it must file a claim against s straw man to get to you. What is it trying to get? Does it want your body in jail? The money in your bank account? Your house? Your business?

The answer is NO. It wants your credit. It already has the rest of it, because everything is either registered or found on registered property. The state does not want the things that are held in the name of the straw man, but it has no compunction against taking those things, if you dishonor it in any way. All those things, except your body, belong to the straw man, which is an officer, agent, or employee of the US or one of its States. They do not belong to you. The “money” (FRN’s) belongs to the Federal Reserve, because it is the entity that created it. The straw man just gets to use it as long as if follows the federal reserve rules. The title to the real property associated with your house is held by the straw man. The business license for your business was issued to the straw man. The registration for the car names the straw man as the owner. The driver’s license was issued to the straw man. None of those assets belong to you. They are all pieces of paper that belong to the straw man, UNLESS it fails to follow the rules.

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 9 |

Presentment has a complaint – a moving party. What is it trying to move? What is its complaint? It

Is usually using a statute as the grounds for the complaint. If public and private can’t mix, the complaint Must be against the public straw man – not you. Why would the State care if a piece of paper violated a (fictitious) law? What is the motivation?

State is trying to move you to let it use your credit. If you refuse, the State can move the court to grant

the use from your dishonor. Does the State really have a complaint, or is it just asking for your help? Maybe the complaint is that it is out of “money”. There is no money. None on the private side (gold and silver). None on the public side (except your credit).

Does the office manager do when it needs more money for paperclips? It requisitions the guys on the top floor for money to buy more paperclips. Do the bosses say, “No Way!”? Of course not! That would be

you are the proper party to fulfill the requisition? Why would you ignore the requisition? Why would get mad and start charging the messenger with fraud? If you ignore the requisitions and spend all your boss’s money trying not to fulfill the requisitions, the business will fail. Where would that leave you?

Your business is down the tubes. You might be in jail for breach of contract. Your property has been taken by the corporate attorneys. Your money is gone. All the people who depended on your business have to use other sources of your products and services. You are a very irresponsible business man. If you had just signed the requisition, you would still be on the top floor. Instead, the trust assets are gone and you are making license plates.

The State has no substance. It has no money. It has no inherent right to anything, except what it has created which is the straw man. It has a very important function. It has been charged with providing for the means by Which you can go into grocery stores, gas stations, libraries, shopping malls, airports, car dealerships, and marts. It is does not get “money” from somewhere, it cannot continue to provide the infrastructure you

find so convenient. The only source it has is taxes. License, permit, and registration fees are a source of revenue for the State, but that is not sufficient for the giant octopus feeding machine we have grown to love and depend on. It needs to feed off your credit, and if you don’t voluntarily let the State use it, the State will use your dishonor to take it.

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS |

PAGE 10 |