You can prepare wv form wv cst 200cu effortlessly using our PDFinity® online tool. FormsPal team is committed to providing you the best possible experience with our tool by continuously adding new features and improvements. Our editor is now even more helpful with the most recent updates! So now, editing documents is easier and faster than ever before. This is what you'll want to do to get going:

Step 1: Simply click the "Get Form Button" above on this page to see our pdf editor. Here you'll find all that is required to work with your document.

Step 2: The tool provides you with the capability to work with the majority of PDF documents in a variety of ways. Transform it by including customized text, correct original content, and place in a signature - all doable within a few minutes!

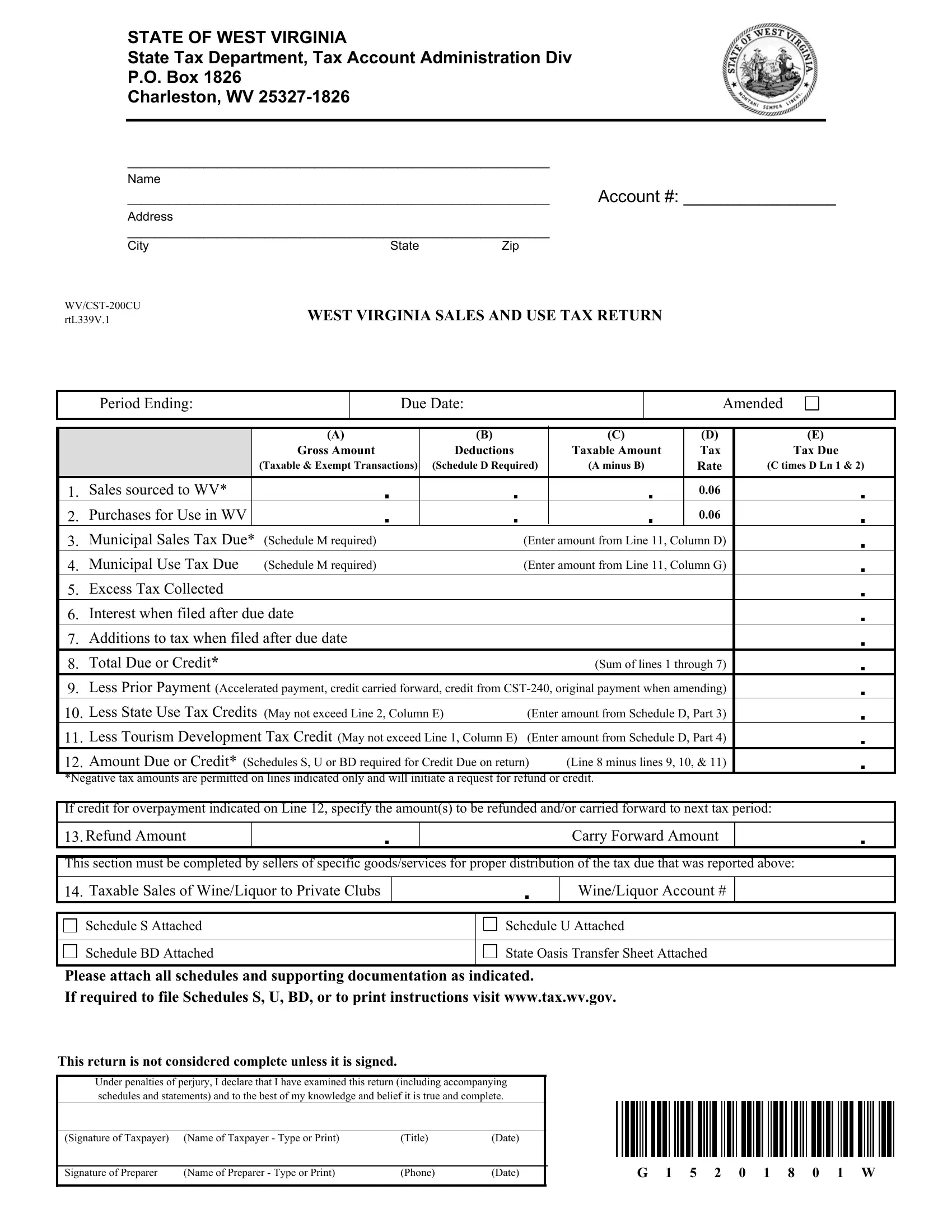

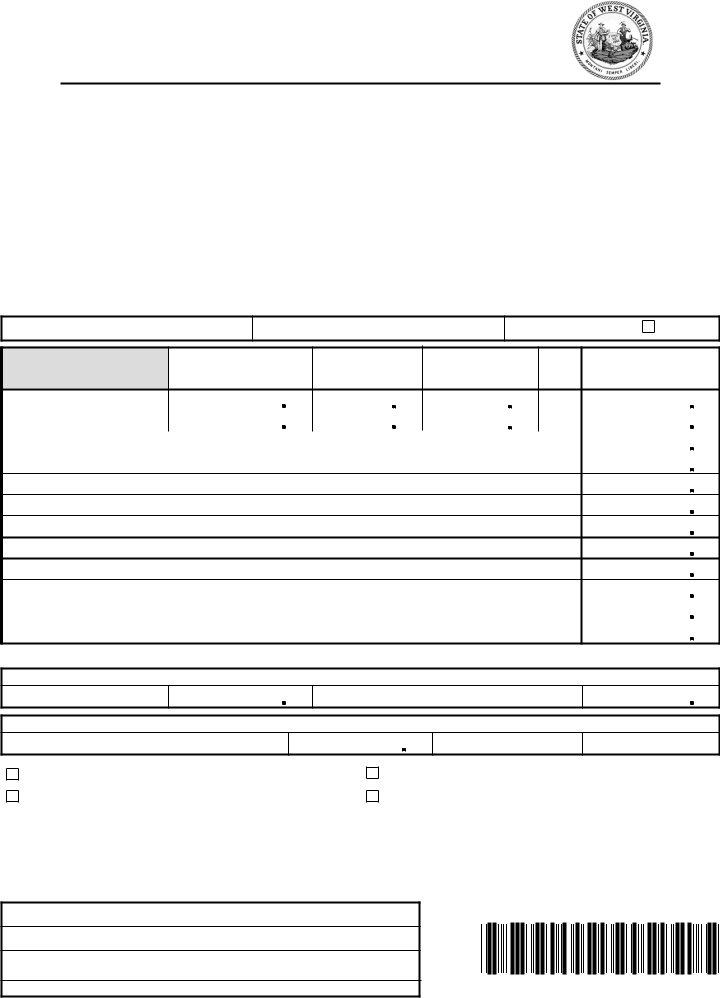

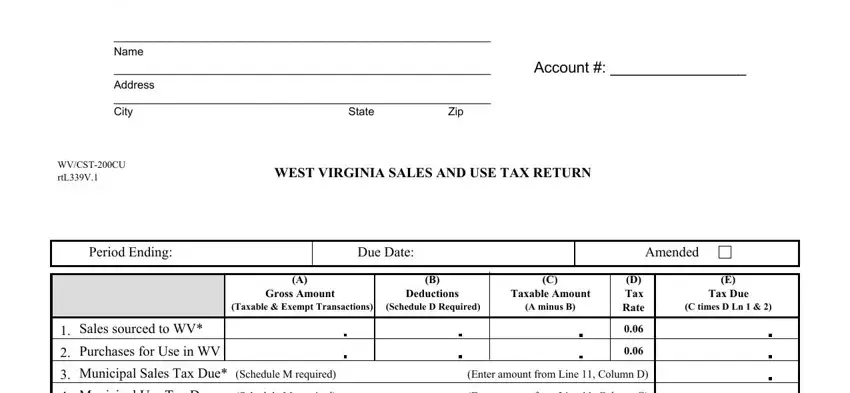

If you want to finalize this document, ensure that you type in the required details in every single blank:

1. First, when filling out the wv form wv cst 200cu, beging with the section with the next blanks:

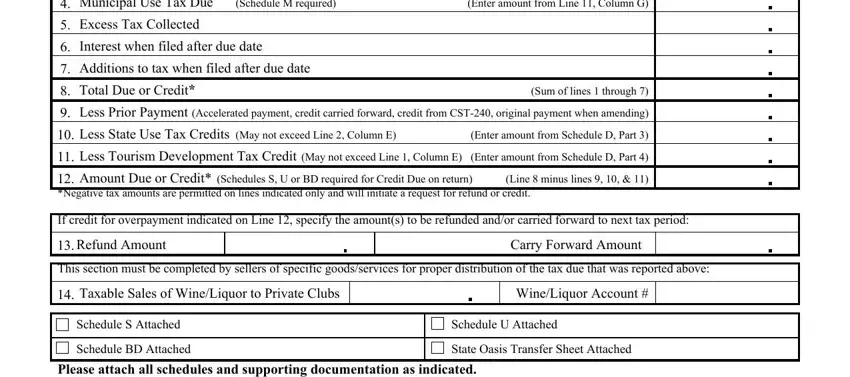

2. Just after this section is filled out, go to type in the suitable details in all these: Municipal Use Tax Due, Schedule M required, Enter amount from Line Column G, Excess Tax Collected, Interest when filed after due date, Additions to tax when filed after, Total Due or Credit, Sum of lines through, Less Prior Payment, Accelerated payment credit carried, Less State Use Tax Credits, May not exceed Line Column E, Enter amount from Schedule D Part, Less Tourism Development Tax, and May not exceed Line Column E.

It is possible to make errors when filling out the Accelerated payment credit carried, thus make sure that you reread it before you finalize the form.

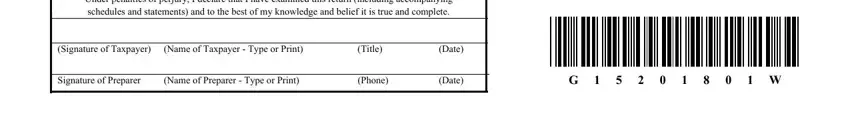

3. This third step will be hassle-free - complete all of the empty fields in Under penalties of perjury I, Signature of Taxpayer, Name of Taxpayer Type or Print, Title, Date, Signature of Preparer, Name of Preparer Type or Print, Phone, Date, and G W in order to finish this part.

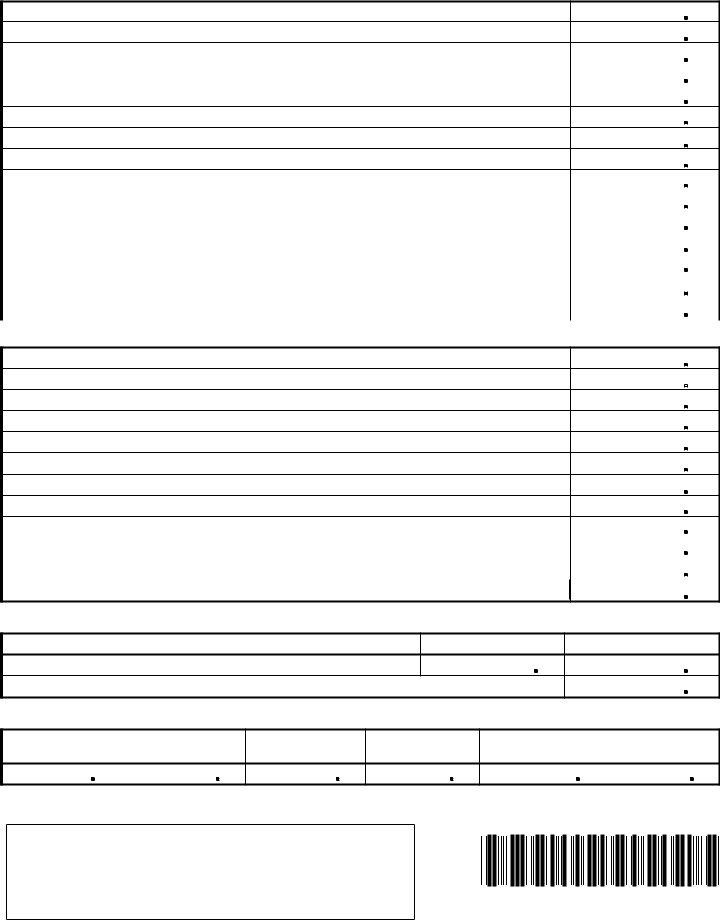

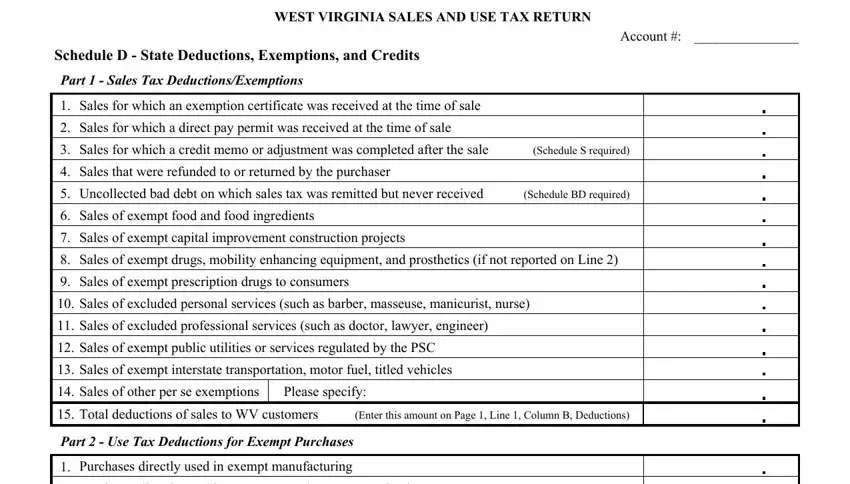

4. The fourth subsection comes with these particular blanks to fill out: WEST VIRGINIA SALES AND USE TAX, Schedule D State Deductions, Part Sales Tax, Account, Sales for which an exemption, Sales for which a direct pay, Sales for which a credit memo or, Schedule S required, Sales that were refunded to or, Uncollected bad debt on which, Schedule BD required, Sales of exempt food and food, Sales of exempt capital, Sales of exempt drugs mobility, and Sales of exempt prescription drugs.

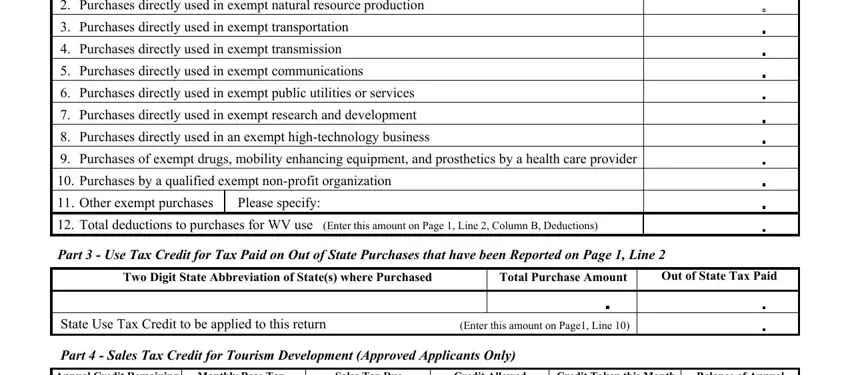

5. Finally, the following final section is what you'll have to finish before closing the PDF. The blank fields here are the following: Purchases directly used in exempt, Purchases directly used in exempt, Purchases directly used in exempt, Purchases directly used in exempt, Purchases directly used in exempt, Purchases directly used in exempt, Purchases directly used in an, Purchases of exempt drugs mobility, Purchases by a qualified exempt, Other exempt purchases Please, Total deductions to purchases for, Enter this amount on Page Line, Part Use Tax Credit for Tax Paid, Two Digit State Abbreviation of, and Total Purchase Amount.

Step 3: Prior to finishing the document, ensure that all blanks are filled in properly. The moment you establish that it's good, click “Done." Sign up with FormsPal right now and easily obtain wv form wv cst 200cu, available for download. All alterations made by you are saved , helping you to modify the file later on if necessary. FormsPal guarantees protected form editing without personal information record-keeping or sharing. Be assured that your information is secure with us!