oregon ct 12 2017 can be filled out with ease. Simply make use of FormsPal PDF tool to complete the task promptly. Our editor is consistently developing to present the very best user experience attainable, and that's thanks to our dedication to constant development and listening closely to customer feedback. Getting underway is easy! All you should do is follow the next simple steps down below:

Step 1: First, access the editor by clicking the "Get Form Button" in the top section of this site.

Step 2: As you start the online editor, you'll see the form made ready to be filled in. Aside from filling in various blank fields, it's also possible to do other sorts of things with the file, particularly adding your own words, changing the original textual content, inserting illustrations or photos, placing your signature to the PDF, and a lot more.

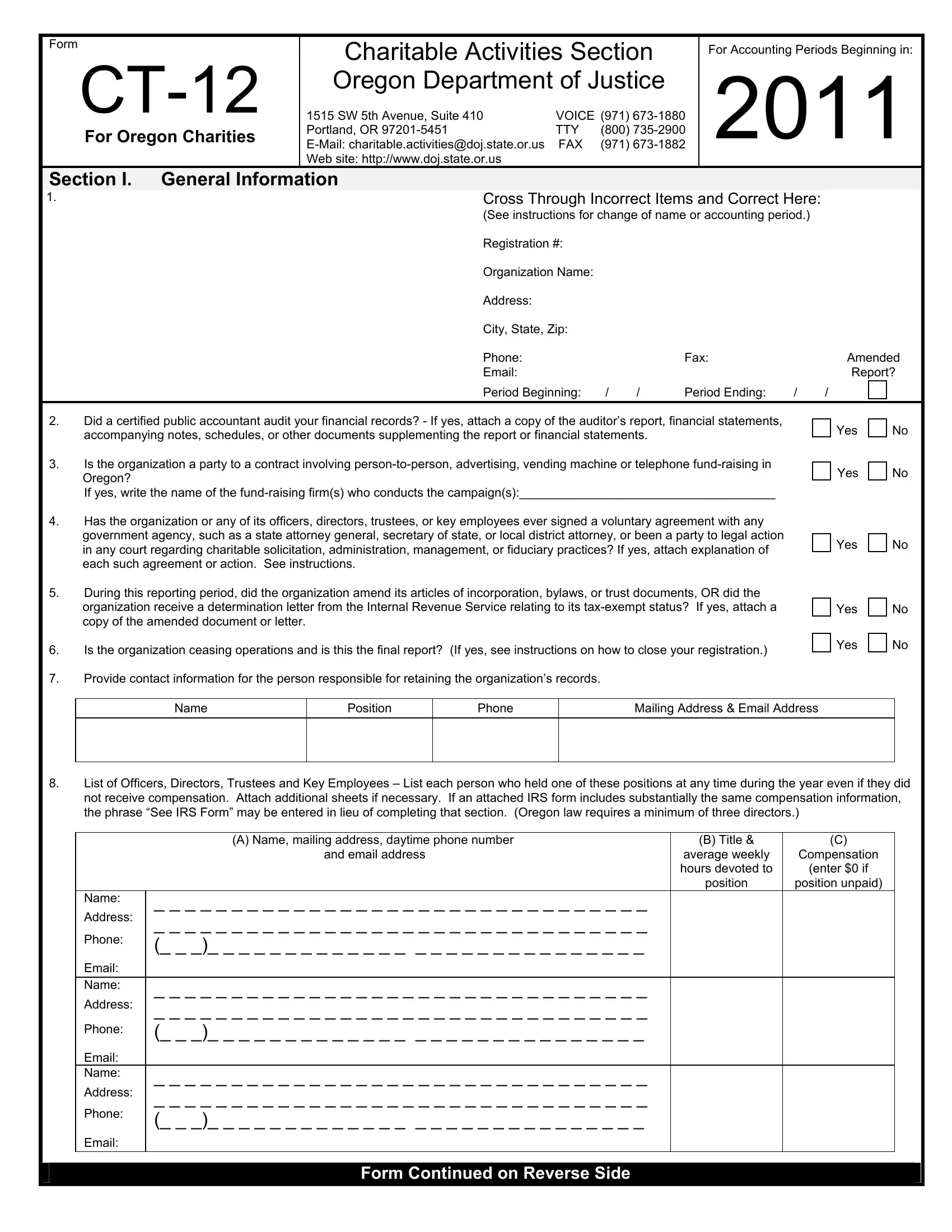

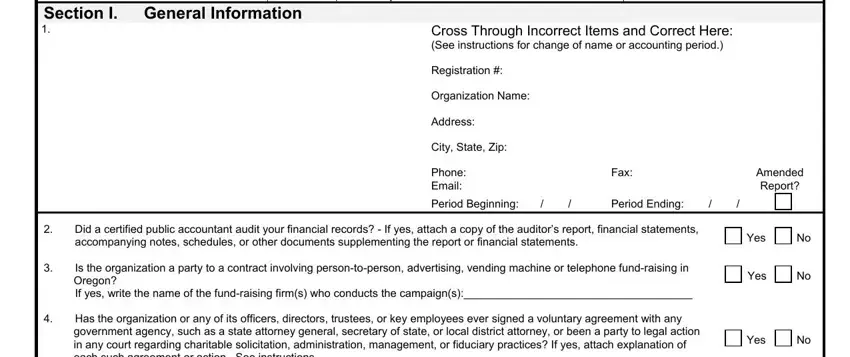

In order to finalize this document, be sure to type in the right information in each and every blank field:

1. It is important to fill out the oregon ct 12 2017 properly, so be attentive when working with the parts containing all of these blanks:

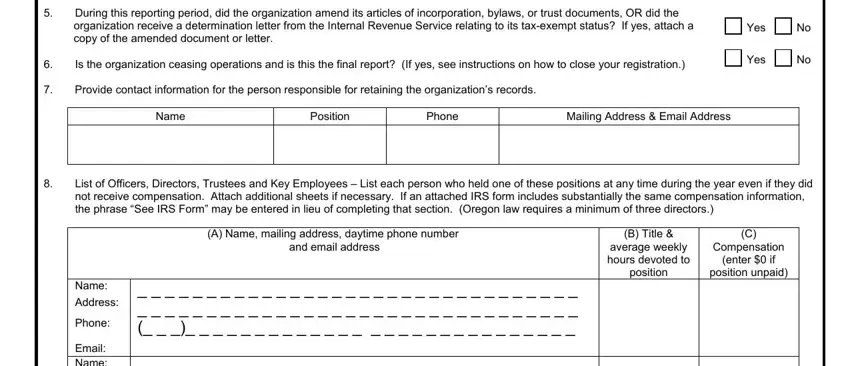

2. The third part is to fill in these particular blanks: Yes, Yes, Did a certified public accountant, Name, Position, Phone, Mailing Address Email Address, List of Officers Directors, A Name mailing address daytime, and email address, B Title, average weekly hours devoted to, position, Name, and Address.

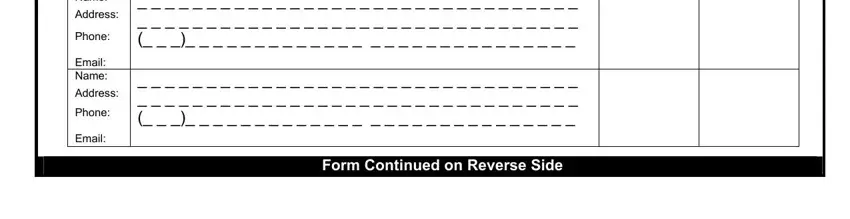

3. Completing Phone Email Name, Address, Phone Email Name, Address, Phone Email, and Form Continued on Reverse Side is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

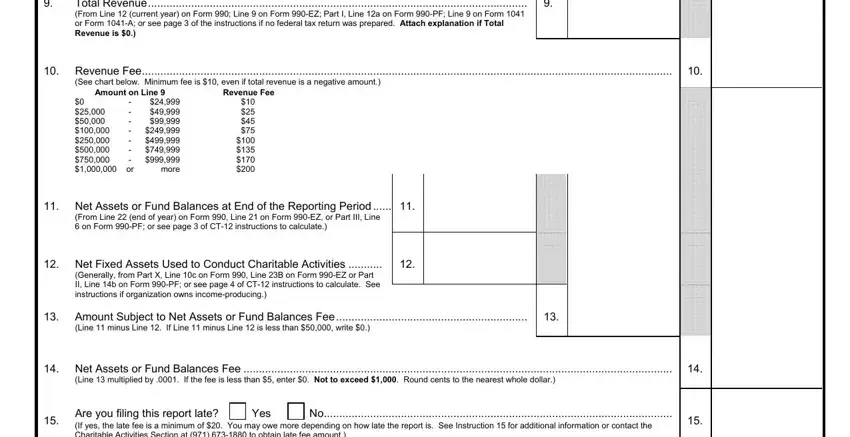

4. To go ahead, this next stage requires typing in a handful of blank fields. Examples of these are Revenue Fee, Amount on Line, more, Total Revenue From Line current, Section II Fee Calculation, Yes, and Are you filing this report late If, which are vital to going forward with this form.

You can certainly make an error while filling out your Are you filing this report late If, and so ensure that you look again before you decide to submit it.

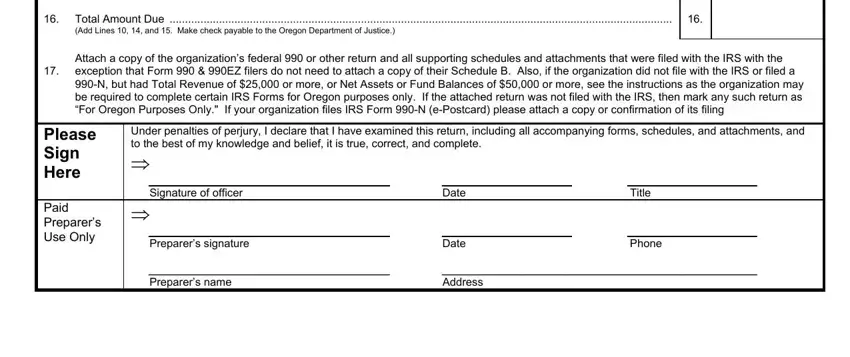

5. Since you come near to the last parts of this file, you'll find a couple more requirements that should be fulfilled. Particularly, Are you filing this report late If, Please Sign Here, Paid Preparers Use Only, Under penalties of perjury I, Signature of officer, Date, Title, Preparers signature, Date, Phone, Preparers name, and Address must all be filled out.

Step 3: Soon after proofreading the fields and details, click "Done" and you are done and dusted! Join us right now and immediately obtain oregon ct 12 2017, available for download. Every edit you make is conveniently kept , making it possible to edit the file at a later stage when necessary. FormsPal ensures your data privacy by using a protected method that never records or distributes any private information typed in. Be confident knowing your paperwork are kept safe each time you use our service!