Businesses navigating the complexities of state tax obligations may often find themselves grappling with the CT-941 form, a crucial document for reconciling Connecticut income tax withholding for every quarter of the fiscal year. This form serves as a communication tool between employers and the Connecticut Department of Revenue Services, ensuring that the state's financial requirements are met accurately and on schedule. As per the form's instructions, it's mandatory to file and pay electronically, streamlining the process and reinforcing the state's commitment to efficiency and environmental friendliness. Importantly, the form demands detailed information about wages paid, taxes withheld, and any credits or adjustments from previous filings. Additionally, it highlights the penalties for late payments or failure to comply with electronic submission rules, underscoring the importance of adherence to deadlines and regulations. Employers must precisely follow the instructions provided, including those for requesting any waivers for electronic filing, to avoid unnecessary penalties or delays. With tax periods clearly defined and specific due dates set throughout the year, the CT-941 form acts not just as a financial record but also as a compliance checkpoint for businesses operating within Connecticut.

| Question | Answer |

|---|---|

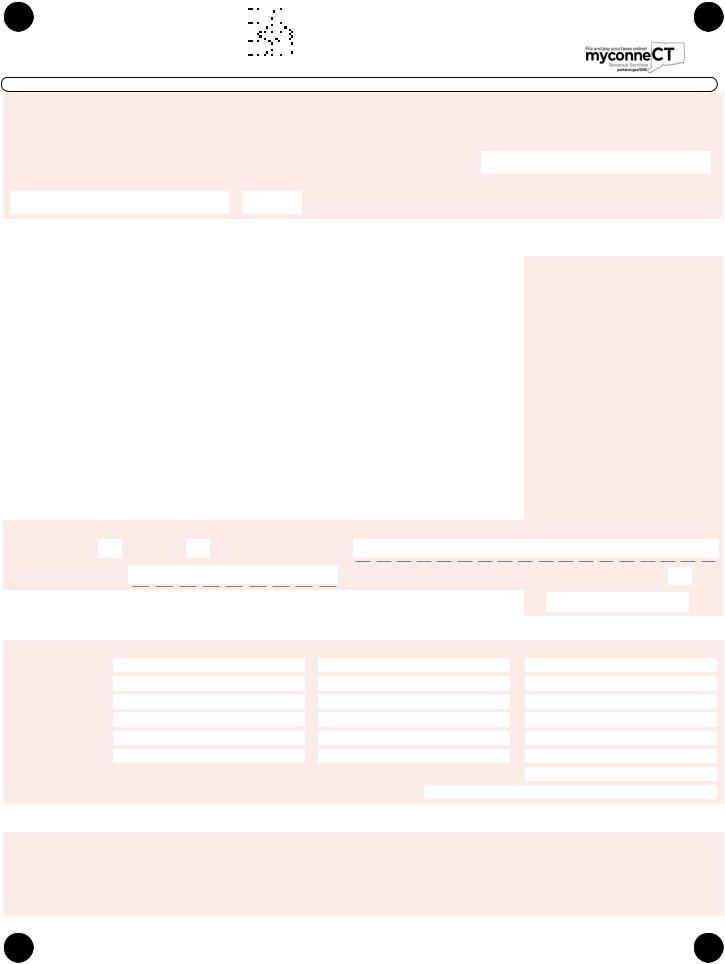

| Form Name | Ct 941 Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | Withholding Forms - CT.GOV-Connecticut's Official State Website |

Department of Revenue Services |

|

|

|

|

|

|

|

|

|

|

Form |

|

2021 |

State of Connecticut |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||||||

PO Box 2931 |

|

|

|

|

|

|

|

|

|

|

Connecticut Quarterly |

|

|

Hartford CT |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Withholding |

|

|

(Rev. 12/20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

941 1220W 01 9999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Form

Name |

|

|

Connecticut Tax Registration Number |

|||||||||||||||||||||||||||||||||||||||||||||

This return MUST be filed electronically! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address (number and street), apartment number, PO Box |

|

Federal Employer ID Number (FEIN) |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

DO NOT MAIL paper return to DRS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town, or post office |

State |

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Enter |

|

reporting quarter (1, 2, 3, or 4) |

|||||||||||||||||||||||||||||||||||||||||||||

Section 1

If you no longer have employees in Connecticut |

Check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

check the box and enter the date of last payroll. |

here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

M M - D D - Y Y Y Y |

|||||||||||||

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Gross wages |

1. |

|

|

00 |

2. |

Gross Connecticut wages |

2. |

|

|

|

|

|||||

|

00 |

||||

3. |

Connecticut tax withheld |

3. |

|

|

|

|

|||||

|

00 |

||||

4. |

Credit from prior quarter |

4. |

|

|

|

|

00 |

||||

5. |

Payments made for this quarter |

5. |

|

|

|

|

|||||

|

00 |

||||

6. |

Total payments: Add Line 4 and Line 5 |

6. |

|

|

|

|

|||||

|

00 |

||||

7. |

Net tax due (or credit): Subtract Line 6 from Line 3. |

7. |

|

|

|

|

|||||

|

00 |

||||

8a. |

Penalty |

8a. |

|

|

|

|

|||||

|

00 |

||||

8b. |

Interest |

8b. |

|

|

|

|

|||||

|

00 |

||||

8. |

Total penalty and interest: Add Line 8a and Line 8b |

8. |

|

|

|

|

|

00 |

|||

9. |

Amount to be credited |

9. |

|

|

|

|

|||||

|

00 |

||||

10. |

Amount to be refunded |

10. |

|

|

|

|

|||||

|

00 |

||||

|

|

|

|

|

|

For faster refund, use Direct Deposit by completing Lines 10a, 10b, and 10c.

10a. Checking |

Savings |

10c. Account number |

|

|

10b. Routing number |

|

|

10d. Will this refund go to a bank account outside the U.S.? |

Yes |

11. Total amount due: Add Line 7 and Line 8. |

...................................................................... 11. |

00 |

||

Section 2 - Summary of Connecticut Tax Liability for the Calendar Quarter: See Instructions.

Pay Period |

Column A - First Month |

Column B - Second Month |

Column C - Third Month |

1.

2.

3.

4.

5.

6.

7. Totals 8. Total liability for the quarter: Add Line 7, Columns A, B, and C. Enter total.

Declaration: I declare under the penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true,

complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fine of not more than $5,000, imprisonment for not more than five years, or both.

Sign Here |

Taxpayer’s signature |

Date |

|||||||||||||||||||||||||||||||||||||||

Keep a |

This return MUST be filed electronically! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MMDDYYYY) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

copy of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this return |

Title |

Telephone number |

|||||||||||||||||||||||||||||||||||||||

for your |

DO NOT MAIL paper return to DRS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form

Payers of nonpayroll amounts must use Form

Form

General Instructions

Form

Form

File this return and make payment electronically u s i n g m y c o n n e C T a t

Only taxpayers that receive a waiver from the electronic filing requirement from DRS may file paper withholding forms. See

Electronic Filing Waiver, below.

Electronic Filing Waiver

Generally, a payment made electronically is a payment made by electronic funds transfer (EFT). See Informational Publication 2020(6), Filing and Paying Connecticut Taxes Electronically.

Only taxpayers that receive a waiver from electronic filing from DRS may file a paper version of this form. To request a waiver from the electronic filing requirement visit portal.ct.gov/DRS

and complete Form

If you received a waiver from electronic filing and payment from DRS, make check payable to Commissioner of Revenue Services. Write your Connecticut Tax Registration Number and the calendar quarter to which the payment applies on your check.

Please note that each form is year specific. To prevent any delay in processing your return, the correct year’s form must be submitted to DRS.

Mail the completed return and payment, if applicable, to the address on the return.

Complete this return in blue or black ink only. Do not use staples.

When to File

Due Dates

First quarter, April 30, 2021; second quarter, July 31, 2021; third quarter, October 31, 2021; and fourth quarter, January 31, 2022.

An employer who makes timely withholding payments and

owes no additional withholding for the quarter has ten days after the normal due date to file Form CT‑941.

If the due date falls on a Saturday, Sunday, or legal holiday, the return will be considered timely if filed by the next business

day.

Employers who are registered for Connecticut income tax

withholding (other than household employers, agricultural employers granted annual filer status, and seasonal filers) are required to file Form CT‑941 for each calendar quarter

even if no tax is due or if no tax was required to be withheld.

Household employers who are registered to withhold

Connecticut income tax from the wages of their household employees should not file Form CT‑941 for each calendar

quarter, but instead must file one Form

Circular CT.

Seasonal and annual filers, including agricultural employers,

may request permission from DRS to file Form CT‑941 for only

the calendar quarters in which they pay Connecticut wages.

Certain agricultural employers may request permission to file one Form

Section 1 - Line Instructions

Line 1: Enter gross wages, for federal income tax withholding purposes, paid to all employees during this quarter.

Line 2: Enter gross Connecticut wages paid during this quarter. Connecticut wages are all wages paid to employees who are residents of Connecticut even if those wages are paid for work performed outside Connecticut by those resident employees and wages paid to employees who are nonresidents of Connecticut if those wages are paid for work performed in Connecticut by those nonresident employees.

If a Connecticut nonresident employee resides in a state that applies a “convenience of the employer” test in determining a nonresident’s source income, and the Connecticut nonresident employee works for a Connecticut employer from a location outside of Connecticut (i.e.: telecommutes), then the wages earned by such Connecticut nonresident must be reported as Connecticut wages if when applying the “convenience of the employer” test of the employee’s state of residence, such wages would be Connecticut sourced.

Line 3: Enter total Connecticut income tax withheld on wages during this quarter. This should equal Section 2, Line 8.

Line 4: Enter credit from your prior quarter Form

repaid to those employees prior to the end of that quarter or prior to filing the return for that quarter, whichever is earlier,

subtract the portion not repaid from Line 9 of your prior quarter

Form CT‑941. Enter the difference.

Line 5: Enter the sum of all payments made for this quarter.

Line 6: Add Line 4 and Line 5. This is the total of your payments and credits for this quarter.

Line 7: Subtract Line 6 from Line 3 and enter the difference. If Line 3 is more than Line 6, complete Line 8a and Line 8b if necessary, then go to Line 11. If Line 6 is more than Line 3, complete Line 9 and Line 10.

Line 8: Enter penalty on Line 8a, interest on Line 8b, and the total on Line 8.

Late Payment Penalty

The penalty for paying all or a portion of the tax late is 10% of the tax paid late.

Penalty for Failure to Pay Electronically

The following graduated penalty amounts will apply if you fail to remit payments electronically:

•First offense – 10% penalty on the amount of the required tax payment, but not more than $2,500;

•Second offense – 10% penalty, but not more than $10,000; and

•Third and subsequent offenses – 10% penalty.

Form |

Page 1 of 2 |

Late Filing Penalty

If no tax is due, DRS may impose a $50 penalty for the late filing of this return.

Interest

Interest is computed on the tax paid late at the rate of 1% per month or fraction of a month.

Line 9 and Line 10: Enter the amount from Line 7 you want credited to the next quarter on Line 9. Enter the amount from Line 7 you want refunded on Line 10.

However, if any portion of the amount on Line 7 was overwithheld from your employee(s) during calendar year

2021 and not repaid to your employee(s) prior to the end of calendar year 2021 or prior to filing the fourth quarter

return, whichever is earlier, the amount not repaid must be

subtracted from the amount on Line 7. Enter the difference

on Line 9 or Line 10.

If you overwithheld Connecticut income tax from your employee(s), the amount overwithheld should be reimbursed to the employee in the same calendar year the overcollection occurred.

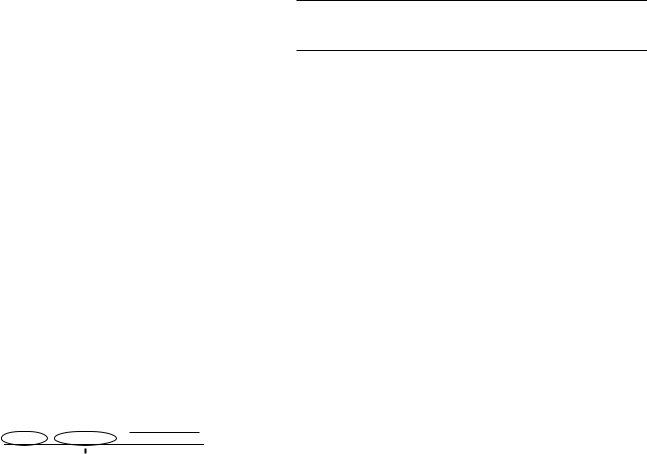

Lines 10a through 10c: Get the refund faster by choosing direct deposit. Complete Lines 10a, 10b, and 10c to have the refund directly deposited into a checking or savings account.

Enter the

number in Lines 10b and 10c. The bank routing number is normally the first nine‑digit number printed on the check or

savings withdrawal slip. The bank account number generally follows the bank routing number. Do not include the check number as part of the account number. Bank account numbers can be up to 17 characters.

|

Name of Depositor |

|

|

|

|

No. 101 |

||||

|

Street Address |

|

Date |

|||||||

|

City, State, Zip Code |

|

|

|

|

|

|

|

||

|

Pay to the |

|

$ |

|

|

|

||||

|

Order of |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of your Bank |

|

|

|

|

|

|

|

||

|

Street Address |

|

|

|

|

|

|

|

||

|

City, State, Zip Code |

|

|

|

|

|

|

|

||

|

092125789 |

091 025 025413 |

0101 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Number |

|

|

|

|

|

|

||

Routing Number |

|

|

|

|

|

|

||||

If any of the bank information supplied for direct deposit does not match, or the applicable bank account is closed prior to the deposit of the refund, the refund will automatically be mailed.

Line 10d: When you request the direct deposit of a refund, federal banking rules require DRS to inquire whether it is a foreign bank account. DRS will not deposit a refund into a foreign bank account. Instead, we will mail the refund to you.

Line 11: If the amount on Line 7 is net tax due, add Line 7 and Line 8. This is the total amount due.

Rounding off to whole dollars

You must round off cents to the nearest whole dollar on your returns and schedules. If you do not round, DRS will disregard the cents.

Round down to the next lowest dollar all amounts that include 1 through 49 cents. Round up to the next highest dollar all amounts that include 50 through 99 cents. However, if you

need to add two or more amounts to compute the amount to enter on a line, include cents and round off only the total.

Example: Add two amounts ($1.29 + $3.21) to compute the total ($4.50) to enter on a line. $4.50 is rounded to $5.00

and entered on the line.

Section 2 - Summary of Connecticut Tax Liability for the Calendar Quarter

Enter Connecticut income tax withheld for each pay period. Add Lines 1 through 6 for each column and enter column totals on Line 7. Add Line 7, Columns A, B, and C. Enter total liability on Line 8. Line 8 should equal Form

Amended Returns

Use myconneCT to amend Form

Reconciliation of Withholding, to amend Form

For More Information

Call DRS Monday through Friday, 8:30 a.m. to 4:30 p.m. at:

•

•

TTY, TDD, and Text Telephone users only may transmit inquiries anytime by calling

Forms and Publications

Visit the DRS website at portal.ct.gov/DRS to download and print Connecticut tax forms and publications.

Form |

Page 2 of 2 |