If you intend to fill out Regs, you won't need to install any kind of software - just make use of our online PDF editor. FormsPal is devoted to providing you with the ideal experience with our editor by continuously adding new functions and upgrades. With these improvements, using our editor gets better than ever! Getting underway is easy! All that you should do is follow these simple steps down below:

Step 1: Hit the "Get Form" button above. It'll open our pdf tool so you can begin completing your form.

Step 2: Using our state-of-the-art PDF editor, you are able to accomplish more than merely fill out blank fields. Try all of the features and make your documents look high-quality with custom textual content added in, or adjust the file's original content to excellence - all that comes along with the capability to add any graphics and sign it off.

Completing this document needs attentiveness. Make sure all mandatory blanks are completed correctly.

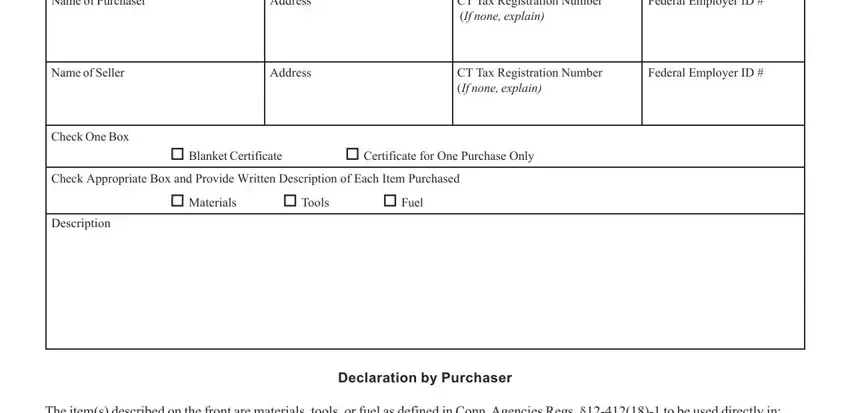

1. The Regs will require specific details to be entered. Be sure the next blanks are filled out:

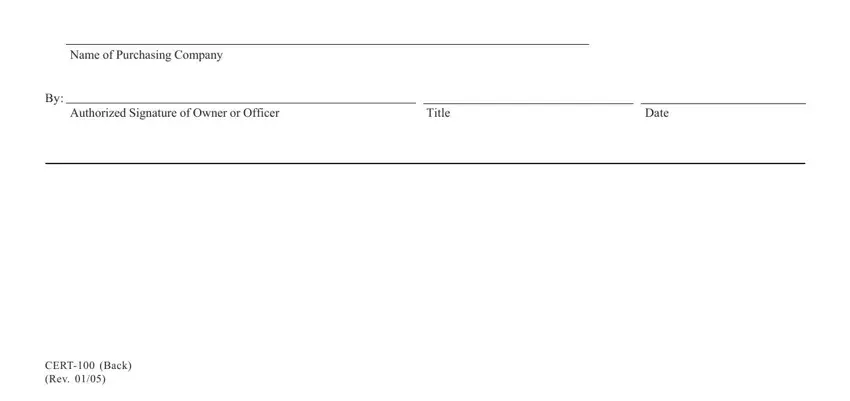

2. Once your current task is complete, take the next step – fill out all of these fields - Name of Purchasing Company, Authorized Signature of Owner or, Title, Date, and CERT Back Rev with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

You can easily make a mistake while filling in the Date, and so be sure you reread it before you decide to submit it.

Step 3: After going through your form fields, press "Done" and you're good to go! Right after registering a7-day free trial account at FormsPal, it will be possible to download Regs or email it at once. The PDF will also be accessible via your personal account menu with your adjustments. FormsPal offers protected form completion devoid of personal data record-keeping or distributing. Feel at ease knowing that your data is safe here!