Should you desire to fill out what is the difference between nc form d 400 and form d 401, you won't need to download and install any applications - just give a try to our online PDF editor. In order to make our editor better and easier to work with, we consistently work on new features, with our users' feedback in mind. All it requires is just a few simple steps:

Step 1: Click the "Get Form" button above. It will open up our editor so you can begin filling in your form.

Step 2: When you start the online editor, you'll notice the form made ready to be filled out. Other than filling out different blanks, you may as well do various other things with the PDF, that is adding any text, editing the initial textual content, adding images, putting your signature on the form, and a lot more.

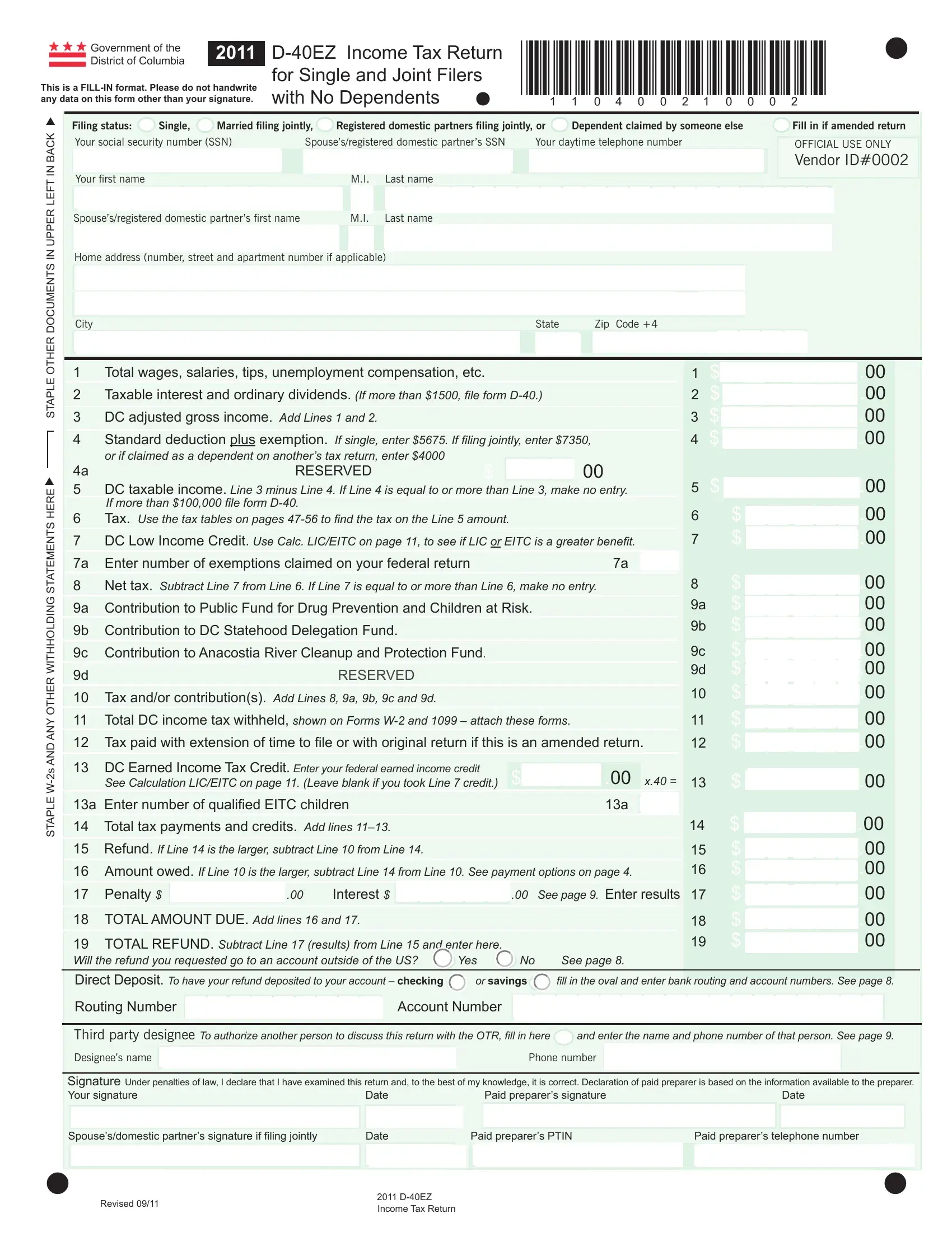

This PDF will need specific information to be entered, therefore ensure that you take some time to fill in what is requested:

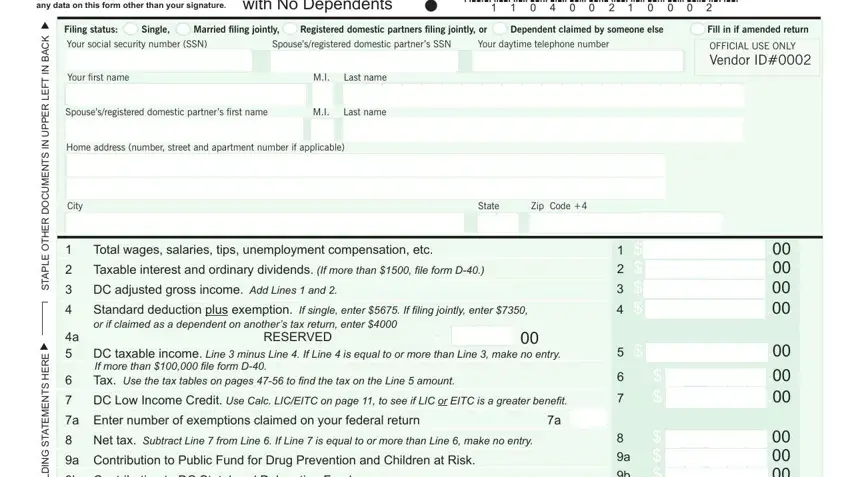

1. First, while filling out the what is the difference between nc form d 400 and form d 401, begin with the form section containing following blanks:

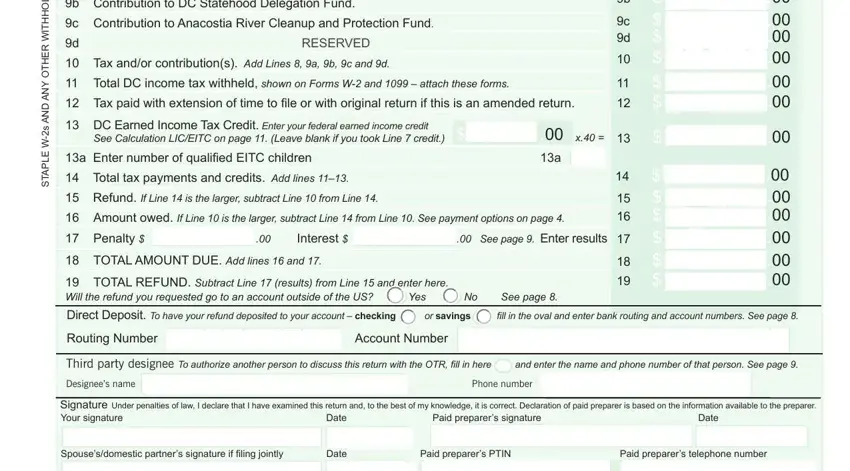

2. Once your current task is complete, take the next step – fill out all of these fields - b Contribution to DC Statehood, c Contribution to Anacostia River, RESERVED, d Tax andor contributions Add, a b c d, See Calculation LICEITC on page, DC Earned Income Tax Credit Enter, Amount owed If Line is the larger, TOTAL AMOUNT DUE Add lines and, s E R E H S T N E M E T A T S G N, TOTAL REFUND Subtract Line, Routing Number Account Number, Third party designee To authorize, Phone number, and Signature Under penalties of law I with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Those who use this form generally make some mistakes when filling out Signature Under penalties of law I in this part. Be sure to re-examine whatever you type in right here.

Step 3: Prior to submitting your document, it's a good idea to ensure that blank fields are filled out correctly. The moment you think it's all good, click on “Done." Join FormsPal now and instantly get access to what is the difference between nc form d 400 and form d 401, available for downloading. All modifications made by you are kept , making it possible to modify the form later when required. FormsPal ensures your information confidentiality by having a protected system that never records or distributes any type of sensitive information involved. Be assured knowing your docs are kept protected any time you use our services!