You may fill in north carolina d 400x form instantly in our PDFinity® editor. In order to make our tool better and more convenient to work with, we constantly develop new features, considering feedback coming from our users. To get started on your journey, consider these easy steps:

Step 1: Access the PDF doc in our editor by pressing the "Get Form Button" in the top area of this page.

Step 2: As soon as you start the online editor, you will see the form made ready to be filled out. Aside from filling out various blanks, you could also perform other things with the Document, particularly writing your own textual content, changing the initial textual content, inserting illustrations or photos, putting your signature on the form, and a lot more.

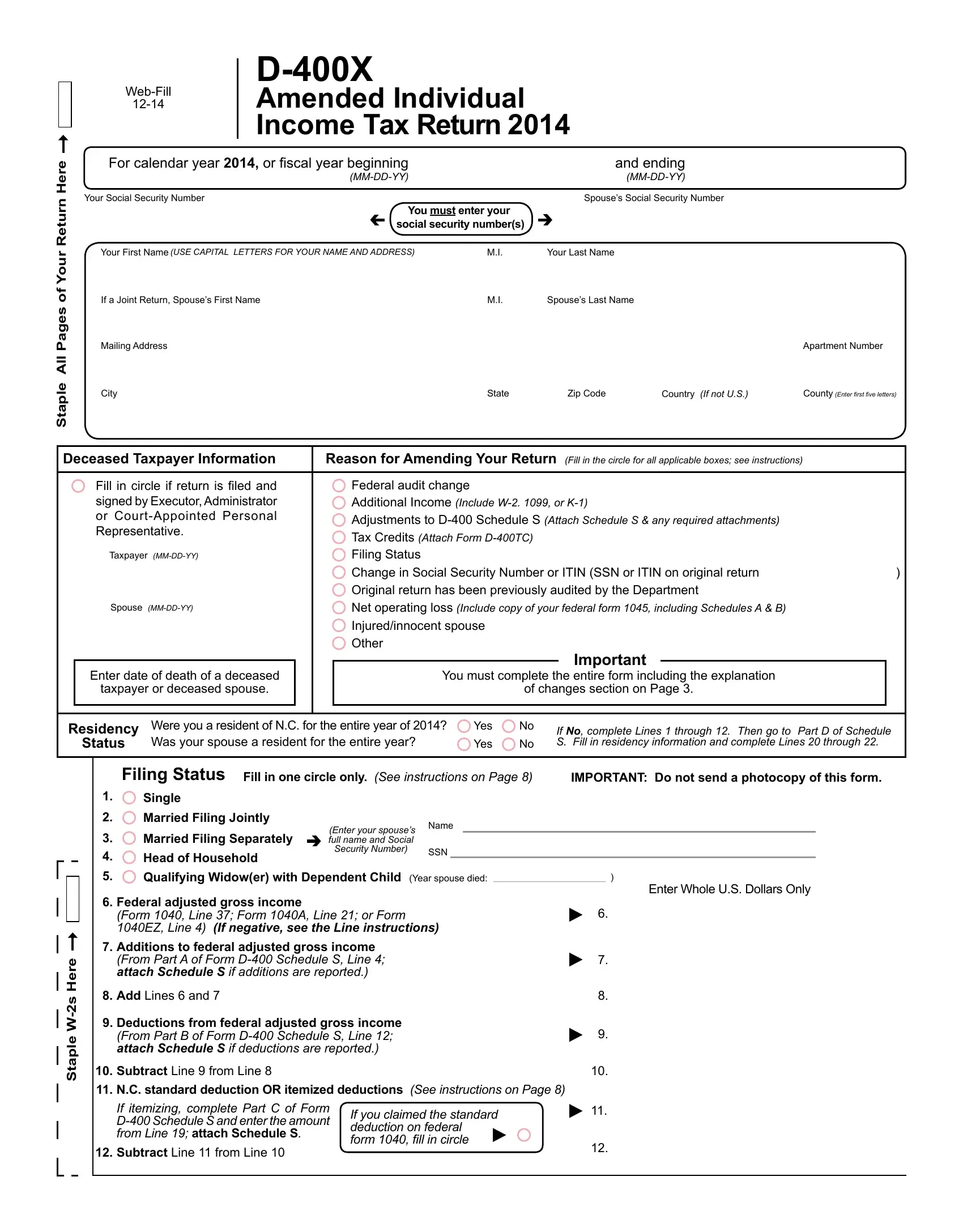

This PDF requires specific information to be entered, thus ensure that you take your time to fill in what is requested:

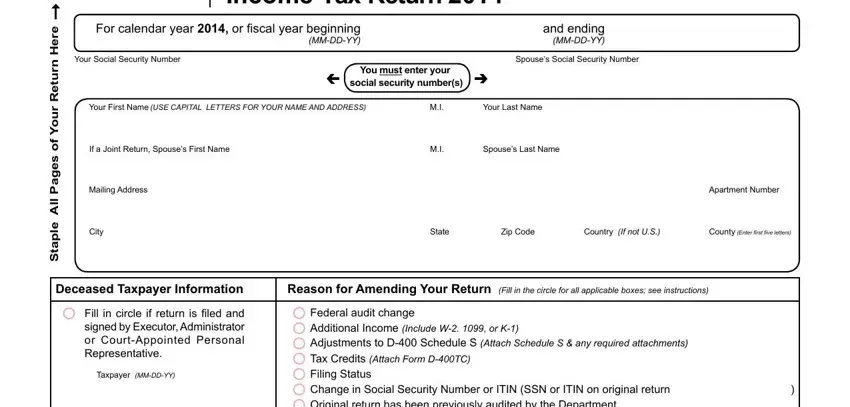

1. When filling out the north carolina d 400x form, be sure to complete all of the important fields in its relevant part. This will help expedite the work, allowing your details to be processed quickly and properly.

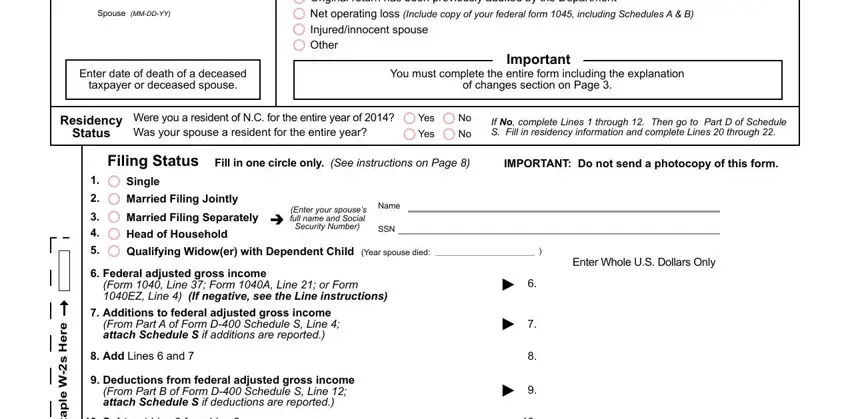

2. The next step is to complete the following blank fields: Spouse MMDDYY, Enter date of death of a deceased, taxpayer or deceased spouse, Federal audit change Additional, You must complete the entire form, of changes section on Page, Important, Residency, Status, Were you a resident of NC for the, Yes, Yes, If No complete Lines through, Filing Status Fill in one circle, and IMPORTANT Do not send a photocopy.

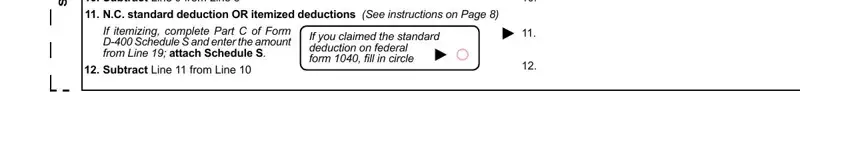

3. Completing Subtract Line from Line, e r e H s W e l p a t S, NC standard deduction OR itemized, If itemizing complete Part C of, Subtract Line from Line, and If you claimed the standard is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

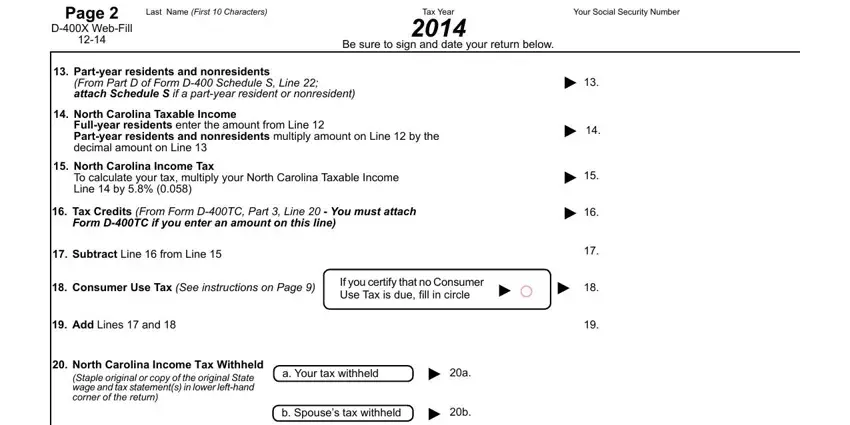

4. The next part requires your input in the following areas: Page, DX WebFill, Last Name First Characters, Tax Year, Your Social Security Number, Be sure to sign and date your, Partyear residents and, North Carolina Taxable Income, North Carolina Income Tax, To calculate your tax multiply, Tax Credits From Form DTC Part, Form DTC if you enter an amount on, Subtract Line from Line, Consumer Use Tax See instructions, and If you certify that no Consumer. Just remember to fill out all of the requested info to move further.

Be really attentive while filling in Your Social Security Number and Consumer Use Tax See instructions, since this is the section where many people make mistakes.

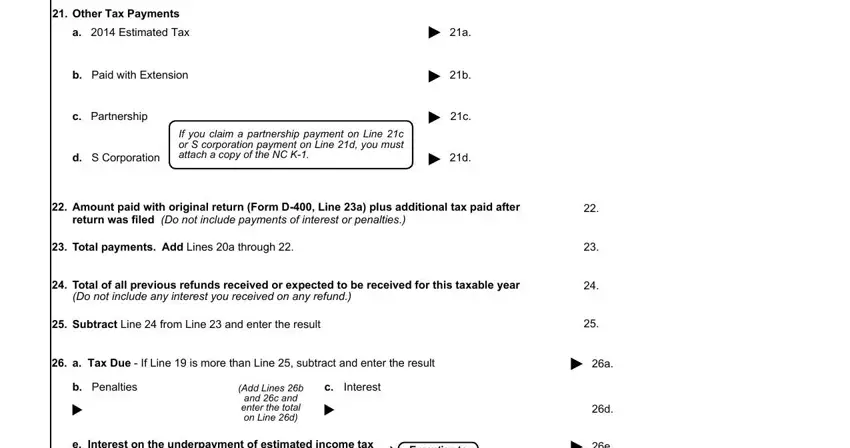

5. This pdf needs to be concluded by dealing with this part. Here you'll find a detailed set of blanks that need specific information for your form submission to be complete: Other Tax Payments a Estimated Tax, b Paid with Extension, c Partnership, d S Corporation, If you claim a partnership payment, Amount paid with original return, return was filed Do not include, Total payments Add Lines a, Total of all previous refunds, Do not include any interest you, Subtract Line from Line and, a Tax Due If Line is more than, b Penalties, c Interest, and Add Lines b.

Step 3: Before finishing your document, double-check that all blanks have been filled in as intended. The moment you establish that it is fine, press “Done." Sign up with us right now and easily use north carolina d 400x form, ready for download. All alterations you make are saved , which means you can edit the file later on if required. We do not sell or share the details you enter when completing forms at our website.