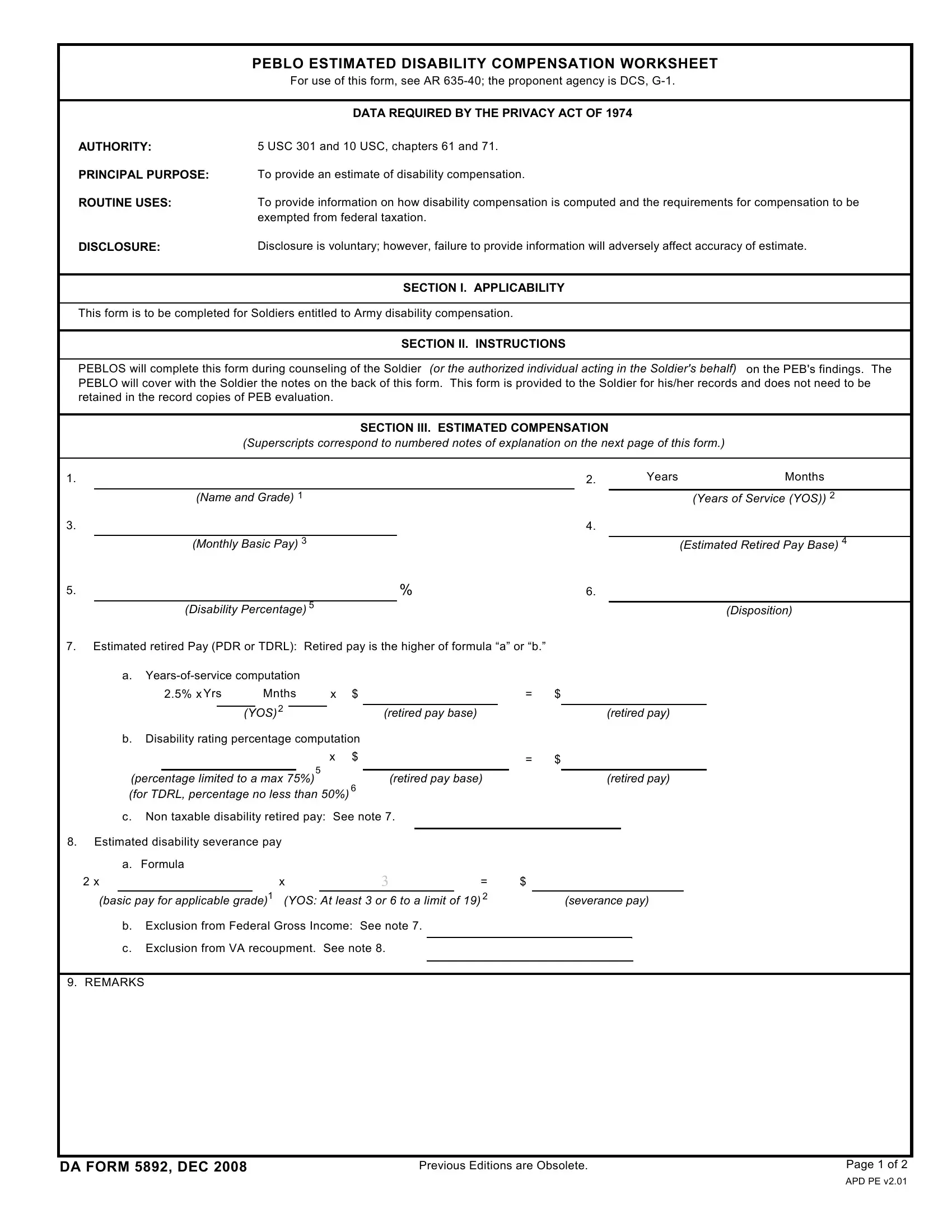

NOTES of Explanation for Estimated Disability Compensation

1.Grade for purposes of retired or severance pay:

a.In accordance with 10 USC 1372, the grade at which a Soldier is retired for disability is the highest of current grade; highest grade satisfactorily held; or the grade to which the Soldier would have been promoted had it not been for the physical disability for which the Soldier is retired. The Soldier meets the "would have been promoted" provision if the Soldier is on an approved promotion list or was otherwise pending promotion. See AR 600-8-19 for "last-day" promotion for enlisted Soldiers. Officers are retired at "promotion-list" grade without actual promotion. For Soldiers who entered the military after 7 September 1980, retirement at "promotion list" grade will have no impact on retired pay. For Soldiers who entered the military before 8 September 1980, retirement at promotion list" grade increases retired pay. See note 4, below.

b.The grade at which severance pay is computed under the provisions of 10 USC 1212 is the same as explained above for retired pay. The provisions for promotion are the same as explained in "a" above.

2.Years of Service (YOS).

a.Retirement: Years of service is computed under 10 USC 1208. (Service computed under 10 USC 1208 is the same as Service computed under 10 USC 1405.) It is combined years of active service and inactive duty points (including membership points, as described in subparagraph "c" below. Each full month of service is counted as 1/12 of a year and any remaining fractional part of a month is disregarded. Regulars who have prior Reserve service are credited with the inactive duty points for good years completed.

b.Severance pay: YOS equals the number of combined years of active service (active duty) and inactive duty points. NDAA 08 lifted the cap from 12 to 19 years and granted Service members a minimum floor of 3 or 6 years. A Soldier awarded severance pay for a disability incurred in the line of duty in a combat zone (as designated by the Secretary of Defense) or incurred during the performance of duty in combat-related operations (as designated by the Secretary of Defense) is accorded the 6-year floor. All others (to include RC members and those with less than six months combined service) are accorded the 3-year floor. DA Form 199, block 10D, reflects the determination of "combat zone/combat-related operations." A period of six months from the 3/6-floor is rounded up to the nearest whole year; less than six months, is rounded down.

c.Nonregular service: For members of the Reserve Components (RC), YOS is the combined years of active service (active duty, which includes Annual Training) and Inactive Duty Training (IDT) (which includes membership points). For USAR Soldiers, combined service is recorded on the Chronological Statement of Retirement Points (ARPC 249-2-E) commonly known as RPAS). See column 10, Total points Creditable. For ARNG Soldiers, combined service is recorded on the Retirement Points History Statement (NG Form 23) (commonly known as RPAM). See column titled, Total Points for Retired Pay. RC IDT is included in the computation of service for RA's with previous RC service. In summary, combined service is computed as set forth below. follows:

(1)One point for each day of active duty.

(2)Fifteen points for membership for each qualifying year in a Reserve Component.

(3)One point for each authorized participation in drills or periods of instruction, not to exceed 60 points for any one anniversary year that closed before September 23, 1996, 75 points for anniversary years that closed on or after September 23, 1996, but before October 30, 2000; and 90 points for anniversary years that close on or after October 30, 2003.

(4)Divide total number of points in (1) thru (3) above by 360 to convert points to years. (Insert answer into formula on worksheet where it calls for

YOS).

3.Monthly basic pay: For members of the RC, the basic pay used for computation purposes is the monthly AD basic pay- not their monthly drill compensation.

4.Retired pay base:

a.For Soldiers who entered the service prior to 8 September 1980, the retired pay base is the basic pay of the Soldier's current grade or highest grade satisfactorily held, whichever is higher. When the Soldier has previously held a higher grade, USAPDA determines highest grade satisfactorily held. Cases involving disciplinary reduction generally must be forwarded to the Grade Determination Review Board. The exception occurs after the Soldier's disability findings were approved by the SA.

b. For Soldiers who entered the service after 7 September 1980, the retired pay base is the high 36-month average of basic pay. When a Soldier has less than 36 months of service, the amount equal to the total amount of basic pay which was received during the period of service is divided by the number of months of service (including any fraction thereof). For members of the RC, their high 36-month average is computed as though they were receiving full monthly basic pay.

5.Maximum percentage. The maximum percentage used as a multiplier against retired pay base for purposes of disability retirement is 75%. The amendment to 10 USC 1409 in 2006 lifting the 75% cap for those who retire for length of service with more than 30 years of service did not include those who retire for disability with greater than 30 years of service or whose disability percentage is greater than 75%.

6.TDRL percentage: When placed on the TDRL, a Soldier will receive retired pay of no less than 50% of his or her retired pay base. The law makes no provision to adjust TDRL compensation for increase or decrease in the severity of the member's condition until the member's removal from the TDRL.

7.Exclusion from Federal gross income: Disability severance pay or the amount of retired pay equal to the disability percentage times the Soldier's retired pay base is excluded from federal gross income under either of the following circumstances.

a.The Soldier was serving in the Armed Forces or was under a binding written commitment to become such a member on 24 September 1975.

b.The disability is combat related under the provisions of 26 USC 104. See AR 635-40.

c.The determination of whether the member's disability meets the criteria for exclusion is documented on DA Form 199, block 10C.

8.Exclusion of severance pay from VA recoupment: NDAA 08 excluded severance pay from deduction from DVA compensation when the severance pay is awarded for a disability incurred in a combat zone as determined by the Secretary of Defense or for a disability incurred during the performance of duty in combat-related operations as designated by the Secretary of Defense. For all other awards, the net amount of disability severance is deducted from DVA compensation.

DA FORM 5892, DEC 2008 |

Page 2 of 2 |