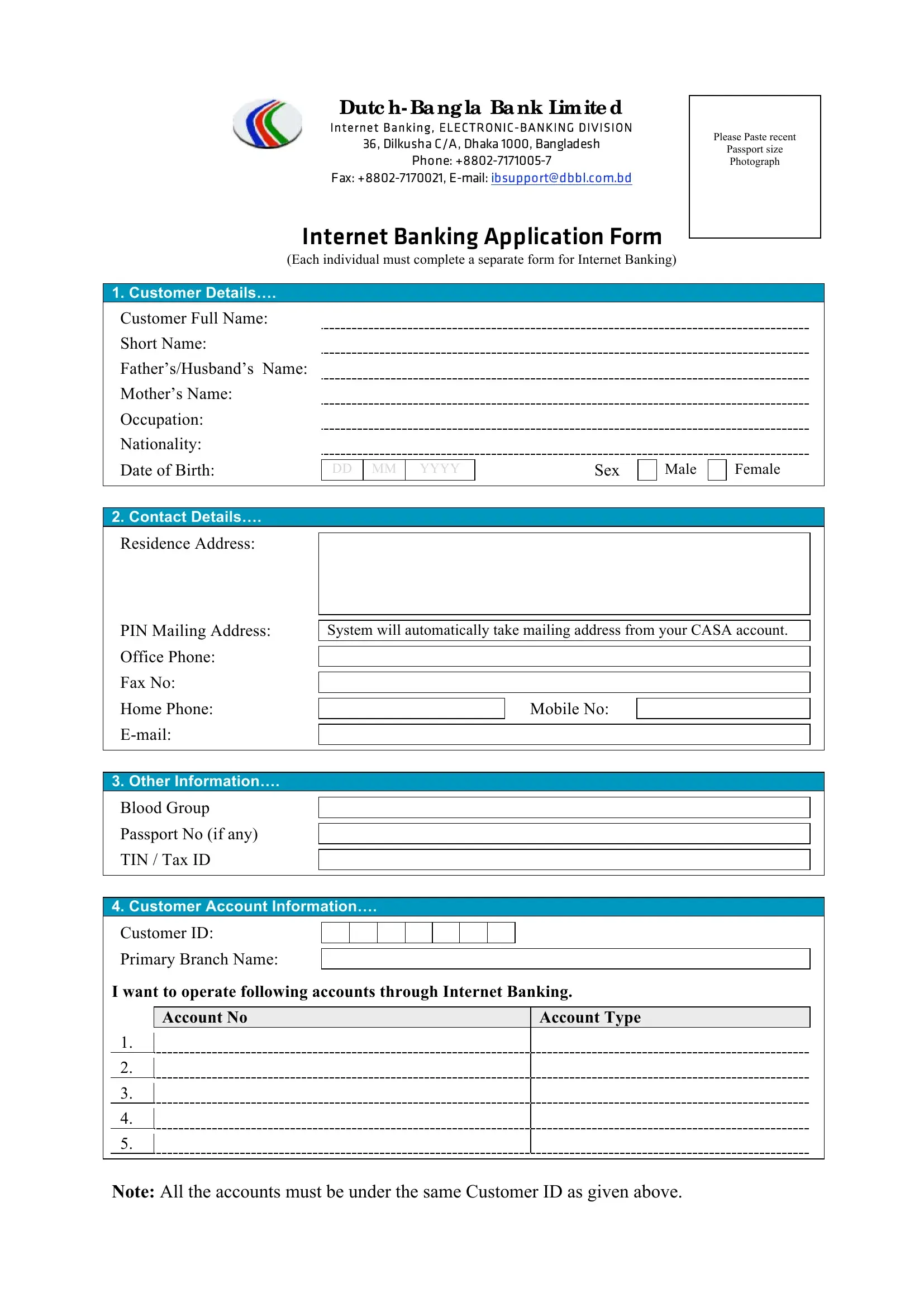

Dutc h- Ba ng la Ba nk Lim ite d

Internet Banking, ELECTRONIC-BANKING DIVISION

36, Dilkusha C/A, Dhaka 1000, Bangladesh

Phone: +8802-7171005-7

Fax: +8802-7170021, E-mail: ibsupport@dbbl.com.bd

Internet Banking Application Form

(Each individual must complete a separate form for Internet Banking)

Please Paste recent

Passport size

Photograph

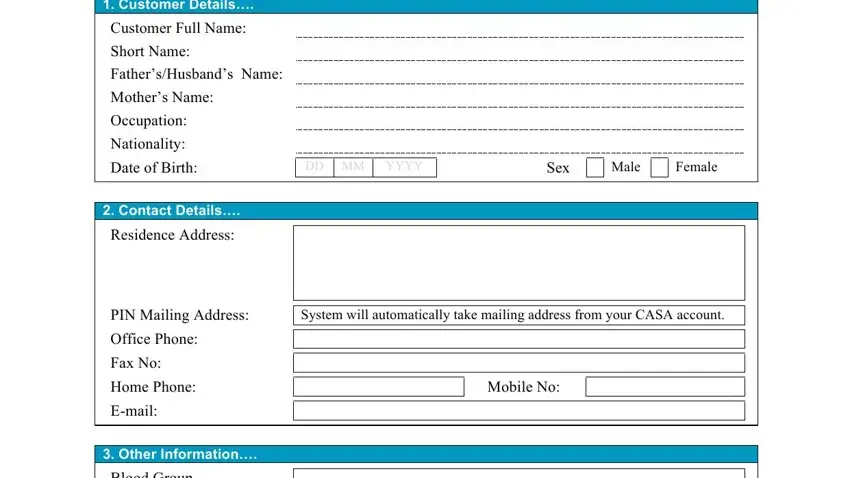

Customer Full Name:

Short Name:

Father’s/Husband’s Name:

Mother’s Name:

Occupation:

Nationality:

Date of Birth:

Residence Address:

PIN Mailing Address: Office Phone:

Fax No:

Home Phone:

E-mail:

System will automatically take mailing address from your CASA account.

Mobile No:

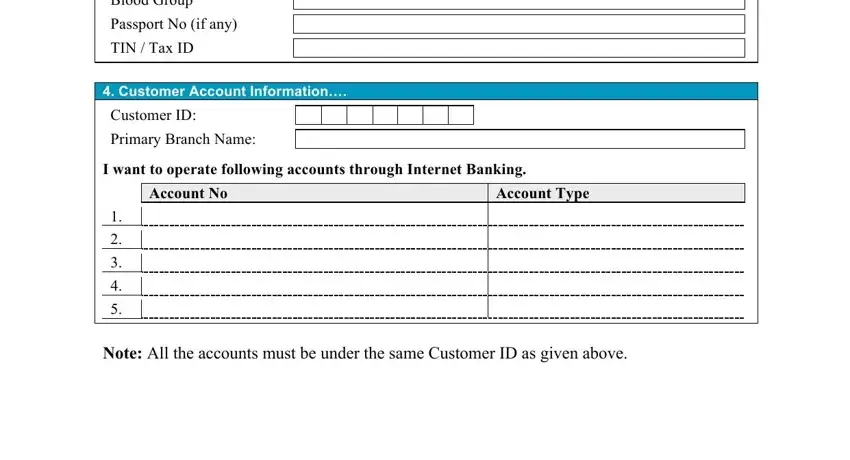

3. Other Information….

Blood Group

Passport No (if any)

TIN / Tax ID

4. Customer Account Information….

Customer ID:

Primary Branch Name:

I want to operate following accounts through Internet Banking.

Account No

1.

2.

3.

4.

5.

Note: All the accounts must be under the same Customer ID as given above.

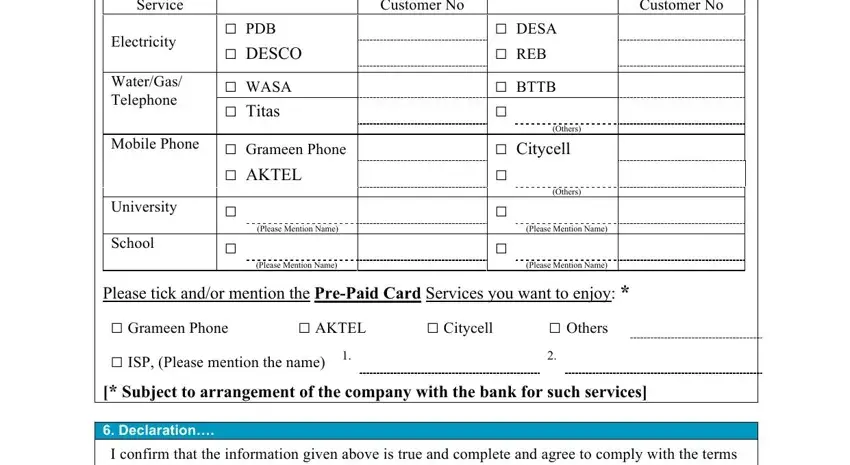

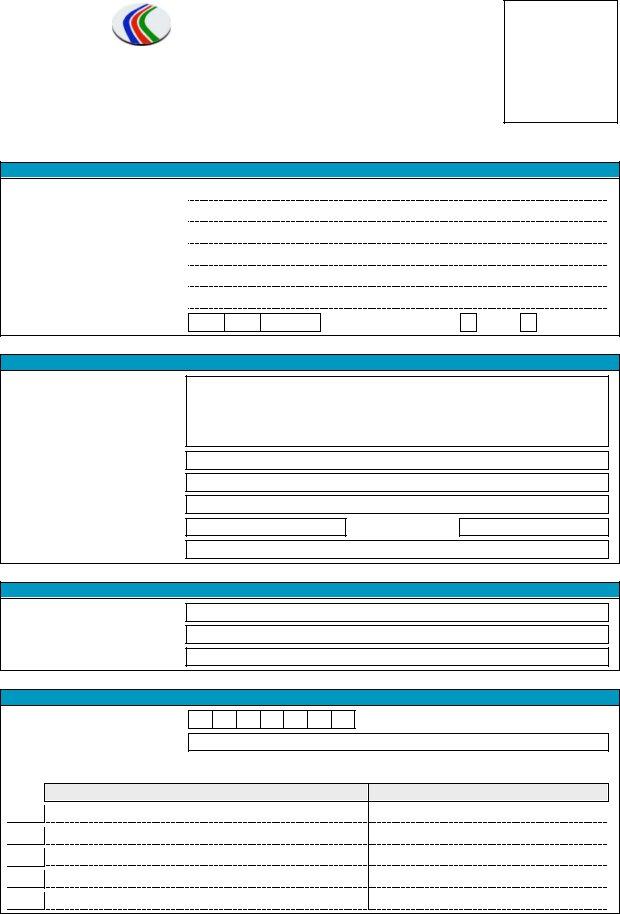

5. Extra Facilities….

Please tick and/or mention the Utility Bill Pay Services, you want to enjoy: *

Type of |

Company Name |

Your Account/ |

Company Name |

Your Account/ |

Service |

|

Customer No |

|

Customer No |

Electricity |

PDB |

|

DESA |

|

DESCO |

|

REB |

|

|

|

|

|

|

|

|

|

Water/Gas/ |

WASA |

|

BTTB |

|

Telephone |

|

|

|

|

|

|

Titas |

|

|

|

|

|

|

|

|

|

|

(Others) |

|

Mobile Phone |

Grameen Phone |

|

Citycell |

|

|

|

|

|

AKTEL |

|

|

|

|

|

|

|

|

|

|

(Others) |

|

University |

|

|

|

|

|

(Please Mention Name) |

|

(Please Mention Name) |

|

School |

|

|

|

|

Please tick and/or mention the Pre-Paid Card Services you want to enjoy: *

Grameen Phone |

AKTEL |

Citycell |

Others |

ISP, (Please mention the name) 1. |

|

2. |

[* Subject to arrangement of the company with the bank for such services]

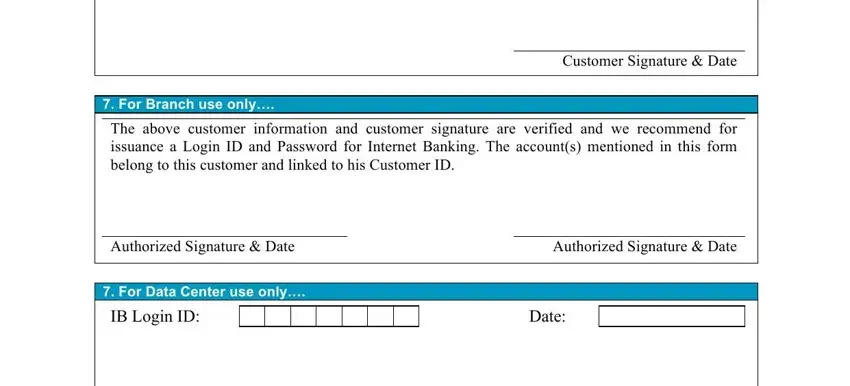

6. Declaration….

I confirm that the information given above is true and complete and agree to comply with the terms and conditions given at next page for Internet Banking. I also agree to be bound by the rules governing customer accounts with Dutch-Bangla Bank Ltd.

Customer Signature & Date

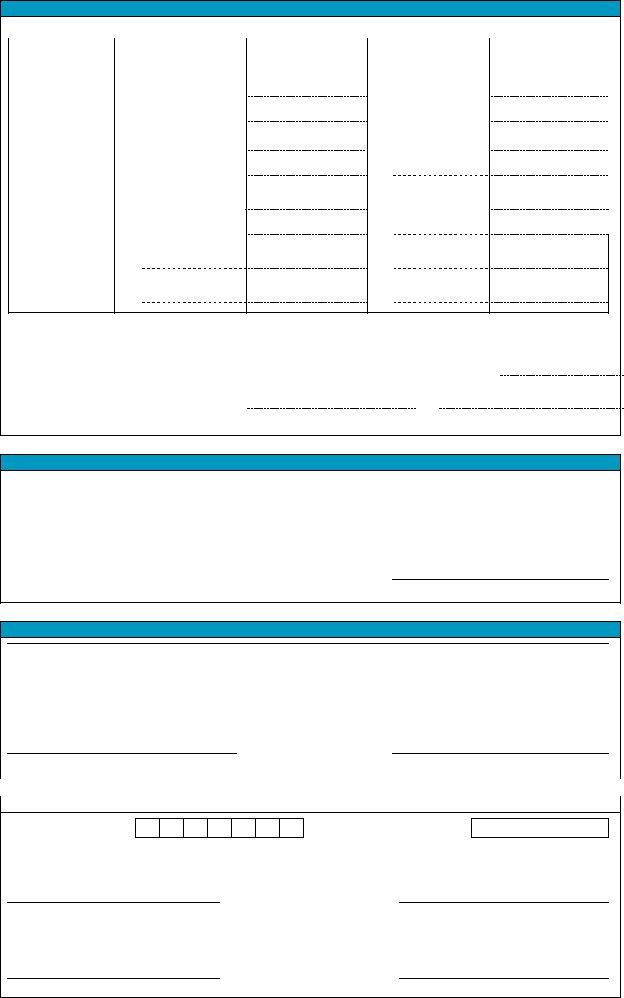

7. For Branch use only….

The above customer information and customer signature are verified and we recommend for issuance a Login ID and Password for Internet Banking. The account(s) mentioned in this form belong to this customer and linked to his Customer ID.

Authorized Signature & Date |

Authorized Signature & Date |

|

|

|

|

7. For Data Center use only…. |

|

Login ID Created by: |

Login ID Authorized by: |

Password Generated by: |

Sent to Branch by: |

DBBL Internet Banking

TERMS & CONDITIONS

(Please read these Terms & Conditions carefully)

These Terms and Conditions provide information about the DBBK Internet Banking service provided to User by Dutch-Bangla Bank Limited. and set out the rights and obligations of the User and DBBL, in connection with the User(s) use to the DBBL Internet Banking Service. In the event of any conflict between these Terms & Conditions and the Rules and Regulations governing the User(s) account with DBBL, these Terms and Conditions shall prevail.

For the purpose of this document, “Internet Banking” refers to the internet banking services provided by Dutch-Bangla Bank Limited provided services such as balance enquiry, details about transactions in the account(s), statement of account, utility bill payment services etc. “User”, “he/she” and/or “his/her” means DBBL customer(s) using DBBL Internet Banking and “DBBL” means Dutch-Bangla Bank Limited, a company duly incorporated under the Companies Act 1994, having its Registered Office at Sena Kalayan Bhaban (3rd, 4th, 5th and 10th Floor) 195 Motijheel C/A, Dhaka-1000; and its branch or its assigns in respect of which the service will be available.

1.APPLICATION FOR DBBL INTERNET BANKING:

1.1.These Terms & Conditions form the contact between the User and DBBL for using Internet Banking. The User shall apply in the prescribed form for use of Internet Banking. DBBL at its sole discretion to accept or reject any such applications.

1.2.By applying for Internet Banking for the first time, the User acknowledges and accepts these Terms & Conditions. Notwithstanding anything contained herein, all Terms & Conditions pertaining to the accounts shall continue to apply.

2.INTERNET BANKING USERS LOG IN ACCESS, PASSWORD & SECURITY PROCEDURES:

2.1.DBBL will provide the customer with unique customer identification (“Customer ID”) and a temporary (“Password”) in the first instance.

2.2.As a safety measure, the User, as a customer should immediately change Password upon his/her first login. User is requested to change his/her Password frequently thereafter as far as possible.

2.3.The customer acknowledges that the Login ID (Customer ID) and the Password selected act as User's authorized signature. This signature authorizes and validates directions given just as an actual written signature does.

2.4.User is responsible for maintaining the confidentially of Customer’s Login ID and Password. User should agree that he/she will not under any circumstances disclose his/her Password to anyone, including anyone claiming to represent the Bank or to someone giving assistance on a technical helpdesk in connection with the service. It should be clearly understood that Bank employees do not need User’s password for any reason whatsoever.

2.5.If User gives his/her Password to anyone or fail to safeguard its secrecy, he/she does so at his/her own risk because anyone with User Password will have access to his/her accounts.

2.6.If User forgets the Internet Banking password, he/she has to request for issue of a new password by sending a written request to DBBL.

2.7.If Customer’s password is lost or stolen, or is known by another individual, he/she must notify DBBL immediately.

2.8.The User agrees and acknowledges that DBBL shall in no way be held responsible or liable if the User incurs any loss as a result of information being disclosed by DBBL regarding his Account(s) or carrying the instruction of the User pursuant to the access of the Internet Banking and the User shall fully indemnify and hold harmless DBBL in respect of the same.

3.SERVICE SOFTWARE & HARDWARE REQUIREMENTS

3.1.User is solely responsible for the maintenance, installations and operation of User’s computer and for the software used in accessing Internet Banking.

3.2.DBBL shall not be responsibility if the Internet Banking System does not working properly due to the failure of electronic or mechanical equipment or communication lines, telephone or other interconnect problems, normal maintenance, unauthorized access, theft, operator errors, severe weather, earthquakes, floods and strikes, or other labor problems.

3.3.DBBL will not be held responsible for any computer virus that affects customer’s computer or the software while using Internet Banking or by accessing Internet Banking through the World Wide Web (WWW).

4.CHARGES:

4.1.DBBL reserves the right to change and recover from the User(s) service charges, as may be fixed time to time. The User hereby authorizes DBBL to recover such charges from his/her account(s). Please refer to DBBL’s charges schedule for specific charges information.

4.2.Charges are subjected to change from time to time at DBBL’s discretion.

5.UNAUTHORIZED/ FRAUDULENT ACTIVITIES:

5.1.Upon obtaining Customer ID and Password, User is requested to check the list of his/her accounts with DBBL. If any of User account is missing, please inform this to DBBL immediately. If a third party account is linked to User’s ID, please inform this to DBBL also. Do not access it or do not perform any transaction on that account. Such activity, if done, will be treated as fraudulent activity.

5.2.If User believes unauthorized transactions are being made with his/her account, he/she should change the Password immediately and notify the DBBL.

5.3.The User should check the Statements for all of his/her accounts for any unauthorized transaction. In case of any discrepancy in details of any transactions carried out in respect of the account, in that event User should immediately inform DBBL in writing.

6.ON-LINE TRANSACTIONS & UTILITY BILL PAYMENT:

6.1.User shall be responsible for all transfers transactions, opening Term Deposit (TD) account and Standing Instruction initiated through Internet Banking.

6.2.No third party transaction is allowed except utility bill payment through DBBL Internet Banking.

6.3.The Utility Bill Payment services is only available to customers of the DBBL Internet Banking Service and shall cover all the utility bill payments of different utility service provider(s) (Billers) as mutually agreed between DBBL and the utility service provider(s).

6.4.The User should accept that he/she will be responsible for putting in the correct account number and transaction amount for the fund transfer request. In such case, DBBL will not be liable for any erroneous transactions incurred arising out of or relating to the customer entering wrong account number and amount.

6.5.Upon DBBL decision, there will be a transaction amount limit though internet banking. Maximum amount of transaction limit can be subjected to change from time to time at DBBL’s discretion.

6.6.Any transaction made after working hours or on public/bank holidays, the transaction value date will be the next working day.

6.7.No transaction is allowed from a non-convertible taka account to a convertible account.

6.8.Any conversion rate of any foreign currency shown and interest rate are only for customer’s convenience. It cannot be taken as price quote from bank’s end.

7.MAINTENANCE OF SUFFICIENT FUND:

7.1.The User shall ensure that there are sufficient funds (or prearranged credit facilities) in my account for transactions through the Internet Banking.

7.2.DBBL shall not be liable for any consequences arising out of its failure to carry out the instructions due to inadequacy of funds and/or credit facilities.

8.ANTI MONEY LAUNDERING:

8.1.Customer should agree and confirm that he/she will not use this Internet Banking facility for money laundering or violate any law related to the money laundering.

8.2.DBBL reserves the right to demand explanation from the User regarding any matter pertaining to money laundering law of the country.

9.PROPRIETARY RIGHTS:

9.1.The User acknowledge that the software underlying the Internet Banking as well as other Internet related software which are required for accessing Internet Banking are the legal property of the respective vendors.

9.2.The permission given by DBBL to access Internet Banking will not convey any proprietary or ownership rights in such software.

9.3.The User shall not attempt to modify, translate, disassemble, decompile or reverse engineer the software underlying Internet Banking or create any derivative product based on the software.

10.GOVERNING LAW:

10.1.These Terms and/or the operations in the Accounts of the User shall be governed by the Laws of Bangladesh, in force.

10.2.DBBL may, in its absolute discretion, commence any legal action or proceedings arising out of the Terms for Internet Banking in any other court, tribunal or other appropriate forum, and the User hereby consents to that jurisdiction.

10.3.Any provision of the Terms for Internet Banking which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of prohibition or unenforceability but shall not invalidate the remaining provisions of the Terms or affect such provision in any other jurisdiction.

11.CHANGES OF TERMS:

11.1.DBBL shall have the absolute discretion to amend or supplement any of the Terms at any time and will attempt to give prior notice of fifteen days for such changes wherever feasible. Such change to the Terms shall be communicated to the User. By using any new services as may be introduced by DBBL, the User shall be deemed to have accepted the changed Terms.

12.TERMINATION ON INTERNET BANKING:

12.1.The User may request for termination of the Internet Banking any time by giving a written notice of at least 15 days to DBBL. The termination shall take effect on the completion of the fifteenth day.

13.BREACH OF TERM & CONDITIONS:

13.1.User must compensate for any loss that occurs as a result of his/her breaking any term of these agreements.

PERCAUTIONARY NOTE:

In order to prevent unauthorized transaction through Internet Banking Service, Users are advised to strictly maintain the following:

1.The password should not be written anywhere.

2.User should make sure that no one is physically watching my passwords when he/she is Logging in.

3.It is important to remember to click 'Log out' after completing his/her Internet Banking session.

4.User should not leave his/her PC unattended with the browser running and a valid user name and Password cached as in such case anyone can gain access to the account.

I hereby acknowledge that I have read and understand the aforesaid terms and conditions and risk involved in Internet Banking operation and agree to comply with them.

Customer Full Name |

Customer Signature & Date |

If you need help with the log in process of Internet Banking or have technical questions, please call DBBL Internet Banking Help Desk at 880-2-7174095-7.

Internet Banking Support can be reached via e-mail at ibsupport@dbbl.com.bd

Or write to:

DBBL Internet Banking Help Desk

Dutch-Bangla Bank Ltd. (19th Floor)

36Dilkusha C/A, Dhaka-1000 Bangladesh