The requirements as prescribed by BoBL for the purpose of due authentication shall be complied and confirmed by the customer, which shall be as hereunder. The customer hereby agreed to conform to the prescribed authentication procedures and security measures required for transactions and shall undertake all reasonable measures to ensure that the login/transaction password is not revealed to any third party, whatsoever. If there is misuse of any facility or service and then loses money from his/their account, it shall be his/their own liability and the BoBL shall not bear any losses whatsoever. If you do not agree to any of these terms and conditions, you are not obliged to sign and execute this document.

The various compliance in respect of customers are:

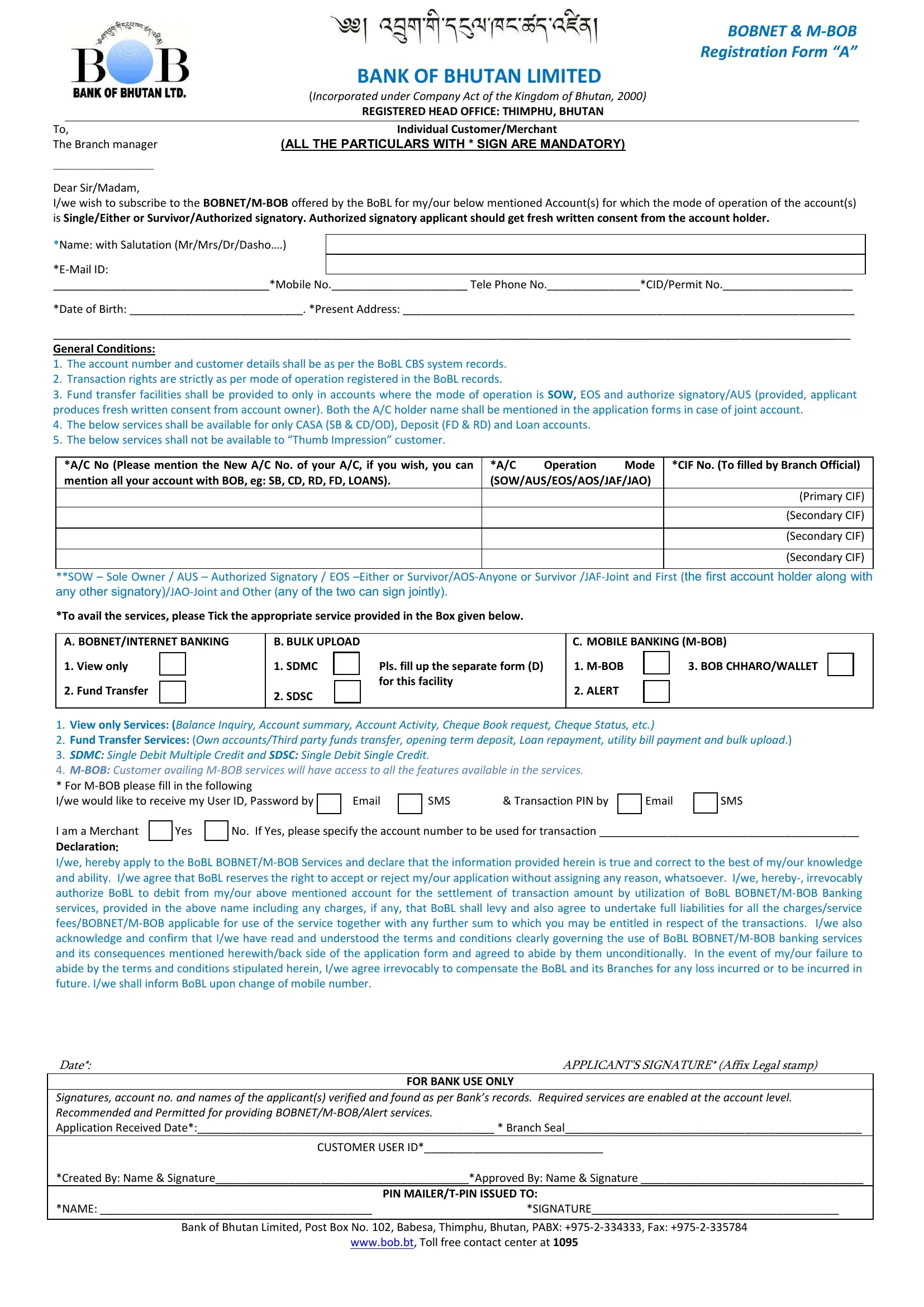

1. Herein after the Internet Banking shall be called as BOBNET and Mobile Banking is called as M- BOB.

2. The Customer shall be allotted User ID, Login Password and Transaction PIN by the BoBL in the first instance wherever applicable. The user shall be required to change the Login Password assigned by BoBL on accessing the BOBNET/M-BOB services for the first time after his/her/its agreeing to the terms and conditions for BOBNET/M-BOB. As a safety measure, the user shall change the Login Password as frequently as possible thereafter or as and when the system requires for the same (which shall be 180 days from the last change) whichever is earlier. In addition, BoBL may at its discretion advise the user to adopt such other means of authentication as it may deem fit.

3.The customer shall be bound by the instructions he/she has initiated in the BOBNET/M-BOB, making it clear that the Bank does not have any liability when his/her instructions using the Login /Transaction/SMS Password are carried out. That is the BoBL is in order in carrying out the instructions of the customer on BOBNET/M-BOB, relying on the Login/Transaction/SMS Password and any transaction thus carried out by the BoBL shall be deemed to have been duly authenticated/authorized by the customer.

4. The customer understands and agrees that the transaction pin is for the purpose of authenticating the transaction and shall have same effect as the specimen signature of authorized signatory of the customer and the customer shall be bound by the transactions initiated by the use of transaction pin. .

5. In case the user forgets the Password, a new Password may be obtained from the BoBL against a formal written request. Such replacements shall not be construed / deemed as the commencement of new contract. In such an event the BoBL shall provide the new Password within a reasonable period. However, till such time no transactions shall be made.

6. The customers are totally responsible and all exercise due care in respect of confidentiality/safekeeping/secrecy of the Login Password /Transaction pin and User ID. If third party gains access to the service in the customer accounts, the customer shall be fully and totally responsible and shall indemnify the BoBL against any liability, cost or damages arising out of claims or suits by such third parties based upon or relating to such access and use.

7. The customer shall refrain from accessing the resources of the BoBL for BOBNET/M-BOB from public locations like browsing centers which are susceptible for hacking of passwords and other misuse. In any such case, the customer shall be responsible and indemnifies BoBL against any liability, costs and damages arising out of such hacking or misuse.

8. The customer shall not attempt to access the information and other details stored with BoBL through any means other than the Internet/Mobile Banking services provided. The customer shall also ensure that unauthorized persons do not access his/her/their/its account(s). In case the third party succeeds in getting an order against the BoBL from the court, forum, etc., due to violation of the above by the customer, then the customer agrees to indemnify the BoBL for the loss caused to the Bank by such violation.

9. The User desirous of availing BOBNET/M-BOB shall either be the account holder and sole signatory or authorized to act independently in case of a joint account. The other joint account holders shall expressly agree with the arrangement and give their consent for: All transactions arising from the use of BOBNET/M-BOB in the joint accounts shall be binding on all the joint account holders, jointly and severally. The Bank shall in no way be liable for any loss/damage whatsoever that may be incurred or alleged to be incurred by the other joint holder in such an event.

10. In case of accounts opened for and on behalf of minors, the natural guardian shall undertake to give all instructions relating to the operation of the account and further undertake not to reveal the User ID, Password, M-PIN and T-PIN to the minor, which if done so will beat that account in case if the account is operated by the minor. In such an event the transaction will be deemed to have been undertaken by the guardian.

11. The BoBL shall have the right of set-off and lien, irrespective of any other lien or charge, present as well as future on the deposits held in the User’s a ou ts hether i si gle a e or

joint name(s), to the extent of all outstanding dues, whatsoever, arising as a result of the BOBNET/M-BOB service extended to and/or used by the customers/users.

12. BoBL shall not be responsible, if the system do not pass the transaction on the transaction date due to system problem and if the payment confirmation is successful in the confirmation page but transaction failed at backend.

NOTICE:

The method of giving notice by the BoBL and the customer are as under:

1. Electronically to the mail box of either party.

2. In writing by delivering them by hand/post/courier/fax/email to the last address given by the customer and in the case of BoBL to the Relatio ship Ma ager to ho the usto ers’

account is linked or to the Branch/s where he/she is maintaining account.

CHARGES

The BoBL reserves the right to charge and recover from the user, service charge for providing the BOBNET/M-BOB service (including but not limited to the right of charging the user for the use of funds transfer). The user hereby authorizes BoBL to recover the service charge by debiting from one of the accounts of the user or by sending a bill to the user who shall be liable to make the payment within the specified period. Failure to do so shall result in recovery of the service charge by the BoBL in a manner as the BoBL may deem fit along with such interest, if any, and/or suspension of the facility of BOBNET/M-BOB without any liability to the BoBL.

CHEQUE BOOK ISSUE:

The customer can request for issue of a cheque book and after 24 hours he/she has to collect it from his/her branch respectively.

OPERATING TIMES, CHANGES AND DISRUPTIONS

The Service shall usually be available for use at the times given in the User Guidance or at other times notified to you. You accept, however, that routine maintenance requirements, excess demand on the systems and circumstances beyond our control may mean it is not always possible for the Service to be available during its normal operating hours. In connection with the Service, we are entitled at any time to:

1. Change the mode of operation; or

2. Add to, remove or otherwise change, end or suspend any of the facilities available; or end the Service.

If we decide to change or end the Service, we shall try to give you prior notice. We will in no way be liable in case of such termination / end of service and / or for any loss caused / suffered in this regard.

EXCLUSIVITY CLAUSE:

The customer hereby agrees to use the website, M-BOB app and USSD strictly for his/her/their/its internal use and not for any illegal purpose or in any manner inconsistent with the terms and conditions. The customer agrees not to use, transfer, distribute or dispose of any information contained in the website, M-BOB app and USSD in any manner that could compete with the business of BoBL or otherwise is against the interests of BoBL. The term of the BOBNET/M-BOB services and to comply with all reasonable written requests made by BoBL and other parties of context, equipment or otherwise to protect their and other parties contractual, statutory and common law rights in the website. The customer agrees to notify BoBL in writing promptly upon becoming aware of any unauthorized access or use of the website by any party or any claim that website infringes upon any copyright, trademark or contractual, statutory or common law rights. The customer is allowed to download and retrieve data from the website M-BOB app and USSD on his/her/their/its computer screen/Mobile Phone (handset), print individual pages on paper, photocopy and store such paper in an electronic form on desk for his/her/their/its exclusive personal use only. The customer further acknowledges that all the intellectual property in the website, M-BOB app and USSD and the service provided continues to vest with BoBL and the customer shall not claim any right hereafter.

PROTECTIVITY CLAUSE

The customer specifically agrees to hold BoBL harmless from any and all claims and agrees that BoBL shall not be liable for any loss, actual or perceived, caused directly or indirectly by government restriction, market regulation, war, strike, virus attack, equipment failure, communication line failure, system failure, data corruption, security failure on the internet,

unauthorized access, hacking, theft or any problems technological or otherwise or other o ditio e o d BoBL’s o trol, that ight pre e t the usto er fro e teri g or BoBL

from executing an instruction, order or direction. Customer further agrees that customer will not be compensated by BoBL for the orders, instructions or directions which could not be executed.

CLOSURE OF ACCOUNT

The customer agrees that he/she/they/it shall be able to exercise the right to close the account(s) with BoBL, only if there is no obligation pending to be met by the customer towards BoBL.

DECLARATION OF BANKING FACILITIES LINKED WITH THE ACOOUNT

I, we hereby agreed to submit in writing to the BoBL about the banking facilities linked to the account while legally transferring the authority to another person/party to operate the account. If I, we fail to notify the same to the BoBL in writing, any consequences thereof shall be my/our own risk and liability whatsoever.

RIGHTS RESERVED

The customer hereby acknowledges and agrees that any rights not expressed herein are reserved. The customer also agrees that the terms and conditions are subject to change from time to time and all the customers shall be automatically bound by such changes, irrespective of the time taken in displaying on the net. In the event of failure to intimate the same, the BoBL shall not be responsible for any action by the user whose authority has been revoked by the Customer.

SURVIVAL OF OBLIGATION

The duties of customers under these terms and conditions shall continue to be in full force and effect, notwithstanding the termination of the BOBNET/BOBSMS/M-BOB Services. The termination of the services shall be without prejudice to any accrued right of BoBL.

NON-TRANSFERABILITY

The facilities granted under BOBNET/M-BOB services to customer/user are not transferable under any circumstances by BoBL without the prior written concern of the account holder.

ARBITRATION

Any dispute arising between the parties hereto in connection with the validity, interpretation or implementation of this agreement, the matter shall be resolved mutually to the extent possible. If a mutual resolution is not possible, the matter shall be referred to Royal Court of Justice, Bhutan.

ACCOUNT CANCELLATION

In case the user does not use the services for a period exceeding 90 days, the Bank will have the right to revoke such inactive account.

UTILITY PAYMENT & BULK UPLOAD:

The user shall upon making the utility payment or bulk upload, crosscheck/confirm their

pa e t or upload fro Bill Pa Vie a d Bulk File Vie |

e u respe ti el i BOBNET |

banking as given in the user manual.

Sig atu e:…………………………………………………Date:……………………………