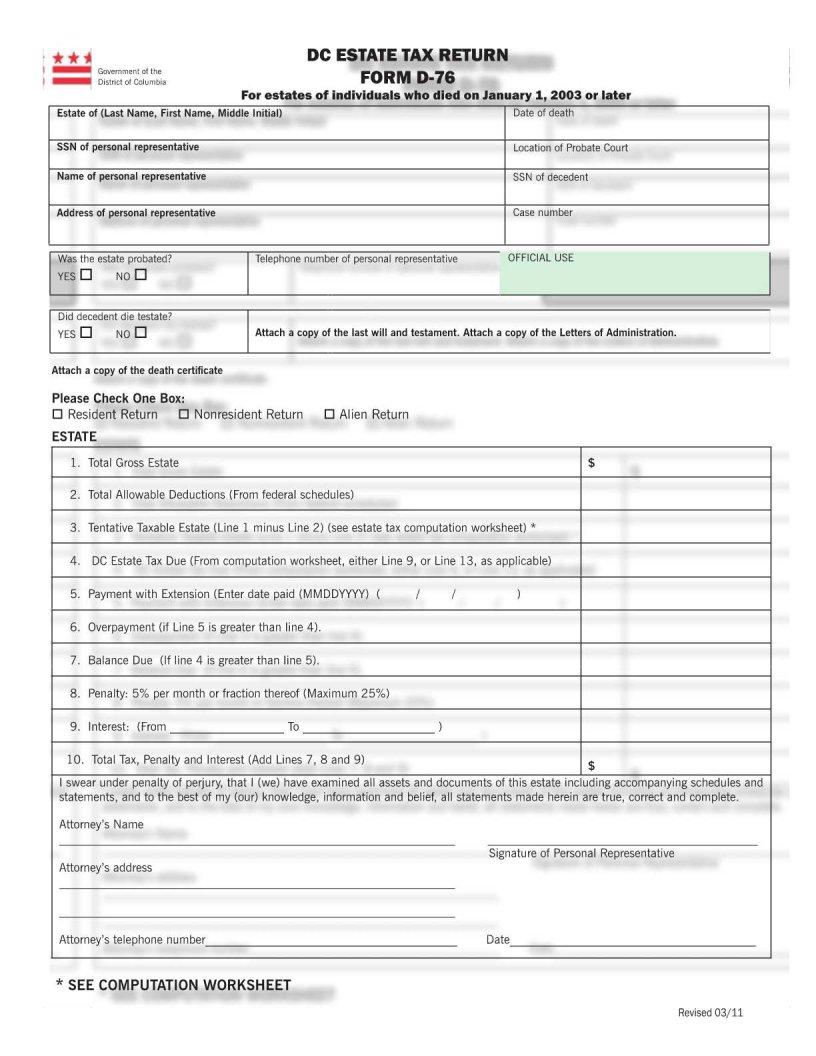

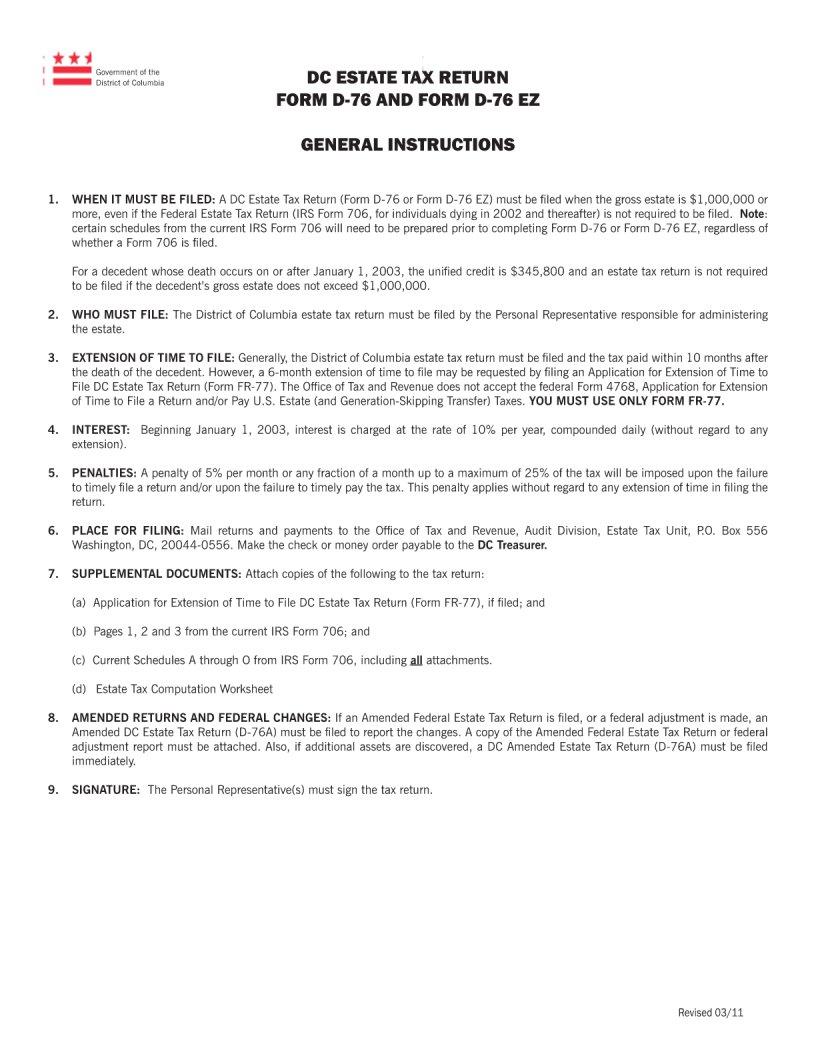

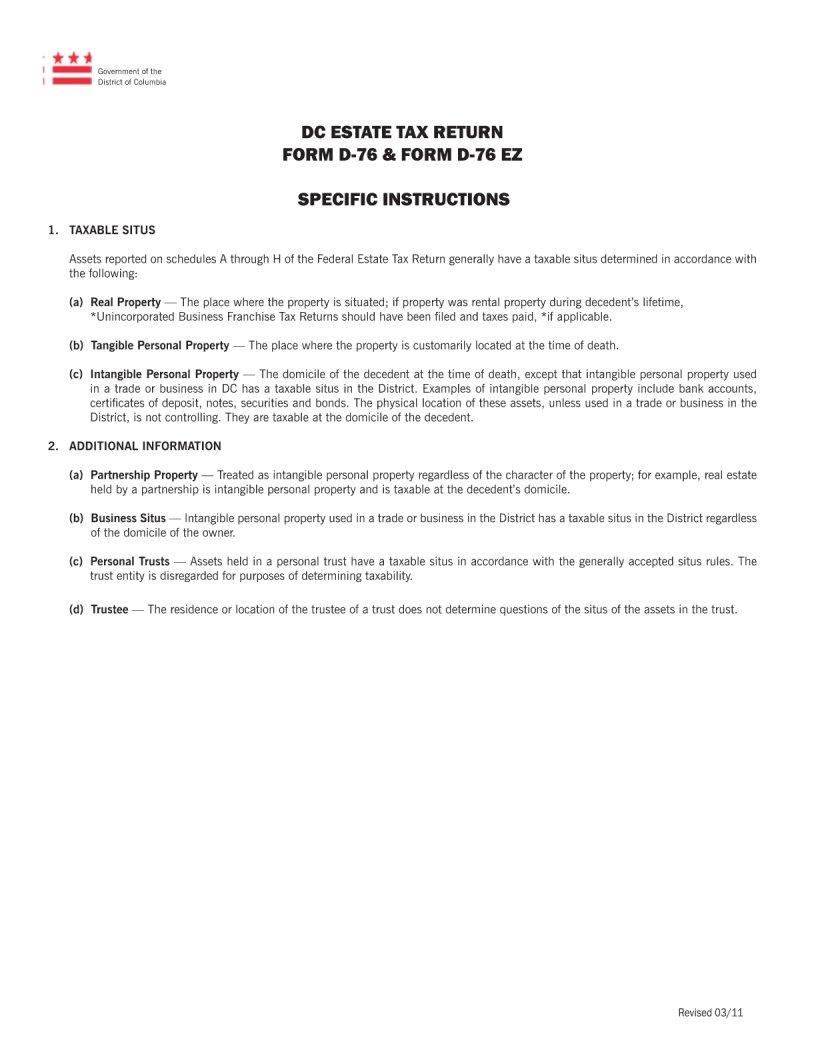

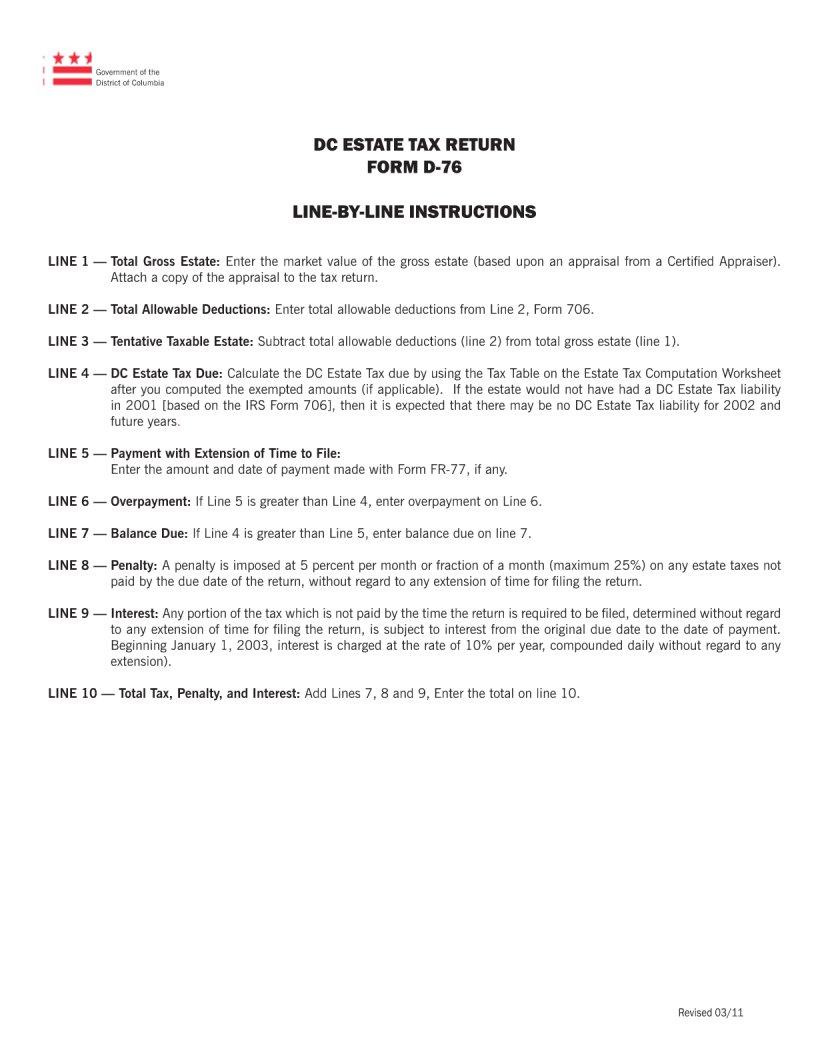

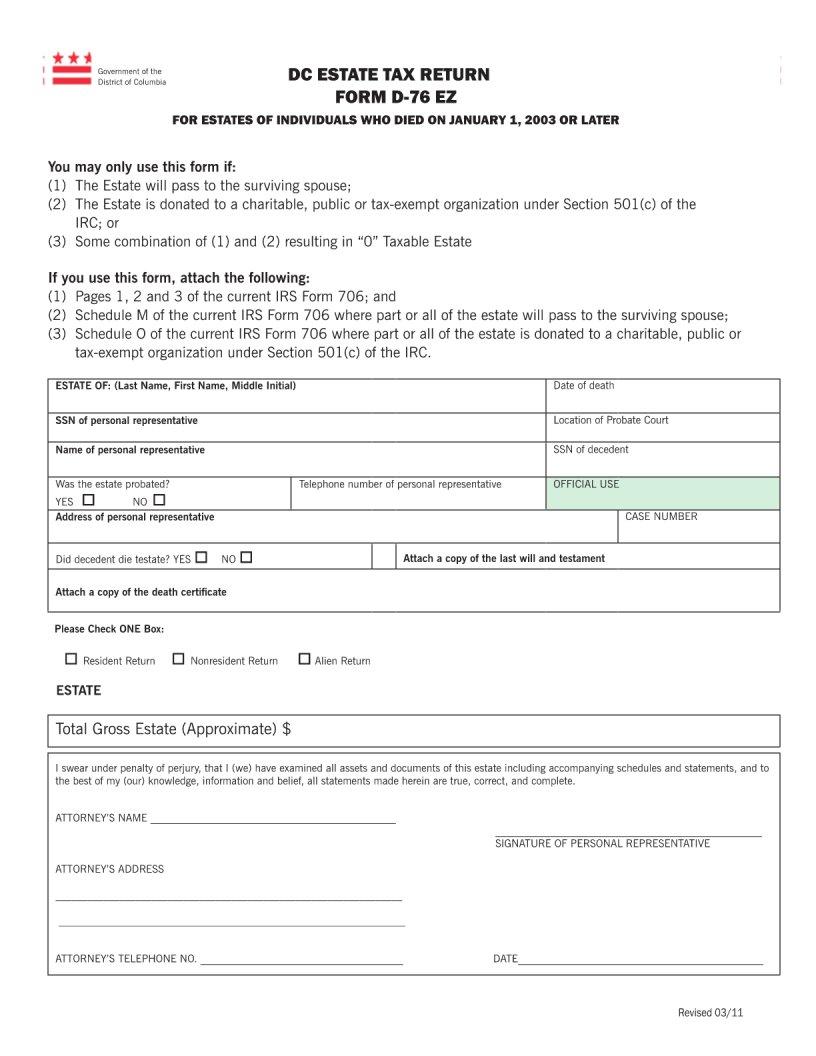

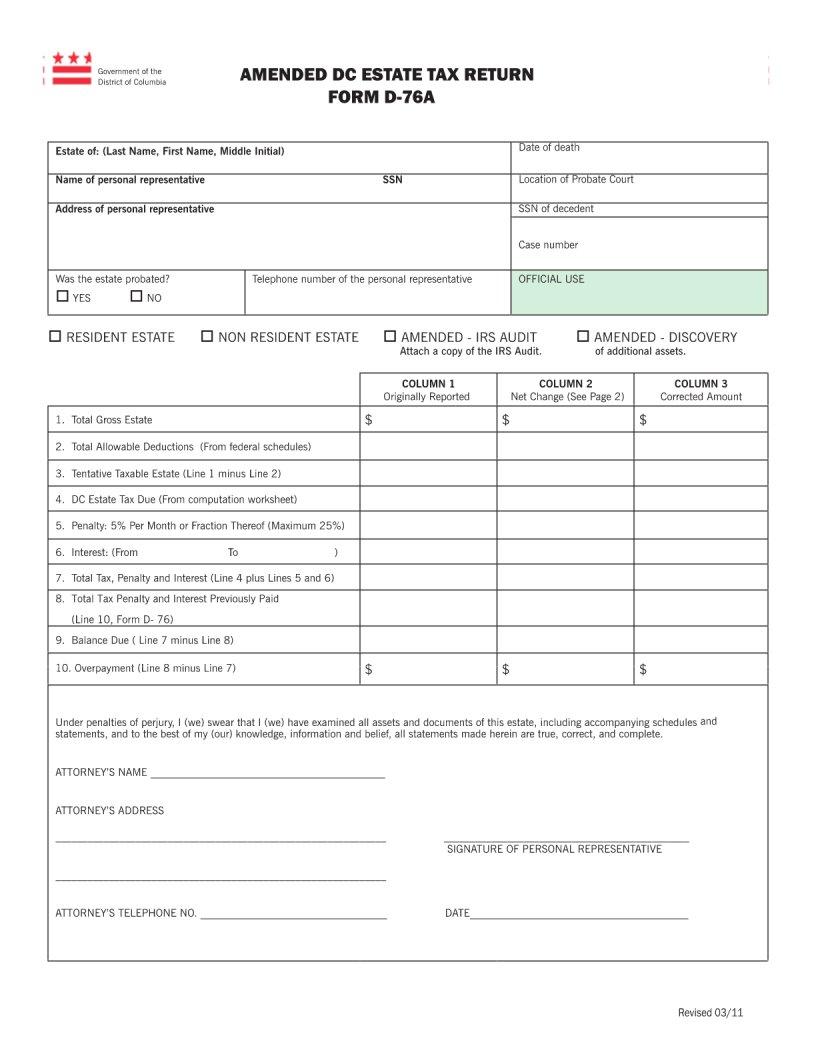

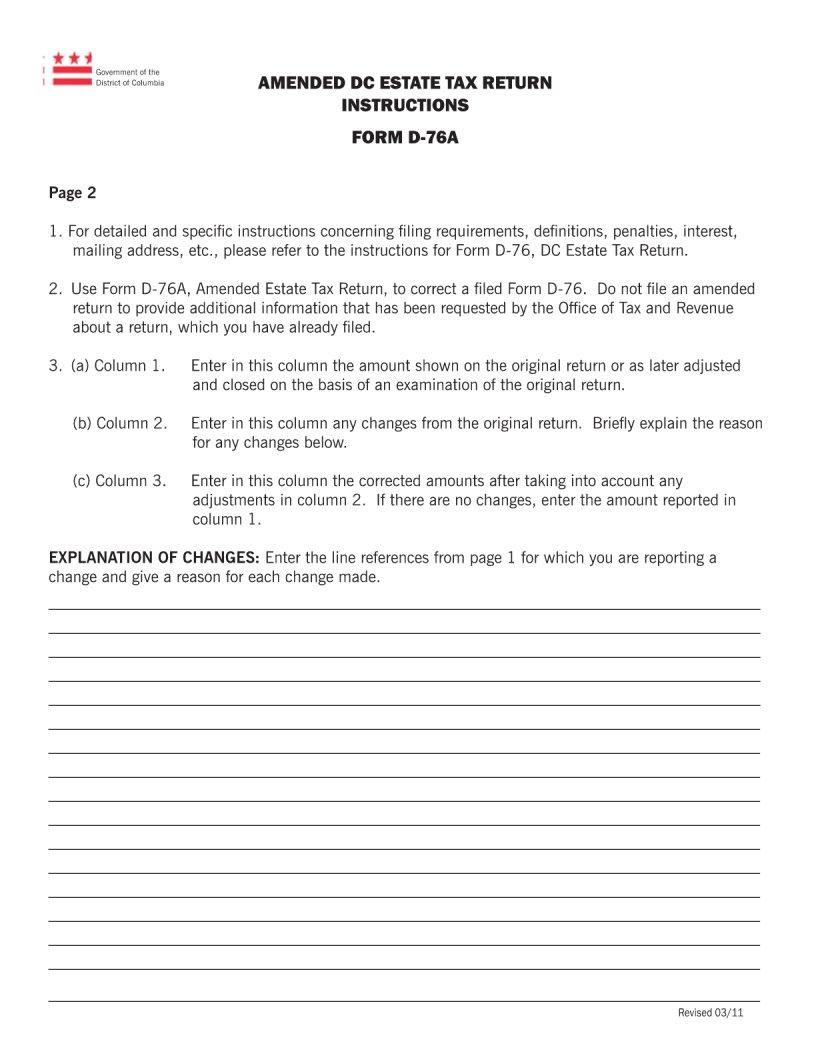

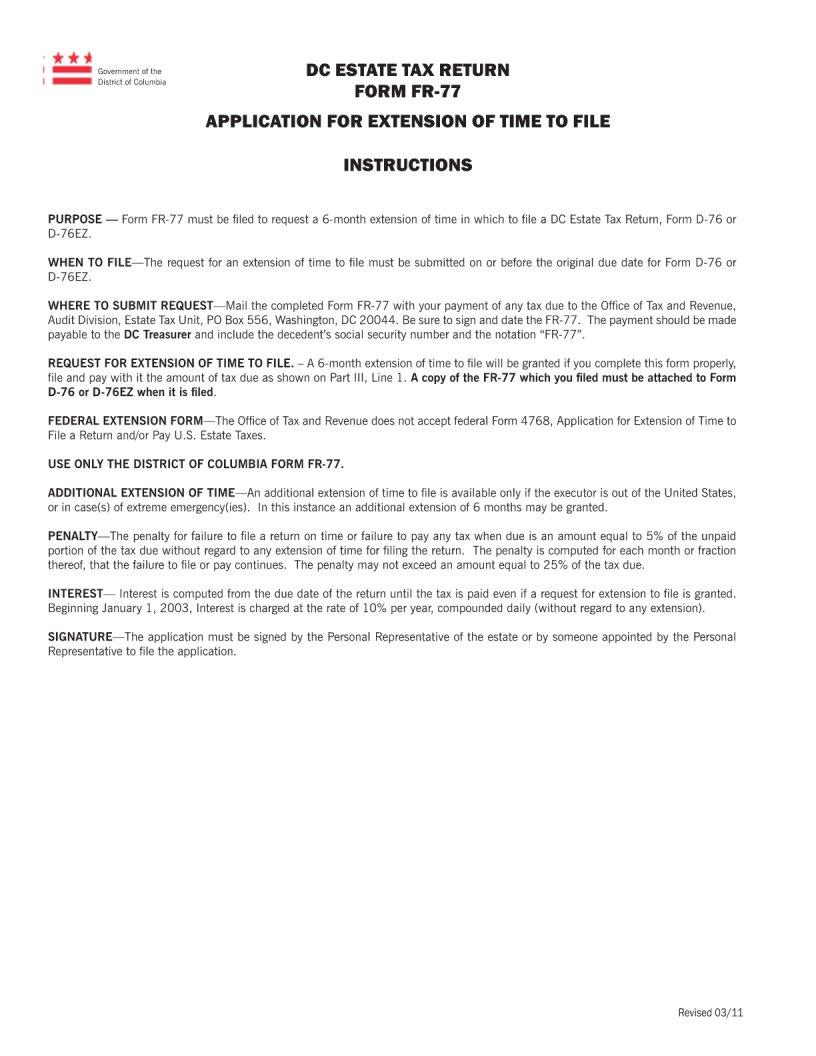

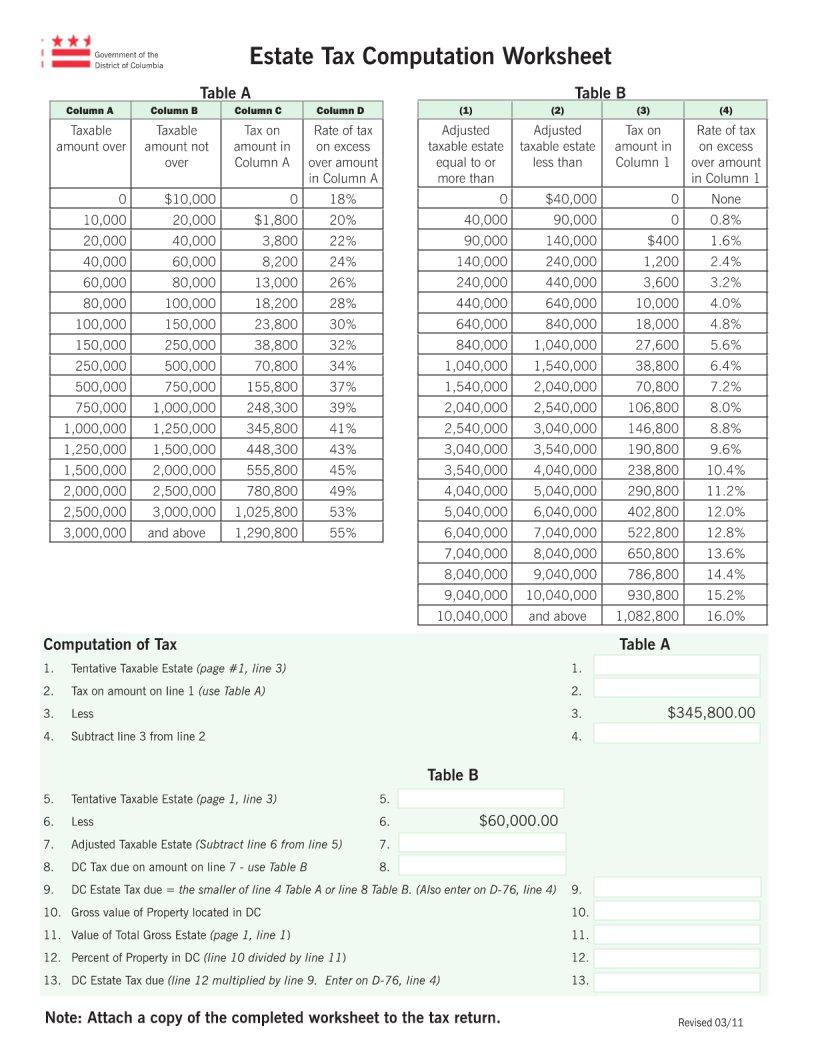

When someone passes away, managing their financial affairs becomes a crucial step for those left behind. In the District of Columbia, the D-76 form plays a central role in this process. This document, known as the DC Estate Tax Return, serves as a comprehensive report of the deceased's estate, outlining its value and determining the estate tax owed to the district. Completing this form requires a detailed inventory of the deceased's assets, including everything from property and bank accounts to stocks and personal belongings. For families and executors, understanding and accurately filling out the D-76 form can be a challenging yet essential part of estate management. Besides its importance in tax calculation, it also ensures that the decedent's financial legacy is handled according to local laws, providing a clear path for the distribution of assets. The implications of this document extend beyond immediate tax concerns, potentially affecting the financial well-being of beneficiaries and the timely resolution of the deceased's estate. It's a critical component in the broader context of estate planning and management in the District of Columbia.

| Question | Answer |

|---|---|

| Form Name | Dc Estate Tax Return Form D 76 |

| Form Length | 16 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min |

| Other names | 2011_d 76_(2) dc estate tax return instructions form |