Whenever you would like to fill out az chandler sales use tax, there's no need to download any kind of software - just try using our online PDF editor. The editor is continually upgraded by us, receiving additional functions and turning out to be a lot more convenient. To begin your journey, go through these basic steps:

Step 1: Click on the "Get Form" button above. It'll open our tool so you can begin filling in your form.

Step 2: As soon as you access the online editor, there'll be the form made ready to be filled in. Aside from filling out different blank fields, it's also possible to do some other things with the form, namely adding custom text, changing the initial textual content, inserting graphics, putting your signature on the document, and much more.

This PDF doc requires specific details; to ensure correctness, take the time to heed the tips down below:

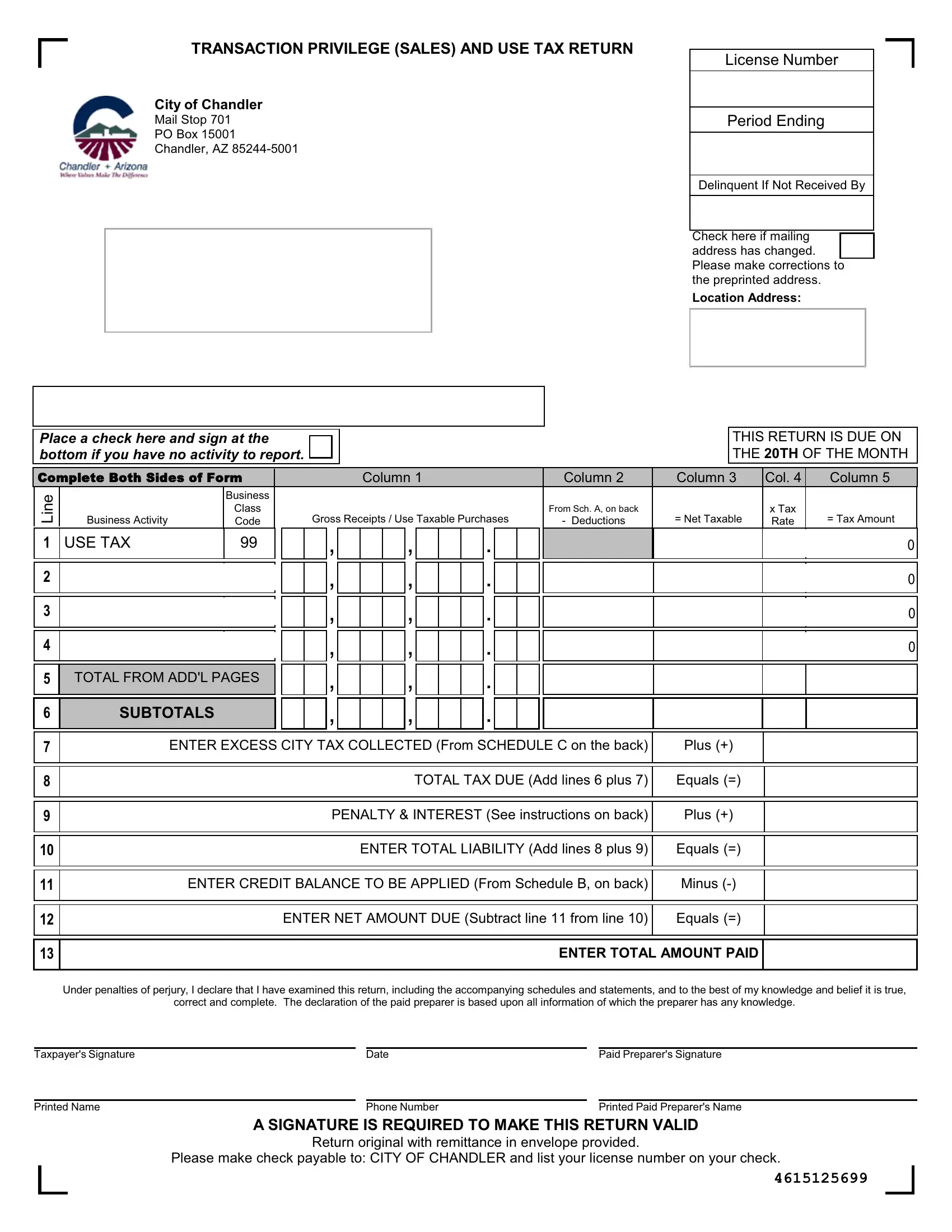

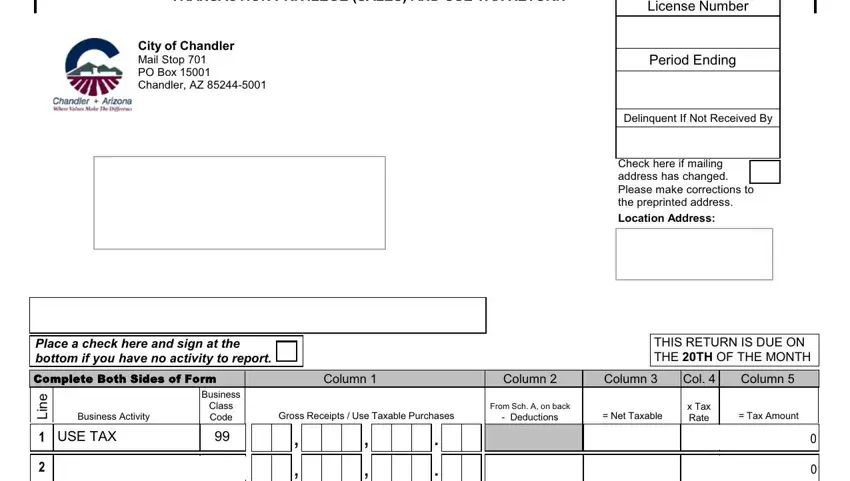

1. You have to fill out the az chandler sales use tax accurately, hence be careful when filling in the segments including these blanks:

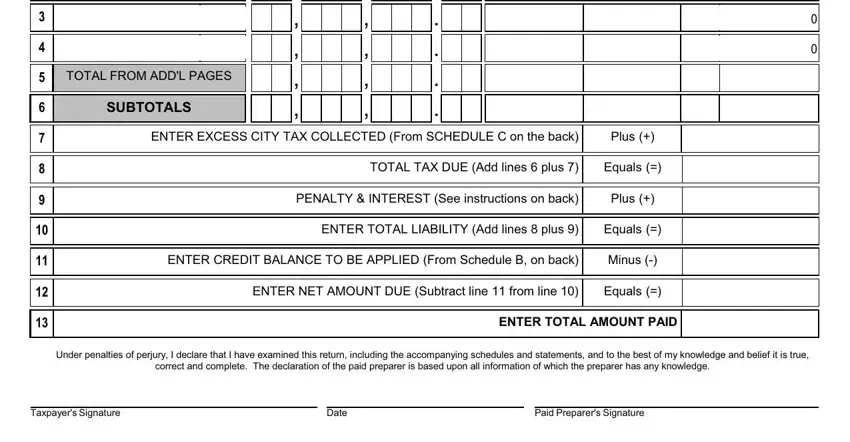

2. Just after the prior part is done, go on to type in the suitable details in these - TOTAL FROM ADDL PAGES, SUBTOTALS, ENTER EXCESS CITY TAX COLLECTED, Plus, TOTAL TAX DUE Add lines plus, Equals, PENALTY INTEREST See instructions, Plus, ENTER TOTAL LIABILITY Add lines, Equals, ENTER CREDIT BALANCE TO BE APPLIED, Minus, ENTER NET AMOUNT DUE Subtract line, Equals, and ENTER TOTAL AMOUNT PAID.

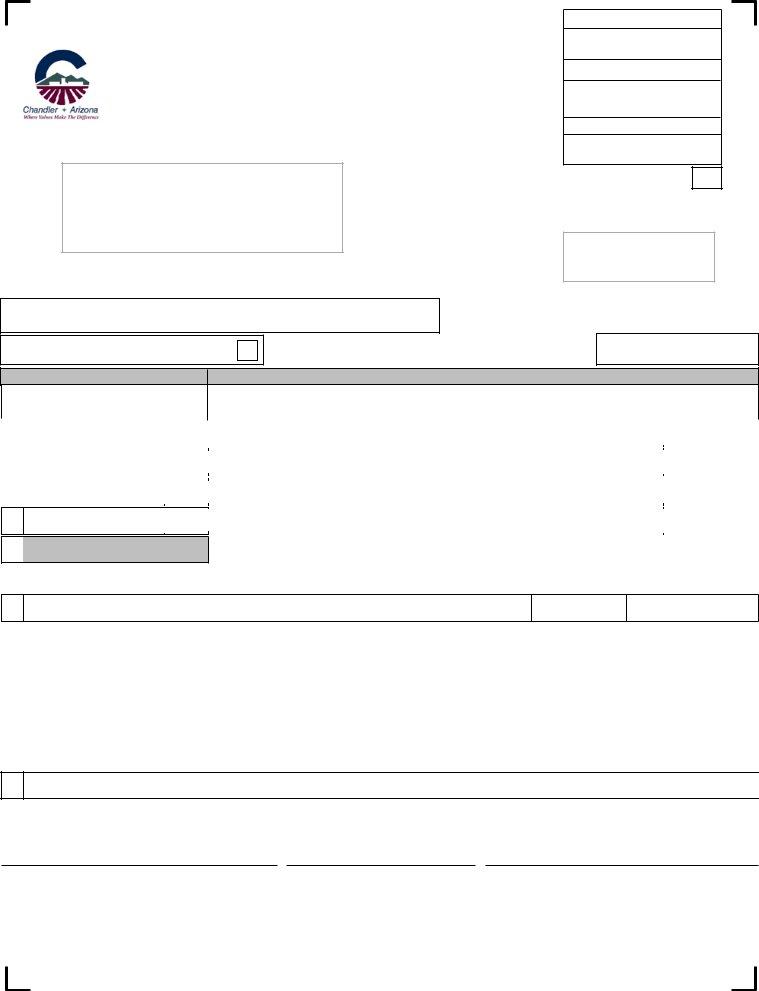

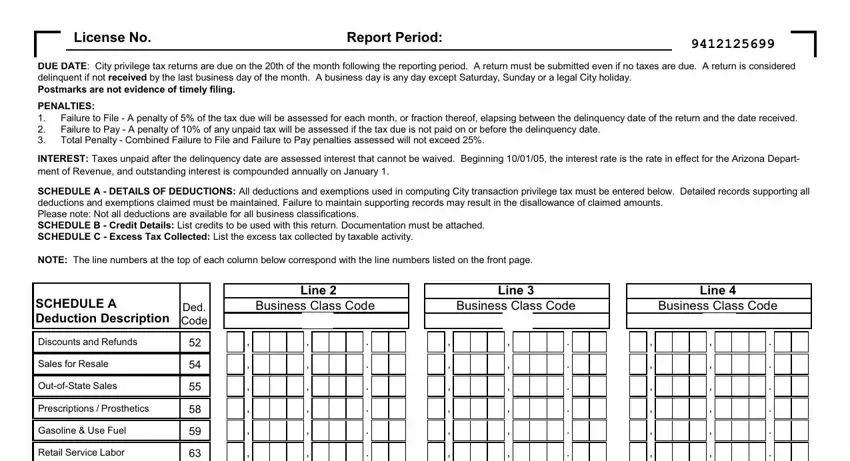

3. Throughout this part, check out License No, Report Period, DUE DATE City privilege tax, PENALTIES, Failure to File A penalty of of, INTEREST Taxes unpaid after the, SCHEDULE A DETAILS OF DEDUCTIONS, NOTE The line numbers at the top, Line, Line, Line, Business Class Code, Business Class Code, Business Class Code, and SCHEDULE A Deduction Description. Every one of these will have to be completed with highest precision.

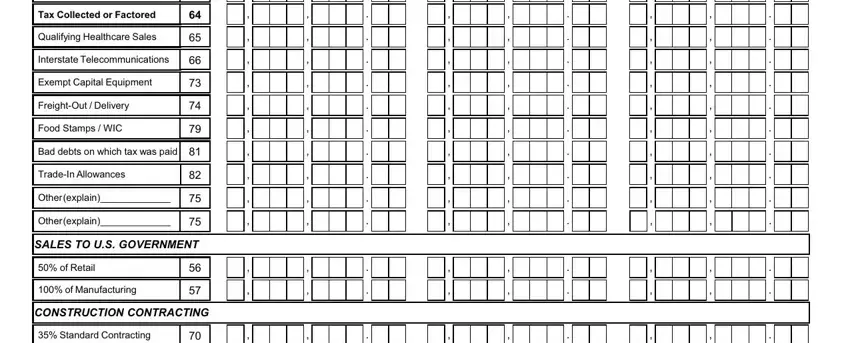

4. This fourth section arrives with these fields to look at: Tax Collected or Factored, Qualifying Healthcare Sales, Interstate Telecommunications, Exempt Capital Equipment, FreightOut Delivery, Food Stamps WIC, Bad debts on which tax was paid, TradeIn Allowances, Other explain, Other explain, SALES TO US GOVERNMENT, of Retail, of Manufacturing, CONSTRUCTION CONTRACTING, and Standard Contracting.

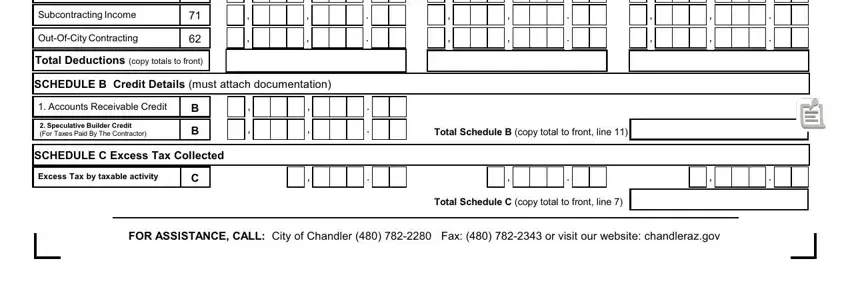

5. This final stage to submit this PDF form is essential. Ensure that you fill out the mandatory blanks, consisting of SCHEDULE B Credit Details must, Accounts Receivable Credit, Speculative Builder Credit For, SCHEDULE C Excess Tax Collected, Excess Tax by taxable activity, FOR ASSISTANCE CALL City of, Subcontracting Income, OutOfCity Contracting, Total Deductions copy totals to, Total Schedule B copy total to, and Total Schedule C copy total to, before using the form. If not, it can generate an unfinished and potentially unacceptable document!

Always be very mindful while completing SCHEDULE B Credit Details must and Subcontracting Income, since this is the section in which most people make mistakes.

Step 3: Right after you've glanced through the information you given, click "Done" to finalize your form. After starting a7-day free trial account at FormsPal, it will be possible to download az chandler sales use tax or send it via email right off. The file will also be readily accessible via your personal account page with all your modifications. FormsPal ensures your data confidentiality by having a secure system that never records or distributes any kind of personal data involved in the process. Be assured knowing your files are kept confidential every time you work with our services!