dc tax form d 40b can be completed with ease. Simply open FormsPal PDF tool to complete the task right away. FormsPal team is devoted to providing you the best possible experience with our tool by regularly releasing new functions and improvements. With these updates, working with our tool becomes better than ever before! With a few easy steps, you'll be able to begin your PDF editing:

Step 1: Click on the orange "Get Form" button above. It's going to open up our tool so you can begin filling out your form.

Step 2: With the help of our advanced PDF file editor, you could do more than simply complete blank form fields. Try all of the features and make your docs appear faultless with custom textual content put in, or adjust the file's original input to perfection - all comes with an ability to insert stunning graphics and sign the document off.

Be mindful while filling in this form. Make sure that each blank field is done properly.

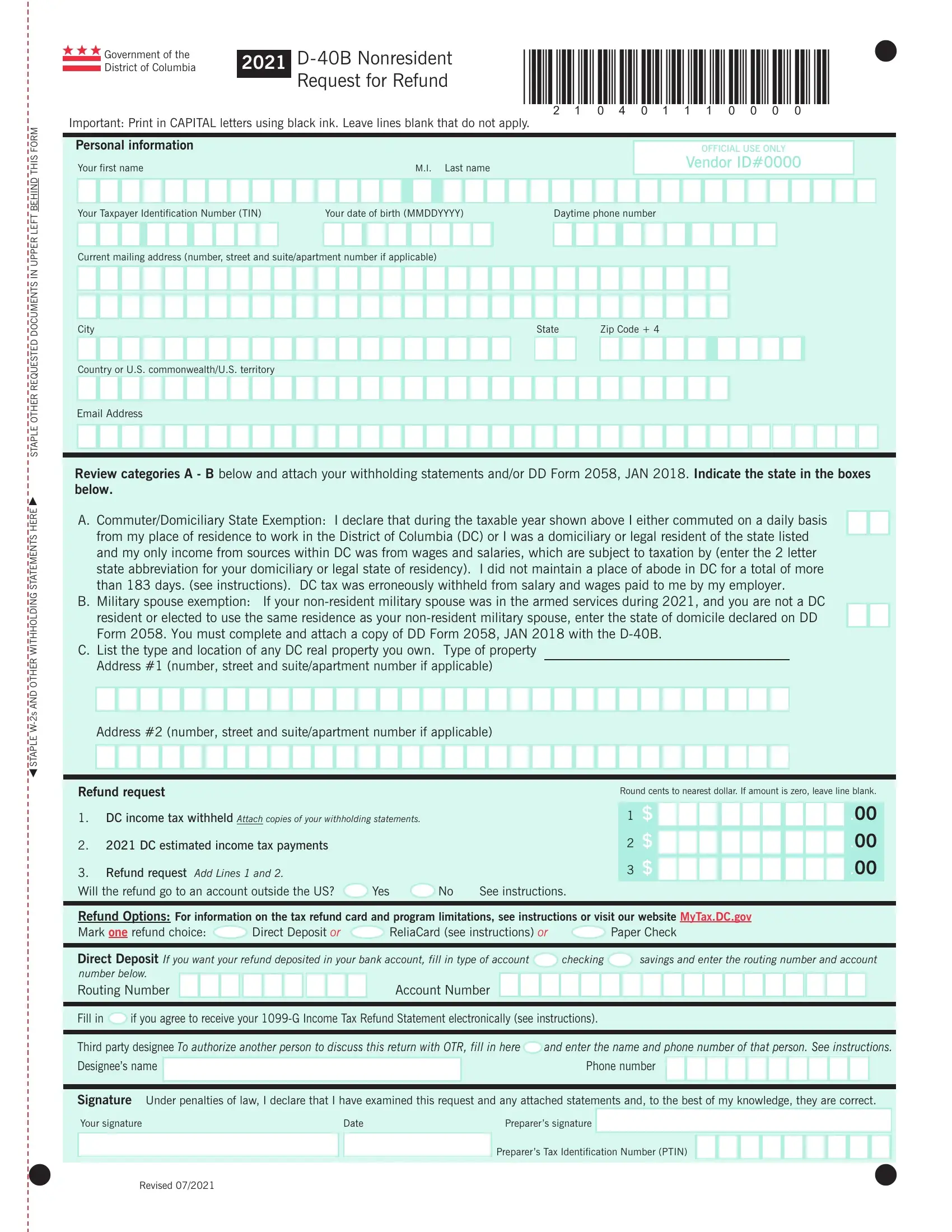

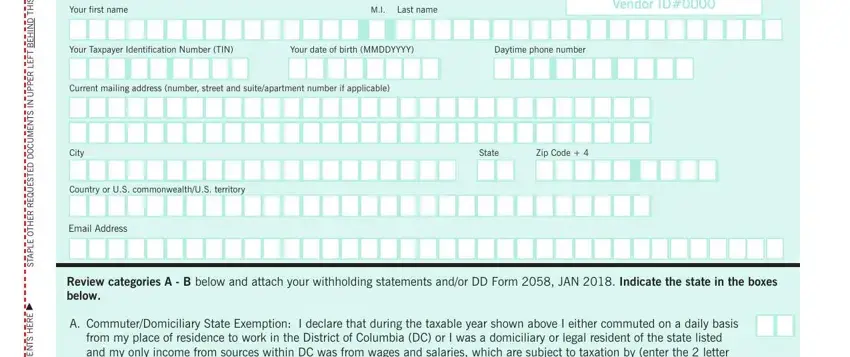

1. The dc tax form d 40b needs specific details to be typed in. Make certain the next fields are filled out:

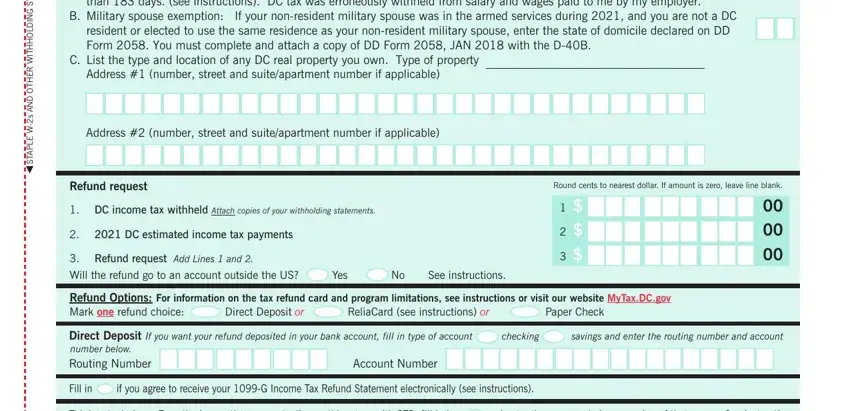

2. The next part is usually to submit the next few fields: E R E H S T N E M E T A T S G N D, from my place of residence to work, B Military spouse exemption If, C List the type and location of, Address number street and, Address number street and, Refund request, DC income tax withheld Attach, DC estimated income tax payments, Refund request Add Lines and, Will the refund go to an account, Yes, See instructions, Round cents to nearest dollar If, and Refund Options For information on.

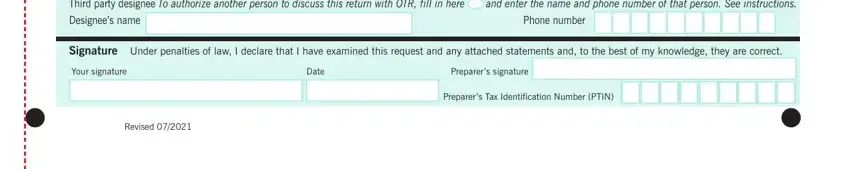

3. This next stage is generally straightforward - complete every one of the form fields in Third party designee To authorize, and enter the name and phone, Phone number, Signature Under penalties of law I, Your signature, Date, Preparers signature, Revised, and Preparers Tax Identification in order to complete this process.

Be really attentive when filling in Preparers signature and Preparers Tax Identification, as this is the section in which a lot of people make some mistakes.

Step 3: Revise everything you have typed into the blanks and hit the "Done" button. After getting a7-day free trial account at FormsPal, you will be able to download dc tax form d 40b or send it through email right off. The PDF document will also be accessible from your personal account menu with your every change. FormsPal ensures your data privacy by using a protected system that never saves or distributes any type of personal information involved in the process. Be assured knowing your paperwork are kept confidential any time you work with our service!