Navigating the complexities of health coverage can be daunting, but the DCH 1426 form seeks to streamline this process for Michigan residents. As an application for Health Coverage & Help Paying Costs, this comprehensive document serves as a gateway to a variety of health insurance options, including affordable private plans, Medicaid, the Healthy Michigan Plan, and MIChild—Michigan's Children's Health Insurance Program. Suitable for individuals and families, including those with immigrant members, it emphasizes accessibility without jeopardizing one's immigration status. Furthermore, its design accommodates a wide range of applicants by offering assistance in different languages and formats for ease of completion. The form intricately links applicants with potential financial aid for premiums via new tax credits and delineates eligibility for free or low-cost insurance grounded in an applicant's income and familial composition. Explicitly, it prompts for detailed personal, familial, and financial information to tailor health coverage options accordingly, ensuring privacy and confidentiality in accordance with legal standards. Additionally, it provides avenues for applicants without complete information to proceed, guaranteeing follow-up and guidance on subsequent steps toward securing health coverage. Through the online application portals for both statewide programs and the insurance marketplace, it significantly reduces application time, catering to the digital convenience preferred by many. The DCH 1426 form ultimately embodies a crucial resource for Michigan's inhabitants, aiming to demystify the insurance application process while facilitating broader access to necessary health care services.

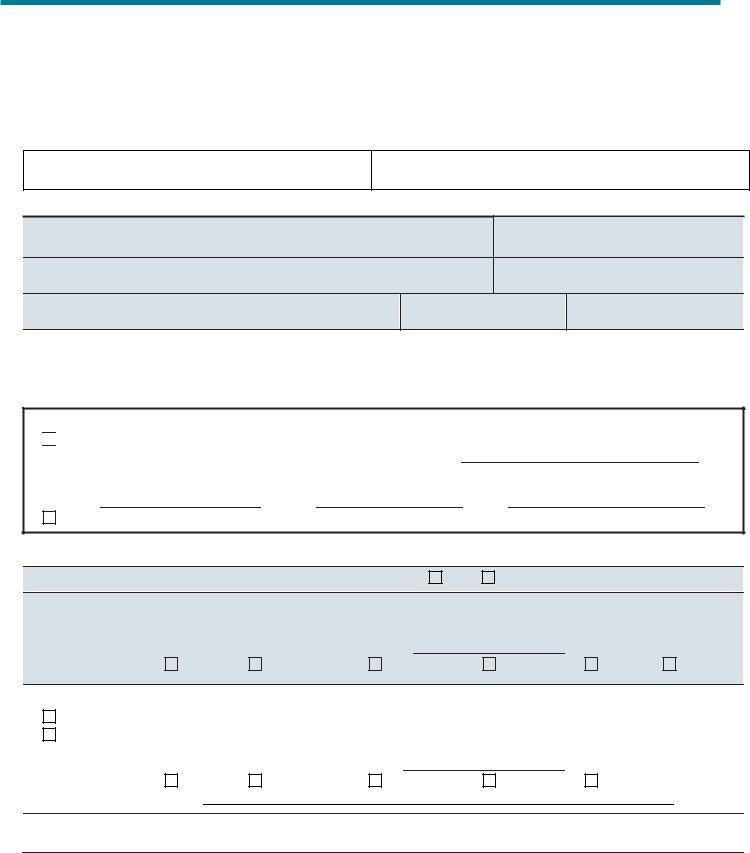

| Question | Answer |

|---|---|

| Form Name | Dch Form 1426 |

| Form Length | 16 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min |

| Other names | dch1426 form, michigan 1426, michigan mdhhs 1426 online, dch 1426 michigan |

Application for Health Coverage & Help Paying Costs

Use this application to see what coverage

choices you qualify for

•Affordable private health insurance plans that offer comprehensive

coverage to help you stay well

•A new tax credit that can immediately help pay your premiums for health coverage

•Free or

Who can use this application?

•Use this application to apply for anyone in your family.

•Apply even if you or your child already has health coverage. You could be eligible for

•Families that include immigrants can apply. You can apply for your child even if you aren’t eligible for coverage. Applying won’t affect your immigration status or chances of becoming a permanent resident or citizen.

•If someone is helping you fill out this application, you may need to complete Appendix C.

Apply faster online

Apply faster online at:

•For coverage through Healthy Michigan Plan and Other programs visit www.michigan.gov/mibridges

•To purchase insurance through the marketplace visit

www.healthcare.gov

What you may need to apply

•Social Security Numbers (or document numbers for any legal need to apply immigrants who need insurance)

•Employer and income information for everyone in your family (for example, from paystubs,

•Policy numbers for any current health insurance

•Information about any

Why do we ask for this information?

We ask about income and other information to let you know what coverage you qualify for and if you can get any help paying for it. We’ll keep all the information you provide private and secure, as required by law.

What happens next?

Send your complete, signed application to the address on page 9. If you don’t have all the information we ask for, sign and submit your application anyway. We’ll

Get help with this application?

•Visit our website www.michigan.gov/mibridges

•Phone: Call our application help line at

•In person: there may be counselors in your area who can help.

•En Español: Llame a nuestro centro de ayuda gratis al

Page 1 of 16 |

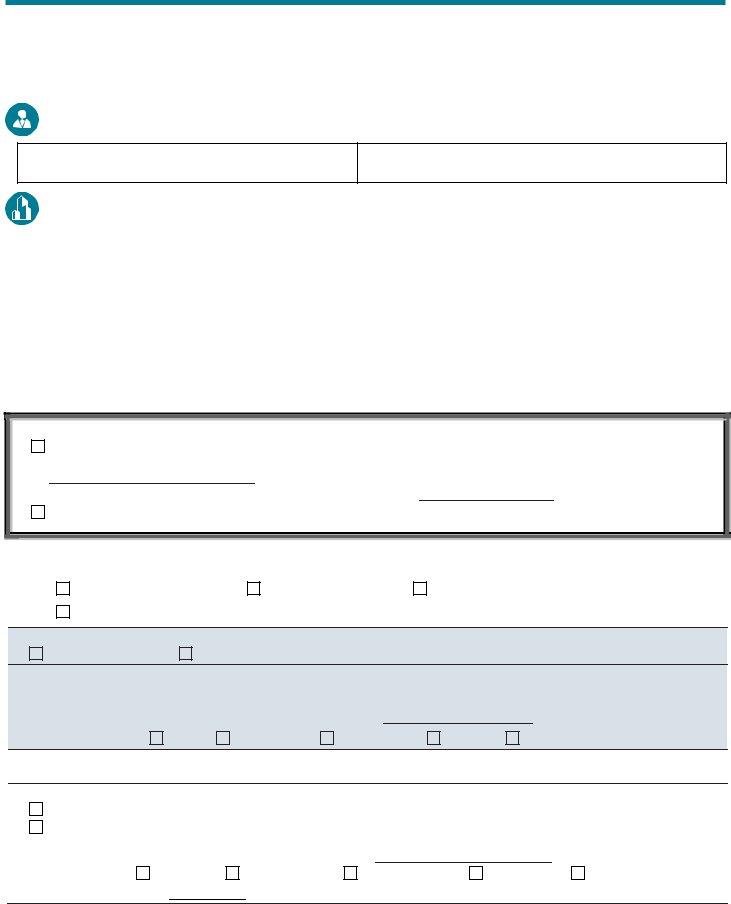

STEP 1

Tell us about yourself.

(We need one adult in the family to be the contact person for your application.)

1. First Name, Middle Name, Last Name, & Suffix

|

2. |

Home Address (Leave blank if you don’t have one.) |

|

|

|

|

|

3. Apartment or Suite Number |

|

|

|

|

|

|

|

|

|

|

|

|

4. |

City |

5. State |

|

|

6. ZIP code |

7. County |

||

|

|

|

|

|

|

|

|

|

|

|

8. |

Mailing Address (if different from home address) |

|

|

|

|

|

9. Apartment or Suite Number |

|

|

|

|

|

|

|

|

|

|

|

|

10. City |

11. State |

|

|

12. ZIP code |

13. County |

|||

|

|

|

|

|

|

|

|

|

|

|

14. Phone Number |

|

|

15. Other Phone Number |

|

|

|

||

|

|

|

|

|

|

|

|

||

|

16. Do you want to get information about this application by email? |

Yes |

No |

|

|

|

|||

|

Email address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. Preferred spoken or written language (if not English) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STEP 2 Tell us about your family.

Who do you need to include on this application?

Complete the Step 2 pages for every person in your family and household, even if the person has health coverage already. The information in this application helps us make sure everyone gets the best coverage they can. The amount of help or type of program you qualify for is based on the number of people in your family and their incomes. If you don’t include someone, even if they already have health coverage, your eligibility could be affected.

For adults who need coverage:

Include these people even if they aren’t applying for health coverage themselves:

•Any spouse

•Any son or daughter under age 21 they live with, including stepchildren

•Any other person on the same federal income tax return (Including any children over age 21 that are claimed on a parent’s tax return). You don’t need to file taxes to get health coverage.

For children under age 21 who need coverage:

Include these people even if they aren’t applying for health coverage themselves:

•Any parent (or stepparent) they live with

•Any sibling they live with

•Any son or daughter they live with, including stepchildren

•Any other person on the same federal income tax return. You don’t need to file taxes to get health coverage.

The amount of assistance or type of program you qualify for depends on the number of people in your family and their incomes. This information helps us make sure everyone gets the best coverage they can.

Complete Step 2 for each person in your family. Start with yourself, then add other adults and children. If you have more than

2 people in your family, you’ll need to make a copy of the pages and attach them. You don’t need to provide immigration status or a Social Security Number (SSN) for family members who don’t need health coverage. We’ll keep all the information you provide private and secure as required by law. We’ll use personal information only to check if you’re eligible for health coverage.

To be eligible for coverage, parents requesting health care coverage for themselves must provide proof that the children have creditable coverage, even if not applying for the children. Credible coverage is health insurance coverage under any of the following: a group health plan; individual health insurance; student health insurance; Medicare; Medicaid; CHAMPUS and TRICARE; The Federal Employees Health Benefits Program; Indian Health Service; The Peace Corps; Public Health Plan (any plan established or maintained by a State, the U.S. government, or a foreign country); Children’s Health Insurance Program (CHIP); or, a state health insurance high risk pool.

Page 2 of 16 |

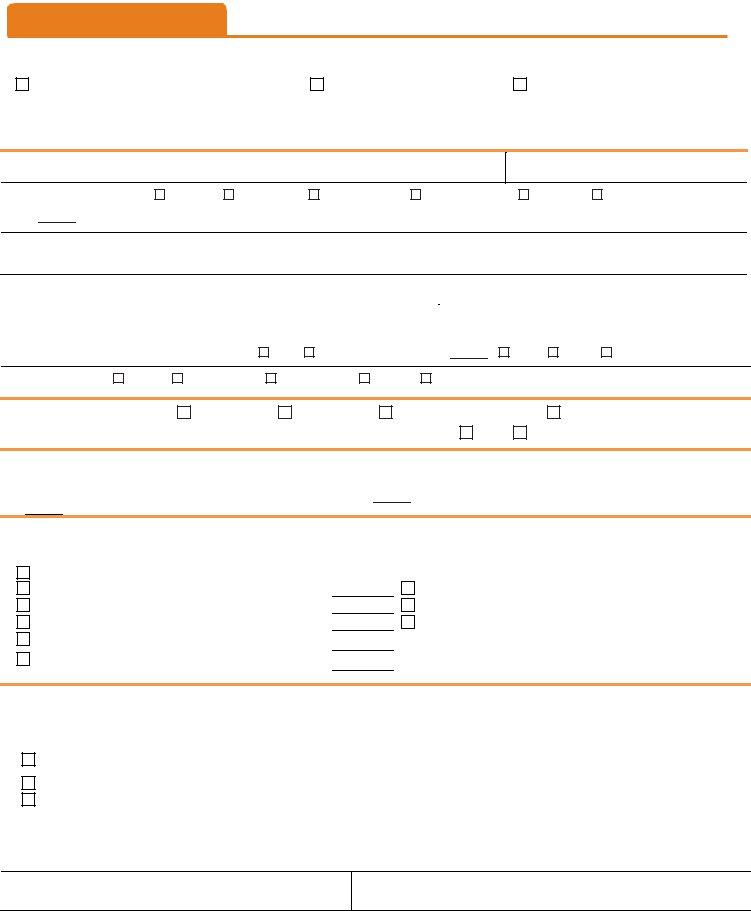

STEP 2: PERSON 1 (Start with yourself)

Complete Step 2 for yourself, your spouse/partner and children who live with you and/or anyone on your same federal income tax return if you file one. See page 1 for more information about who to include. If you don’t file a tax return, remember to still add family members who live with you.

1. First name, Middle name, Last name, & Suffix |

2. Relationship to you? |

|

|

|

|

|

|

|

|

SELF |

|

3. Date of birth (mm/dd/yyyy) |

|

4. |

Gender: |

|

5. Are you married? |

Yes |

No |

|

|

|

|

|

Male |

Female |

If YES, Spouse name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Do you live with at least one or more child(ren) under the age of 19, and are you the main person taking care of this child? |

Yes |

No |

|||||||

If Yes, provide child(ren) names and relationship to you: |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

7. Are you a |

Yes |

No |

|

|

|

|

|

|

|

8. Did you consume water from the Flint Water System and live, work or receive childcare or education at an address that was served by the Flint Water

System from April 2014 through present day? |

Yes |

No If yes, complete Appendix D. |

|||||||

9. Are you under 21? |

Yes |

No If YES, provide parent names |

|||||||

Mother's Name: |

|

|

|

|

|

|

|

Father's Name: |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

10. Social Security Number (SSN) |

|

- |

|

- |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

We need this if you want health coverage and have an SSN. Providing your SSN can be helpful if you don’t want health coverage too since it can speed up the application process. We use SSNs to check income and other information to see who’s eligible for help with health coverage costs. If someone wants help getting an SSN, call

11.Do you plan to file a federal income tax return NEXT YEAR?

(You can still apply for health insurance even if you don’t file a federal income tax return.)

YES. If yes, please answer questions |

|

NO. If no, skip to question c. |

|

|||||||

a. Will you file jointly with a spouse? |

Yes |

No |

|

|

|

|

||||

If yes, name of spouse: |

|

|

|

|

|

|

|

|||

b. Will you claim any dependents on your tax return? |

Yes |

No |

|

|

|

|||||

If yes, list name(s) of dependents: |

|

|

|

|

|

|

|

|||

c. Will you be claimed as a dependent on someone’s tax return? |

Yes |

No |

|

|||||||

If yes, please list the name of the tax filer: |

|

|

|

|

|

|

||||

How are you related to the tax filer? |

_______________________________________________________ |

|

||||||||

12. Are you pregnant now/last three months? |

Yes |

No If yes, how many babies are expected this pregnancy? |

|

|||||||

Due Date/end date? |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

13.Do you need health coverage?

(Even if you have insurance, there might be a program with better coverage or lower costs.)

YES. If yes, answer all the questions below. NO. If no, skip to the income questions on page 4. Leave the rest of this page blank.

13a. |

Were you in foster care in Michigan at age 18 or older? |

Yes |

No |

|

|

14. |

Do you have a physical, mental, or emotional health condition that causes limitations in activities (like bathing, dressing, daily chores, etc), live |

||||

|

in a medical facility or nursing home, or are you medically frail? |

Yes |

No |

||

|

|

|

|

|

|

15. Are you a U.S. citizen or U.S. national? |

Yes |

|

No |

|

|

|

|

|

|

|

|

16.If you aren’t a U.S. citizen or U.S. national, do you have eligible immigration status?

|

Yes. Fill in your document type and ID number below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

a. Immigration document type |

|

|

|

|

|

b. Document ID number |

|

|

|

|

|

|

|

|

|

|

||||||

|

c. Have you lived in the U.S. since 1996? |

Yes |

|

No |

d. Are you, or your spouse or parent a veteran or an |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

member of the U.S. military? |

Yes |

|

|

|

No |

|||||||||

|

e. U.S. entry date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. Do you want help paying for medical bills from the last 3 months? |

|

Yes |

No |

Which month(s) |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

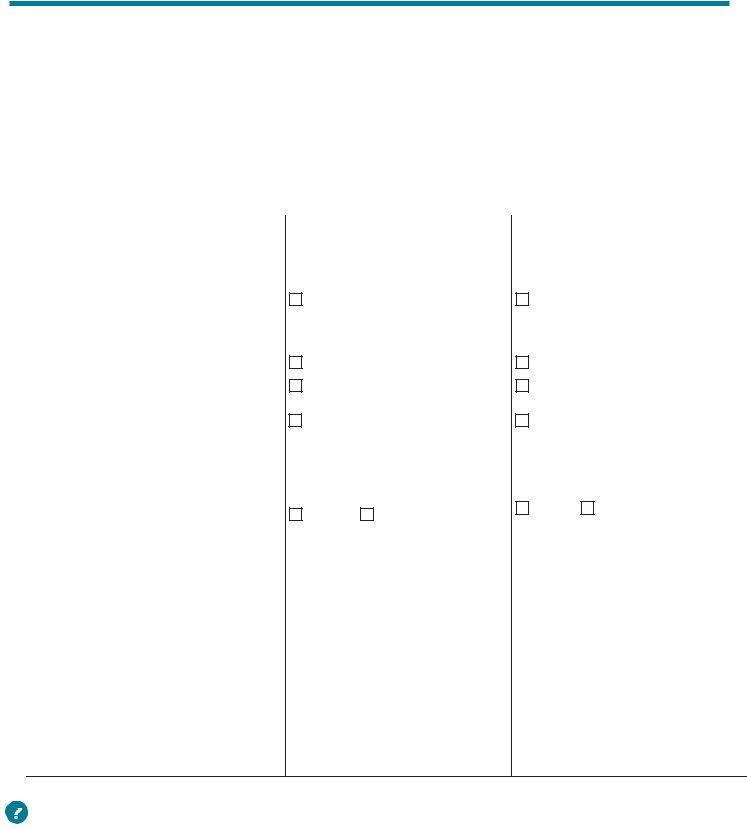

18. If Hispanic/Latino, ethnicity (OPTIONAL - check all that apply.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Mexican |

|

Mexican American |

|

Chicano/a |

|

Puerto Rican |

|

Cuban |

|

|

Other |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

19. Race (OPTIONAL - check all that apply.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

White |

|

|

American Indian or |

|

Filipino |

|

|

|

|

Other Asian |

|

|

|

Samoan |

||||||||

|

Black or African |

|

|

Alaska Native |

|

|

Japanese |

|

|

|

Native Hawaiian |

|

|

|

Other Pacific Islander |

||||||||

|

American |

|

|

Asian Indian |

|

|

Korean |

|

|

|

|

Guamanian or |

|

|

|

Other |

|||||||

|

|

|

|

Chinese |

|

|

Vietnamese |

|

|

|

Chamorro |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 of 16 |

STEP 2: PERSON 1 (Continue with yourself)

Current Job & Income Information

Employed |

Not employed |

If you're currently employed, tell us about |

Skip to question 30 |

your income. Start with question 20. |

|

CURRENT JOB 1:

20. Employer name and address

21. Employer phone number

22. Wages/tips (before taxes)

Hourly

Weekly

Every 2 weeks

Twice a month

Monthly

Yearly

$

23. Average hours worked each WEEK

CURRENT JOB 2: (If you have more jobs and need more space, attach another sheet of paper.)

24. Employer name and address |

25. Employer phone number |

|

|

26. Average # of hours expected to work |

|

per |

Week

Pay Period Rate of pay $

Hourly

Weekly

Other

27. How often paid:

Weekly

Every 2 weeks

Twice a month

Monthly

Other

28. In the past year, did you: |

Change jobs |

Stop working |

Start working fewer hours |

|

28a. Is your income in the previous three months consistent with the current month’s income? |

Yes |

|||

No

None of these

29.If

b.How much net income (profits once business expenses are paid) will you get from this

$

30. OTHER INCOME THIS MONTH: Check all that apply, give the amount and how often you get it.

NOTE: You don’t need to tell us about child support, veteran’s payment, or Supplemental Security Income (SSI).

None |

|

|

Unemployment |

$ |

How often? |

Pensions |

$ |

How often? |

Social Security |

$ |

How often? |

Retirement accounts |

$ |

How often? |

|

|

|

Alimony/Support rec’d |

$ |

How often? |

|

|

|

Net farming/fishing |

$ |

How often? |

|

|

Net rental/royalty |

$ |

How often? |

|

|

Other income |

$ |

How often? |

||

Type: |

|

|

|

|

Court Order Date |

|

|

|

|

|

|

|

||

|

|

|

|

|

31. DEDUCTIONS: Check all that apply, give the amount and how often you get it.

If you pay for certain things that can be deducted on a federal income tax return, telling us about them could make the cost of health coverage a little lower. NOTE: You shouldn’t include a cost that you already considered in your answer to net

Alimony/Support paid |

$ |

How often? |

|

Court Order Date |

|

|||

|

|

|

|

|

|

|

|

|

Other deductions |

$ |

How often? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Student loan interest |

$ |

How often? |

|

Type: |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32.YEARLY INCOME: Complete only if your income changes from month to month. If you don’t expect changes to your monthly income, skip to the next person.

Your total income this year

$

Your total income next year (if you think it will be different)

$

THANKS! This is all we need to know about you.

Page 4 of 16 |

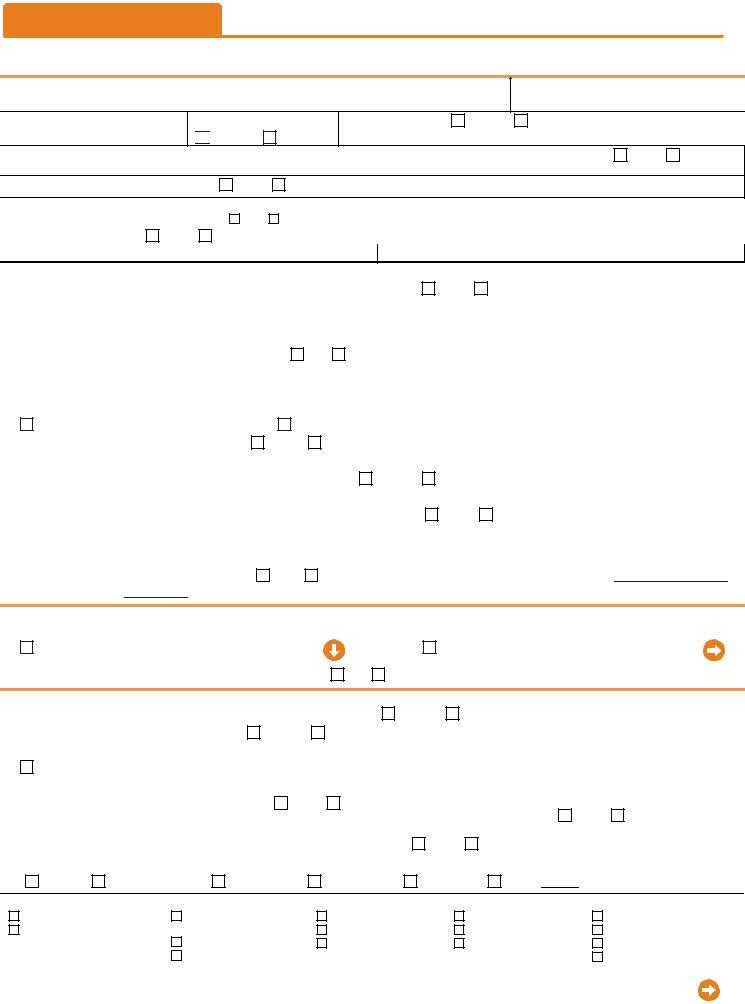

STEP 2: PERSON 2

Complete Step 2 for yourself, your spouse/partner, and children who live with you and/or anyone on your same federal income tax return if you file one. See page 1 for more information about who to include. If you don’t file a tax return, remember to still add family members who live with you.

1. First name, Middle name, Last name, & Suffix

2. Relationship to you?

3. Date of birth (mm/dd/yyyy)

4.Gender: Male

Female

5.Are you married? If YES, Spouse name:

Yes

No

6.Does PERSON 2 live with at least one chld under the age of 19, and are they the main person taking care of this child? If Yes, provide child(ren) names and relationship to you:

Yes

No

7. Is PERSON 2 a

Yes

No

8. Did you consume water from the Flint Water System and live, work or receive childcare or education at an address that was served by the Flint Water

System from April 2014 through present day? |

Yes |

No If yes, complete Appendix D. |

9.Is PERSON 2 under 21? Mother's name:

Yes

No If YES, provide parent names

Father's name:

Please answer the following questions if PERSON 2 is 22 or younger:

10. Did PERSON 2 have insurance through a job and lose it within the past 3 months?

Yes

No

a. If yes, end date: |

|

|

|

|

|

|

|

|

b. Reason the insurance ended: |

|

|

|||

11. Social Security Number (SSN) |

- |

|

- |

|

|

We need this if you want health care coverage and have a SSN. |

||||||||

|

|

|

|

|

|

|

||||||||

12. Does PERSON 2 live at the same address as you? |

Yes |

No |

||||||||||||

If no, list address: |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.Does PERSON 2 plan to file a federal income tax return NEXT YEAR?

(You can still apply for health insurance even if you don't file a federal income tax return.) |

|

|

|||||||||

YES. If yes, please answer questions |

|

NO. If no, skip to questions c. |

|

|

|||||||

a. Will PERSON 2 file jointly with a spouse? |

Yes |

No |

|

|

|

|

|||||

If yes, |

name of spouse: |

|

|

|

|

|

|

|

|||

b. Will PERSON 2 claim any dependents on his or her tax return? |

Yes |

No |

|

|

|||||||

If yes, |

list name(s) of dependents: |

|

|

|

|

|

|

|

|||

c. Will PERSON 2 be claimed as a dependent on someone's tax return? |

|

Yes |

No |

|

|||||||

If yes, |

please list the name of the tax filer: |

|

|

|

|

|

|

|

|||

How is PERSON 2 related to the tax filer: |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

14.Is PERSON 2 pregnant now/last three months? Due Date/end date?

Yes

No If yes, how many babies are expected this pregnancy?

15. Does PERSON 2 need health coverage?

(Even if they have insurance, there might be a program with better coverage or lower costs.)

YES. If yes, please answer questions below. |

|

|

NO. If no, skip to the income questions on page 6. |

|

|

|

Leave the rest of this page blank. |

15a. Was PERSON 2 in foster care in Michigan at age |

18 or older? |

Yes |

No |

16. Does PERSON 2 have a physical, mental, or emotional health condition that causes limitations in activities (like bathing, dressing, daily chores, etc),

live in a medical facility or nursing home, or are they medically frail? |

Yes |

No |

||

17. Is PERSON 2 a U.S. citizen or U.S. national |

Yes |

No |

|

|

18.If PERSON 2 isn't a U.S. citizen or U.S. national, do they have eligible immigration status?

Yes. Fill in their document type and ID Number below. |

|

|

|

|

|

|

|

|

|

|

|||

a. Document type |

|

|

|

|

b. Document ID number |

|

|

|

|

|

|

||

c. Has PERSON 2 lived in the U.S. since 1996? |

Yes |

No |

d. Is PERSON 2, or their spouse or parent a veteran or an |

||||||||||

e. U.S. entry date |

|

|

|

|

member in the U.S. military? |

Yes |

No |

||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

||||||||

19. Does PERSON 2 want help paying for medical bills from the last 3 months? |

Yes |

No Which month(s) |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20.If Hispanic/Latino, ethnicity (OPTIONAL - check all that apply.)

Mexican |

Mexican American |

Chicano/a |

Puerto Rican |

Cuban |

Other |

21.Race (OPTIONAL - check all that apply.)

|

White |

American Indian or |

Filipino |

Vietnamese |

Guamanian or Chamorro |

|

Black or African American |

Alaska Native |

Japanese |

Other Asian |

Samoan |

|

|

Asian Indian |

Korean |

Native Hawaiian |

Other Pacific Islander |

|

|

Chinese |

|

|

Other |

|

|

|

|

|

|

|

|

Page 5 of 16 |

|||

STEP 2: PERSON 2

Current Job & Income Information

Employed

If you're currently employed, tell us about your income. Start with question 22.

Not employed Skip to question 32.

CURRENT JOB 1:

22. Employer name and address

23. Employer phone number

24. Wages/tips (before taxes)

Hourly

Weekly

Every 2 weeks

Twice a month

Monthly

Yearly

$

25. Average hours worked each WEEK

CURRENT JOB 2: (If you have more jobs and need more space, attach another sheet of paper.)

26. Employer name and address |

27. Employer phone number |

|

|

28. Average # of hours expected to work |

|

per |

Week

Pay Period Rate of pay $

Hourly

Weekly

Other

29. How often paid:

Weekly

Every 2 weeks

Twice a month

Monthly

Other

30. In the past year, did you: |

Change jobs |

Stop working |

Start working fewer hours |

|

30a. Is your income in the previous three months consistent with the current month’s income? |

Yes |

|||

No

None of these

31.If

b.How much net income (profits once business expenses are paid) will you get from this

$

32. OTHER INCOME THIS MONTH: Check all that apply, give the amount and how often you get it.

NOTE: You don’t need to tell us about child support, veteran’s payment, or Supplemental Security Income (SSI).

None |

|

|

Unemployment |

$ |

How often? |

Pensions |

$ |

How often? |

Social Security |

$ |

How often? |

Retirement accounts |

$ |

How often? |

Alimony/Support rec’d |

$ |

How often? |

Net farming/fishing |

$ |

How often? |

||

Net rental/royalty |

$ |

How often? |

||

Other income |

$ |

How often? |

||

Type: |

|

|

|

|

Court Order Date |

|

|

|

|

|

|

|

|

|

33. DEDUCTIONS: Check all that apply, and give the amount and how often you get it.

If you pay for certain things that can be deducted on a federal income tax return, telling us about them could make the cost of health coverage a little lower.

NOTE: You shouldn’t include a cost that you already considered in your answer to net

Alimony/Support paid |

$ |

How often? |

|

Court Order Date |

||

Other deductions |

$ |

How often? |

|

|

|

|

Student loan interest |

$ |

How often? |

|

Type: |

||

|

|

|

|

|

|

|

34.YEARLY INCOME: Complete only if PERSON 2's income changes from month to month. NOTE: If you do not expect changes to PERSON 2 move on to STEP 3.

PERSON 2's total income this year |

PERSON 2's total income next year (if you think it will be different) |

$ |

$ |

THANKS! This is all we need to know about PERSON 2.

If you have more than two people to include, make a copy of Step 2: Person 2 (pages 5 and 6) and complete.

Page 6 of 16 |

STEP 3 American Indian or Alaska Native (AI/AN) family member(s)

1.Are you or is anyone in your family American Indian or Alaska Native?

No. If no, skip to Step 4

Yes. If yes, go to Appendix B.

STEP 4 Your Family’s Health Coverage

Answer these questions for anyone who needs health coverage. Answer the questions for child(ren) even if not applying for the child(ren),

1.Is anyone enrolled in health coverage now from the following?

YES. If yes, check the type of coverage and write the person(s) name(s) next to the coverage they have. |

NO. |

|

||||||||||||||

|

Medicaid |

|

|

Employer insurance |

|

|

|

|||||||||

|

CHIP/MIChild |

|

|

Name of health insurance: |

|

|

|

|||||||||

|

|

Policy Number: |

|

|

|

|||||||||||

|

(a) Medicare |

|

|

|

|

|||||||||||

|

|

Is this COBRA coverage? |

Yes |

No |

||||||||||||

|

(b) Do you want help paying Medicare premiums? |

Yes |

||||||||||||||

|

No |

|

|

|

|

|

|

Yes |

No |

|||||||

|

TRICARE (Don't check if you have direct care or Line of Duty) |

Is this a retiree health plan? |

||||||||||||||

|

Other |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

Name of health insurance |

|

|

|

|||||

|

VA health care programs |

|

|

Policy Number: |

|

|

|

|||||||||

|

|

Is this a |

||||||||||||||

|

Peace Corps |

|

||||||||||||||

|

|

Yes |

No |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

2.Is anyone listed on this application offered health coverage from a job? Check yes even if the coverage is from someone else's job, such as a parent or spouse.

YES. If yes, you'll need to complete and include Appendix A. Is this a state employee benefit plan?

NO. If no, continue to Step 5.

Yes

No

STEP 5 Read & sign this application.

•I’m signing this application under penalty of perjury which means I’ve provided true answers to all the questions on this form to the best of my knowledge. I know that I may be subject to penalties under state and federal law if I provide false and or untrue information.

•I know that I must tell the Michigan Department of Health and Human Services (MDHHS) if anything changes (and is different than) what I wrote on this application. I can visit www.michigan.gov/mibridges or call my specialist to report any changes. I understand that a change in my information could affect the eligibility for member(s) of my household.

•I know that under federal law, discrimination isn’t permitted on the basis of race, color, national origin, sex, age, sexual orientation, gender identity, or disability. I can file a complaint of discrimination by visiting www.hhs.gov/ocr/office/file.

•I confirm that no one applying for health insurance on this application is incarcerated (detained or jailed). if not,

is incarcerated.

(name of person)

We need this information to check your eligibility for help paying for health coverage if you choose to apply. We’ll check your answers using information in our electronic databases and databases from the Internal Revenue Service (IRS), Social Security Administration, the Department of Homeland Security, and/or a consumer reporting agency. If the information doesn’t match, we may ask you to send us proof.

Renewal of coverage in future years

To make it easier to determine my eligibility for help paying for health coverage in future years, I agree to allow the Marketplace and the State of Michigan to use income data, including information from tax returns. The Marketplace and the State of Michigan will send me a notice, let me make any changes, and I can opt out at any time.

Yes, renew my eligibility automatically for the next

5 years (the maximum number of years allowed), or for a shorter number of years:

4 years |

3 years |

2 years |

1 year |

Don’t use information from tax returns to renew my coverage. |

Page 7 of 16 |

If anyone on this application is eligible for Medicaid, Healthy Michigan Plan, or MIChild

•I am giving to the Michigan Department of Health and Human Services (MDHHS) our rights to pursue and get any money from other health insurance, legal settlements, or other third parties. I am also giving to the Michigan Department of Health and Human Services rights to pursue and get medical support from a spouse or parent.

• Does any child on this application have a parent living outside of the home? |

Yes |

No |

•If yes, I know I will be asked to cooperate with the agency that collects medical and child support from an absent parent. If I think that cooperating to collect medical and child support will harm me or my children, I can tell Medicaid and I may not have to cooperate.

Medicaid Estate Recovery (MA)

I understand that upon my death MDHHS has the legal right to seek recovery from my estate for services paid by Medicaid, including Healthy Michigan Plan. This means that some or all of my estate may be recovered. MDHHS will not seek to recover against the estate while there is a legal surviving spouse or a legal surviving child who is under the age of 21, blind, or disabled. An estate consists of real and personal property. If you have received an asset disregard due to a

My right to appeal

If I think the Health Insurance Marketplace or Medicaid, Healthy Michigan Plan, or MIChild has made a mistake, I can appeal its decision. To appeal means to tell someone at the Health Insurance Marketplace, Medicaid, Healthy Michigan Plan, or MIChild that I think the action is wrong, and ask for a fair review of the action. I know that I can find out how to appeal by contacting the Marketplace at

Bring or mail a signed, written hearing request to your MDHHS office. Faxes or photocopies are not acceptable. The

The hearing request must be signed by you or by your parent, spouse, attorney,

Michigan Administrative Hearings Service (MAHS) will deny your hearing request if we receive your request more than 90 days after we mailed the notice to deny, terminate or reduce your benefits. The person who signed the hearing request cannot show a court order or signed statement from you and is not your lawyer, spouse or parent.

Voter Registration |

|

|

If you are not already registered to vote at your current address, would you like to register to vote? |

Yes |

No |

Applying or declining to register to vote will not affect the amount of help that you will be provided. If you would like help filling out the voter registration application form, we will help you. The decision whether to seek or accept help is yours. You may fill out the voter registration application form in private.

If you believe that someone has interfered with your right to:

•Register to vote.

•Decline to register to vote.

•Privacy in deciding whether to register or in applying to register to vote.

•Choose your own political party or other political preference.

You may file a complaint with:

Secretary of State

PO Box 20126

Lansing, MI

NOTE: If you do not check either box, we will assume you have decided not to register to vote at this time. Checking ‘yes’ does not register you to vote. If you check ‘yes’ a voter registration application will be forwarded to you. You may also register online at www.michigan.gov/sos

Coordination of health care programs and providers (MA)

The State’s medical assistance program relies on a large number of managed care health programs, mental health and substance abuse programs, and private providers to deliver quality care to individuals like you. To make sure you receive a high level of care and that your benefits are coordinated, providers in the program may share information about your care (or your child or ward) with other providers in the program when such information and consultation is clinically needed.

Information about you, your child or ward (MA)

Necessary information may be shared between health plans and programs in which you participate. Health plans, programs and providers that deliver health care to you may share necessary information in order to manage and coordinate health care and benefits. This information may include, when applicable, information relative to HIV, AIDS,

Sign this application. The person who filled out Step 1 should sign this application. If you’re an authorized representative you may sign here, as long as you have provided the information required in Appendix C.

Computer

Page 8 of 16 |

Wages reported by my employer(s) to the Department of Labor and Economic Growth will be checked against wage information I report to the MDHHS. My Social Security Number will be used to check this information. Throughout the year, my Social Security Number will also be checked with other sources such as the Internal Revenue Service (IRS), Unemployment Compensation, and the Social Security Administration concerning income or assets.

The information obtained through this

Signature

Date (mm/dd/yyy)

STEP 6 Mail completed application.

Mail your signed application to:

Michigan Department of Health and Human Services

Health Insurance Affordability Program

PO Box 8123

Royal Oak, MI

Authority: The Patient Protection and Affordable Care Act (Publication

Completion: This form is required to enroll in health coverage.

Page 9 of 16 |

APPENDIX A

Health Coverage from Jobs

You DON’T need to answer these questions unless someone in the household is eligible for health coverage from a job. Attach a copy of this page for each job that offers coverage.

Tell us about the job that offers coverage.

Take the Employer Coverage Tool on the next page to the employer who offers coverage to help you answer these questions. You only need to include this page when you send in your application, not the Employer Coverage Tool.

EMPLOYEE Information

1. Employee name (First, Middle, Last)

2. Employee Social Security Number

EMPLOYER Information

3.Employer name

5.Employer address

4.Employer Identification Number (EIN)

6.Employer phone number

7. City

8. State

9. ZIP code

10. |

Who can we contact about employee health coverage at this job? |

|

|

|

|

11. |

Phone number (if different from above) |

12. Email address |

|

|

|

13.Are you currently eligible for coverage offered by this employer, or will you become eligible in the next 3 months? Yes (Continue)

13a. If you're in a waiting or probationary period, when can you enroll in coverage?

(mm/dd/yyyy)

List the names of anyone else who is eligible for coverage from this job.

Name:Name:Name:

No (Stop here and go to Step 5 in the application)

Tell us about the health plan offered by this employer.

14. Does the employer offer a health plan that meets the minimum value standard*?

Yes

No

15.For the

a.How much would the employee have to pay in premiums for this plan? $

b. How often?

Hourly

Weekly

Every 2 weeks

Twice a month

Monthly

Yearly

16. What change will the employer make for the new plan year (if known)?

Employer won't offer health coverage

Employer will start offering health care coverage to employees or change the premium for the

a. How much will the employee have to pay in premiums for that plan? $

b. How often? |

Weekly |

Date of change (mm/dd/yyyy)

Every 2 weeks

Twice a month

Quarterly

Yearly

*An

NEED HELP WITH YOUR APPLICATION? Visit www.michigan.gov/mibridges or call us at

Page 10 of 16 |

EMPLOYER COVERAGE TOOL

Use this tool to help answer questions in Appendix A about any employer health coverage that you’re eligible for (even if it’s from another person’s job, like a parent or spouse). The information in the numbered boxes below match the boxes on Appendix A. For example, the answer to question 14 on this page should match question 14 on Appendix A.

Write your name and Social Security number in boxes 1 and 2 and ask the employer to fill out the rest of the form. Complete one tool for each employer that offers health coverage.

EMPLOYEE Information

The employee needs to fill out this section.

1. Employee name (First, Middle, Last)

2. Social Security Number

EMPLOYER Information

|

|

|

Ask the employer for this |

information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Employer name |

|

|

|

|

4. |

Employer Identification Number (EIN) |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Employer address (the Marketplace will |

send notices to this address) |

|

|

6. |

Employer phone |

number |

|

|||

|

7. |

City |

|

|

|

8. State |

|

9. ZIP code |

|

|||

|

|

|

|

|

|

|||||||

|

10. |

Who can we contact about employee health coverage at this job? |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

11. |

Phone number (if different from above) |

|

12. Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

13. Is the employee currently eligible for coverage offered by this employer, or will the employee be eligible in the next 3 months?

Yes (Continue)

If the employee is not eligible today, including as a result of a waiting or probationary period, when is the employee eligible for coverage?

(mm/dd/yyyy)

If you're in a waiting or probationary period, when can you enroll in coverage?

No (STOP and return this form to employee)

Tell us about the health plan offered by this employer.

Does the employer offer a health plan that covers an employee’s spouse or dependent?

Yes. Which people?

No (Go to question 14)

Spouse

Dependent(s)

14. Does the employer offer a health plan that meets the minimum value standard*?

Yes (Go to question 15)

No (STOP and return form to employee)

15.For the

a. How much would the employee have to pay in premiums for this plan? $

b. How often?

Weekly

Every 2 weeks

Twice a month

Quarterly

Yearly

If the plan year will end soon and you know that the health plans offered will change, go to question 16. If you don’t know, STOP and return form to employee.

16. What change will the employer make for the new plan year (if known)?

Employer won't offer health coverage

Employer will start offering health care coverage to employees or change the premium for the

a . How much will the employee have to pay in premiums for that plan? $

b. How often? |

Weekly |

Date of change (mm/dd/yyyy)

Every 2 weeks

Twice a month

Quarterly

Yearly

*An

Page 11 of 16 |

APPENDIX B

American Indian or Alaska Native Family Member (AI/AN)

Complete this appendix if you or family members are American Indian or Alaska Native. Submit this with your Application for Health Coverage & Help Paying Costs.

Tell us about your American Indian or Alaska Native family member(s).

American Indians and Alaska Natives can get services from the Indian Health Services, tribal health programs, or urban Indian health programs. They also may not have to pay cost sharing and may get special monthly enrollment periods. Answer the following questions to make sure your family gets the most help possible.

NOTE: If you have more people to include, make a copy of this page and attach.

|

|

|

|

|

AI/AN PERSON 1 |

|

|

|

AI/AN PERSON 2 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Name |

First |

|

Middle |

First |

|

Middle |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(First name, Middle name, Last name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last |

|

|

|

Last |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Member of a federally recognized tribe? |

|

Yes |

|

|

|

|

Yes |

|

|

|

|

||

|

|

If yes, tribe name |

If yes, tribe name |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

No |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Has this person ever gotten a service from the |

|

Yes |

|

|

|

|

Yes |

|

|

|

|

|||

|

Indian Health Service, a tribal health program, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or urban Indian health program, or through a |

|

No |

|

|

|

|

No |

|

|

|

|

||

|

referral from one of these programs? |

|

|

|

|

|

|

|

|

|

||||

|

|

If no, is this person eligible to get services |

If no, is this person eligible to get services from |

|||||||||||

|

|

from the Indian Health Service, tribal health |

the Indian Health Service, tribal health |

|||||||||||

|

|

programs, or urban Indian health programs, |

programs, or urban Indian health programs, or |

|||||||||||

|

|

or through a referral from one of these |

through a referral from one of these programs? |

|||||||||||

|

|

programs? |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Yes |

No |

|

Yes |

No |

|||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Certain money received may not be counted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for Medicaid or the Children’s Health |

$ |

|

|

|

|

$ |

|

|

|

|

|

||

|

Insurance Program (CHIP). List any income |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(amount and how often) reported on your |

How often? |

How often? |

|||||||||||

|

application that includes money from these |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

sources: |

|

|

|

|

|

|

|

|

|

|

|

|

|

•Per capita payments from a tribe that come from natural resources, usage rights, leases, or royalties

•Payments from natural resources, farming, ranching, fishing, leases, or royalties from land designated as Indian trust land by the Department of Interior (including reservations and former reservations)

•Money from selling things that have cultural significance

NEED HELP WITH YOUR APPLICATION? Visit www.michigan.gov/mibridges or call us at

Page 12 of 16 |

APPENDIX C

Assistance with Completing this Application

You can choose an authorized representative.

You can give a trusted person permission to talk about this application with us, see your information, and act for you on matters related to this application, including getting information about your application and signing your application on your behalf. This person is called an "authorized representative." If you ever need to change your authorized representative, contact the Michigan Department of Health and Human Services. If you’re a legally appointed representative for someone on this application, submit proof with the application.

1. Name of authorized representative (First name, Middle name, Last name)

2. Address

3. Apartment or suite number

4. City

5. State

6. ZIP code

7. Phone number

8. Organization name

9. ID number (if applicable)

By signing, you allow this person to sign your application, get official information about this application, and act for you on all future matters with this department.

10. Your signature

11. Date (mm/dd/yyyy)

For certified application counselors, navigators, agents, and brokers only.

Complete this section if you’re a certified application counselor, navigator, agent, or broker filling out this application for somebody else.

1.Application start date (mm/dd/yyyy)

2.First name, Middle name, Last name, & Suffix

3. Organization name

11. Date (mm/dd/yyyy)

NEED HELP WITH YOUR APPLICATION? Visit www.michigan.gov/mibridges or call us at

Page 13 of 16 |

APPENDIX D

Flint Water Group

By completing these questions, you are requesting enhanced Medicaid coverage for individuals due to potential exposure to lead in the city of Flint water system.

Answer the questions below for anyone who is currently under age 21, pregnant, or pregnant within the last 2 months. Please list anyone who consumed water from the Flint water system and lived, worked, or received childcare or education at an address that was served by the Flint water system at any time from April 2014 through the present.

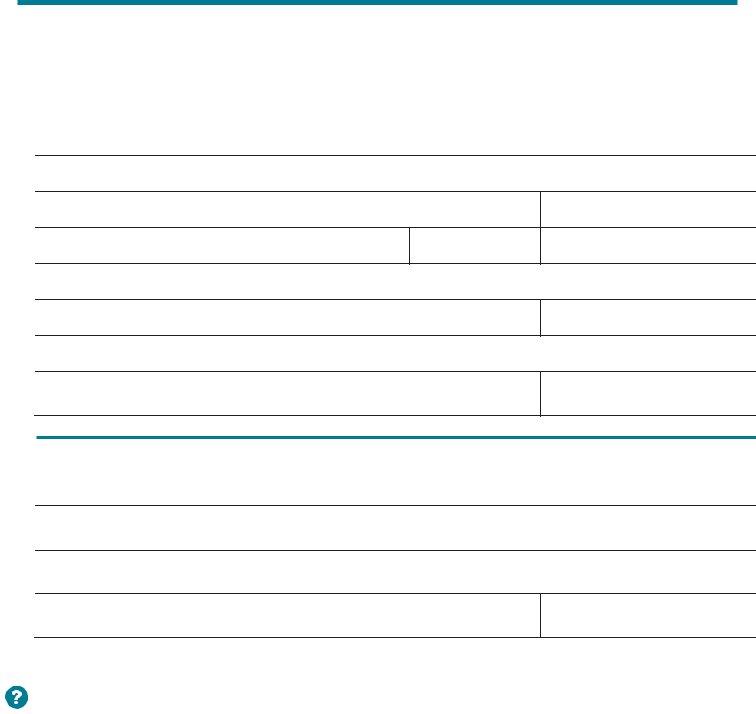

1.Between April 2014 and present day, did any applicant live at an address that was served by the Flint water system? Please include all addresses and indicate all applicants who lived at each address.

Address served by the Flint water system

Names of applicants who lived at the address

Dates applicants lived at the address (From/To)

2.Between April 2014 and present day, did any applicant work at an address that was served by the Flint water system? Please include all addresses and indicate all applicants who worked at each address.

Address served by the Flint water system

Names of applicants who worked at the address

Dates applicants worked at the address (From/To)

3.Between April 2014 and present day, did any applicant attend school or receive childcare at an address that was served by the Flint water system? Please include all addresses and indicate all applicants who attended school or received childcare at each address.

Address served by the Flint water system

Names of applicants who attended school/childcare at the address

Dates applicants attended school/childcare at the address (From/To)

You may be asked to provide verification or proof that you consumed water and lived, worked or received regular services (attend childcare or school) at an address that was served by the Flint water system from April 2014 through present day. Any knowingly false information or statements provided may be reviewed by the Office of Inspector General.

NEED HELP WITH YOUR APPLICATION? Visit www.michigan.gov/mibridges or call us at

Page 14 of 16 |

|

|

Michigan Department of Health and Human Services (MDHHS) |

|

|

|

|

|

|

|

|

|

|||||||||

|

Please note if needed, free language assistance services are available. |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Call |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

||||||||||||||

Spanish |

|

ATENCIÓN: si habla español, tiene a su disposición servicios gratuitos de asistencia |

|

|

|

|

||||||||||||||

|

|

lingüística. Llame al |

|

|

|

|

|

|

|

|

|

|

|

|||||||

Arabic |

|

مﻗر) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

Chinese |

|

注意:如果您使用繁體中文,您可以免費獲得語言援助服務。請致電 |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Syriac (Assyrian) |

|

ܵܵ |

ܵ ܿܿ |

ܿ |

ܿ |

ܿ |

ܿ |

ܵ ، |

ܵܵܿ ܵ |

ܵܵ |

ܿ |

ܿ |

|

|

ܿ |

ܿ |

: |

ܵܵ |

|

|

|

|

ܐܢܫܠܒܸ ܐܬܪܝܼܗܕܼ ܐܬܹܡܠܼ ܚܸܢܘܬܝܠܒܼ |

ܩܕܼ ܢܘܬܝܨܼ ܡ |

ܐܝܪܘܬܐ ܐܢܫܠܸܢܘܬܝܡܼ ܙܡܸ |

ܗܼ |

ܐܟܹܢܘܬܚܐܼ ܢܐܸ |

ܐܪܗܘܙܼ |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

ܵ |

|

ܿ |

|

|

|

ܵܿ |

|

|

|

|

|

|

|

|

|

|

|

|

|

ܐܢܝܢܡ ܠܥ ܢܘܪܩ ܬܝܐܢܓܡ |

||||||||

|

|

|

|

|

|

ܵ |

ܸ |

ܼ |

ܿ . |

ܼ |

ܵ |

|

ܼ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Vietnamese |

|

CHÚ Ý: Nếu bạn nói Tiếng Việt, có các dịch vụ hỗ trợ ngôn ngữ miễn phí dành cho bạn. Gọi số |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Albanian |

|

KUJDES: Nëse flitni shqip, për ju ka në dispozicion shërbime të asistencës gjuhësore, pa |

|

|

|

|||||||||||||||

|

|

pagesë. Telefononi në |

|

|

|

|

|

|

|

|

|

|

||||||||

Korean |

|

주의: 한국어를 사용하시는 경우, 언어 지원 서비스를 무료로 이용하실 수 있습니다. |

|

|

||||||||||||||||

|

|

|

|

|||||||||||||||||

|

|

4627 |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

||||||||||||||

Bengali |

|

ল�� ক�নঃ যিদ আপিন বাংলা, কথা বলেত পােরন, তাহেল িনঃখরচায় ভাষা সহায়তা |

|

|

|

|

||||||||||||||

|

|

পিরেষবা উপল� আেছ। েফান ক�ন |

|

|

|

|

|

|

||||||||||||

Polish |

|

UWAGA: Jeżeli mówisz po polsku, możesz skorzystać z bezpłatnej pomocy językowej. |

|

|

|

|

||||||||||||||

|

|

Zadzwoń pod numer |

|

|

|

|

|

|

|

|

|

|

|

|||||||

German |

|

ACHTUNG: Wenn Sie Deutsch sprechen, stehen Ihnen kostenlos sprachliche |

|

|

|

|

|

|

||||||||||||

|

|

Hilfsdienstleistungen zur Verfügung. Rufnummer |

|

|

|

|

||||||||||||||

Italian |

|

ATTENZIONE: In caso la lingua parlata sia l'italiano, sono disponibili servizi di assistenza |

|

|

|

|||||||||||||||

|

|

linguistica gratuiti. Chiamare il numero |

|

|

|

|

|

|

|

|||||||||||

Japanese |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Russian |

|

ВНИМАНИЕ: Если вы говорите на русском языке, то вам доступны бесплатные услуги |

|

|

||||||||||||||||

|

|

перевода. Звоните |

|

|

|

|

|

|

|

|

|

|

||||||||

|

OBAVJEŠTENJE: Ako govorite |

|

|

|

|

|||||||||||||||

|

|

besplatno. Nazovite |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Tagalog |

|

PAUNAWA: Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong |

||||||||||||||||||

|

|

sa wika nang walang bayad. Tumawag sa |

|

|

|

|

|

|||||||||||||

The Michigan Department of Health and Human Services (MDHHS) does not discriminate against any individual or group because of race, religion, age, national origin, color, height, weight, marital status, genetic information, sex, sexual orientation, gender identity or expression, political beliefs or disability. Further, MDHHS:

•Provides free aids and services to people with disabilities to communicate with us, such as: O Qualified sign language interpreters

O Written information in other formats (large print, audio, accessible electronic formats, other formats); and

•Provides free language services to people whose primary language is not English, such as:

OQualified interpreters

OInformation written in other languages

If you need these services, contact the Section 1557 Coordinator. The contact information is found below.

If you believe that MDHHS has not provided services, or discriminated in another way, you can file a grievance with the Section 1557 Coordinator. You can file a grievance in person or by mail, fax, or email. If you need help filing a grievance, the Section 1557 Coordinator is available to help you.

MDHHS Section 1557 Coordinator

Compliance Office, 4th Floor

P.O. Box 30195

Lansing, MI 48909

Page 15 of 16 |

You can also file a civil rights complaint with the responsible federal agency.

If your grievance or complaint is about your |

If your grievance or complaint is about your application for or current food |

Medicaid application, benefits or services |

assistance benefits, you can file a discrimination complaint with the U.S. |

you can file a civil rights complaint with the |

Department of Agriculture (USDA) Program by: |

U.S. Department of Health and Human |

|

Services at https://bit.ly/2pBS4YG, or by |

Completing a Complaint Form, |

mail or phone at: |

https://bit.ly/2g9zzpU or at any USDA office, or write a letter addressed to |

|

USDA at the address below. In your letter, provide all of the information |

U.S. Department of Health and Human |

requested in the form. |

Services |

|

200 Independence Avenue, SW |

To request a copy of the complaint form, call |

Room 509F, HHH Building |

Send your completed form or letter to USDA by mail: |

Washington, D.C. 20201 |

U.S. Department of Agriculture |

Office of the Assistant Secretary for Civil Rights |

|

|

1400 Independence Avenue, SW |

Complaint forms are available at |

Washington, D.C. |

https://bit.ly/2IKsHMS. |

|

|

Fax: |

MDHHS is an equal opportunity provider. |

|

Page 16 of 16 |