The DD Form 2058-2 serves as a vital document for Native American service members seeking an exemption from state income tax withholding on their military compensation. Enacted under the authority of 5 U.S.C. 5516, 5517, and Executive Order 9397, its primary purpose is to recognize the unique status of Native American military personnel who can claim a federally recognized tribe and reservation or Indian Country as their domicile. It mandates service members to furnish personal details, tribal affiliation, and certify their exemption eligibility based on established criteria. The form importantly emphasizes the voluntary nature of disclosure, yet highlights the necessity of a Social Security Number to prevent processing errors. This certificate does not only interface with the military's active duty pay system but also interacts with state tax authorities, ensuring the proper application of tax exemptions. Completion results in the cessation of state income tax withholding, facilitating financial relief for eligible service members. However, it obliges them to update any status changes impacting their exemption. Guidance from a Legal Assistance Officer is recommended for those uncertain about their domicile status, underscoring the form's role not only in tax exemption but also in legal clarity for Native American service members.

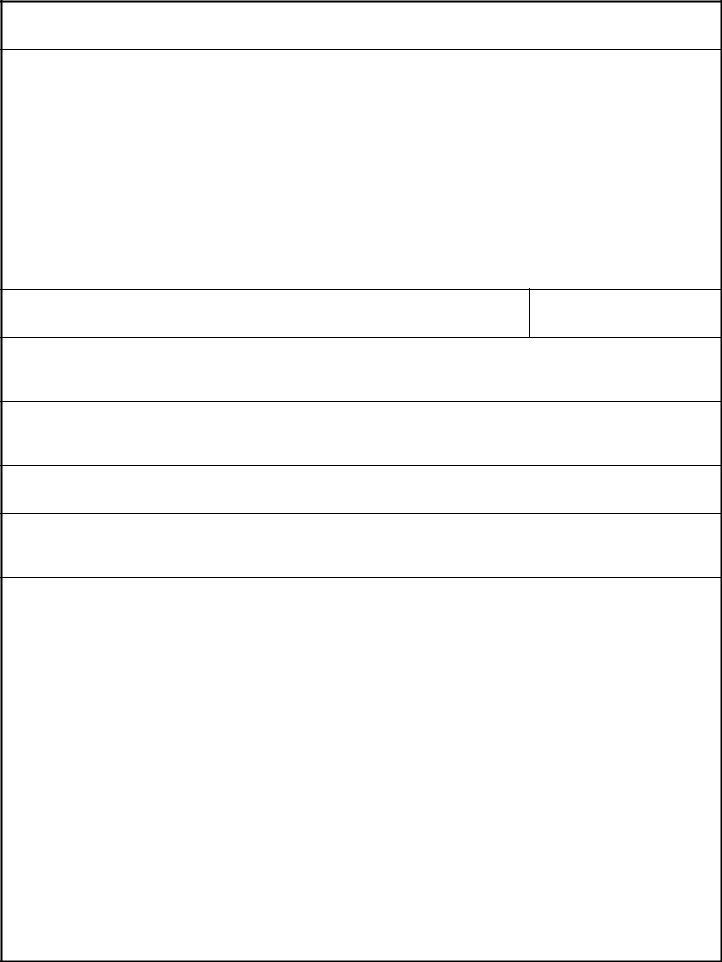

| Question | Answer |

|---|---|

| Form Name | Dd Form 2058 2 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | dd2058 2 dd form 2058 2 |

NATIVE AMERICAN STATE INCOME TAX WITHHOLDING EXEMPTION CERTIFICATE

PRIVACY ACT STATEMENT

AUTHORITY: 5 U.S.C. 5516, 5517, and EO 9397.

PRINCIPAL PURPOSE(S): To enable a Native American service member to stop State income taxes withholding from military compensation.

ROUTINE USE(S): The information obtained will become part of the active duty pay system of records of the service concerned and may be disclosed to routine users of these records (including State tax authorities) as disclosed in its record system notice.

DISCLOSURE: Disclosure is voluntary. Failure to complete this form will result in withholding of State income taxes from your pay. Disclosure of SSN is voluntary. However, to avoid erroneous application of your withholding exemption to the account of another member, this exemption certificate will not be processed without your SSN.

1.NAME (Last, First, Middle Initial)

2. SOCIAL SECURITY NUMBER

3.MILITARY ADDRESS (Unit, Street, City, State, ZIP Code)

4.CURRENT MAILING ADDRESS (Street, City, State, ZIP Code)

5.NAME OF FEDERALLY RECOGNIZED TRIBE THAT YOU ARE A MEMBER OF

6.NAME OF FEDERALLY RECOGNIZED TRIBAL RESERVATION OR INDIAN COUNTRY THAT YOU CLAIM AS YOUR DOMICILE (Include the name of the State the reservation is located within)

7.I CERTIFY THAT I ANTICIPATE MEETING THE TWO CONDITIONS NECESSARY TO BE EXEMPT FROM WITHHOLDING

FOR THE CALENDAR YEAR |

|

. I ALSO DECLARE THAT I WILL IMMEDIATELY NOTIFY THE FINANCE OFFICER |

|

|

|

|

|

OF ANY CHANGES THAT AFFECT MY WITHHOLDING STATUS. |

|||

|

|

|

|

8. SIGNATURE OF APPLICANT |

|

|

9. DATE (YYYYMMDD) |

|

|

|

|

INSTRUCTIONS

Completing this certificate allows you to claim exemption from State income tax withholding on your military compensation if you satisfy the following tests:

1.You claim as your State of legal residency/domicile a federally recognized tribal reservation or Indian Country.

2.You are an enrolled member of that federally recognized Native American tribe.

If you satisfy these conditions, the Soldiers' and Sailors' Civil Relief Act provides that your tax home remains on the reservation/in Indian country. Consequently, you may stop State income tax withholding on your military compensation.

If you have any doubt with regard to your State of legal residence/domicile, you are advised to see your Legal Assistance Officer (JAG representative) for advice prior to completing this form.

Effective date of exemption election. Withholding of State income tax will stop the month after the month in which you file this certificate. DFAS cannot make retroactive adjustments.

DD FORM