The DD 2656-6 form, known as the Survivor Benefit Plan (SBP) Election Change Certificate, plays a crucial role for uniformed service retirees looking to amend their SBP elections due to significant life events. This document, governed under the guidelines of 10 U.S.C. Chapter 73, subchapters II and III, DoD Instruction 1332.42, and DoD Financial Management Regulation, Volume 7B, Chapter 43, along with Executive Order 9397 (SSN) delineates a structured pathway for retirees to adjust their SBP coverage. Whether driven by marriage, remarriage, the birth or adoption of a child, divorce, or the death of a spouse, this form facilitates the necessary adjustments to ensure that the Survivor Benefit Plan aligns with the current realities of the retiree’s life. Completing the form accurately is voluntary but crucial; errors or omissions can delay or incorrectly alter the survivor benefits payable in the unfortunate event of the member's death. The instructions within the form guide retired members through the process of modifying their election, specifying the occurrence of specific conditions that make them eligible for such changes. It also directs them to include requisite documentary evidence, such as marriage certificates or divorce decrees, to support their election change. Depending on their service branch, retirees are instructed to submit the completed form either to the Defense Finance and Accounting Service or the U.S. Public Health Service/Commissioned Corps. With its emphasis on ensuring the right coverage for survivors, the DD 2656-6 form underscores the importance of keeping beneficiary information up-to-date, reflecting the dynamics of the retiree’s family life.

| Question | Answer |

|---|---|

| Form Name | Dd Form 2656 6 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | dd form 2656 6 fillable, dd form 2656 fillable pdf, survivor benefit plan form, dd form 2656 6 |

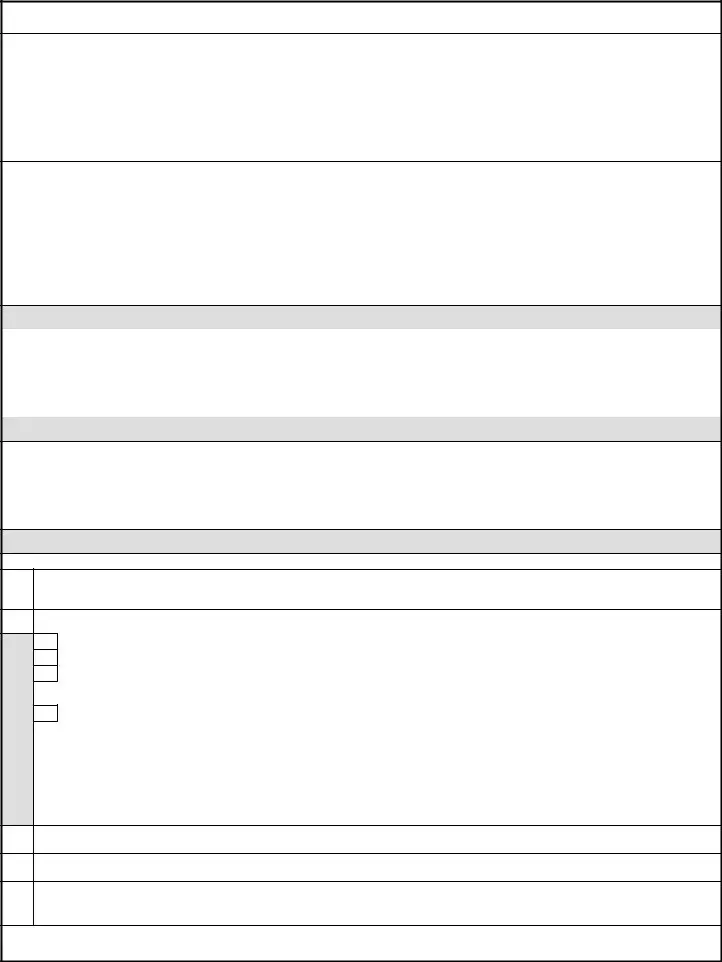

SURVIVOR BENEFIT PLAN ELECTION CHANGE CERTIFICATE

PRIVACY ACT STATEMENT

AUTHORITY: 10 U.S.C. Chapter 73, subchapters II and III; DoD Instruction 1332.42, Survivor Annuity Program Administration; DoD Financial Management Regulation, Volume 7B, Chapter 43; and E.O. 9397 (SSN).

PRINCIPAL PURPOSE(S): Used by uniformed service retirees to change their Survivor Benefit Plan election upon certain events occurring.

ROUTINE USE(S): None.

DISCLOSURE: Voluntary; however, failure to provide the requested information may result in an incorrect election and/or delayed payment of survivor benefits in the event of the member's death..

INSTRUCTIONS

This form is used to change a Survivor Benefit Plan election. A retired member may change an election under certain circumstances when specific conditions are met. Section III of this form describes these conditions and instructs you what additional sections of the form to complete. Complete this form and submit to the appropriate agency listed below with appropriate documentation, such as marriage certificates, birth certificates, divorce decree, etc., as required. Contact your Service Representative if you have questions or need assistance completing this form. For Army, Navy, Air Force and Marine Corps accounts, send the completed form to: Defense Finance and Accounting Service, US Military Retirement Pay, PO Box 7130, London, KY

NOTE: Do NOT use this form to elect to terminate SBP coverage under the provisions of Title 10 U.S.C., Section 1448a. Use DD Form

Do NOT use this form to elect coverage for a former spouse. Use DD Form

SECTION I - MEMBER INFORMATION

1. |

NAME (Last, First, Middle Initial) |

2. SOCIAL SECURITY NUMBER |

3. DATE OF RETIREMENT |

4. DATE OF BIRTH |

|

|

|

(YYYYMMDD) |

(YYYYMMDD) |

|

|

|

|

|

5. |

MAILING ADDRESS (Street, Apartment Number, City, State, and ZIP Code) |

6. TELEPHONE NUMBER |

||

|

|

|

|

(Include area code) |

|

|

|

|

|

SECTION II - CURRENT COVERAGE

7. MY CURRENT COVERAGE IS: (X one)

|

NO COVERAGE |

|

SPOUSE ONLY |

|

CHILD ONLY |

|

SPOUSE AND CHILD |

|

|

|

|

|

|

|

|

|

INSURABLE INTEREST |

|

FORMER SPOUSE |

|

FORMER SPOUSE AND |

|

SUSPENDED COVERAGE |

|

|

|

CHILD |

|

(See NOTE) |

||

|

|

|

|

|

|

NOTE: Suspended coverage occurs when the member loses his/her spouse beneficiary to death or divorce; or his/her former spouse beneficiary remarries before age 55; or his/her children exceed the age for eligibility.

SECTION III - CONDITIONS THAT TRIGGER ELIGIBILITY TO CHANGE COVERAGE

8. I AM REQUESTING A CHANGE IN COVERAGE BASED ON: (X all that apply)

MARRIAGE. A member, who does not have a spouse at the time of initial eligibility, may provide SBP for the first spouse acquired after retirement by electing coverage before the first anniversary of that marriage. Coverage and cost begin on the first anniversary of the marriage (coverage begins immediately upon the birth of a child to the member and spouse beneficiary).

REMARRIAGE. A member whose spouse coverage is suspended due to death of the spouse or divorce, has three options upon remarriage (choose one option only by placing an X in the appropriate block):

(1)Resume existing level of coverage for my new spouse (X appropriate block in Section IV);

(2)Increase existing level of coverage - up to full retired pay (Complete Section IV);

(3)Not resume any SBP coverage for my new spouse (Complete Sections VI and VII).

The following additional option is available for members who have former spouse coverage, who remarry and the member is allowed to discontinue that coverage:

(4) Select coverage for my new spouse if my current coverage is former spouse coverage (Complete Section IV).

NOTE: An election in Section V which increases my initial level of coverage will result in an amount owed that is equal to the difference between the amount of SBP costs that would have been incurred if the new level of coverage had originally been elected and the amount of SBP costs that I have incurred to date, plus interest. I understand that payment of the amount owed must be made prior to the first anniversary of the remarriage. I also understand that although this election must be submitted within the first year of marriage, my new spouse will not be an eligible SBP beneficiary until the first anniversary of our marriage (or upon the birth of our child born after the date of our marriage, if earlier). My failure to notify DFAS or the PHS payroll office, as appropriate, of my SBP decision will result in automatic coverage at the previous level and a debt for monthly premiums will accrue beginning upon the first anniversary of our marriage. In the event of my death, payment of the monthly premium debt must be completed before my spouse will receive payment of the SBP annuity.

ACQUIRING A DEPENDENT CHILD. A member who does not have a dependent child at the time of initial eligibility for SBP may elect coverage for a dependent child within the

DIVORCE. A member with spouse coverage who divorces, AND who does not elect former spouse coverage, is automatically in a "Suspended Coverage" status. To elect former spouse coverage, submit DD Form

DEATH OF SPOUSE. A member with spouse coverage, who subsequently loses that spouse to death, must select "Suspend Coverage" in Section IV. Reminder: Death does not permanently terminate SBP spouse coverage. Coverage and costs are simply suspended pending future events.

NOTE: If either "Divorce" or "Death of Spouse" is selected, and the member had previously elected spouse and child coverage, the coverage would

convert to "Child Only" coverage if the member has an eligible child. Exception: In the event of divorce and the member is required to provide former spouse coverage.

DD FORM |

PREVIOUS EDITION IS OBSOLETE. |

Adobe Professional 8.0 |

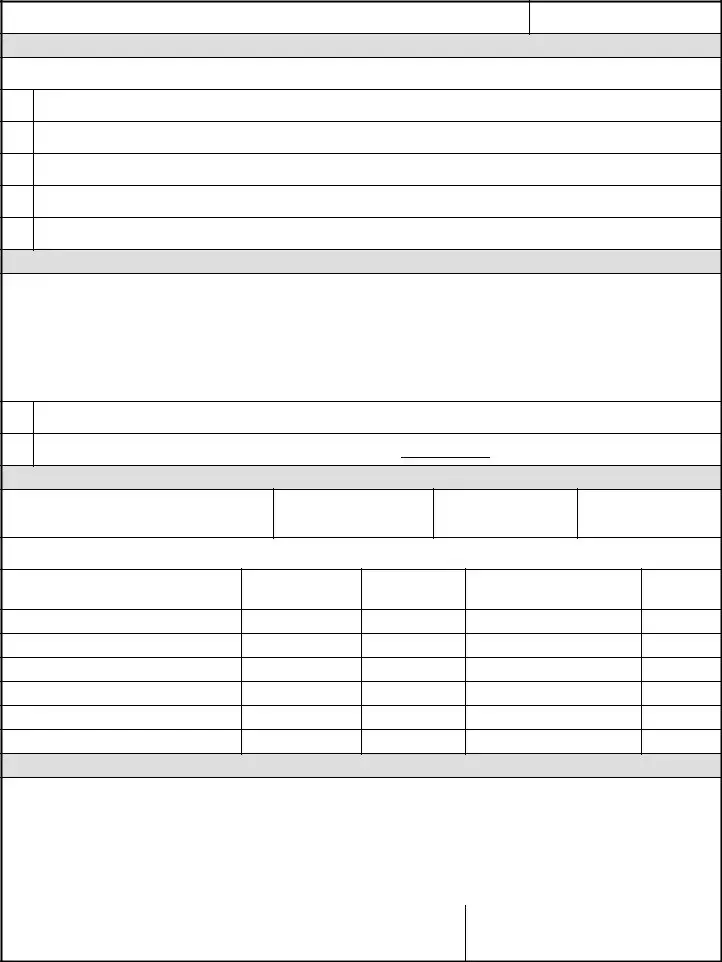

MEMBER NAME (Last, First, Middle Initial)

SSN

SECTION IV - REQUESTED CHANGE TO COVERAGE

9.PLACE AN X IN THE APPROPRIATE BOX TO INDICATE YOUR ELECTION. NOTE: If you are changing to former spouse coverage, disregard this form. Instead, submit DD Form

RESUME EXISTING COVERAGE. (Complete Sections VI and VII below.)

SPOUSE ONLY. (Complete Sections V through VII below.)

SPOUSE AND CHILD(REN). (Complete Sections V through VII below.)

CHILD(REN) ONLY. (Complete Sections V through VII below.)

SUSPEND COVERAGE. (Complete Section VII below.)

SECTION V - LEVEL OF COVERAGE

10.If this is an initial election (or if increasing the level of coverage following remarriage), select the monthly amount of retired pay you wish to have the survivor annuity based on. NOTE: You cannot decrease the level of existing coverage. Your covered spouse beneficiary will receive an annuity that will pay 55 percent of the level of coverage you select until their age 62 and will pay between 45 to 50 percent during the

Place an X in the appropriate box to indicate your election.

FULL RETIRED PAY.

REDUCED AMOUNT OF RETIRED PAY (Cannot be less than $300.00) $

SECTION VI - SPOUSE AND CHILD(REN) INFORMATION (If applicable)

11.A. SPOUSE'S NAME (Last, First, Middle Initial)

B. SOCIAL SECURITY NUMBER

C. DATE OF BIRTH

(YYYYMMDD)

12.DATE OF MARRIAGE (YYYYMMDD)

13.DEPENDENT CHILDREN. Complete this section for your unmarried, dependent children who are under age 18; or under age 22 if full time students; or any age if disabled and incapable of

a.CHILD'S NAME (Last, First, Middle Initial)

b. SOCIAL SECURITY NUMBER

c. DATE OF BIRTH

(YYYYMMDD)

d. RELATIONSHIP (Son, daughter, stepson, etc.) (Indicate "FS" if from previous marriage)

e.DISABLED?

(Yes/No)

SECTION VII - MEMBER SIGNATURE

A NOTARY PUBLIC OR SBP COUNSELOR MUST WITNESS THE MEMBER'S SIGNATURE. The witness cannot be the member's spouse, or

beneficiary.

14. SIGNATURE OF MEMBER |

|

15. DATE SIGNED (YYYYMMDD) |

|

|

|

16.A. PRINTED NAME OF WITNESS |

B. SIGNATURE |

C. DATE SIGNED (YYYYMMDD) |

(Last, First, Middle Initial) |

|

|

|

|

|

D. MAILING ADDRESS OF WITNESS (Include ZIP Code)

E. (For Notary Use Only)

MY COMMISSION EXPIRES: (YYYYMMDD)

DD FORM