Dealing with PDF documents online can be super easy with this PDF editor. You can fill out dd form 879 fillable here without trouble. The editor is continually upgraded by our staff, getting awesome functions and becoming much more convenient. Here's what you would want to do to begin:

Step 1: Click on the "Get Form" button above. It'll open our pdf tool so you can begin filling in your form.

Step 2: As you launch the tool, you will find the form prepared to be filled out. Besides filling out various fields, you can also do other sorts of things with the Document, namely writing your own text, changing the initial textual content, inserting illustrations or photos, affixing your signature to the form, and a lot more.

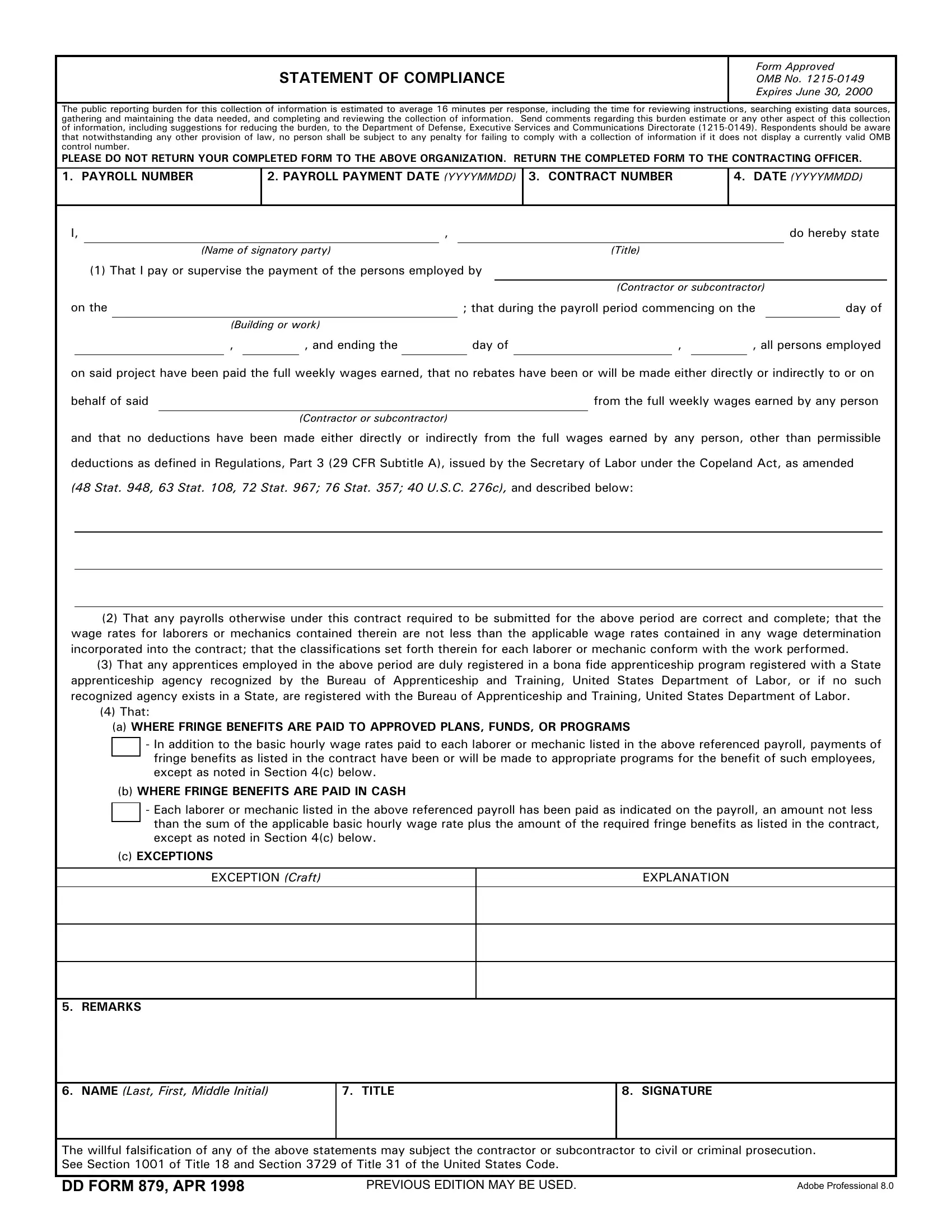

When it comes to blank fields of this particular form, this is what you should know:

1. The dd form 879 fillable involves certain details to be entered. Make sure the next blank fields are filled out:

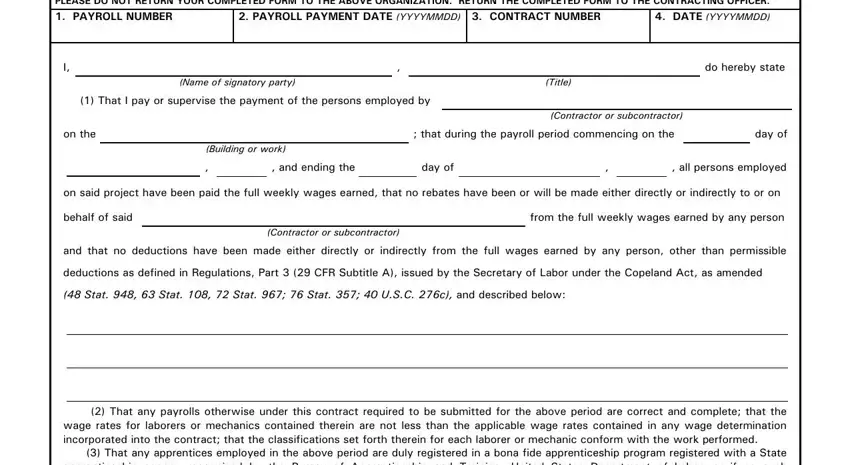

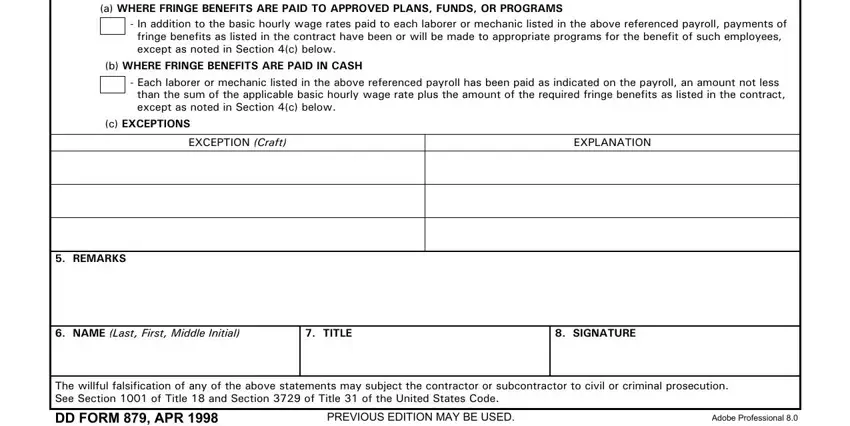

2. After the last part is finished, you're ready add the necessary particulars in That any payrolls otherwise under, In addition to the basic hourly, b WHERE FRINGE BENEFITS ARE PAID, Each laborer or mechanic listed, c EXCEPTIONS, EXCEPTION Craft, EXPLANATION, REMARKS, NAME Last First Middle Initial, TITLE, SIGNATURE, The willful falsification of any, and PREVIOUS EDITION MAY BE USED Adobe allowing you to proceed further.

As for PREVIOUS EDITION MAY BE USED Adobe and TITLE, be sure you review things in this current part. These two are the most important ones in this page.

Step 3: Confirm that your details are correct and click on "Done" to complete the process. Right after setting up afree trial account at FormsPal, it will be possible to download dd form 879 fillable or email it promptly. The PDF form will also be accessible via your personal account menu with all your edits. Whenever you work with FormsPal, you can certainly fill out documents without being concerned about database incidents or entries getting distributed. Our protected platform ensures that your private information is stored safe.