Our PDF editor that you're going to make use of was created by our top developers. You can complete the de 2063 form instantly and effortlessly with our application. Just adhere to this specific guide to start out.

Step 1: Choose the button "Get Form Here" on this site and hit it.

Step 2: Now you can modify your de 2063. You may use the multifunctional toolbar to insert, delete, and modify the text of the document.

Fill out the next segments to create the file:

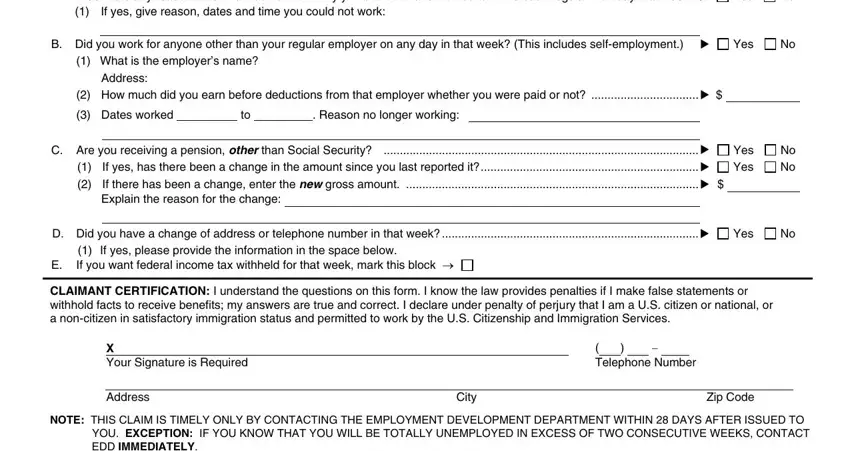

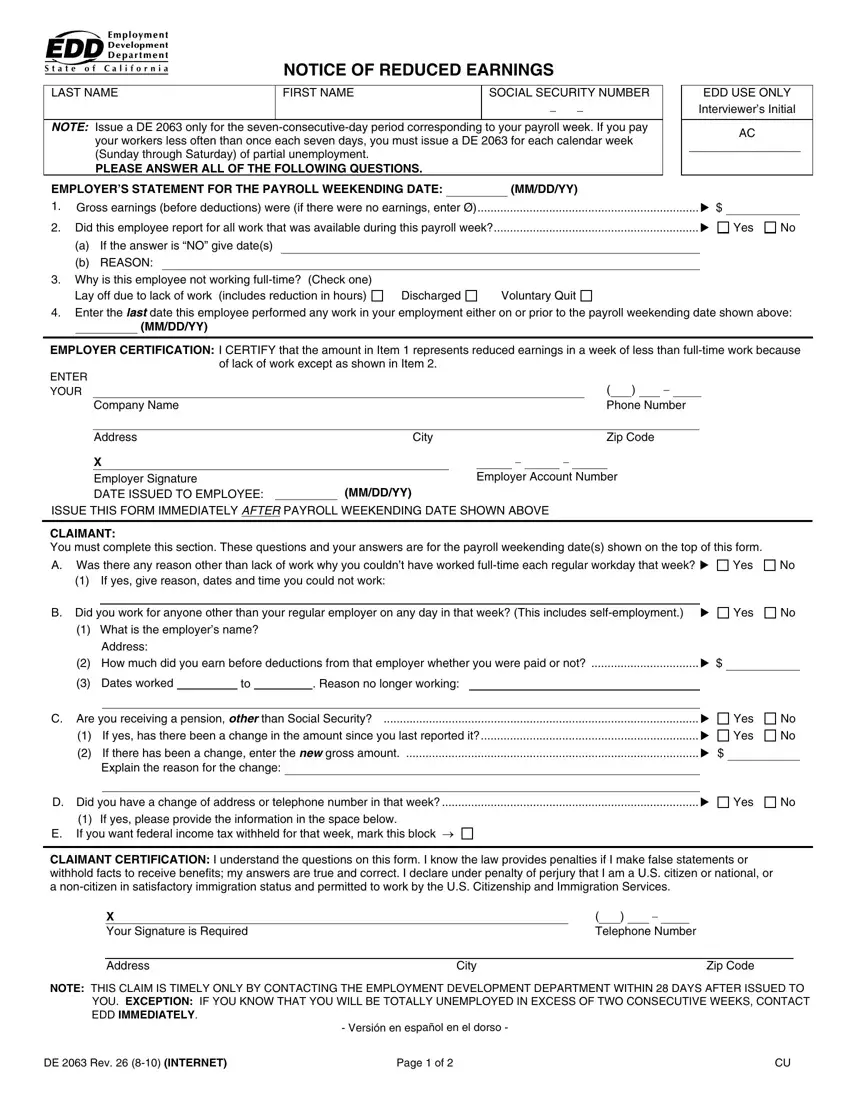

You have to fill out the CLAIMANT You must complete this, Yes, If yes give reason dates and time, B Did you work for anyone other, Yes, What is the employers name, Address, How much did you earn before, Reason no longer working, C Are you receiving a pension, Yes If yes has there been a, No No, D Did you have a change of address, Yes, and If yes please provide the box with the essential information.

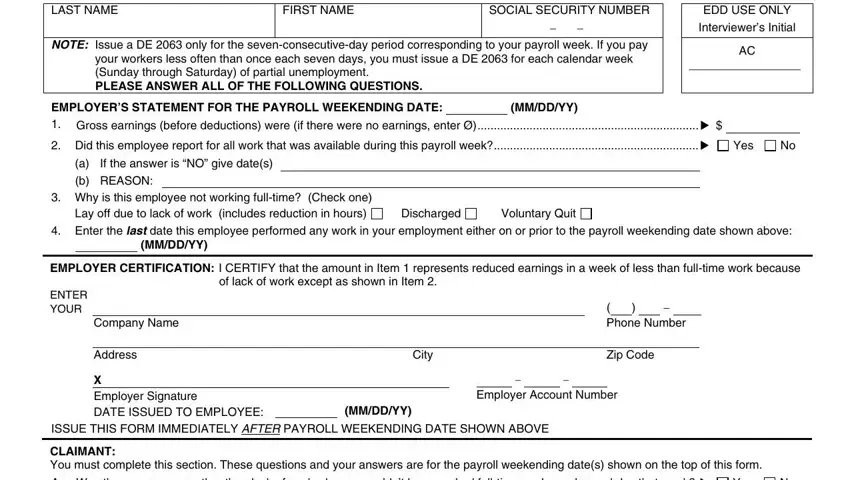

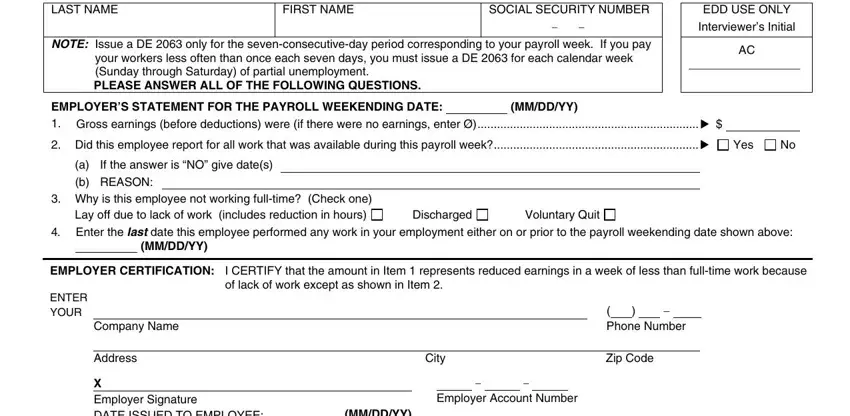

In the section dealing with LAST NAME, NOTICE OF REDUCED EARNINGS FIRST, SOCIAL SECURITY NUMBER, NOTE Issue a DE only for the, your workers less often than once, EDD USE ONLY Interviewers Initial, EMPLOYERS STATEMENT FOR THE, MMDDYY, Did this employee report for all, Yes, If the answer is NO give dates, a b REASON, Why is this employee not working, Discharged, and Voluntary Quit, it's important to type in some significant particulars.

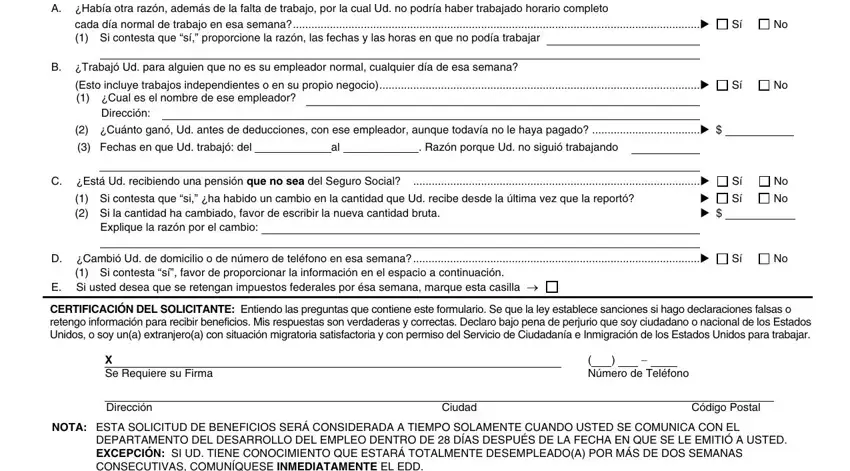

Please make sure to list the rights and obligations of the sides in the A Había otra razón además de la, cada día normal de trabajo en esa, B Trabajó Ud para alguien que no, Esto incluye trabajos, Dirección, Cuánto ganó Ud antes de, Razón porque Ud no siguió, C Está Ud recibiendo una pensión, Si contesta que si ha habido un, Explique la razón por el cambio, D Cambió Ud de domicilio o de, Si contesta sí favor de, E Si usted desea que se retengan, CERTIFICACIÓN DEL SOLICITANTE, and X Se Requiere su Firma space.

Step 3: Choose the "Done" button. So now, it is possible to export the PDF file - download it to your electronic device or forward it by using email.

Step 4: Be certain to prevent future complications by creating as much as two copies of your form.

Yes

Yes

No

No