You can complete ca spousal property petition instantly in our online tool for PDF editing. FormsPal is dedicated to giving you the absolute best experience with our editor by regularly releasing new capabilities and enhancements. Our tool is now even more useful thanks to the newest updates! So now, editing PDF files is a lot easier and faster than ever. To start your journey, take these basic steps:

Step 1: Open the form inside our tool by hitting the "Get Form Button" in the top section of this page.

Step 2: The tool offers you the opportunity to change PDF documents in a range of ways. Change it by including any text, correct what is originally in the file, and put in a signature - all manageable in minutes!

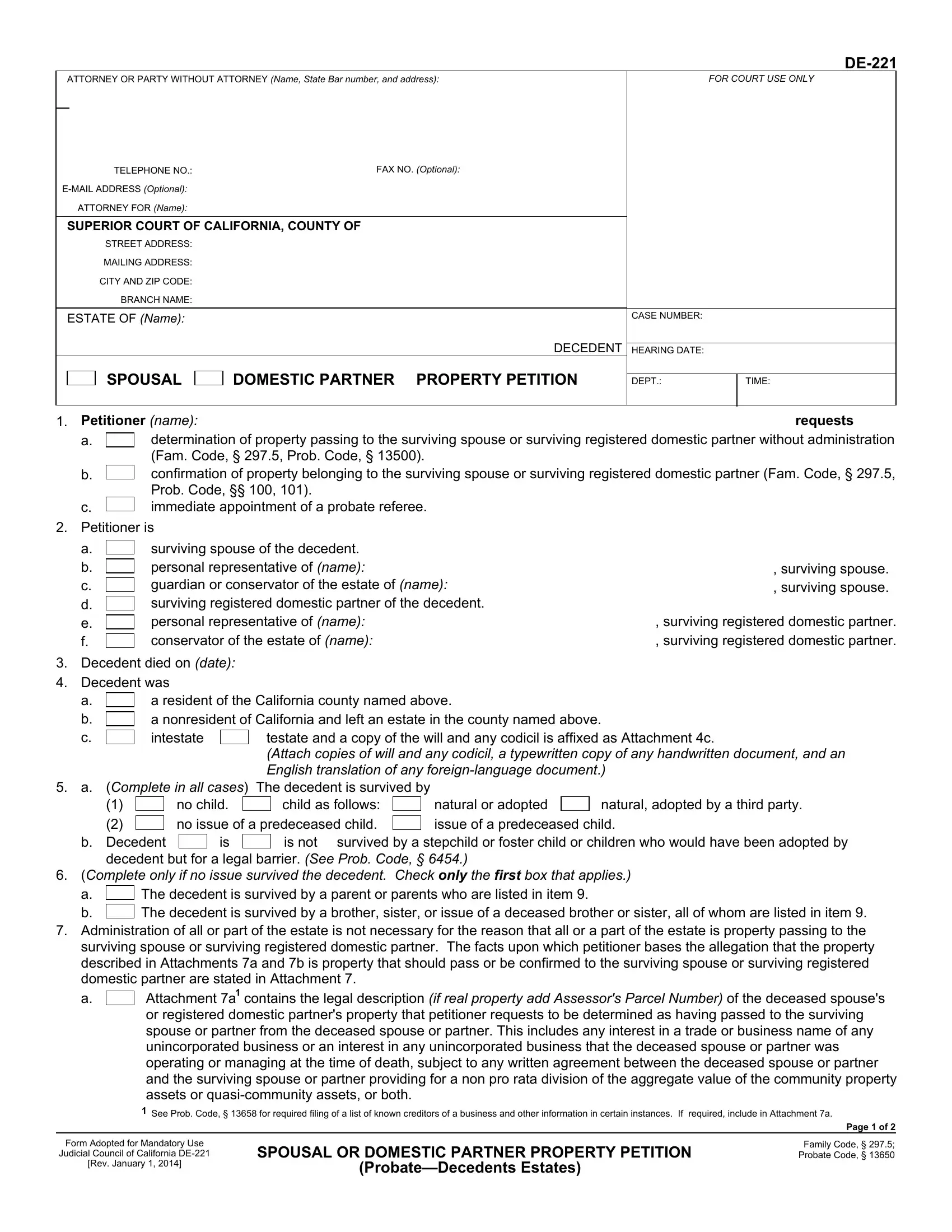

With regards to the blanks of this particular PDF, here is what you want to do:

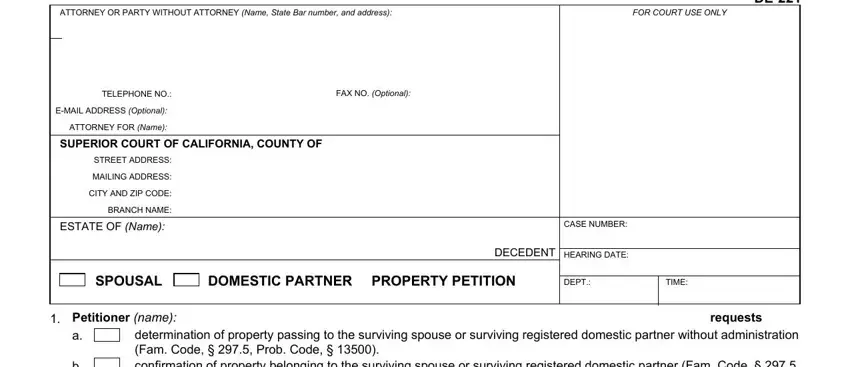

1. Complete your ca spousal property petition with a number of necessary blanks. Get all the necessary information and make sure there's nothing missed!

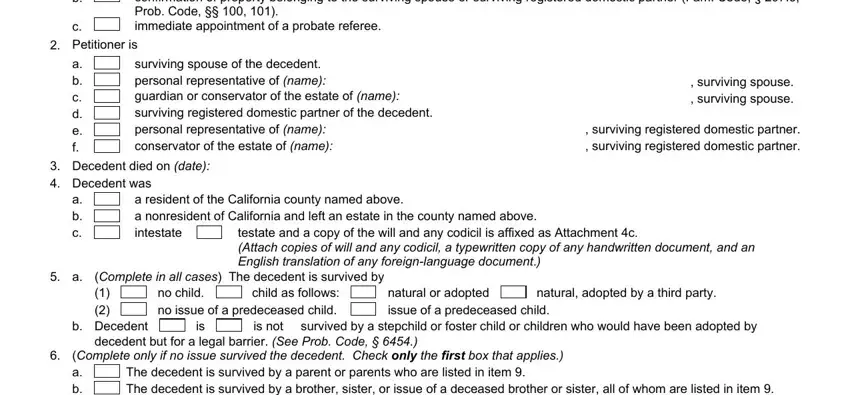

2. The subsequent stage is to submit the following blanks: determination of property passing, Petitioner is, a b c d e f, surviving spouse of the decedent, surviving spouse surviving spouse, surviving registered domestic, Decedent died on date Decedent was, a resident of the California, testate and a copy of the will and, Complete in all cases The decedent, no child child as follows no issue, natural or adopted issue of a, natural adopted by a third party, is not survived by a stepchild or, and Complete only if no issue survived.

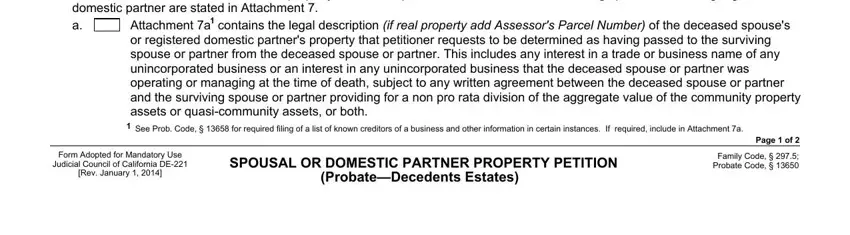

3. Completing Complete only if no issue survived, Attachment a contains the legal, Form Adopted for Mandatory Use, Judicial Council of California DE, Rev January, SPOUSAL OR DOMESTIC PARTNER, ProbateDecedents Estates, Page of, and Family Code Probate Code is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Regarding Judicial Council of California DE and ProbateDecedents Estates, be sure you take another look in this current part. The two of these are thought to be the most important ones in the document.

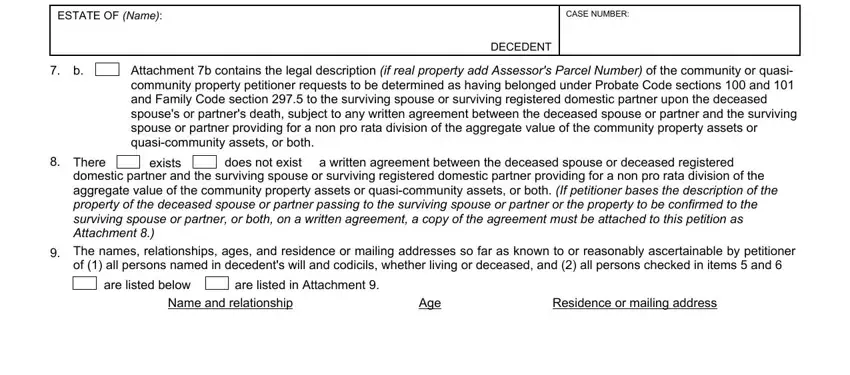

4. Filling out ESTATE OF Name, CASE NUMBER, Attachment b contains the legal, DECEDENT, exists, does not exist a written agreement, There domestic partner and the, are listed below, are listed in Attachment, Name and relationship, Age, and Residence or mailing address is essential in the next part - be certain to don't hurry and fill out every blank area!

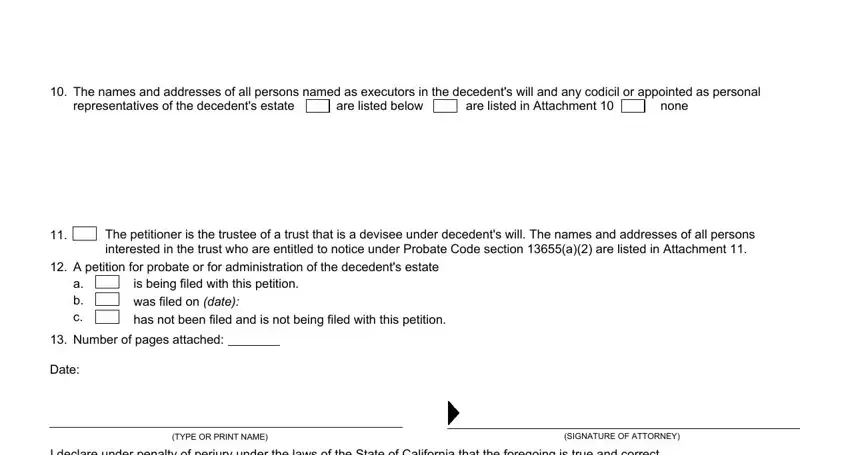

5. Lastly, the following final portion is what you will need to finish before closing the form. The fields in question include the next: The names and addresses of all, are listed in Attachment, are listed below, none, The petitioner is the trustee of a, A petition for probate or for, has not been filed and is not, is being filed with this petition, was filed on date, Number of pages attached, Date, I declare under penalty of perjury, TYPE OR PRINT NAME, and SIGNATURE OF ATTORNEY.

Step 3: Always make sure that the information is right and then press "Done" to continue further. After starting afree trial account at FormsPal, it will be possible to download ca spousal property petition or send it through email directly. The form will also be at your disposal via your personal account with all your modifications. Here at FormsPal.com, we do everything we can to ensure that your details are stored private.