Our PDF editor that you may apply was made by our top level software engineers. It is possible to obtain the edd change of address form form immediately and conveniently applying our application. Merely adhere to the following guideline to start out.

Step 1: Hit the button "Get form here" to access it.

Step 2: So, you are on the document editing page. You may add information, edit existing details, highlight specific words or phrases, insert crosses or checks, insert images, sign the form, erase needless fields, etc.

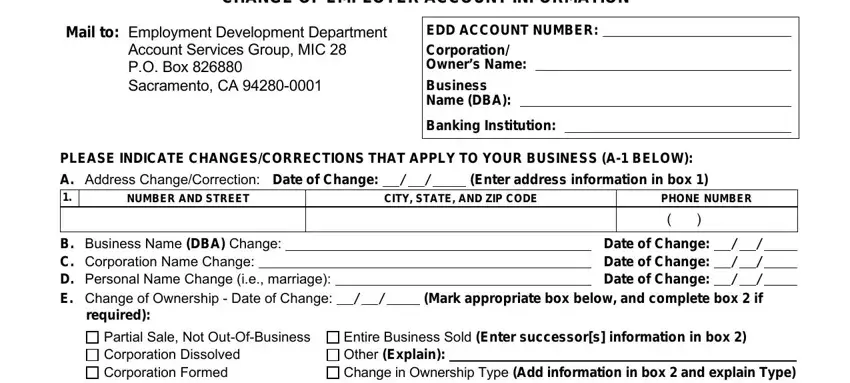

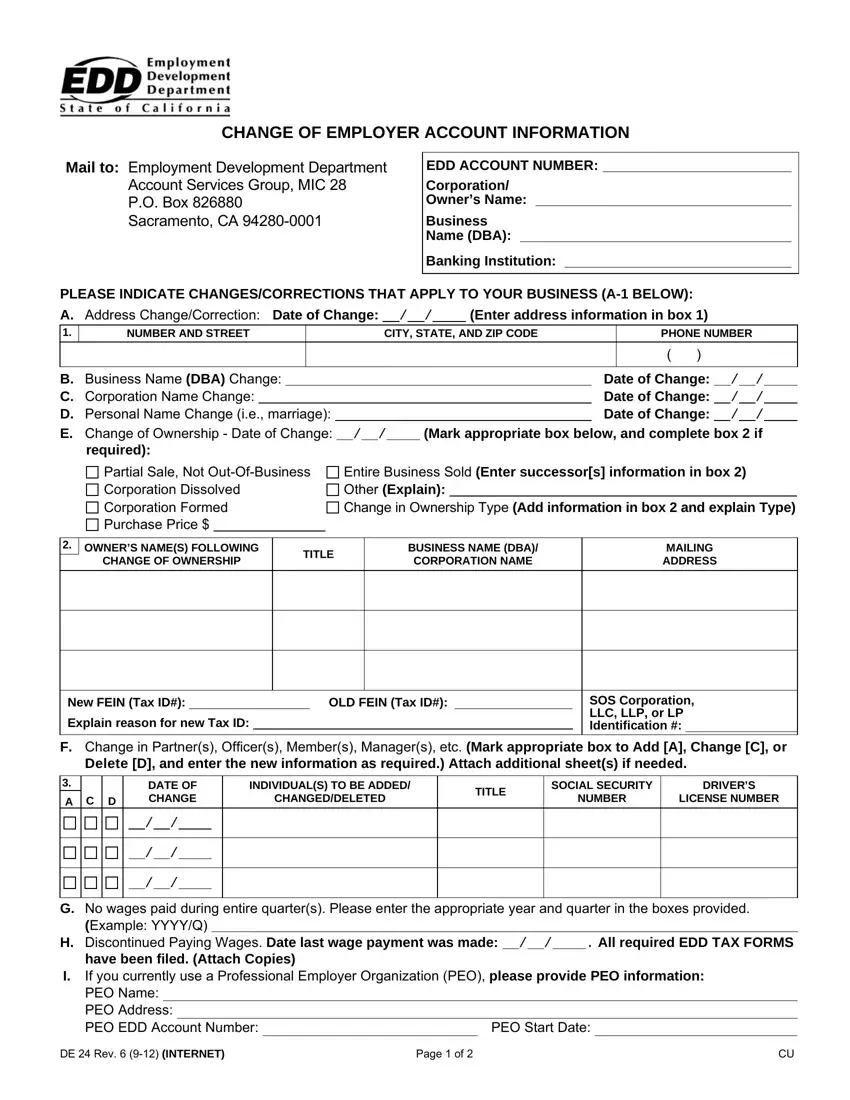

For every single part, prepare the data demanded by the program.

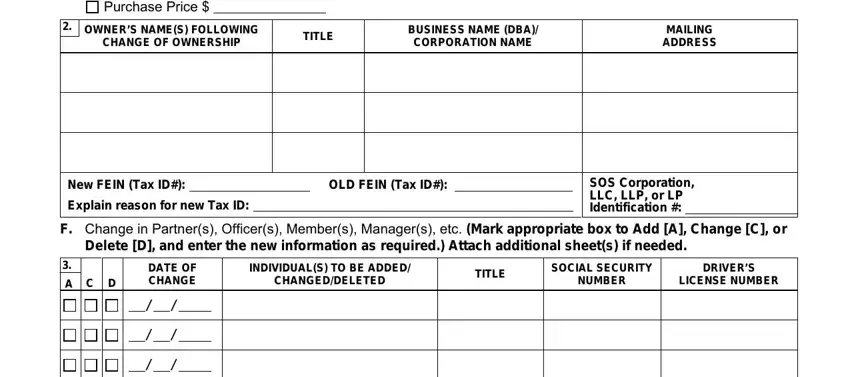

Provide the asked particulars in the Partial Sale Not OutOfBusiness, CHANGE OF OWNERSHIP, TITLE, Entire Business Sold Enter, BUSINESS NAME DBA CORPORATION NAME, MAILING ADDRESS, New FEIN Tax ID Explain reason for, SOS Corporation LLC LLP or LP, OLD FEIN Tax ID, Delete D and enter the new, A C D, DATE OF CHANGE, INDIVIDUALS TO BE ADDED, TITLE, and SOCIAL SECURITY NUMBER box.

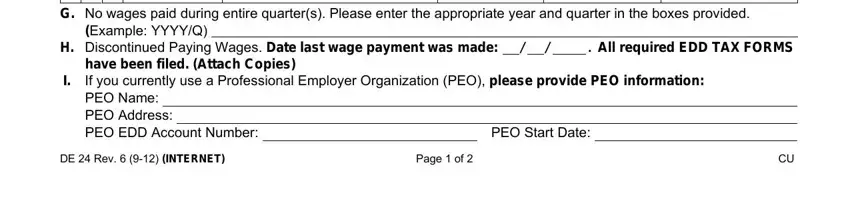

The application will require data to instantly prepare the section G No wages paid during entire, Example YYYYQ, H Discontinued Paying Wages Date, have been filed Attach Copies If, PEO Start Date, DE Rev INTERNET, and Page of.

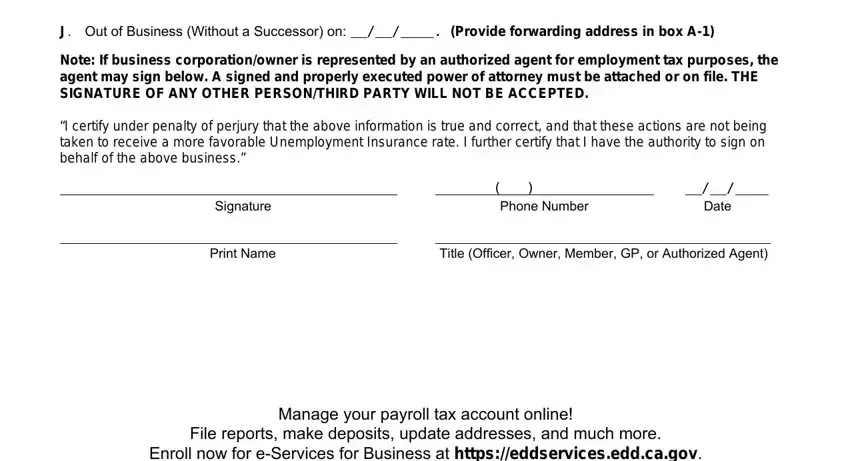

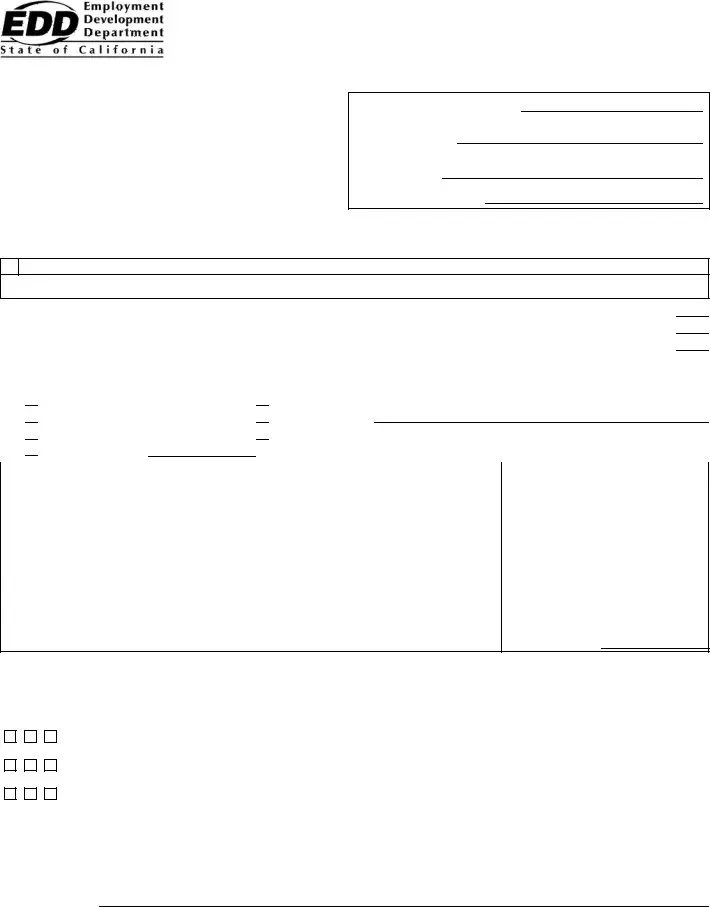

The J Out of Business Without a, Note If business corporationowner, I certify under penalty of perjury, Signature, Phone Number, Date, Print Name, Title Officer Owner Member GP or, and Manage your payroll tax account area could be used to point out the rights and responsibilities of both parties.

Step 3: Press the Done button to confirm that your finished form may be transferred to every gadget you choose or mailed to an email you specify.

Step 4: You can generate copies of the form toremain away from any potential future problems. Don't worry, we cannot distribute or track your data.

Partial Sale, Not

Partial Sale, Not

Corporation Dissolved

Corporation Dissolved

Corporation Formed

Corporation Formed

Purchase Price $

Purchase Price $