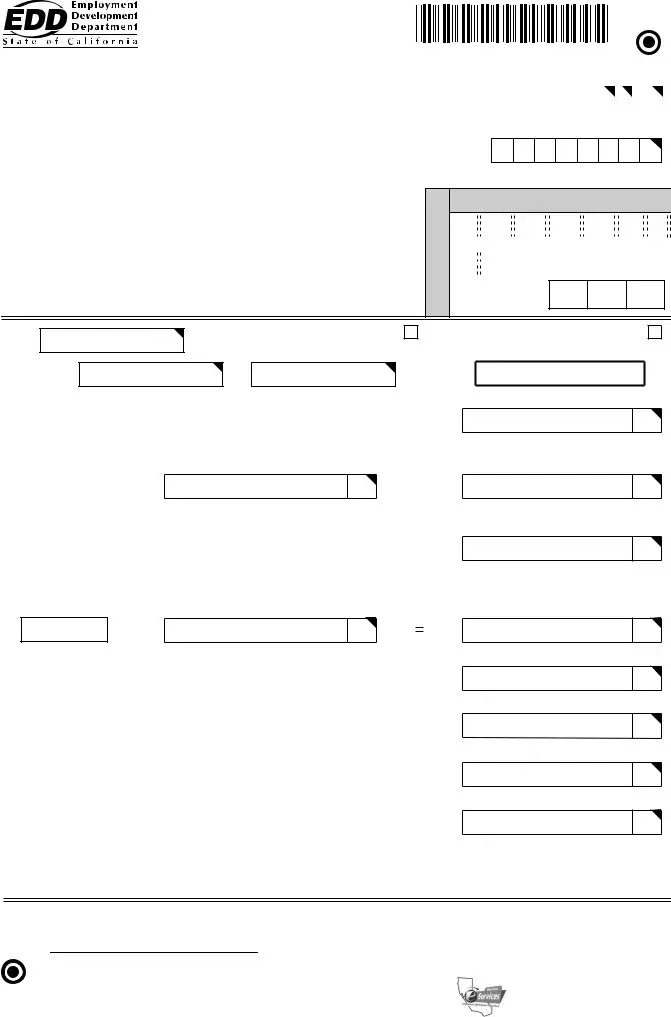

INSTRUCTIONS FOR COMPLETING THE

QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES (DE 9)

PLEASE TYPE ALL INFORMATION

Did you know you can file this form online using the EDD’s e-Services for Business?

For a faster, easier, and more convenient method of reporting your DE 9 information, visit the EDD’s website at www.edd.ca.gov.

Contact the Taxpayer Assistance Center at (888) 745-3886 (voice) or TTY (800) 547-9565 (non-verbal) for additional forms or inquiries regarding

reporting wages or the subject status of employees. Refer to the California Employer’s Guide (DE 44) for additional information.

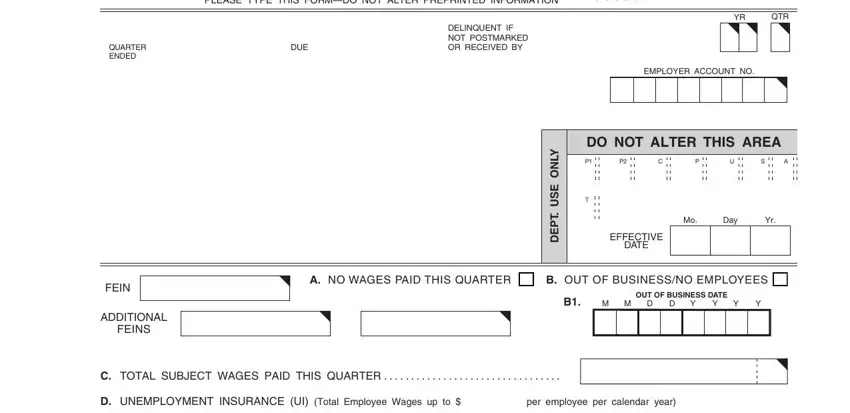

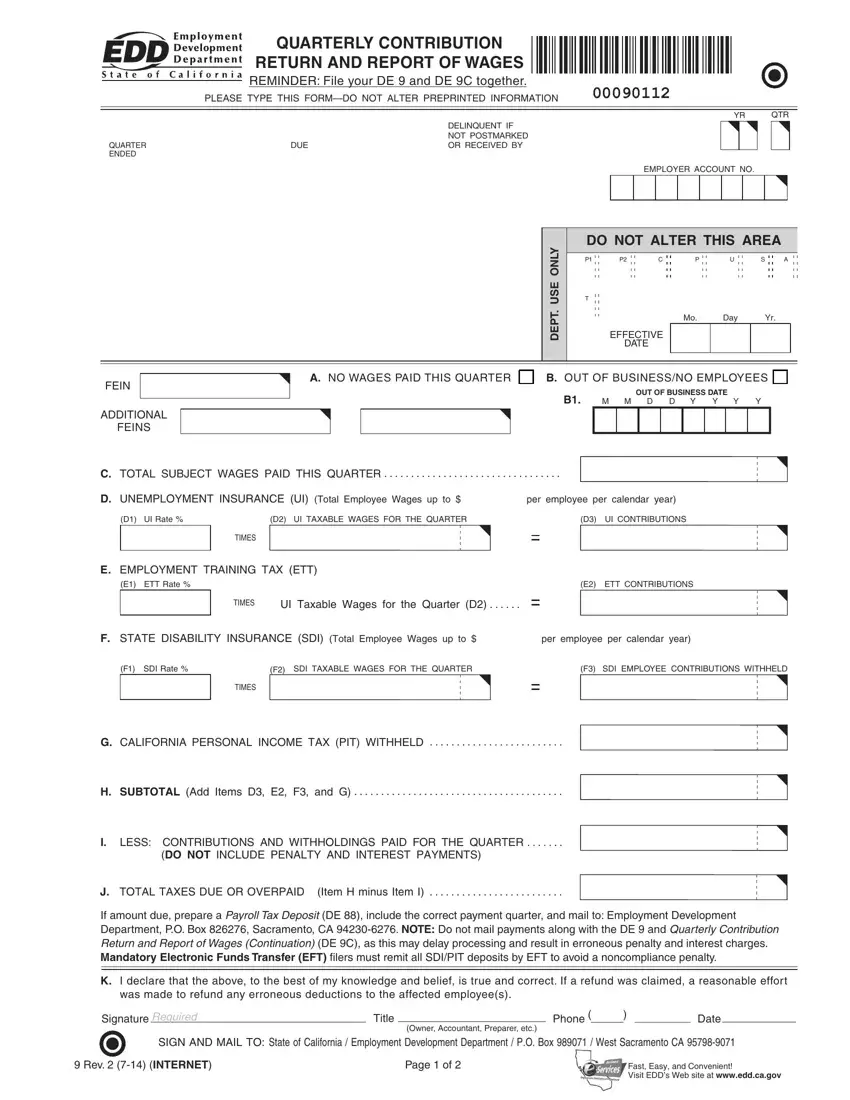

If this form is not preprinted, please include your business name and address, State employer account number, the quarter ended date, and the year and quarter for which this form is being iled.

Verify/enter your Federal Employer Identiication Number (FEIN): The number should be the same as your federal account number. If the number is not correct, line it out and enter the correct number. If you have more than one FEIN relating to your State number, enter the additional FEINs in the boxes provided.

ITEM A. No Wages Paid This Quarter - You must ile this return even though you had no payroll. If you had no payroll, check

Item A and complete Item K. You must also complete a Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) indicating no payroll for this quarter.

ITEM B. Out of Business/No Employees - Check this box if you are out of business (OB) or no longer have employees (NE) and this is your inal return. You must complete B1 if you are out of business.

NOTE: If you select the Line B Out of Business/No Employees and have No Payroll for the quarter, you must complete Item C and Item O on the DE 9C.

ITEM B1. Enter the OB/NE date where indicated and complete Line K.

NOTE: If you closed the business this quarter, you must ile the DE 9 and DE 9C within ten days of closing the business to avoid any penalties.

ITEM C. Total Subject Wages Paid This Quarter - Enter the total subject wages paid to all employees during the quarter.

ITEM D. Unemployment Insurance (UI)

D1. UI Rate - Enter the UI rate as a percentage if not already shown.

D2. UI Taxable Wages - Enter total UI taxable wages for the quarter. (Do not include exempt wages; refer to the California Employer’s Guide [DE 44] for details.)

D3. Employer’s UI Contributions - Multiply D1 by the amount entered in D2 and enter this calculated amount in D3.

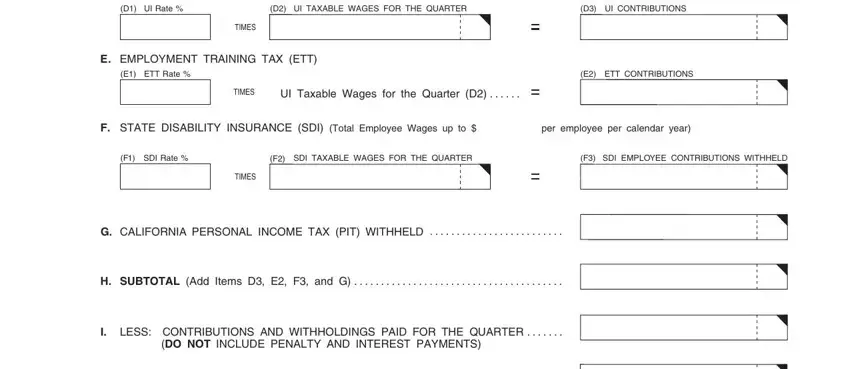

ITEM E. Employment Training Tax (ETT)

E1. ETT Rate - Enter the ETT rate as a percentage if not already shown.

E2. ETT - Multiply E1 by the amount entered in D2 and enter this calculated amount in E2.

ITEM F. State Disability Insurance (SDI)

F1. SDI Rate - Enter the SDI rate as a percentage if not already shown (includes Paid Family Leave percentage).

F2. SDI Taxable Wages - Enter the total SDI taxable wages for the quarter. (Do not include exempt wages; refer to the California Employer’s Guide [DE 44] for details.)

F3. Multiply F1 by the amount entered in F2 and enter this calculated amount in F3.

ITEM G. California Personal Income Tax (PIT) Withheld - Enter total California PIT withheld during the quarter.

NOTE: If over $350 in PIT is withheld, it may be necessary to deposit more frequently. For additional information, visit the EDD’s website at www.edd.ca.gov/Payroll_Taxes.

ITEM H. Subtotal - Add Items D3, E2, F3, and G; enter the amount in the SUBTOTAL box.

ITEM I. Contributions and Withholdings Paid for the Quarter - Total of all deposits of UI, ETT, SDI, and PIT paid for the quarter. NOTE: Do not include any payments made for prior quarters or for penalty and interest.

ITEM J. Total Taxes Due or Overpaid - Item H minus Item I. If an amount is due, submit a Payroll Tax Deposit (DE 88) with your payment and mail to P.O. Box 826276, Sacramento, CA 94230-6276.

NOTE: Mailing payments with the DE 9 form delays payment processing and may result in erroneous penalty and interest charges.

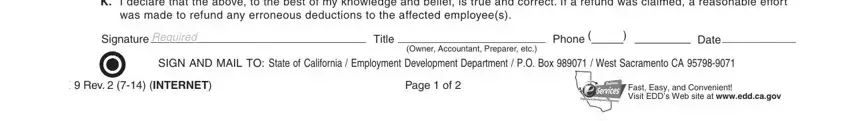

ITEM K. Signature of preparer or responsible individual, including title, telephone number, and signature date.

THIRD-PARTY SICK PAY

Employers and Payers of Third-Party Sick Pay: Please refer to the California Employer’s Guide (DE 44) for completing this form.

INFORMATION

FILING THIS RETURN/REPORT - California law requires employers to report all UI/SDI subject California wages paid and California PIT withheld during the quarter.

A PENALTY of 15% (10% for periods prior to 3rd quarter 2014) plus interest will be charged for underpayment of contributions and California PIT withheld per Section 1112(a) of the California Unemployment Insurance Code (CUIC). In addition, a penalty of 15% (10% for periods prior to 3rd quarter 2014) of the unpaid contributions and California PIT withheld will be charged for failure to ile the return/report within 60 days of the due date pursuant to Section 1112.5 of the CUIC.