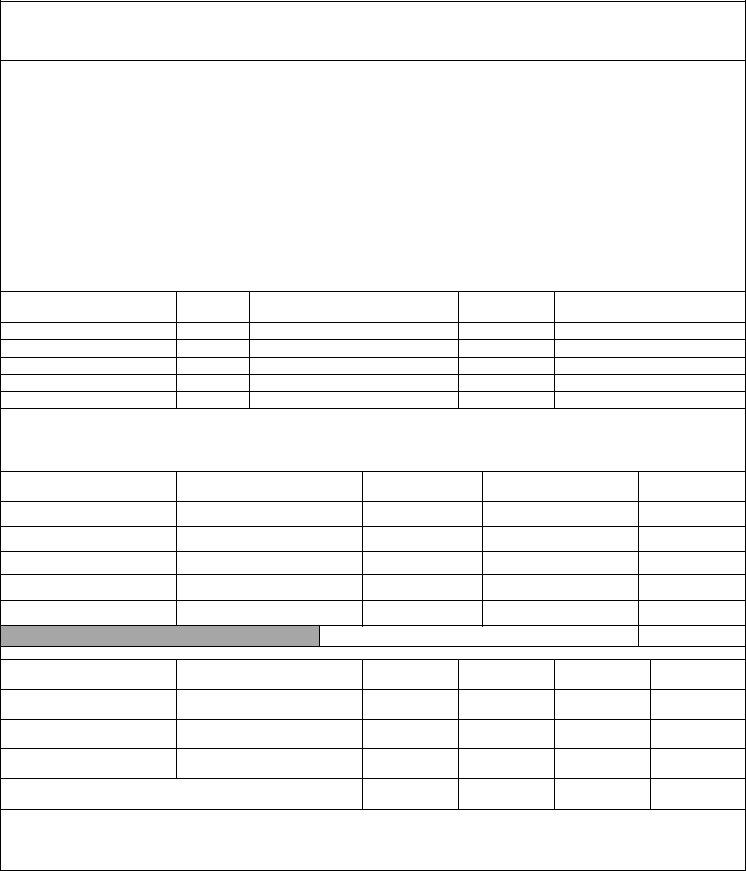

The Debtor Financial Statement form serves as a comprehensive document designed to encapsulate the financial health and operations of a commercial entity. It requires detailed inputs ranging from basic identification information, such as the name and address of the business and the employer identification number, to more intricate financial data, including but not limited to, accounts receivable, bank accounts, credit availability, and details of real property owned. The form delineates between various types of business structures like sole proprietorships, partnerships, and corporations, ensuring specificity in its application. Additionally, it delves into assets and liability analysis, providing space for the listing of assets such as cash on hand, life insurance policies, real property, and vehicles, alongside corresponding liabilities and equities. A section dedicated to income and expense analysis further extends the form’s utility by capturing the essence of the business’s operational turnover and expenditures over a specified period. It culminates in a certification that demands the truthfulness and accuracy of the information provided under the penalties of perjury. This form stands not just as a financial snapshot but as a critical tool in assessing a business's viability, risks, and overall fiscal stewardship, facilitating decision-making processes for creditors or regulatory bodies.

| Question | Answer |

|---|---|

| Form Name | Debtor Financial Statement Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | Pymt, bankruptcies, III, debtor financial statement |

Commercial Debtor Financial Statement

Note: Complete all blocks, except shaded areas. Write “N/A” (not applicable) in those blocks that do not apply.

1 Name and address of business |

2 |

Business phone number |

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

3 |

(Check appropriate box) |

|

|

|

|

Γ |

Sole Proprietor |

Γ Other (specify) |

||

|

Γ |

Partnership |

___________________________________ |

||

|

Γ |

Corporation |

___________________________________ |

||

|

|

|

|

|

|

4 Name and title of person being interviewed |

5 |

Employer identification number |

|

6 Type of business |

|

|

|

|

|

|

|

7 Information about owner, partners, officers, major shareholder, etc.

Name of Institution

Effective

Date

Home Address

Phone

Number

Social Security |

Total Shares |

Number |

of Interest |

|

|

Section I General Financial Information

8 Latest filed income tax return ► |

Form |

Tax year ended |

Net income before taxes |

|

|

|

|

|

|

|

|

9Bank accounts (List all types of accounts including payroll and general, savings, certificates of deposit, etc.)

Name of Institution

Address

Type of Account

Account No.

Balance

Total (Enter in item 17)………………………………………………… ►

10Bank credit available (Line of credit, etc.)

Name of Institution

Address

Credit Limit |

Amount Owed |

Credit

Available

Monthly

Payments

Totals (Enter in items 24 or 25 as appropriate) ►

11 Location, box number, and contents of all safe deposit boxes rented or accessed.

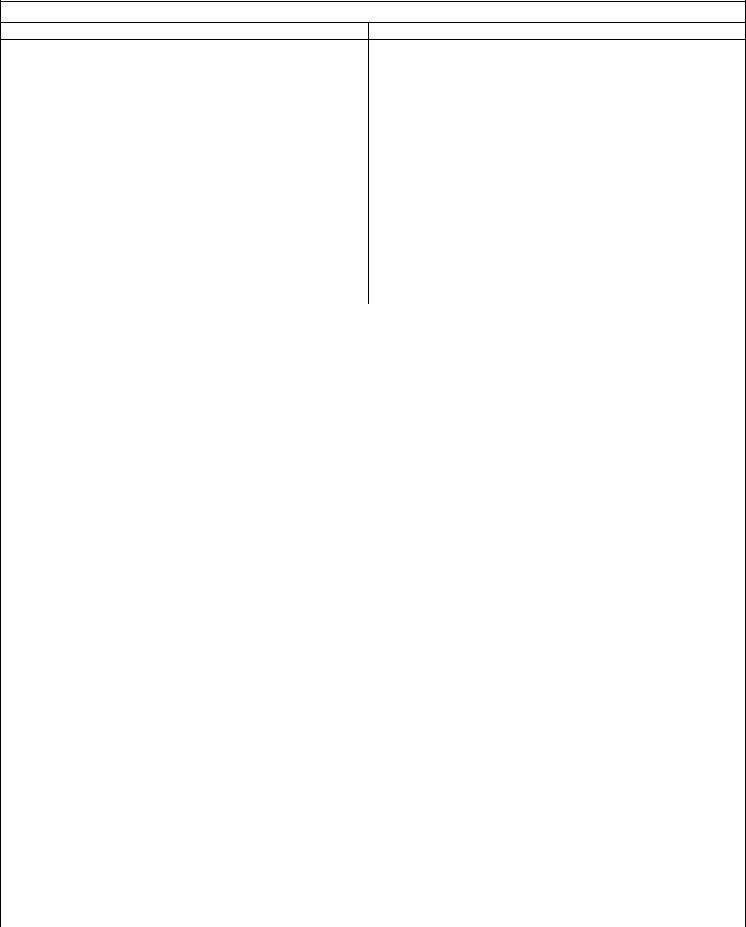

Section I (continued) General Financial Information

12 Real Property

Brief description and type of ownership |

|

|

Physical Address |

|||

a |

|

|

|

|

|

|

|

|

|

|

|

|

County ………………….. |

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

County ………………….. |

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|

County ………………….. |

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

County ………………….. |

|

|

|

|

|

|

|

13 Life insurance policies owned with business as beneficiary |

|

|

|

|

|

|

Name Insured |

Company |

Policy Number |

Type |

|

Face Amount |

Available Loan Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (Enter in item 19) ……………………………………………………………………………………………………………………… ► |

|

|||||

|

|

|

|

|

|

|

14a Additional information regarding financial condition (Court proceedings, bankruptcies filed or anticipated, transfers of assets for less than full value, changes in market conditions, etc. Include information regarding company participation in trusts, estates,

b If you know of any person or |

(i) |

Who borrowed the funds? |

|

|

|

organization that borrowed or otherwise |

|

|

|

|

|

provided funds to pay net payrrolls: |

|

|

|

|

|

(ii) |

Who supplied the funds? |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

15 Account/notes receivable (include current contract jobs, loans to stockholders, officers, partners, etc.) |

|

|

|||

|

|

|

|

|

|

Name |

|

Address |

Amount Due |

Date Due |

Status |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (Enter in item 18)……………………………………………… ► |

$ |

|

|

||

|

|

|

|||

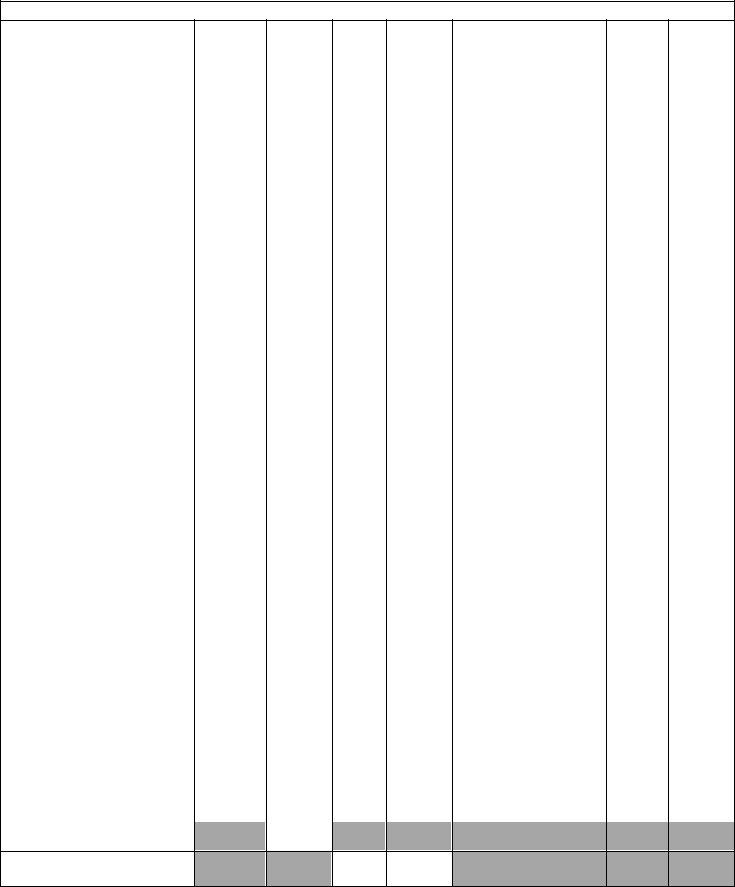

Section II Assets and Liability Analysis

|

(a) |

|

|

(b) |

(c) |

|

(d) |

(e) |

(f) |

(g) |

(h) |

|

|

|

Description |

|

Cur. Mkt. |

Liabilities |

|

Equity |

Amount of |

Name and Address of |

Date |

Date of |

|

||

|

|

|

|

|

Value |

Bal. Due |

|

In |

Mo. Pymt. |

Lien/Note Holder/Obligee |

Pledged |

Final Pymt. |

|

|

|

|

|

|

|

|

Asset |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

Cash on hand |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

Bank Accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

Accounts/Notes receivable |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

Life insurance loan value |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

Real |

|

a |

|

|

|

|

|

|

|

|

|

|

|

Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

(from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

item 12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

Vehicles |

|

a |

|

|

|

|

|

|

|

|

|

|

|

(model, year, |

|

|

|

|

|

|

|

|

|

|

|

|

|

and license) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

Machinery |

|

a |

|

|

|

|

|

|

|

|

|

|

|

and |

|

|

|

|

|

|

|

|

|

|

|

|

|

equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

(specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

Merchandise |

|

a |

|

|

|

|

|

|

|

|

|

|

|

inventory |

|

|

|

|

|

|

|

|

|

|

|

|

|

(specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

Other assets |

|

a |

|

|

|

|

|

|

|

|

|

|

|

(specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

Other |

|

a |

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

(including |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

notes and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

judgements) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

h |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 Federal taxes owed (prior years)

27 Total

$

$

Section III Income and Expense Analysis

The following information applies to income and expenses during the period |

Accounting method used |

|

|||

|

to |

|

|

|

|

|

Income |

|

|

Expenses |

|

|

|

|

|

|

|

28 |

Gross receipts from sales, services, etc. |

$ |

34 Materials purchased |

$ |

|

|

|

|

|

|

|

29 |

Gross rental income |

|

|

(Number of employees………….) |

|

|

|

|

35 |

Net wages and salaries |

|

|

|

|

|

|

|

30 |

Interest, |

|

36 Rent |

|

|

|

|

|

|

|

|

31 |

Dividends |

|

|

(Treasury use only) |

|

|

|

|

37 |

Allowable installment payments |

|

|

|

|

|

|

|

32 |

Other income (specify) |

|

38 Supplies |

|

|

|

|

|

|

|

|

|

|

|

39 |

Utilities/telephone |

|

|

|

|

|

|

|

|

|

|

40 |

Gasoline/oil |

|

|

|

|

|

|

|

|

|

|

41 |

Repairs and maintenance |

|

|

|

|

|

|

|

|

|

|

42 |

Insurance |

|

|

|

|

|

|

|

|

|

|

43 |

Current taxes |

|

|

|

|

|

|

|

|

|

|

44 |

Other (specify) |

|

|

|

|

|

|

|

33 |

Total income |

$ |

45 Total expenses (Treasury use only) |

$ |

|

|

|

|

|

|

|

|

|

|

46 |

Net difference (Treasury use only) |

$ |

|

|

|

|

|

|

Certification: Under penalties of perjury, I declare that to the best of my knowledge and belief this statement of assets, liabilities, and other information is true, correct, and complete.

47 Signature |

48 Date |

|

|