Whenever you would like to fill out Delaware Form 1100X, you don't have to download any kind of applications - simply give a try to our PDF editor. To make our tool better and more convenient to work with, we consistently design new features, taking into consideration feedback from our users. To get the ball rolling, consider these basic steps:

Step 1: Hit the "Get Form" button above. It's going to open up our tool so that you could start completing your form.

Step 2: As soon as you access the editor, you will get the document all set to be completed. In addition to filling out various fields, you can also do other things with the Document, including putting on your own textual content, modifying the original text, inserting illustrations or photos, putting your signature on the document, and more.

This PDF doc requires specific information; in order to guarantee consistency, take the time to adhere to the subsequent recommendations:

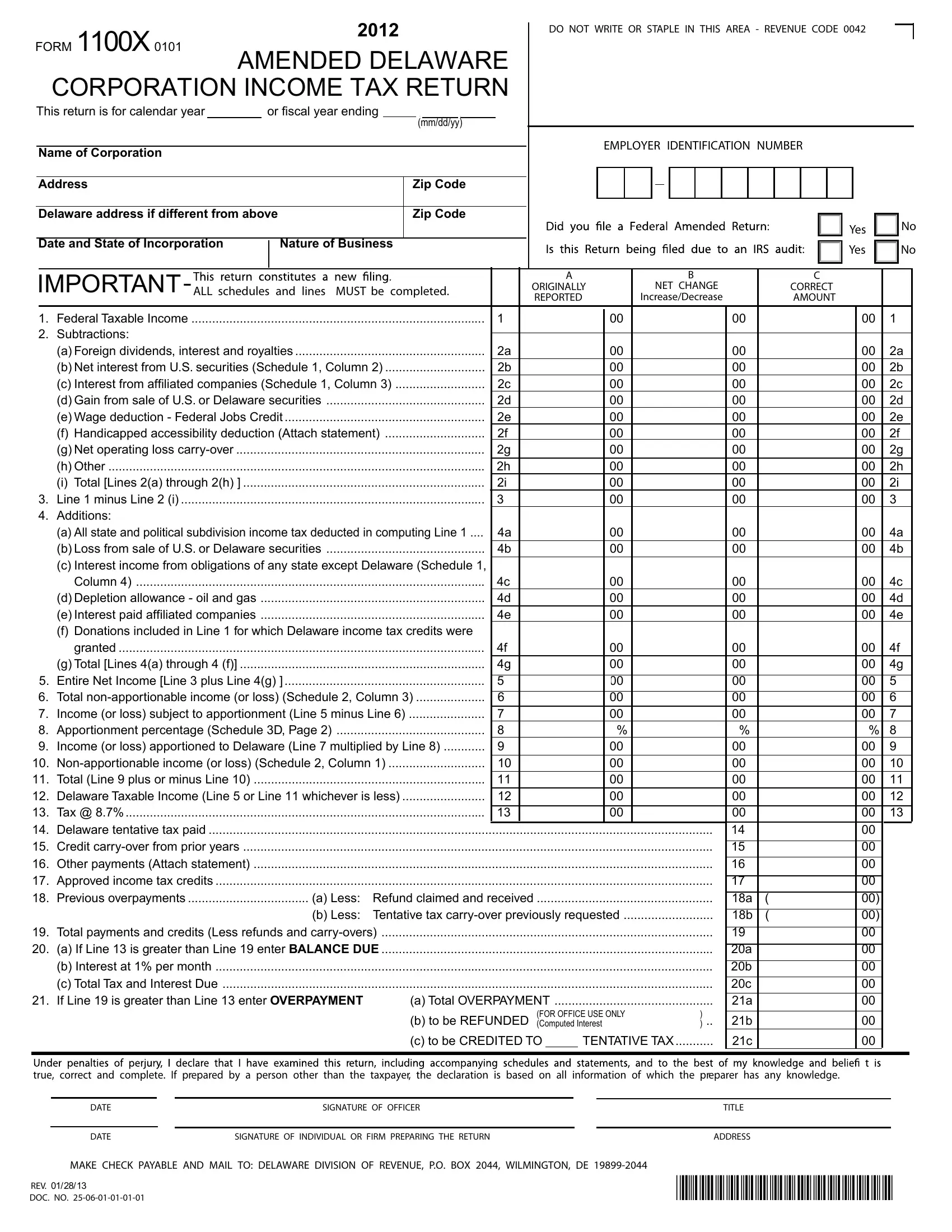

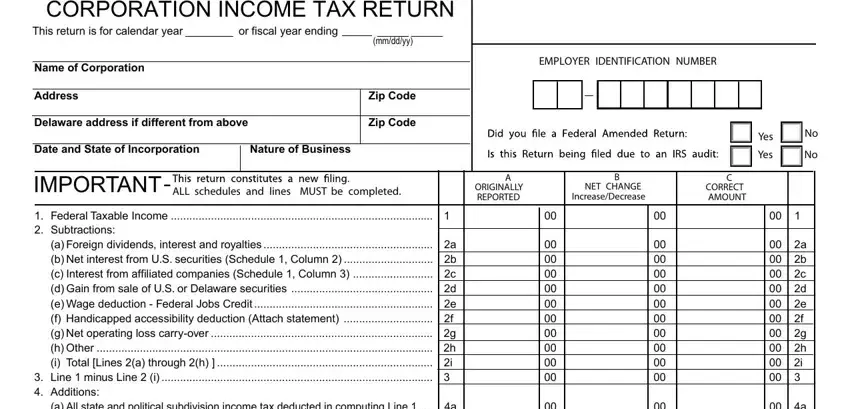

1. Firstly, once filling out the Delaware Form 1100X, begin with the section that includes the following blank fields:

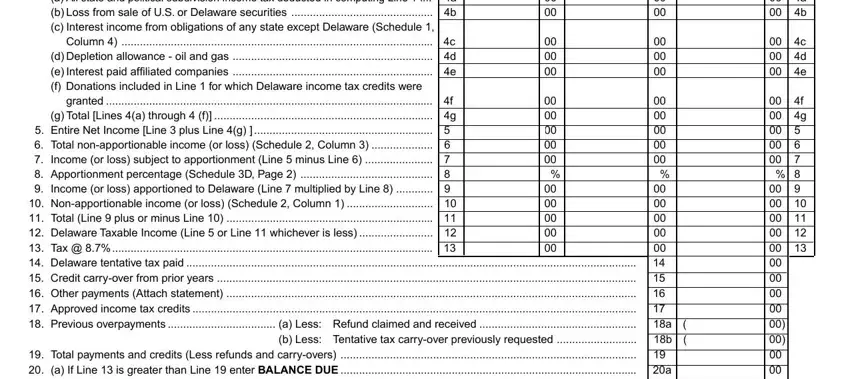

2. After the previous section is done, it is time to insert the necessary specifics in a All state and political, Column c d Depletion allowance, granted f g Total Lines a through, Entire Net Income Line plus Line, a b, c d e, f g, a b a b c a, and Nonapportionable income or loss so you're able to move on to the third step.

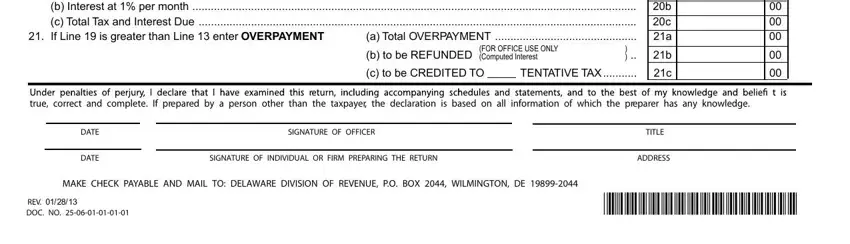

3. The following segment will be about f g, a b a b c a, Nonapportionable income or loss, b to be REFUNDED, FOR OFFICE USE ONLY Computed, c to be CREDITED TO, TENTATIVE TAX, true correct and complete, If prepared by a person other than, information of which the preparer, DATE, DATE, SIGNATURE OF OFFICER, SIGNATURE OF INDIVIDUAL OR FIRM, and TITLE - fill in each one of these blanks.

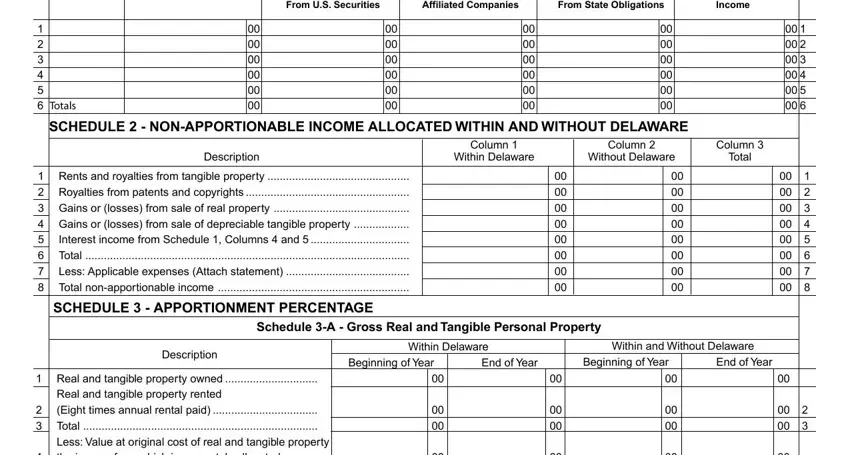

4. Filling out From US Securities, Affiliated Companies, From State Obligations, Income, Totals, SCHEDULE NONAPPORTIONABLE INCOME, Description, Column, Within Delaware, Column, Without Delaware, Column, Total, Rents and royalties from tangible, and Royalties from patents and is crucial in this fourth form section - you should definitely be patient and fill out each blank area!

Be extremely attentive when filling in Column and Description, since this is the part where a lot of people make mistakes.

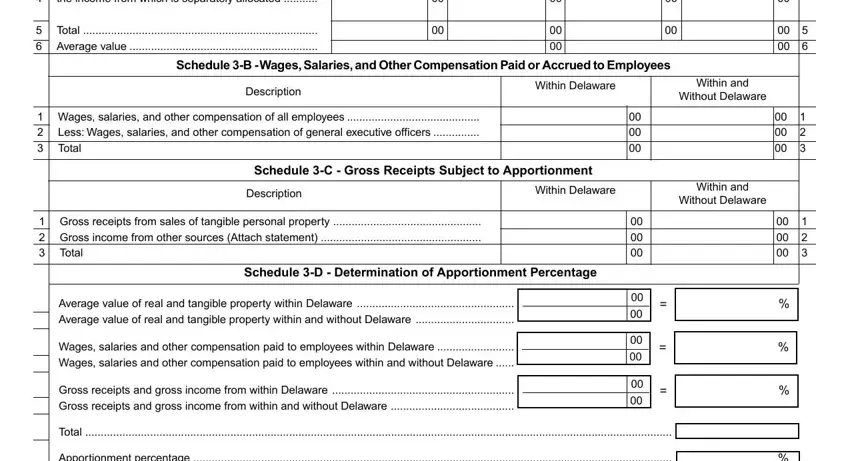

5. To wrap up your form, the final section requires a number of extra fields. Entering the income from which is, Total, Average value, Schedule B Wages Salaries and, Description, Within Delaware, Within and, Without Delaware, Wages salaries and other, Less Wages salaries and other, Total, Schedule C Gross Receipts Subject, Description, Within Delaware, and Gross receipts from sales of will certainly conclude the process and you can be done quickly!

Step 3: Spell-check all the information you've typed into the blank fields and then click the "Done" button. After creating afree trial account with us, it will be possible to download Delaware Form 1100X or send it through email directly. The form will also be accessible in your personal cabinet with your every edit. At FormsPal.com, we aim to be sure that all of your information is stored private.