The PDF editor which you'll use was designed by our main developers. It is possible to fill in the deo po drawer 5150 document easily and effortlessly applying our app. Just keep up with the guide to get going.

Step 1: To start out, hit the orange button "Get Form Now".

Step 2: You're now on the file editing page. You can edit, add content, highlight certain words or phrases, put crosses or checks, and include images.

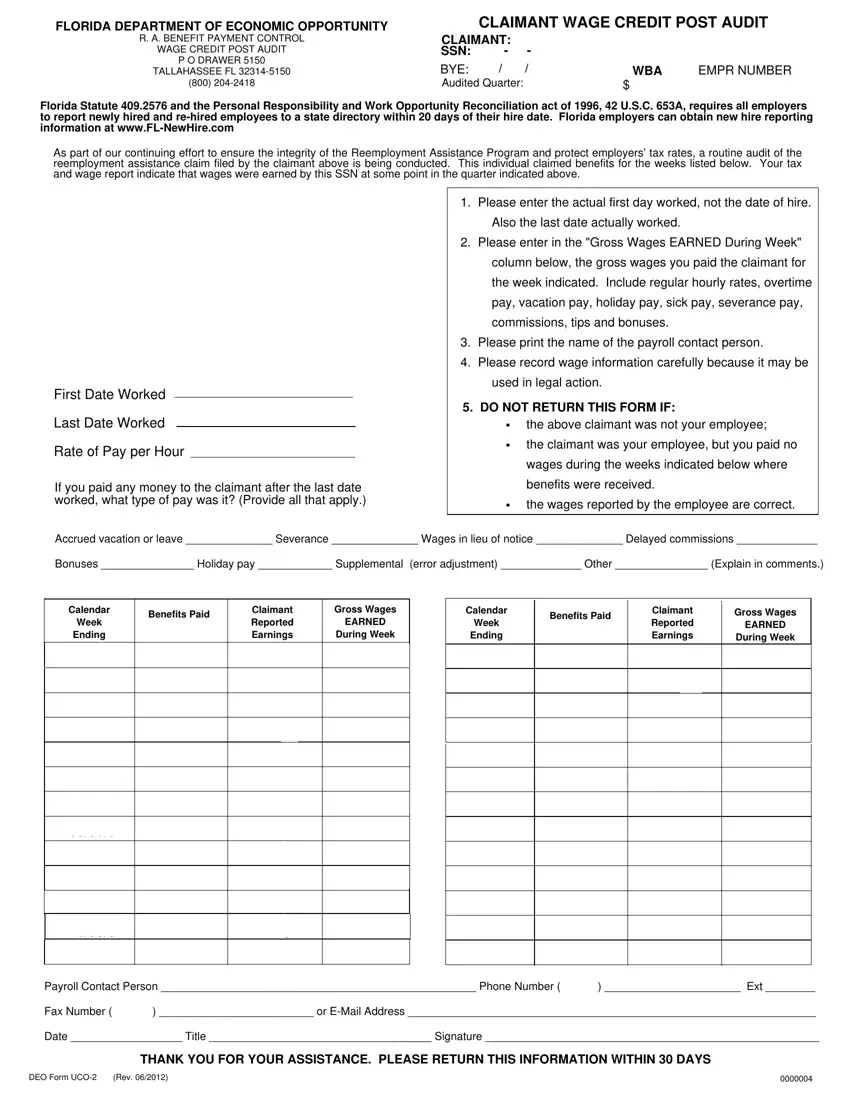

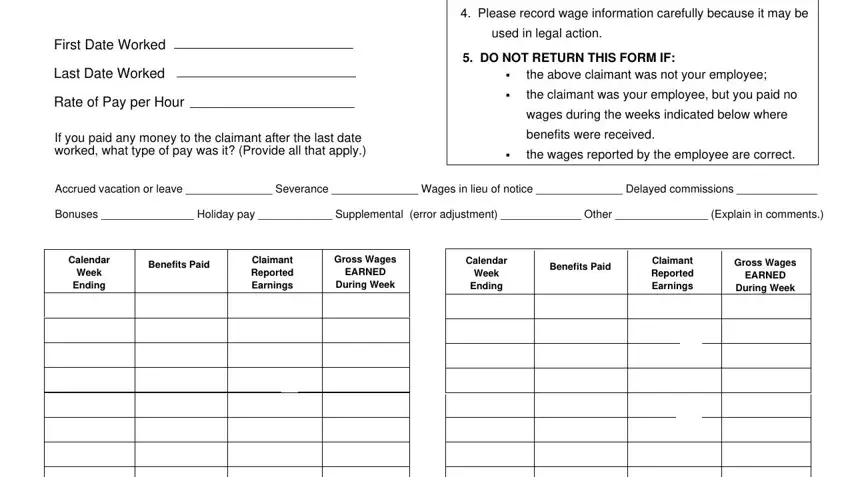

If you want to complete the deo po drawer 5150 PDF, provide the details for all of the sections:

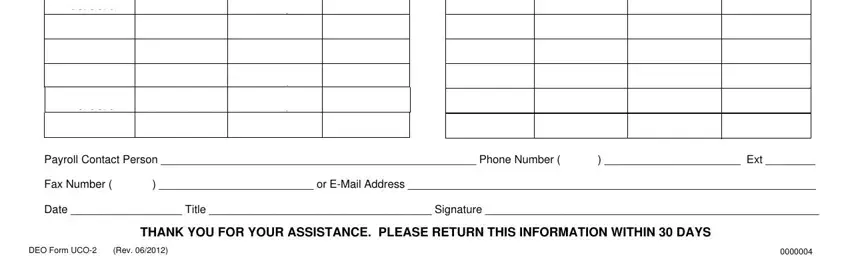

Fill in the Payroll Contact Person Phone, Fax Number or EMail Address, Date Title Signature, DEO Form UCO Rev, and THANK YOU FOR YOUR ASSISTANCE areas with any information that is required by the program.

Step 3: Click the "Done" button. Now it's easy to export your PDF document to your device. In addition, you can easily send it via email.

Step 4: Generate a minimum of several copies of your document to refrain from any sort of possible troubles.