Detroit Form D 1120 can be completed online effortlessly. Simply use FormsPal PDF editing tool to finish the job without delay. To make our editor better and easier to utilize, we constantly design new features, with our users' suggestions in mind. This is what you'd have to do to get going:

Step 1: Simply hit the "Get Form Button" at the top of this page to get into our form editor. This way, you will find everything that is needed to fill out your file.

Step 2: With this state-of-the-art PDF editing tool, you can actually accomplish more than just complete blank fields. Express yourself and make your forms seem perfect with custom textual content put in, or fine-tune the original content to perfection - all backed up by an ability to incorporate stunning pictures and sign it off.

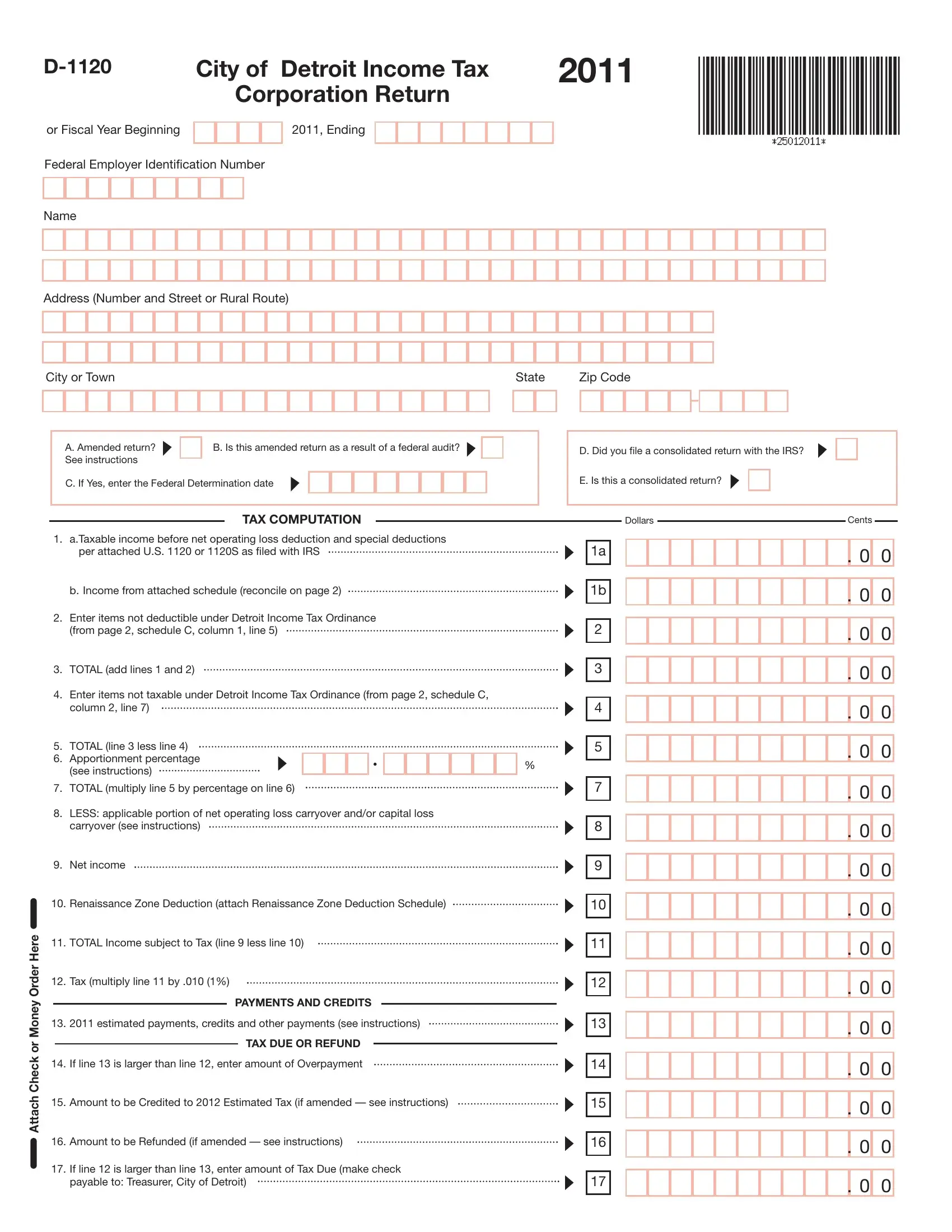

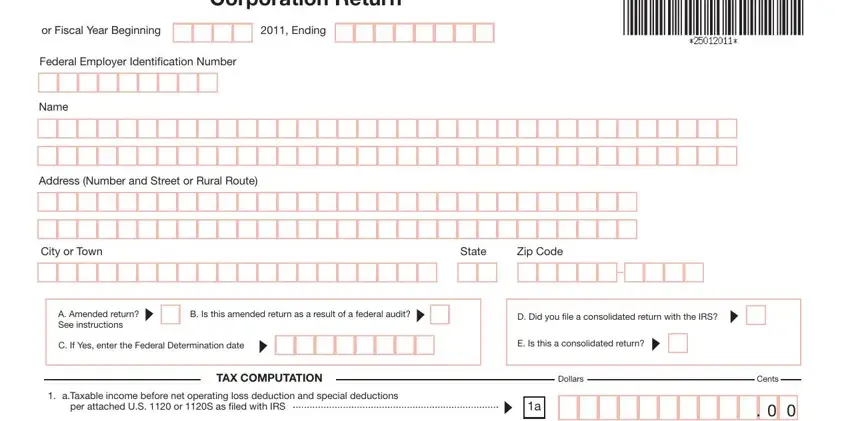

In an effort to finalize this form, make sure that you enter the right details in every single field:

1. When filling in the Detroit Form D 1120, be sure to include all of the essential blanks in the relevant form section. It will help facilitate the work, making it possible for your information to be handled promptly and appropriately.

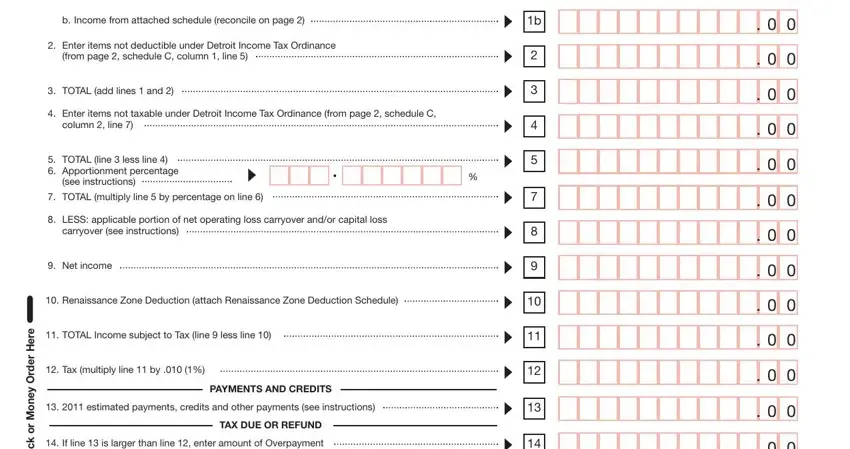

2. Just after this part is filled out, go to enter the relevant information in these - b Income from attached schedule, Enter items not deductible under, TOTAL add lines and, Enter items not taxable under, TOTAL line less line, TOTAL multiply line by, LESS applicable portion of net, Net income, Renaissance Zone Deduction attach, TOTAL Income subject to Tax line, Tax multiply line by, PAYMENTS AND CREDITS, estimated payments credits and, If line is larger than line, and TAX DUE OR REFUND.

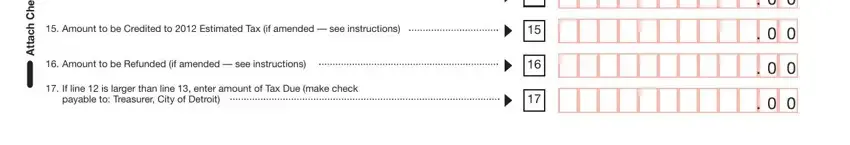

3. This next step is normally rather easy, If line is larger than line, Amount to be Credited to, Amount to be Refunded if amended, If line is larger than line, r o k c e h C h c a t t A, and DOCID - all of these blanks is required to be filled out here.

Concerning Amount to be Refunded if amended and DOCID, make sure you review things here. The two of these are definitely the most significant fields in this form.

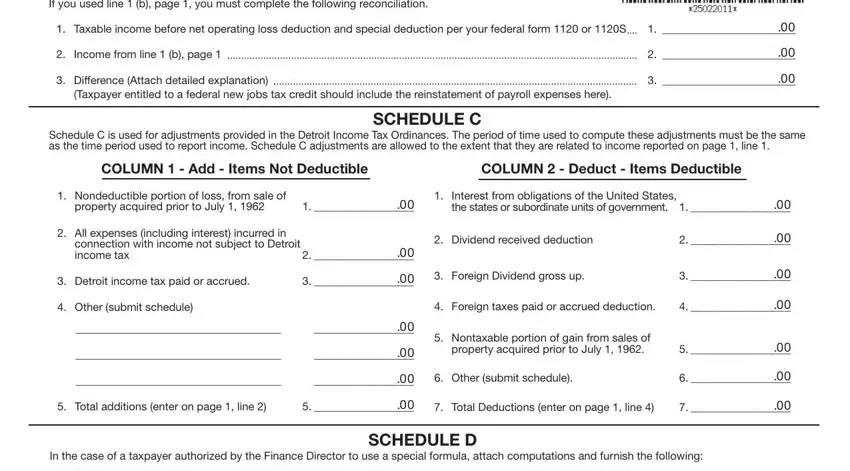

4. This next section requires some additional information. Ensure you complete all the necessary fields - If you used line b page you must, Taxable income before net, Income from line b page, Difference Attach detailed, Taxpayer entitled to a federal new, Schedule C is used for adjustments, COLUMN Add Items Not Deductible, COLUMN Deduct Items Deductible, SCHEDULE C, Nondeductible portion of loss, Interest from obligations of the, All expenses including interest, income tax, Dividend received deduction, and Detroit income tax paid or - to proceed further in your process!

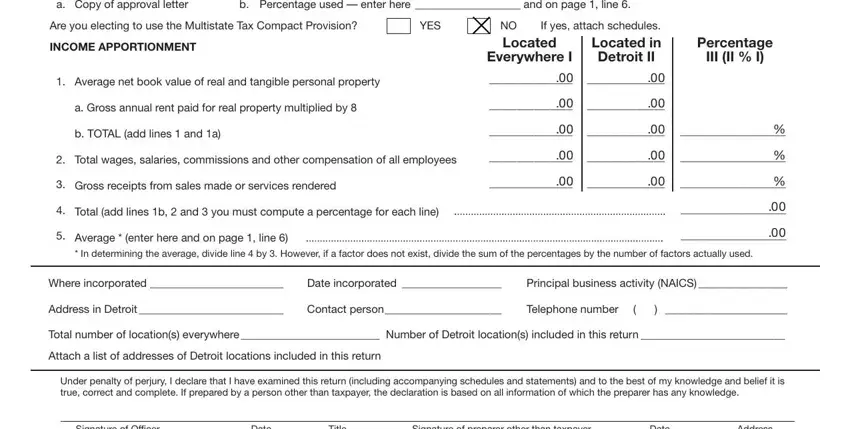

5. The form must be concluded by going through this area. Further you will find a full listing of fields that have to be filled in with correct details for your document submission to be accomplished: a Copy of approval letter b, Are you electing to use the, INCOME APPORTIONMENT, Located Located in Percentage, Average net book value of real, a Gross annual rent paid for real, b TOTAL add lines and a, Total wages salaries commissions, Gross receipts from sales made or, Total add lines b and you must, Average enter here and on page, In determining the average divide, Where incorporated Date, Address in Detroit Contact person, and Total number of locations.

Step 3: Right after you've reread the details in the file's blanks, press "Done" to finalize your form. Sign up with FormsPal right now and easily gain access to Detroit Form D 1120, ready for downloading. All alterations made by you are preserved , which means you can customize the pdf later as needed. When you use FormsPal, you're able to complete forms without worrying about information breaches or entries getting distributed. Our protected platform helps to ensure that your personal details are maintained safely.