It shouldn’t be a challenge to create wisconsin 504 amendment taking advantage of our PDF editor. This is the way it is possible to quickly create your template.

Step 1: The first thing will be to select the orange "Get Form Now" button.

Step 2: You will find each of the actions that you may undertake on the template when you have accessed the wisconsin 504 amendment editing page.

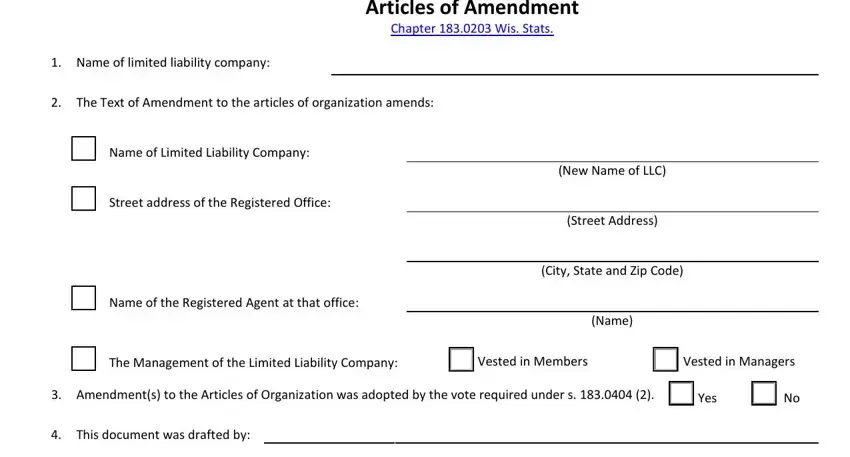

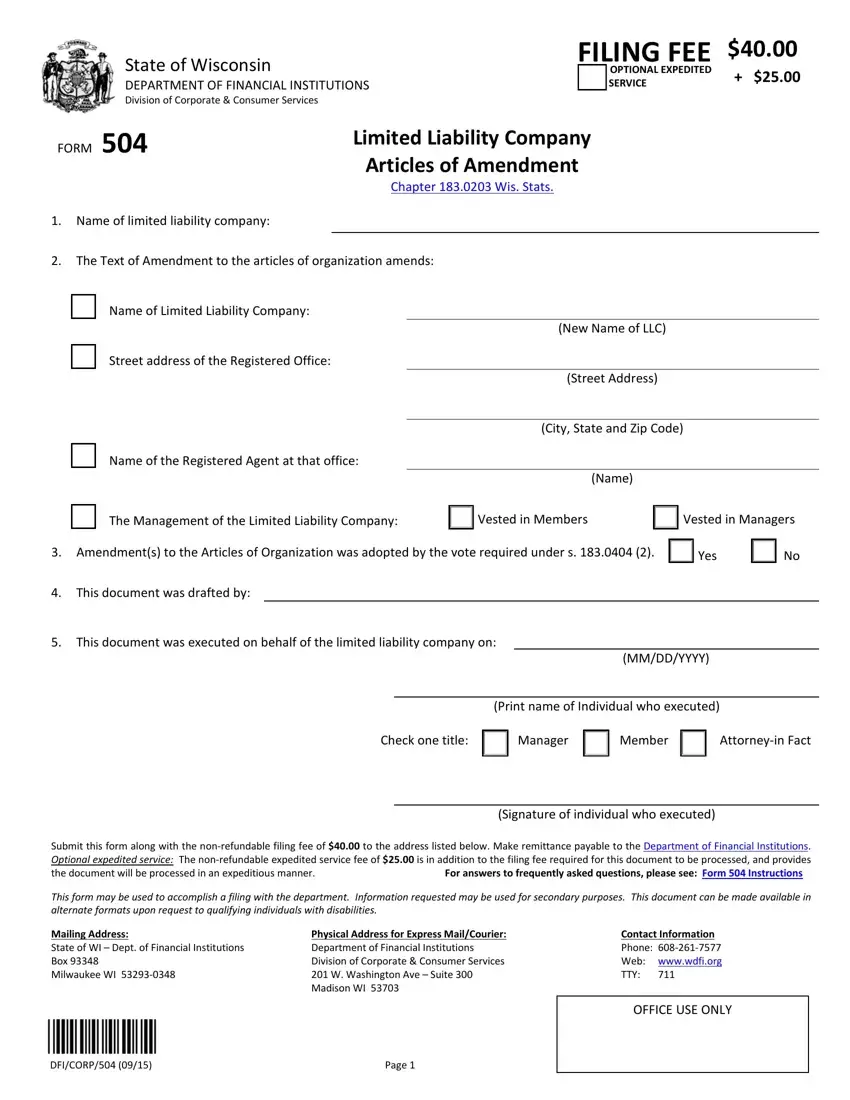

All of the following sections will help make up the PDF document:

Put the asked information in the Signature of individual who, Submit this form along with the, For answers to frequently asked, This form may be used to, Mailing Address State of WI Dept, Physical Address for Express, Contact Information Phone Web, OFFICE USE ONLY, DFICORP, and Page segment.

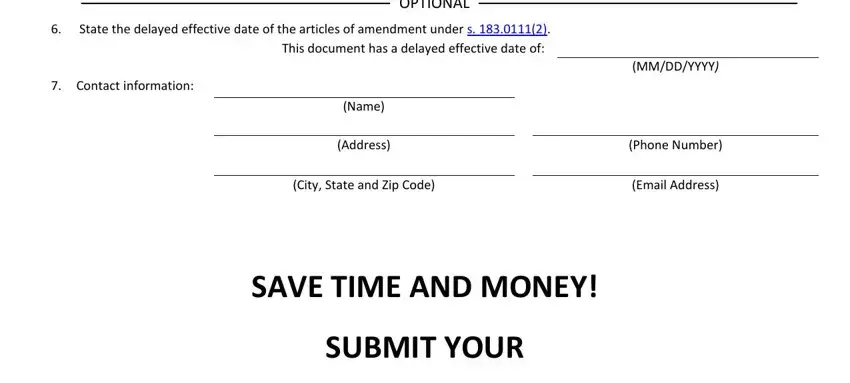

Point out the main information about the State the delayed effective date, OPTIONAL, Contact information, Name, Address, City State and Zip Code, MMDDYYYY, Phone Number, Email Address, SAVE TIME AND MONEY, and SUBMIT YOUR segment.

The wwwwdfiorg, Submit this form along with the, For answers to frequently asked, This form may be used to, Mailing Address State of WI Dept, Physical Address for Express, Contact Information Phone Web, and OFFICE USE ONLY field will be your place to place the rights and responsibilities of all parties.

Step 3: Hit the "Done" button. Next, you can export your PDF file - upload it to your electronic device or forward it by means of electronic mail.

Step 4: It may be simpler to create copies of your form. You can rest assured that we are not going to publish or read your particulars.

Manager

Manager

Member

Member