dhs 4574 b spouse form can be completed online without any problem. Just use FormsPal PDF tool to complete the job fast. The tool is continually updated by our staff, getting useful functions and growing to be even more convenient. Getting underway is simple! Everything you need to do is follow the following basic steps down below:

Step 1: Access the form in our editor by pressing the "Get Form Button" above on this webpage.

Step 2: As you access the file editor, you will find the form ready to be filled out. In addition to filling in various fields, you may as well perform other actions with the file, specifically adding your own text, changing the original textual content, inserting graphics, affixing your signature to the form, and more.

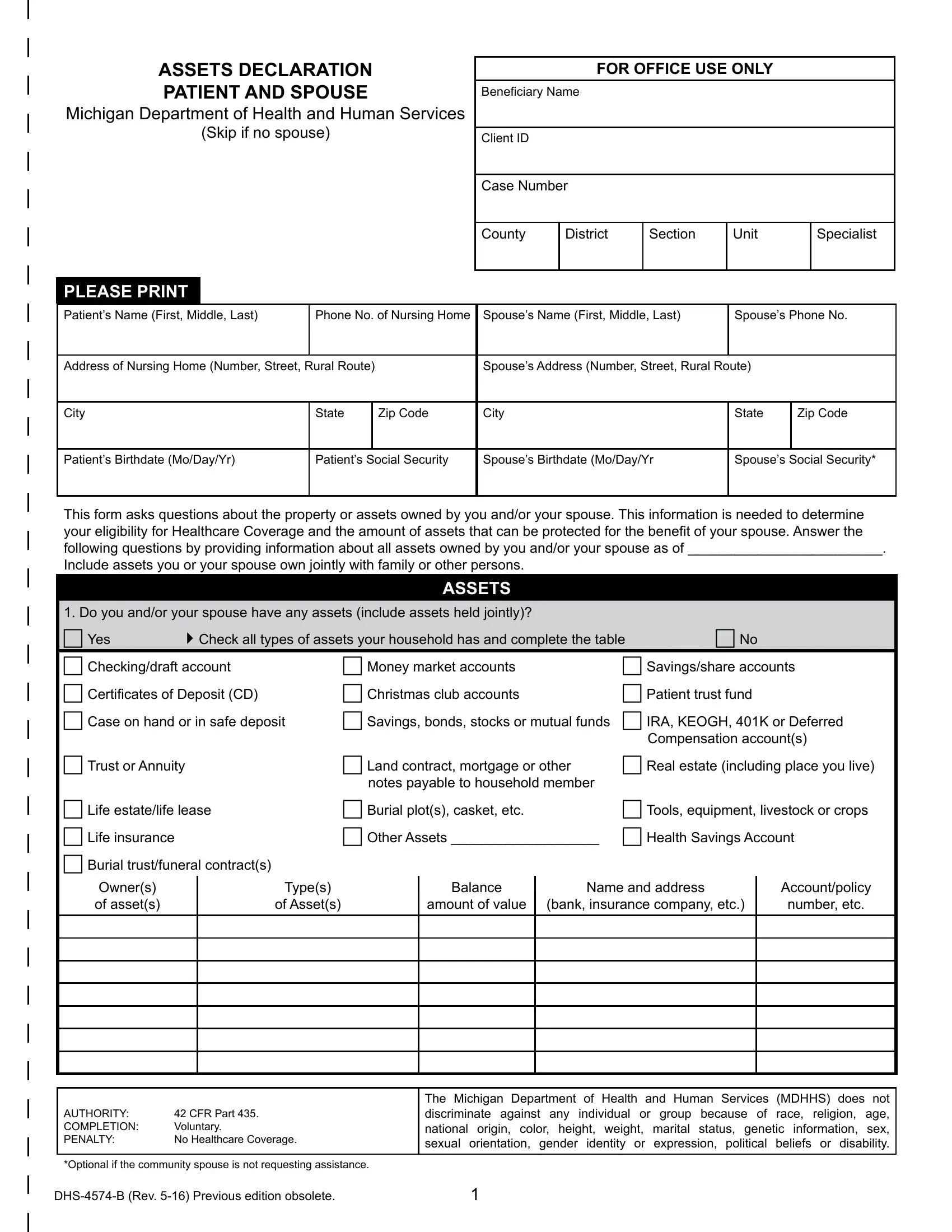

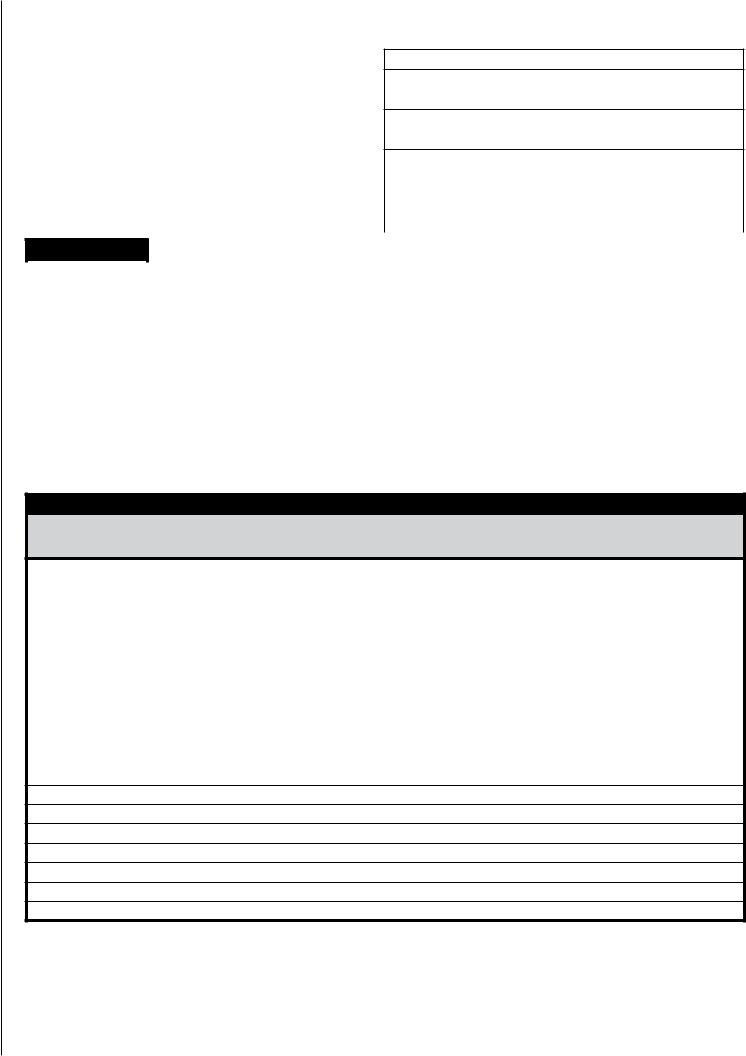

This PDF will need specific information to be entered, so you should definitely take whatever time to fill in exactly what is required:

1. When filling in the dhs 4574 b spouse form, make certain to include all needed blank fields in their relevant section. This will help expedite the work, allowing your information to be processed quickly and correctly.

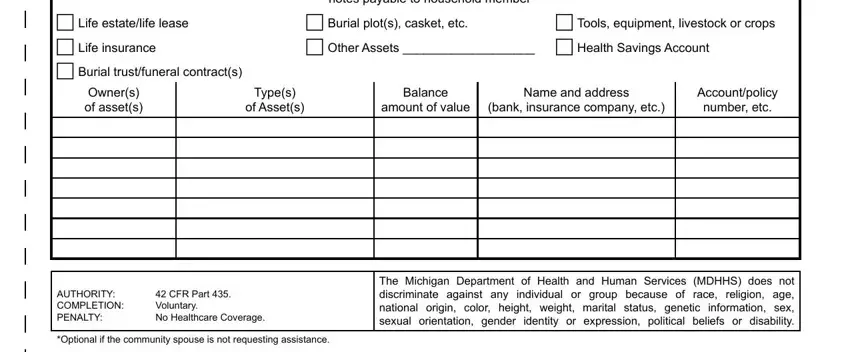

2. Soon after the previous section is filled out, go to enter the relevant information in these: c Life estatelife lease c Life, notes payable to household member, c Burial plots casket etc c Other, c Tools equipment livestock or, Owners of assets, Types, of Assets, Balance, amount of value, Name and address, bank insurance company etc, Accountpolicy number etc, AUTHORITY COMPLETION PENALTY, CFR Part Voluntary No Healthcare, and Optional if the community spouse.

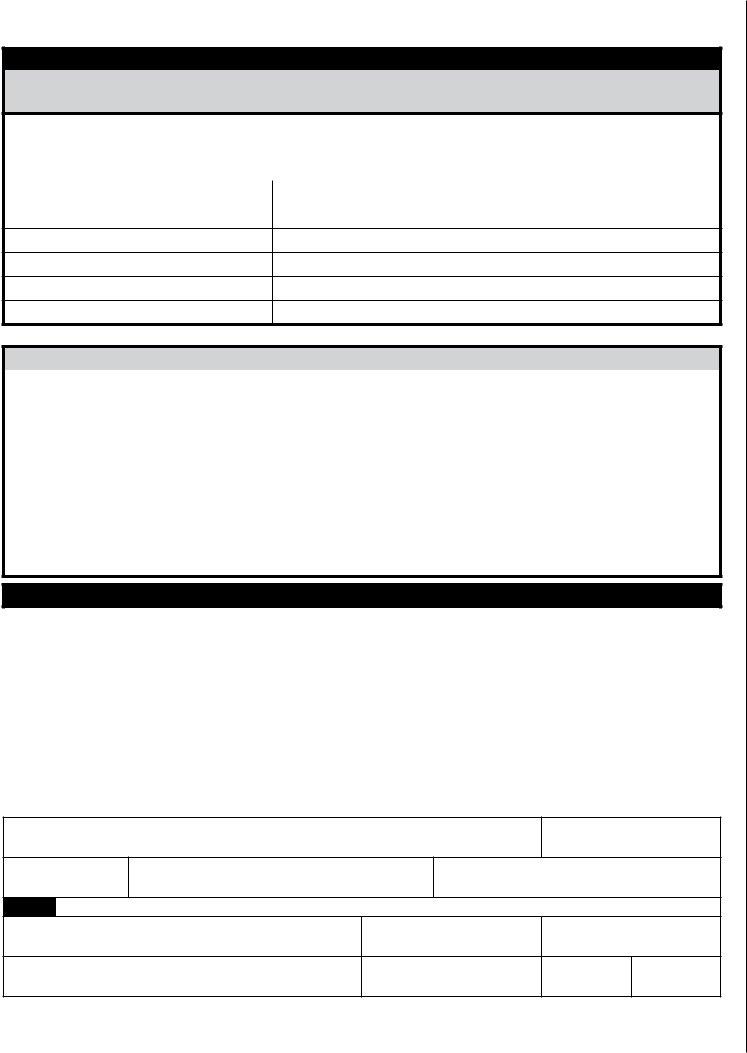

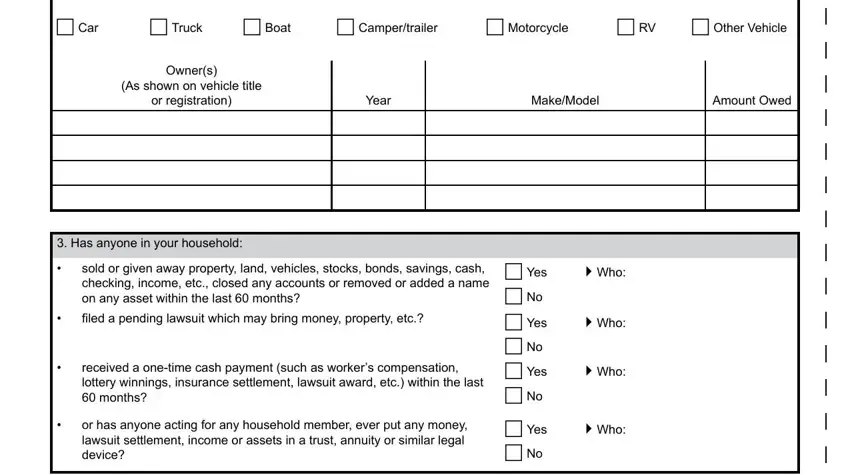

3. Completing c Car, c Truck, c Boat, c Campertrailer, c Motorcycle, c RV, c Other Vehicle, Owners, As shown on vehicle title, or registration, Year, MakeModel, Amount Owed, Has anyone in your household, and sold or given away property land is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

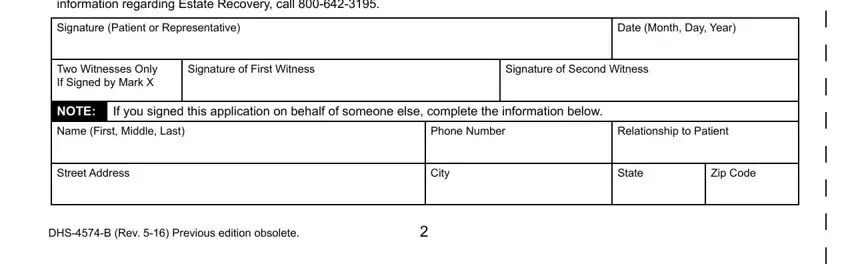

4. The next section arrives with these fields to consider: Estate Recovery I understand that, Signature Patient or Representative, Date Month Day Year, Two Witnesses Only If Signed by, Signature of First Witness, Signature of Second Witness, If you signed this application on, NOTE Name First Middle Last, Phone Number, Relationship to Patient, Street Address, City, State, Zip Code, and DHSB Rev Previous edition obsolete.

Concerning State and Zip Code, be sure that you double-check them in this current part. The two of these are viewed as the key ones in the page.

Step 3: Go through the information you have typed into the blank fields and press the "Done" button. After creating a7-day free trial account with us, it will be possible to download dhs 4574 b spouse form or send it via email at once. The PDF will also be at your disposal through your personal cabinet with your every single edit. FormsPal guarantees risk-free document editing without personal data record-keeping or any sort of sharing. Be assured that your information is safe with us!