Navigating through the maze of managing student loans can often seem daunting, but understanding your billing details can significantly ease the process. The Dlstfd Student Loan form serves as a critical tool in this journey. Aspire Resources Inc., in partnership with the U.S. Department of Education, issues this comprehensive statement, detailing every aspect of your loan account—from the amount due to the breakdown of payments made towards principal, interest, and any fees incurred. With sections outlining the total principal outstanding, current and past due amounts, interest rates, and loan ownership, the document provides a clear overview of your financial obligations and payment history. The form also includes instructions for making payments, updating personal information, and understanding various loan statuses—from repayment to grace periods, each designed to keep borrowers informed and on track. Whether it's your first time reviewing the form or you're a seasoned borrower, grasping the intricacies of your loan billing statement is a key step in effective loan management, avoiding delinquency, and ultimately, successful loan repayment.

| Question | Answer |

|---|---|

| Form Name | Dlstfd Student Loan Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | loan program dlstfd, loan type dlstfd, Seq, amazon |

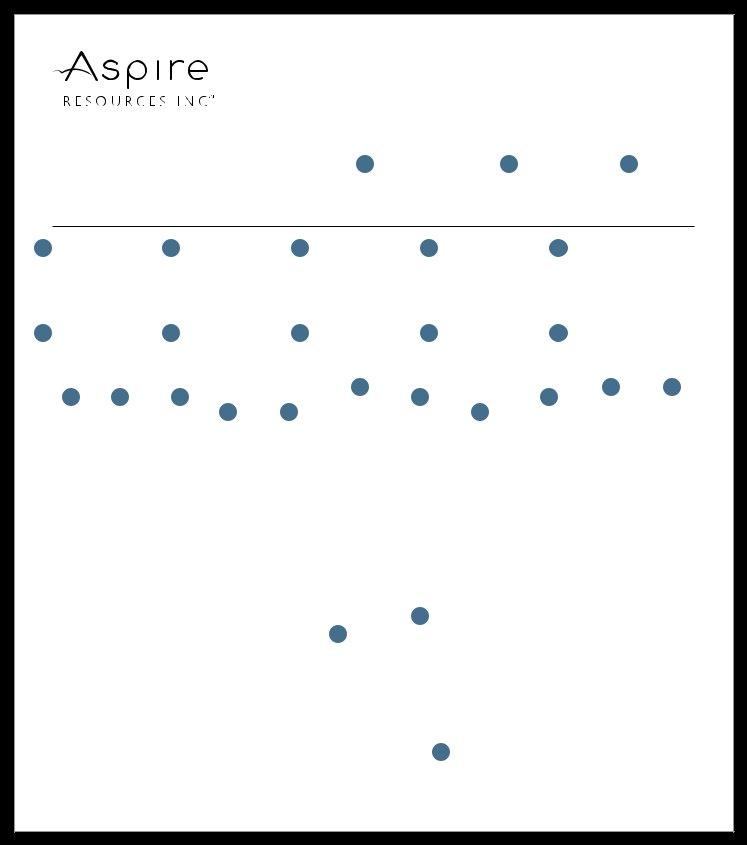

Sample Student Loan Bill

Page 1

Aspire Resources Inc.

A U.S. Department of Education Contractor

Name |

1 Account Number |

2 Date Billed |

3 Due Date |

YOUR NAME |

00 0000 0000 |

4 |

Date Last |

5 |

Principal Paid Since |

6 |

Interest Paid Since |

7 |

Fees Paid Since |

8 |

Total Pmnts Rcvd |

|||||||

|

Payment Received |

|

Last Statement |

|

Last Statement |

|

|

Last Statement |

|

Since Last Statement |

||||||

|

|

$6.77 |

|

|

$24.83 |

|

|

$0.00 |

|

$31.60 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Total Principal |

|

Outstanding Late |

||

9 |

Bill Type |

10 |

Amount Past Due |

11 |

Current Due |

|

12 |

And Interest Due |

13 |

Fees to Date |

|

|||||

|

INSTALL |

|

$0.00 |

|

|

$31.60 |

|

|

$31.60 |

|

$0.00 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

23 |

24 |

|

14 |

15 |

16 |

|

|

|

|

Monthly |

|

20 |

|

22 |

|

Current |

Total |

|

|

|

|

|

|

17 |

|

18 |

|

|

|

21 |

|

|

|||

|

Loan |

First |

Loan |

|

|

Installment |

|

Int |

Amount |

|

Amount |

Amount |

||||

|

|

|

|

|

|

|

|

|||||||||

|

Seq |

Disb |

Program |

Status |

Owner |

|

Amount |

|

Rate |

Balance |

Past Due |

Due |

Due |

|||

|

1 |

12/12/03 |

DLSTFD |

REPAY |

DEPT OF ED |

$17.91 |

2.625% |

$6,521.20 |

$0.00 |

|

$17.91 |

$17.91 |

||||

|

2 |

12/12/03 |

DLUNST |

REPAY |

DEPT OF ED |

$13.69 |

2.625% |

$4,988.15 |

$0.00 |

|

$13.69 |

$13.69 |

||||

Return lower portion with payment to name and address listed below. Do not staple, fold or tape. Checks should be made payable to Aspire Resources Inc. and include your 10 digit account number.

Customer Statement |

25 ¨ Check to indicate change of address on reverse |

26Amount Paid - Do not write dollar ($) sign in boxes below or on check.

Account Number |

Due Date |

$ |

Total Amount Due |

|

00 0000 0000 |

$31.60 |

|||

|

||||

|

|

|

2011312016312424902100013664008000000000000006 |

YOUR NAME |

27 DEPARTMENT OF EDUCATION |

ADDRESS |

ASPIRE RESOURCES INC. |

CITY, STATE, ZIP |

PO BOX 530308 |

|

ATLANTA, GA |

1.Account Number

Your

2.Date Billed

Date Aspire generated your bill.

3.Date Due

Date your payment is due to avoid delinquency.

4.Date Last Payment Received

Date Aspire received your last loan payment.

5.Principal Paid Since Last Statement

Amount applied to outstanding principal for loans listed on the bill since the previous bill was generated.

6.Interest Paid Since Last Statement

Amount applied to outstanding interest for loans listed on the bill since the previous bill was generated.

7.Fees Paid Since Last Statement

Amount applied to outstanding fees for loans listed on the bill since the previous bill was generated.

8.Total Pmnts Rcvd Since Last Statement

Total amount applied to loans listed on the bill since the previous bill was generated.

9.Bill Type

Type of bill or statement. Bill types and their required actions are:

Install (Installment) — Make your regular monthly payment. Interest — Pay the outstanding interest amount to avoid interest capitalization.

Int Notice — No action needed, but this outstanding interest will capitalize if not paid.

10.Amount Past Due

Total unpaid amount from the previous billing cycle for all loans listed on the bill.

11.Current Due

Total amount you owe to Aspire for this billing cycle.

12.Total Principal and Interest Due Amount Past Due plus Current Due

13.Outstanding Late Fees to Date

Unpaid late fees for loans listed on the bill.

14.Loan Seq

Reference number for a specific loan.

15.First Disb

Date the first disbursement for this loan was made.

16.Loan Program

DLSTFD — Direct Subsidized Stafford Loan DLUNST — Direct Unsubsidized Stafford Loan DLPLGB — Direct Student PLUS Loan DLPLUS — Direct Parent PLUS Loan

DLSCNS — Direct Subsidized Consolidation Loan DLUCNS — Direct Unsubsidized Consolidation Loan DLCNSL — Direct Consolidation Loan

DLPCNS — Direct Parent Consolidation Loan

DLSSPL — Direct Subsidized Spousal Consolidation Loan DLUSPL — Direct Unsubsidized Spousal Consolidation Loan DLSPCN — Direct Spousal Consolidation Loan

TEACH — Direct TEACH Loan

STFFRD — FFEL Subsidized Stafford Loan

UNSTFD — FFEL Unsubsidized Stafford Loan PLUS — FFEL Parent PLUS Loan

PLUSGB — FFEL Graduate PLUS Loan

SUBCNS — FFEL Subsidized Consolidation Loan UNCNS — FFEL Unsubsidized Consolidation Loan CNSLDN — FFEL Consolidation Loan

SLS — FFEL Supplemental Loan for Students

17.Status

Current status of this loan:

Repay (Repayment) — Monthly payments required. Inter (Interim) — In school. No monthly payment required while attending school.

Defer (Deferment) — Regular monthly payments temporarily suspended. You are responsible for interest on unsubsidized loans.

Forb (Forbearance) — Regular monthly payments temporarily suspended. You are responsible for interest during forbearance.

Grace (Grace Period) — No monthly payment required for a period of time (usually six months) after leaving school. You may be responsible for interest on your loans during grace periods.

18.Owner

The entity that currently owns this loan.

19.Monthly Installment Amount

Amount you are required to pay each month on this loan.

20.Int Rate

The current fixed or variable interest rate for this loan.

21.Balance

The principal amount remaining to be paid on this loan. This does not include accrued interest and is not your payoff amount.

22.Amount Past Due

Unpaid amount from the previous billing cycle for this loan.

23.Current Amount Due

Amount you owe Aspire for this billing cycle for this loan.

24.Total Amount Due

Amount Past Due plus Current Amount Due for this loan.

25.Change of Address Checkbox

Indicate a change of address by checking this box and updating your contact information on the reverse. Sign in to your account to update your contact information online.

26.Amount Paid

Amount of your check or money order.

27.Address

Mail your payment to this address to avoid delays in processing.

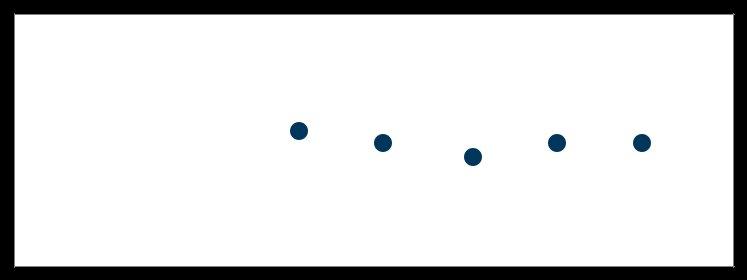

Page 2

Name |

|

|

|

Account Number |

Date Billed |

Due Date |

||

YOUR NAME |

|

|

00 0000 0000 |

|||||

|

|

|

|

|

|

|

||

LOAN INFORMATION |

|

|

|

|

|

|

||

|

|

|

28 |

|

|

|

|

|

|

|

|

Original |

29 |

|

31 |

32 |

|

|

|

|

|

30 |

|

|

||

Loan |

First |

Loan |

Principal |

Total Interest |

Total Principal |

Aggregate |

||

|

||||||||

Seq |

Disb |

Program |

Amount |

Paid |

Total Fees Paid |

Paid |

Amount Paid |

|

1 |

12/12/03 |

DLSTFD |

$7,346.17 |

$1,170.99 |

$0.00 |

$1,174.11 |

$2,197.89 |

|

2 |

12/12/03 |

DLUNST |

$5,555.47 |

$885.88 |

$0.00 |

$888.24 |

$1,662.67 |

|

28.Original Prinicpal Amount

Amount you originally borrowed with this loan.

29.Total Interest Paid

Total amount of interest paid on this loan since it has been serviced by Aspire.

30.Total Fees Paid

Total amount of fees paid on this loan since it has been serviced by Aspire.

31.Total Principal Paid

Total amount of principal paid on this loan since it has been serviced by Aspire.

32.Aggregate Amount Paid

Total amount paid on this loan since it has been serviced by Aspire, including amounts paid toward interest and fees and against principal.