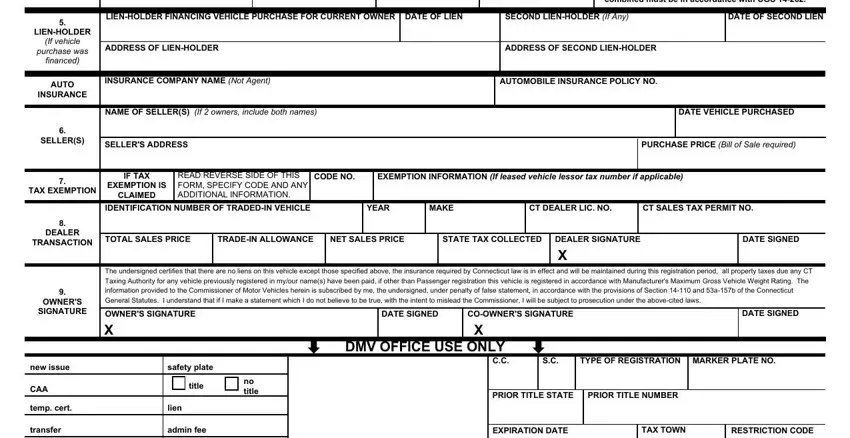

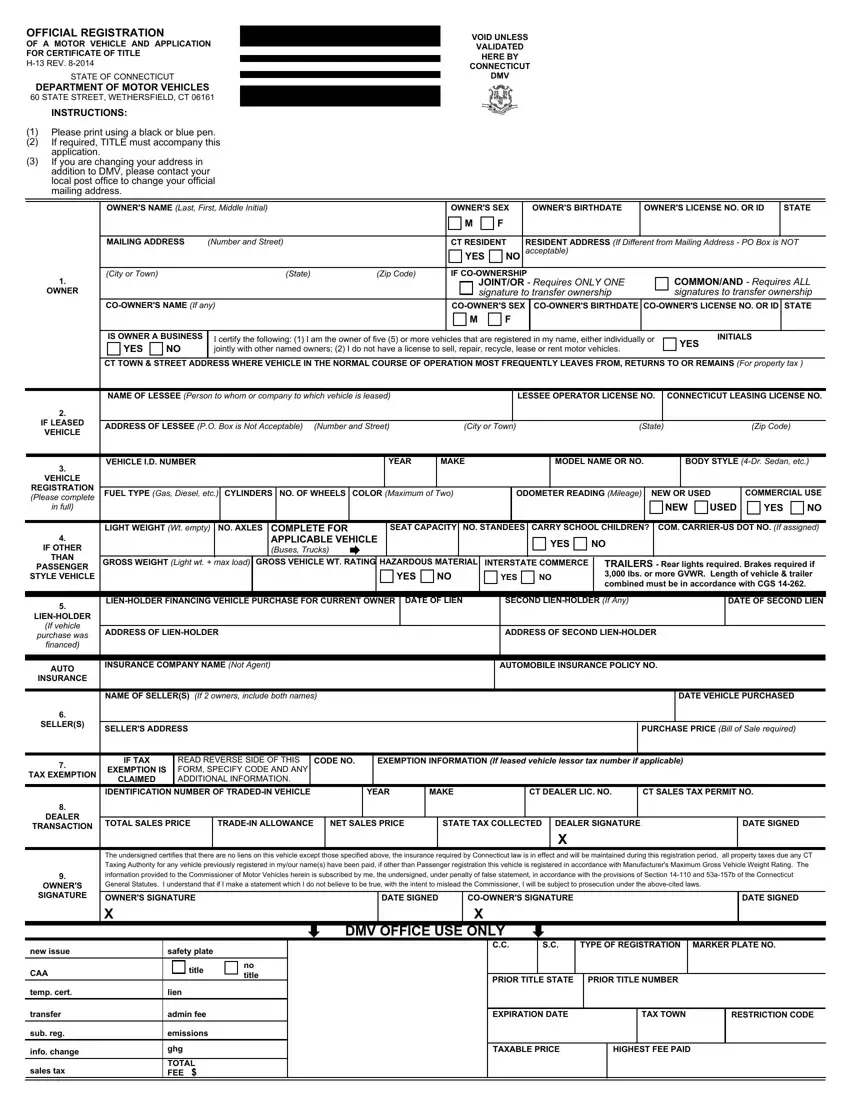

Transfer between immediate family members (Only MOTHER, FATHER, SPOUSE (wife, husband, civil union), DAUGHTER, SON, SISTER or BROTHER qualify as "immediate family members"). Specify code "1" and in the area labeled EXEMPTION INFORMATION, write which of the above-listed relationships describes the person from whom you obtained the vehicle. Specify the state in which this immediate family member previously registered the vehicle. In order to qualify for this exemption, the vehicle must have been registered in this immediate family member's name for at least 60 days.

Sale to a Connecticut exempt organization or to a governmental agency. Specify code "2" and write the Connecticut Tax Exemption Number beginning with "E" in the area labeled EXEMPTION INFORMATION or attach a copy of the organization's Internal Revenue Code Section 501(c)(3) or 501(c)(13) exemption letter issued by the IRS.

Sales or Use Tax was paid to another jurisdiction. An official receipt or dealer's invoice must be presented identifying the amount of sales tax paid. Specify code "3" and, in the area labeled EXEMPTION INFORMATION, write the amount of tax paid and the jurisdiction to which this tax was paid.

Vehicles purchased while residing outside of Connecticut. Out-of-state registration or photocopy is required. Vehicles should have been registered out-of-state at least 30 days prior to application for Connecticut registration. Specify code "4" and, in the area labeled EXEMPTION INFORMATION, write in order (1) the state in which you were residing when you purchased vehicle, (2) the date the vehicle was purchased, (3) the date the vehicle was registered in that state, and (4) the date the vehicle was first moved to Connecticut.

Other reasons. Specify code "5" and write the applicable letter from the list below in the area labeled EXEMPTION INFORMATION.

5A) GIFT - If vehicle was received as a gift, provide a copy of form AU-463, "Motor Vehicle and Vessel Gift Declaration". These forms are available at all DMV offices.

5B) VEHICLE PURCHASED BY A LESSOR EXCLUSIVELY FOR LEASE OR RENTAL - Provide the Connecticut Tax Registration Number of the lessor/purchaser.

5C) SALE BY A FEDERAL AGENCY, FEDERAL CREDIT UNION OR AMERICAN RED CROSS - Vehicle must have been obtained from a Federal Agency, a Federal Credit Union or the American Red Cross.

5D) CORPORATE ORGANIZATION, REORGANIZATION OR LIQUIDATION - Acquiring a vehicle in connection with the organization, reorganization or liquidation of an incorporated business provided (a) the last taxable sale, transfer or use of the motor vehicle was subjected to Connecticut sales or use tax, (b) the transferee is the incorporated business or a stockholder thereof.

5E) PARTNERSHIP OR LLC ORGANIZATION OR TERMINATION - Acquiring a vehicle in connection with the organization or termination of a partnership or LLC provided (a) the last taxable sale, transfer or use of the motor vehicle was subjected to Connecticut sales or use tax, and (b) the purchaser is the partnership or limited liability company, as the case may be, or a partner or member, thereof, as the case may be.

5F) HIGH MPG PASSENGER MOTOR VEHICLES - Section 12-412(110) exempts the sale on and after January 1, 2008, and prior to July 1, 2010, of any passenger motor vehicle, as defined in section 14-1, that has a U.S. EPA estimated city or highway gasoline mileage rating of at least 40 miles per gallon.

5G) COMMERCIAL TRUCKS, TRUCK TRACTORS, TRACTORS AND SEMITRAILERS AND VEHICLES USED IN COMBINATION THEREWITH - Section 12-412(70)(A)(i) exempts commercial trucks, truck tractors, tractors and semitrailers and vehicles used in combination therewith which have a gross vehicle weight rating in excess of 26,000 pounds.

Section 12-412(70)(A)(ii) exempts commercial trucks, truck tractors, tractors and semitrailers and vehicles used in combination therewith operated actively and exclusively during the period commencing upon its purchase and ending one year after the date of purchase for the carriage of interstate freight pursuant to a certificate or permit issued by the Interstate Commerce Commission (ICC) or its successor agency. Purchaser - please attach a copy of your certificate or permit that was issued by the ICC or its successor agency, and a copy of a properly completed Dept. of Revenue Services CERT-105, Commercial Motor Vehicle Purchased Within Connecticut for Use in the Carriage of Freight in Interstate Commerce.