TS 216 (11/10/2013)

Page 2

INSTRUCTIONS

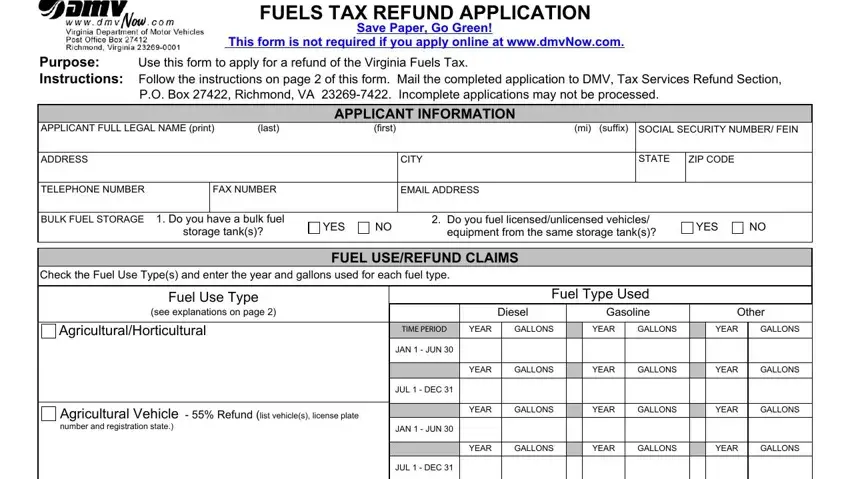

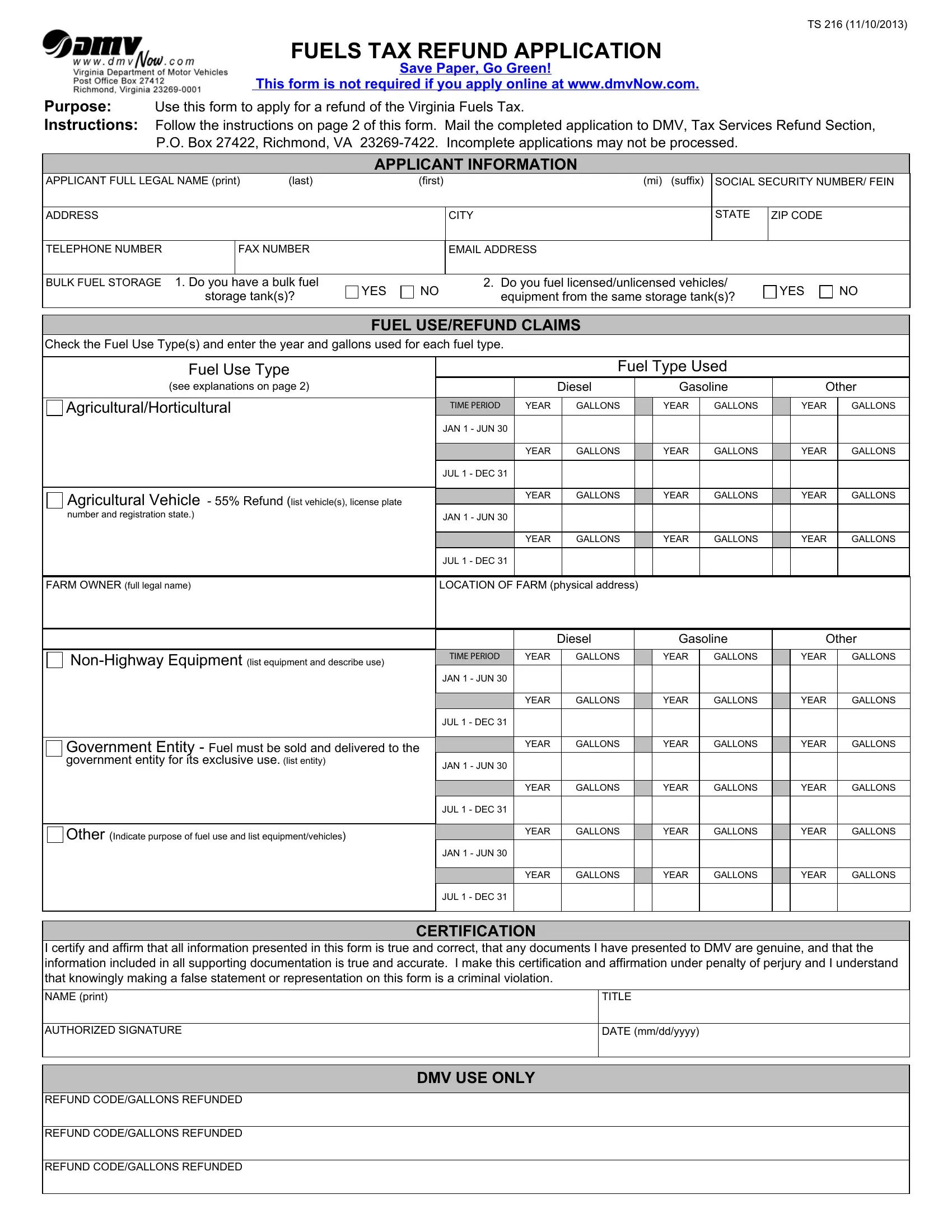

APPLICANT INFORMATION

Complete the Applicant Information section and answer the questions regarding bulk fuel storage. If you answered YES to question 2 you must submit a fuel disbursement list. This list must show the date, number of gallons and the vehicle/equipment in which the fuel was used.

FUEL USE/REFUND CLAIMS PERIOD

Check the box(es) that apply to your Fuel Use Type(s) (see Explanation of Fuel Use Types below). Provide the following if applicable:

-list vehicles or equipment

-farm owner/location

-list government entity

-indicate purpose of fuel use

Beside each Fuel Use Type checked, enter the year and number of gallons used during the appropriate time period in the columns under Fuel Type Used (diesel, gasoline or other).

NOTE: Effective July 1, 2013, tax rates for fuel will change every six months (time period). Fuel gallons must be entered into the correct time period to receive the applicable tax rate refund for that time period.

CERTIFICATION

Read and complete the Certification section. Refunds will not be processed without a signed certification.

FINALIZE

Mail completed application and supporting documents to DMV, Tax Services Refund Section, P.O. Box 27422, Richmond, Virginia 23269-7422. The postmark date on your mailed application is recorded as the date DMV received your application.

NOTE: First-time refund applicants must include all invoices/tickets/receipts that support their refund claim.

INVOICE/TICKET/RECEIPT REQUIREMENTS

Receipts, tickets, or invoices used to support your refund claim must be dated within the 12 month period preceding the date DMV receives your application.

Invoices/tickets/receipts must meet the following requirements:

•must be for fuel purchased in Virginia in amounts of 5 gallons or more and which support the amounts entered on your application

•indicate the exact date of purchase (month/day/year)

•include the number of gallons and type of fuel purchased

•show the amount paid for the fuel

•include the seller's name and location address

•must be readable - illegible, altered or duplicate invoices/tickets/receipts will not be accepted

•must be submitted in date order

RECORD KEEPING

Invoices/tickets/receipts and fuel disbursement lists (if applicable) that support your application must be retained for 4 years from the date DMV receives the refund application (Virginia Code § 58.1-2261). You may be requested to provide such documentation to DMV at any time during this 4 year period either before or after the refund is paid. Failure to provide the requested documentation will result in the denial or reversal of your refund.

EXPLANATION OF FUEL USE TYPES

Agricultural/Horticultural - Fuel used exclusively for agricultural or horticultural purposes on lands owned or leased by the owner or lessee of the vehicle. Only fuel used in UNLICENSED vehicles/equipment is eligible for refund. Vehicles with F farm tags do not qualify for a refund.

Agricultural Vehicle 55% Refund - Fuel used in vehicles designed or permanently adapted exclusively for bulk spreading or spraying of agricultural liming materials, chemicals, or fertilizer are eligible for a refund of 55% of the state fuel tax paid. Enter the farm owner's name and the location of the farm.

Non-highway Equipment - Fuel used in unregistered self-propelled equipment manufactured or designed for a specific off-road use and used on the job site. Examples of non-highway equipment includes: construction equipment, well drillers, and excavating equipment.

Government Entity - Fuel must be sold and delivered directly to the government entity for its exclusive use in order to qualify for a refund. Fuel sold to, delivered to or used by a government contractor is not eligible for a refund.

Other: • Volunteer fire fighting companies/rescue squads

•Stationary engines, pumping or mixing equipment. If the equipment is on a vehicle, there must be a separate auxiliary fuel tank to operate the equipment and the vehicle must be incapable of propulsion while the auxiliary tank is in use.

•Generators, lawn equipment, chain saws, ATV's, and other off- road uses

•Refrigerated units

•Rail cars

•Accidental loss of fuel

•Private, non-profit, non-sectarian schools

•Solid waste compacting vehicles, ready-mix concrete mixers, bulk feed delivery trucks (35% refund)

•Transportation District - fuel used by a person providing transit service under contract or lease with any transportation district. The refund is paid to the person performing such transportation.

•Department of Aging

•Vehicles owned by a non-profit organization providing specialized transportation for the elderly and disabled

•Other uses allowed by Virginia Code.