You'll be able to prepare nbs i hawaii search easily in our PDFinity® editor. The editor is consistently upgraded by our staff, getting new features and becoming greater. All it takes is several easy steps:

Step 1: Firstly, open the pdf tool by clicking the "Get Form Button" in the top section of this webpage.

Step 2: The editor provides you with the opportunity to modify nearly all PDF forms in many different ways. Improve it with any text, adjust what is originally in the document, and include a signature - all close at hand!

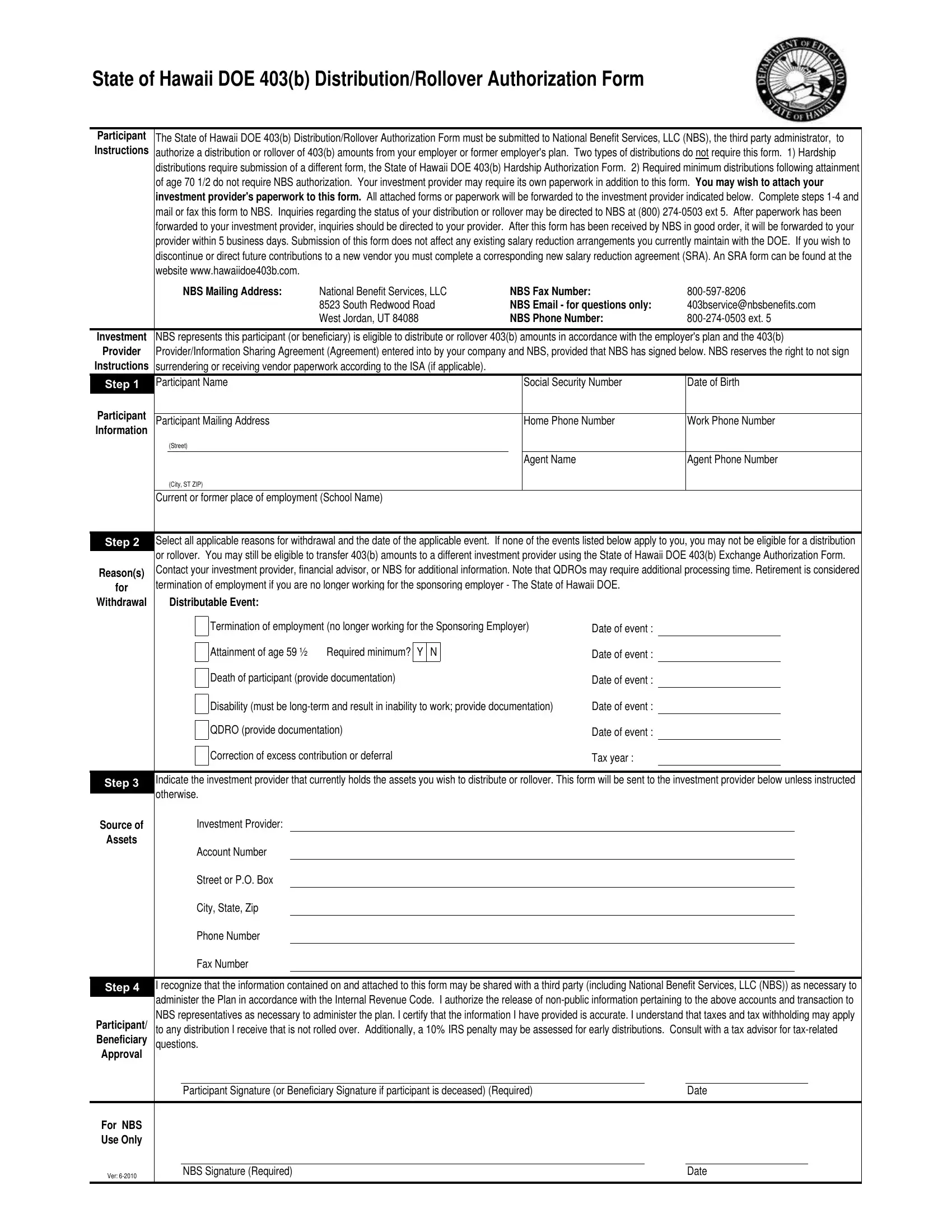

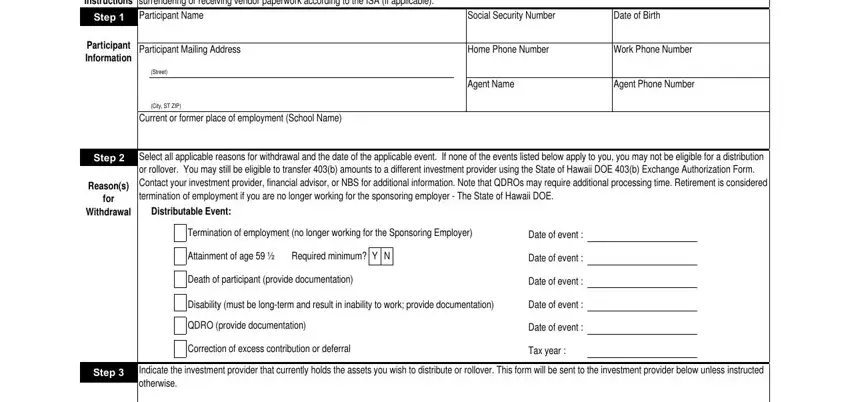

If you want to complete this document, be sure you enter the information you need in each and every blank field:

1. The nbs i hawaii search requires specific details to be entered. Be sure that the subsequent fields are complete:

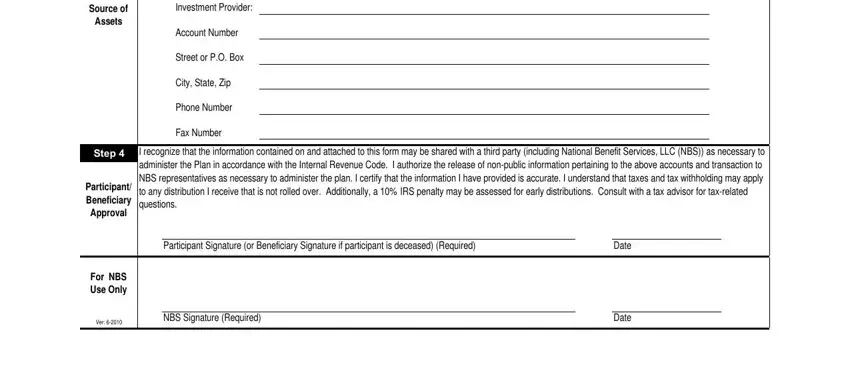

2. Soon after filling in the last part, go on to the subsequent part and complete the essential particulars in all these blanks - Investment Provider, Account Number, Street or PO Box, City State Zip, Phone Number, Fax Number, I recognize that the information, Participant Signature or, Source of, Assets, Step, Participant Beneficiary Approval, For NBS Use Only, Ver, and NBS Signature Required.

Be extremely careful while completing Participant Signature or and NBS Signature Required, because this is where a lot of people make a few mistakes.

Step 3: Right after you've reviewed the details provided, click on "Done" to conclude your FormsPal process. Grab the nbs i hawaii search the instant you sign up for a free trial. Instantly access the document from your FormsPal cabinet, together with any edits and adjustments being automatically synced! FormsPal is dedicated to the personal privacy of all our users; we always make sure that all personal information put into our editor is kept protected.