You could work with dol form online instantly with the help of our online editor for PDFs. To retain our editor on the leading edge of practicality, we work to put into action user-driven capabilities and improvements regularly. We're always thankful for any suggestions - play a vital role in reshaping PDF editing. All it takes is just a few easy steps:

Step 1: Hit the "Get Form" button above. It will open up our editor so you can start filling out your form.

Step 2: As you open the file editor, you will get the document all set to be filled in. Other than filling out various blank fields, you can also do various other actions with the Document, particularly adding any textual content, modifying the initial textual content, inserting illustrations or photos, signing the document, and a lot more.

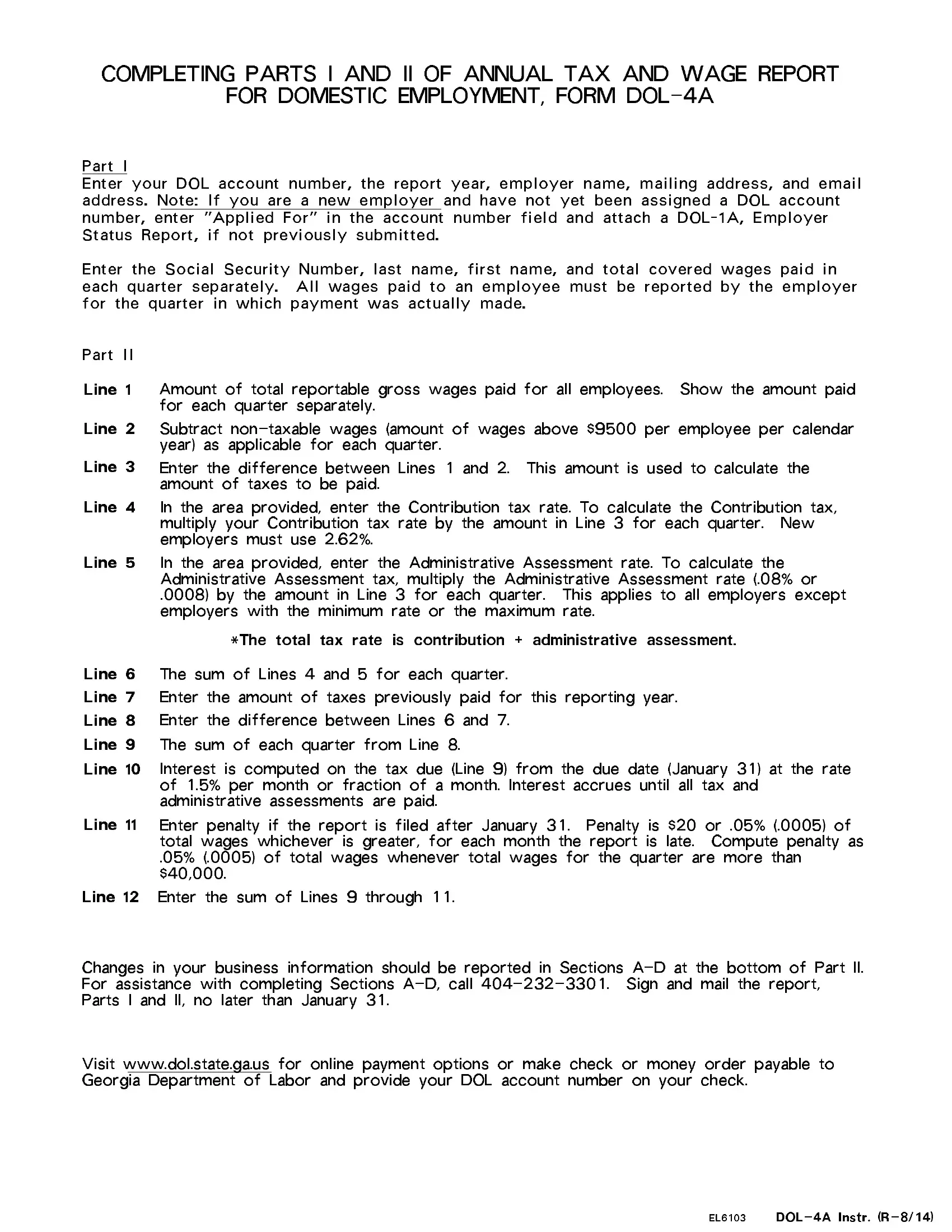

In an effort to finalize this document, be sure to provide the right information in each field:

1. Fill out your dol form online with a number of essential fields. Get all of the important information and ensure there is nothing missed!

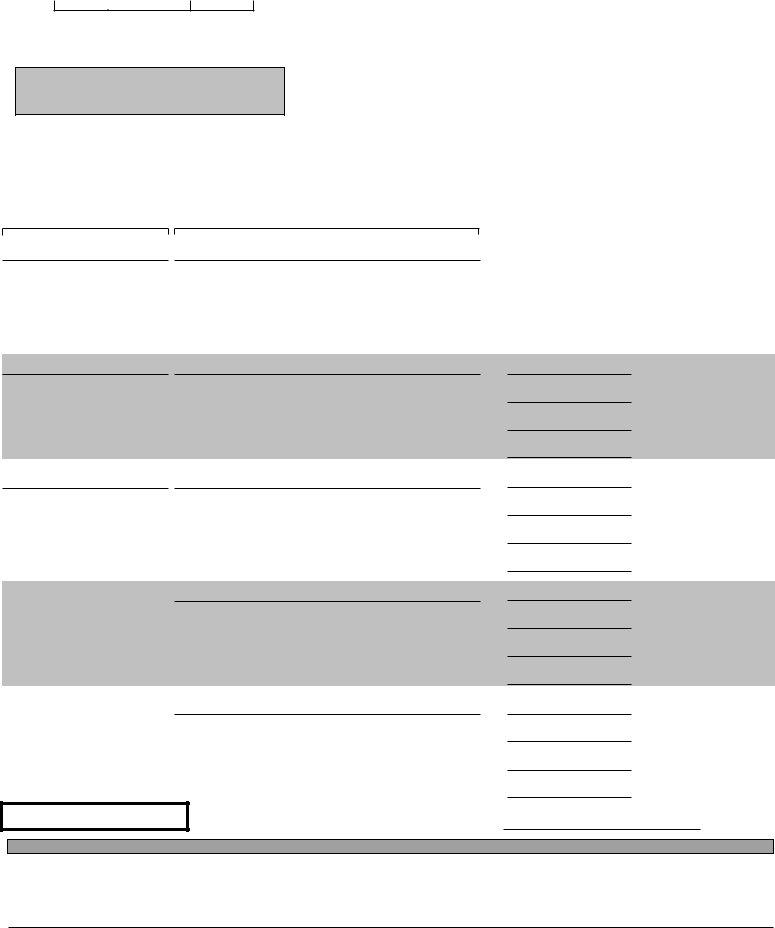

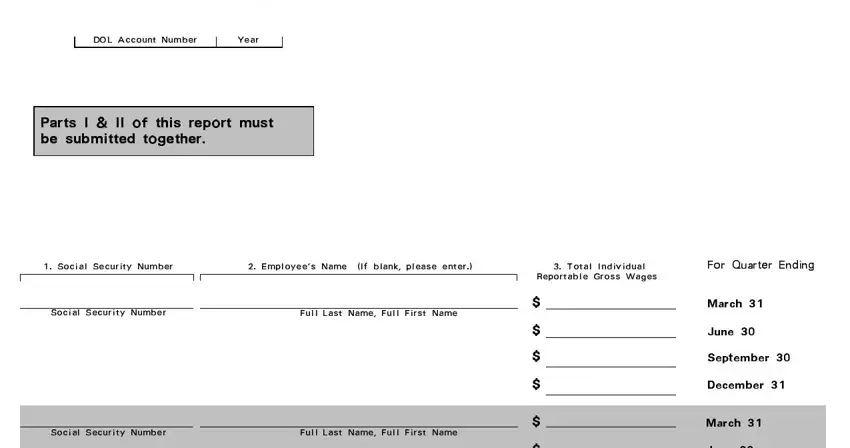

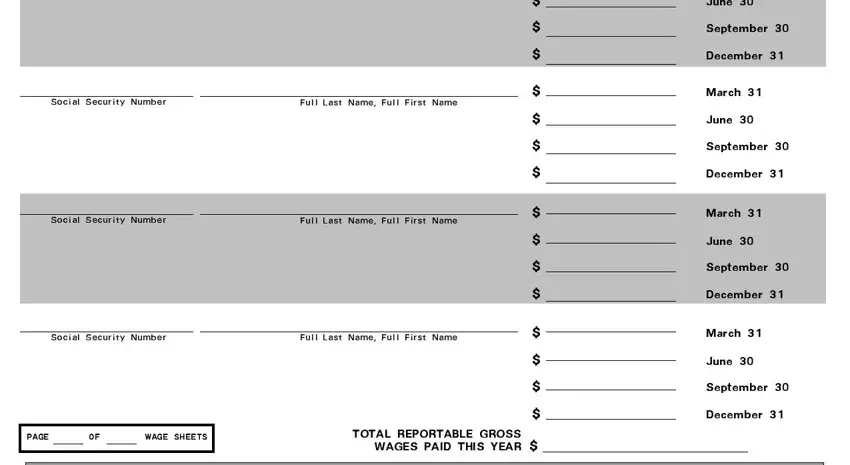

2. The next step is to fill in these fields: Social Security Number, Full Last Name Full First Name, Social Security Number, Full Last Name Full First Name, Social Security Number, Full Last Name Full First Name, PAGE OF WAGE SHEETS, TOTAL REPORTABLE GROSS, WAGES PAID THIS YEAR, June, September, December, March, June, and September.

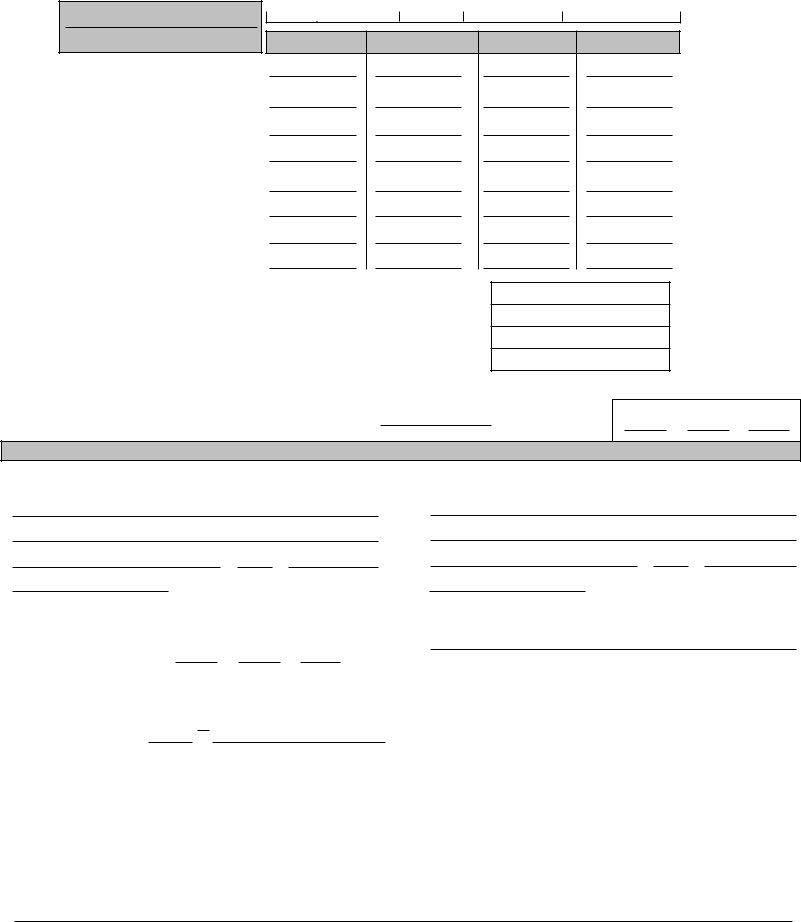

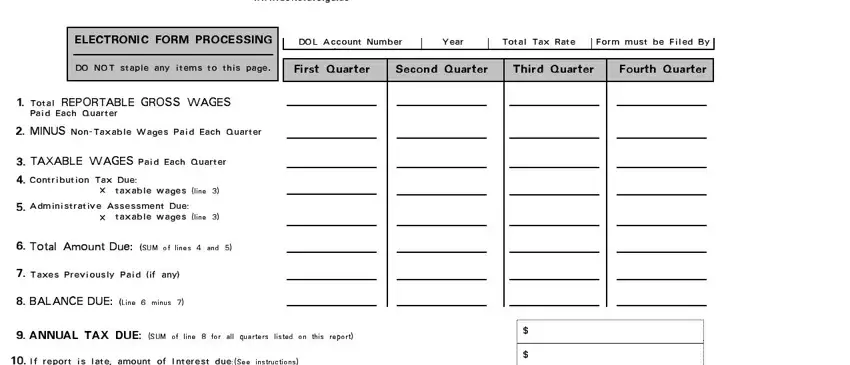

3. This next segment is about Tel wwwdolstategaus, ELECTRONIC FORM PROCESSING, DOL Account Number, Year, Total Tax Rate, Form must be Filed By, DO NOT staple any items to this, iFirst Quarter Second Quarter, Total REPORTABLE GROSS WAGES, Paid Each Quarter, MINUS NonTaxable Wages Paid Each, TAXABLE WAGES Paid Each Quarter, Contribution Tax Due, X taxable wages line, and Administrative Assessment Due - complete all of these fields.

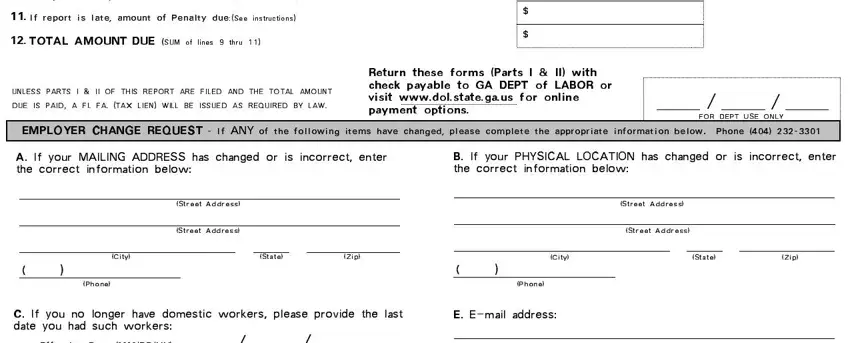

4. To go onward, the next section requires filling out a few blanks. Examples include If report is late amount of, If report is late amount of, TOTAL AMOUNT DUE SUM of lines, UNLESS PARTS I II OF THIS REPORT, DUE IS PAID A FI FA TAX LIEN WILL, Return these forms Parts I II, FOR DEPT USE ONLY, EMPLOYER CHANGE REQUEST If ANY of, A If your MAILING ADDRESS has, B If your PHYSICAL LOCATION has, Street Address, Street Address, Street Address, Street Address, and City, which are key to continuing with this particular document.

It is possible to get it wrong when filling in the If report is late amount of, so make sure you reread it before you submit it.

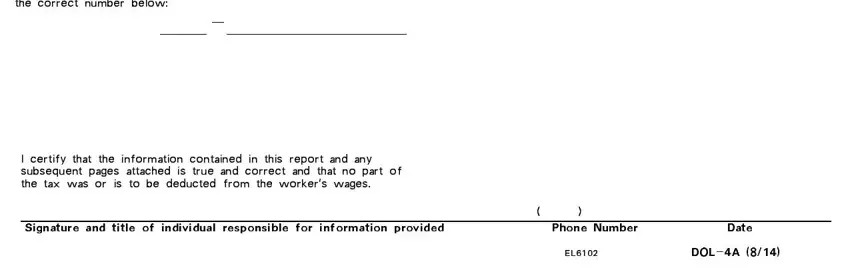

5. This final notch to conclude this PDF form is critical. Make sure to fill in the required blanks, such as D If your Federal Employer, I certify that the information, Signature and title of individual, and DOLA, before submitting. Failing to accomplish that might lead to a flawed and probably nonvalid paper!

Step 3: Before moving forward, it's a good idea to ensure that form fields were filled in the correct way. When you believe it's all good, click “Done." Right after setting up afree trial account here, it will be possible to download dol form online or send it through email right off. The PDF form will also be readily available from your personal account menu with your changes. FormsPal is dedicated to the personal privacy of all our users; we always make sure that all information put into our editor is secure.